Arrested economic development: 36 percent of Millennials living at home delaying financial adulthood. Less than one-third of Millennials employed.

- 4 Comment

Young Americans are living at home in record numbers. Millennials are living at home for much longer because of the poor economic conditions for the young. Think about the perfect storm of financial pain for young Americans. College costs are astronomical and many are going into massive debt to pursue a college education. If not, then it is very likely that you’ll end up in one of the top low paying jobs since we have decimated our manufacturing sector. Next, because of low earnings, the median net worth of those 25 to 34 is zero dollars. Do you have one dollar in your bank account and no debt? Congrats. You are wealthier than most young Americans. A recent research report from Pew Research Center indicates this trend is still going on. Many young Americans are delaying the biggest payment of being an adult, that of paying rent or a mortgage. A stunning 36 percent of Millennials live at home.

Failure to launch

Americans for the most part are fiercely independent. If you look on freeways across the nation you have a ridiculous amount of empty car space because people need one car for one person (even though most cars will sit 4 people nicely). It is mass inefficiency. Yet that is the current system. So to think that people are living at home because they suddenly want to connect with mom and dad is mistaken. We now have the largest share of young people living at home in over a generation:

Source:Â Pew Research Center

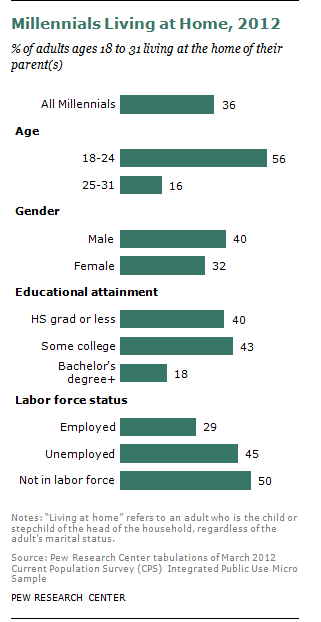

Millennials are those 18 to 31. 36 percent of this group lives at home. What is interesting is that most of the 18 to 24 group are off going to college. And given student loan debt, most are off going to college and accumulating massive debt.  More males are living at home as well from this group (40 percent versus 32 percent for females).

What is more telling is that from this group, only 29 percent are actually employed.Â

This is an incredibly large group of 21.6 million people. The economy has been a dismal place to be for many young Americans even since the recovery started in the summer of 2009. Yet as we have noted much of the recovery has gone to a very small sliver of the population while the stock market has been a big spectacle for most people given that the majority of Americans do not own one piece of stock.

Big change for those living at home?

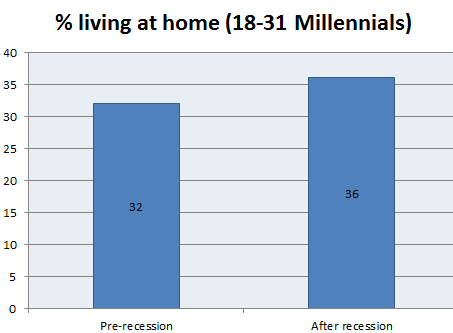

You would expect that with four years of “recovery†under our belt that these figures would improve. Yet they have not:

Just before the recession hit, 32 percent of this group was living at home compared to 36 percent today. In raw numbers, this is a jump of 3.1 million Americans in this category. And this has major implications for the long-term. Start a career later in life and your earnings are suppressed (given the time it takes to build skills/expertise and move up the firm/organization ladder). You also lose out on building up retirement funds or purchasing a home.

It ties in perfectly with the latest data from the National Association of Realtors showing that over 30 percent of all purchases nationwide went to investors (those mostly with alternative financing beyond a mortgage). It certainly isn’t the young pushing the housing market up. The bailouts have largely assisted the large financial class but the bulk of Americans continue to live in recession like conditions.

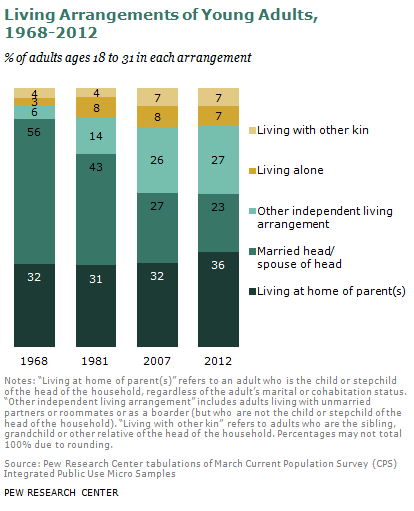

And to compare to past generations this is a big shift:

The recession has kept many younger Americans from going off and starting independent households. Which is interesting because the marriage rate also dropped for this group. In 2007 30 percent of Millennials were married compared to 25 percent today. Doesn’t look like a recovery for young Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Dave Mowers said:

By destroying the wealth base for the majority of Americans and replacing the purchasing of financial assets by them with investors you make even more of the economy solely dependent in finance which is the supposed opposite of what the bank bail outs and new regulations were meant to achieve; stability. Now we will be facing constant crisis in housing every time their is a recession as the “new” class of home buyers unloads assets to cover losses.

This country is a cesspool of corruption. We need to audit the Fed, we need equality in monetary policy.

November 5th, 2013 at 12:05 pm -

Johnny said:

A new generation of entrepreneurs will be created out if this situation.

November 6th, 2013 at 2:22 am -

SueQ said:

I “get” the implication in your post regarding the housing market, the fact that so many young people don’t have jobs, lived at home with mom and dad, and won’t have the financial wherewithal to buy homes and have savings. But there’s another truth at work too: because of the shit sandwich, mom and dad won’t be able to sell their homes for what they would have been able to before criminal Wall Street stole their inflated value via derivatives and economic collapse, so the kids most likely will stay home, take carte of mom and dad and inherit the house. Already happening in my neighborhood. 40-year-olds with kids are squeezing in with mom and dad, working but paying no rent or helping with their own and kids’ expenses while mom and dad provide all cleaning service, laundry service, food, child care. Thanks a lot Wall Street and “central” banks, you’ve done a great job in driving a thriving economy out of business you jackasses.

November 6th, 2013 at 7:39 am -

David Reischer said:

The Millenials arrived to the party late. All that is left is Zima and half eaten cocktail weenies.

November 6th, 2013 at 3:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!