The new American retirement nightmare: Many Americans find they are completely unprepared for retirement.

- 3 Comment

Starting in late 2010, we reached a threshold where baby boomers were reaching the age of 65 at a rate of 10,000 per day. This will last into 2030. What was once thought of as a retirement age is no longer the case. The body has not evolved to adapt to financial circumstances but people are largely broke. Many older Americans are working into old age merely to keep the lights turned on in their homes and apartments. The troubles trickle all the way down. In fact, many are now finding their children boomeranging back home because of economic circumstances. The naïve dream of retiring to Miami with unlimited margaritas was just that. A dream. Many Americans are finding that older age and a weak economy has caught up to them. As it turns out, the idealistic vision of retirement is turning out to be a nightmare for many.

Retirement worries

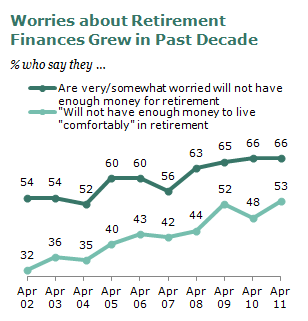

Retirement worries have grown over the last decade:

Source:Â Pew Research Center

53 percent of Americans do not feel they will have enough money in retirement. 66 percent of Americans are “very/somewhat worried†they will not have enough money in retirement. This is a large portion of our population. These worries based on emotions match up to what we see in the facts. One out of three Americans has absolutely nothing saved. Zero. Nada. Nil. Hard to retire on nothing when the bills are still coming in. Since 10,000 Americans are hitting the age of 65 each day, more resources are going to be pulled from Social Security and Medicare. These systems to function are going to fall heavily on the backs of younger Americans who are in a worse financial predicament.

No pension

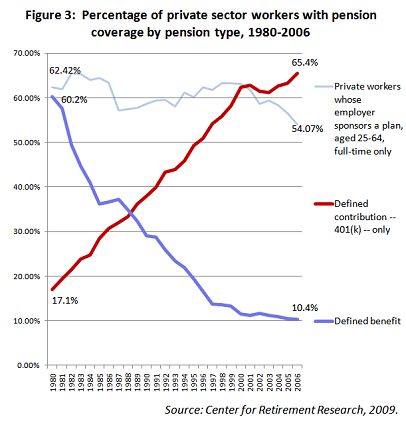

The pension has gone the way of the dinosaur over the last generation:

Starting in the early 1980s, everyone was suppose to save money in 401k plans and suddenly would become a millionaire by the time 30 years passed. Well 30 years have passed and guess what? That never happened. Wall Street turned our financial institutions into casinos and converted real estate, a once safe investment, into a speculative commodity. The results are disastrous as the first survey has found. Americans are flat out not ready to retire. You can’t make up for lost time so here we are. Of course the financial industry would like to blame Americans and many eat this up feeling like temporally embarrassed millionaires.

It was thought of that there would be three key pillars to a retirement plan; a pension, 401k/403b, and finally Social Security. As we are finding out, most Americans are simply going to rely on Social Security. Not a great plan when we are already in soft default mode.

No savings

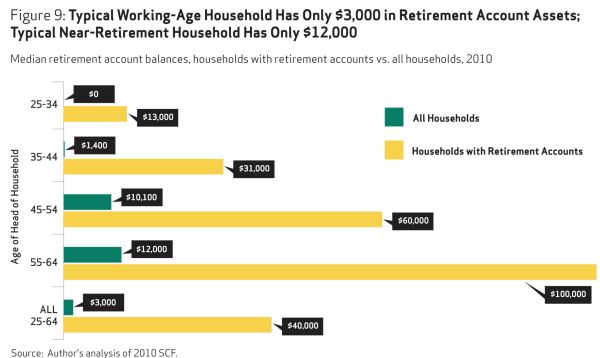

Let us take a look at the hard numbers however and see if retirement has become a nightmare:

Source:Â Pew Research Center

The typical working-age household only has $3,000 socked away for retirement! More troubling, of those that bothered saving, the median amount saved is $40,000. Essentially one year of expenses for your average American household.

When you look at the 55-64 age range you find that of all households in this category, the median amount saved is $12,000. So much for relying on a massive nest egg built over the decades. As we have noted before, the stock market is largely a sham for most Americans and this data simply reinforces that.

At least with a pension, money was forced into a savings account. For better or worse, this had better outcomes for most Americans. The 401k revolution hasn’t really helped sadly. Why? It isn’t that savings is bad because it is paramount to being successful. Larger macro trends like the dismantling of the middle class have made it harder for people to save and turning the stock market into a high frequency trading casino doesn’t help to instill confidence.

Working at 75 and over

You would think that at least at 75, retirement would be in reach:

“(USA Today) It’s hard to know how many older workers are also forced to retire. But there is a growing number of older Americans who are not retired and are in search of a job. The number of unemployed Americans age 75 and older increased from 11,000 in 1990 to 75,000 in 2011, according to AARP.â€

More Americans are having to work deep into old age. The new retirement model is that there is no retirement. With 10,000 people reaching 65 each day it isn’t like we are suddenly seeing 10,000 jobs being freed up because many are simply not leaving their jobs (if they are working). Young Americans are battling it out for many of the low wage jobs out there. The rallying cry of the next elections should be on how to restore the middle class and stop this retirement nightmare from continuing.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Khannea SunTzu said:

If the US of America were an unfettered democracy there would be no problem here – people would just redistribute money and resource claims from the 1% at the top by means of nationalization and taxing. Being a democracy means 99 sheep can lynch a wolf and do a little carnivorous redistribution. No one would complain. Not many people did after the French revolutions. A few might escape, a la scarlet pimpernel to Europe. Trust me, we don’t want those filthy parasites here in Europe either. They can fuck off and go to Singapore or Dubai.

Sadly … the US of A is not a functional, unfettered democracy. The people are brainwashed, not terribly bright, under-educated, docile, afraid of black clad uniformed sithboy bullies and the democratic system in place is as silly as pig iron lifeboats on the Titanic.

Do I pity the poor old-timers who will inherit a future not dissimilar to the best scenes of Elysium? A little. But on the other hand, they sure had a nice time.

I suggest they accept the facts and *commemorate* the good old days. Worked in Russia too.

November 23rd, 2013 at 1:12 pm -

Hey You said:

The financial situation is more or less like the health situation. Just like financial imprudence, people who have disbused their bodies are looking for a magic pill to solve all their problems of ill health.

Sorry; too late.

November 25th, 2013 at 8:18 pm -

Ulysses said:

“Saving” has no meaning unless the fundamental question is answered – saving what and for what purpose?

Consider:

1. The dollar is now a fiat currency with zero intrinsic value which has lost 90% of its purchasing power over the last four decades and the trend continues.

2. The zero-interest rate policy of the Greenspan-Bernanke cabal has made getting a safe and decent return out of savings quite impossible.

3. Inflation (legalized counterfeiting), instead of being a criminal offense, has become an economic tool.

Therefore saving is now not only meaningless but outright suicidal.

November 29th, 2013 at 1:17 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!