The booming non-labor force in the United States: Those not in the labor force surged by nearly 1,000,000. A large portion of added jobs were in low wage sectors.

- 3 Comment

Any job is a good job for the headlines. While one part of the BLS survey showed that US payrolls increased by 200,000 last month, another survey finds that nearly 1,000,000 Americans dropped out of the labor force. That is right, a stunning 932,000 Americans simply dropped out of the labor force last month bringing our labor force participation rate to a new 35 year low. More importantly, a large part of those200,000 added jobs were in the form of low wage retail and food sector jobs. For the headlines anything is good news and the stock market continues to rally (even though most Americans don’t even own stocks because they are too broke once all bills are paid). The drop in the labor force participation rate was not unforeseen but the current rate of growth is very troubling. Of course, the Fed now “hints†at tapering but the evidence shows that the Fed is in soft default mode. We have a boom in the non-labor force segment of our economy.

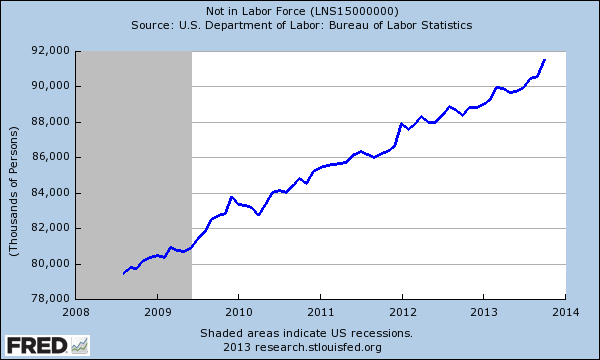

Those not in the labor force

A whopping 91.5 million Americans are not in the labor force (close to one-third of the country):

Source:Â BLS

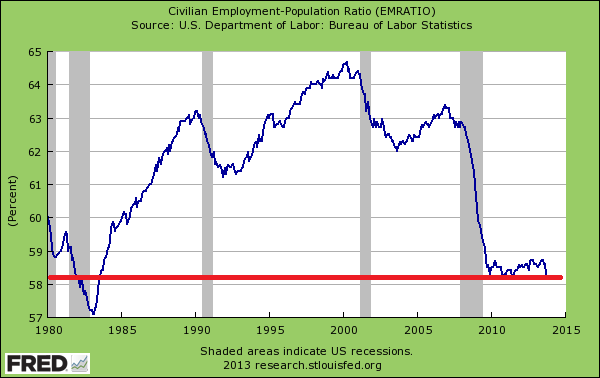

The big drop from last month of 932,000 is the largest one month drop ever recorded. This new data plunged the employment population ratio down to a new 35 year low:

Source:Â BLS

Of course, the media is merely focused on the 200,000 jobs that were added. What about the nearly 1,000,000 drop in the labor force participation rate? Will these people maintain their consumption power without work? It is unlikely they are independently wealthy given retirement figures. To the contrary, these are broke households. This all fits in line with a record number of Americans on means-tested programs like food stamps and disability.

Low wage jobs

The US is disproportionately adding low wage jobs. Even in the latest report, 1 out of 4 jobs were added in the very low wage (and temporary) retail and food sectors. This is why the top occupations in the US do not pay what you think:

Out of our top jobs only one has a decent salary. Even 50 years ago, top jobs were in blue collar work that actually paid a living wage. Today, the jobs are coming from cashiers at Wal-Mart or food workers at Burger King. Not exactly enough to send your kids to the expensive world of college. Yet to escape this fate, many young Americans roll the dice with maximum levels of student debt to give themselves a fighting chance for a job.

Also, we need to add at least 200,000 jobs per month merely to keep up with population growth. If anything is happening, we are simply treading water but the problem on those dropping out of the labor force is that our costs are accelerating at a growing speed. The burden of retiring baby boomers and other programs is largely falling on a young and poorer work force. It isn’t all too clear whether this strategy will work.

Unfortunately the media is catering to this massive run in the stock market while the economy is actually not as hot as it appears. For the next couple of months it is important to examine what jobs are being added given the very seasonal holiday season. Early 2014 will shed some light on where things truly are.

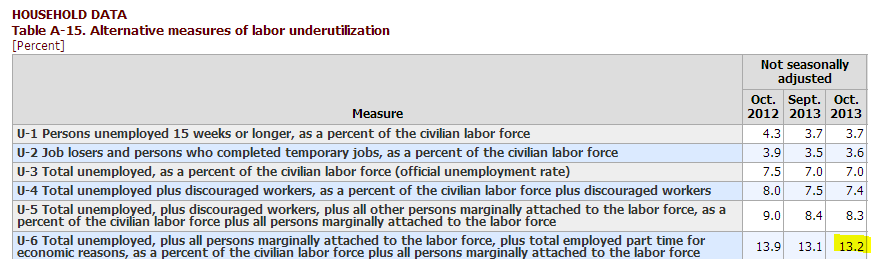

The rate of those marginally attached to the labor force U6, the broadest measure of employment also increased last month:

This report wasn’t as strong as it is being made out to be especially when you have close to 1 million Americans dropping out of the labor force.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Dan said:

I think the dropping out of the labor force was related to the shutdown and people reporting they were temporarily unemployed/laid off. Please see this article by Dean Baker on this at:

http://www.cepr.net/index.php/data-bytes/jobs-bytes/jobs-2013-11

Second paragraph.Also, with retirees and the existing workforce paying for that, all anyone has to do is make the payroll tax a flat tax for everyone, including for capital gains income. Lastly, the boomers already paid twice for their retirement when Ragan doubled the payroll tax in 1984 in anticipation of the boomers’ retirements. That is why there is now a 2.7 trillion dollar surplus in Social Security to pay for the retirements.

November 8th, 2013 at 5:50 pm -

Gary Reber said:

The American people continue to be misled and misdirected with “bad news” presented as “good news.” The reality is that the real unemployment rate is at least 13.8 percent, not 7.3 percent if those who have given up looking for work and those who are working part-time when they need a full time job are counted. The situation, according to Social Security data is that if your income from wages and salaries is $30,000+ you make more than 60 percent of Americans wage earners.

What is dreadful but a reality that can no longer be ignored is that tectonic shifts in the technologies of production will ever more replace more jobs than will be created and at the same time devalue the worth of labor. Such technology innovation is occurring all over the world. Technology can be adopted in “now” time without the requirement of historical time-spent invention and innovation, and, as a result, can create a level playing field on a global scale. It means the graduates of American universities have to now compete with the educated and non-educated young living throughout India and Eastern Europe, and as well as throughout Asia and China. Jobs as an income source will not be sufficient for the majority of unskilled and uneducated Americans to afford high-cost necessity commodities like education, healthcare and energy, which have had double-digit cost growth.

And while technology is the future driver of economic growth and the big money maker, the need for those who know how to build and manipulate machines and software will be far less than the need to provide job opportunities with decent middle-class wages and salaries for the majority of the population. Such job opportunities for the unskilled and uneducated just will not be forthcoming unless there is substantial economic growth. Those educated to build and manipulate machines and sophisticated digital software operations will become more financially successful on average than people in other sectors. The reality is that private sector job creation in numbers that match the pool of people willing and able to work is constantly being eroded by physical productive capital’s ever increasing role. This non-human factor of production will continue to drive economic growth with ever more technological invention and innovation.

What is needed is to broaden the personalized ownership of FUTURE wealth-creating, income-producing productive capital assets embodied in America’s viable and prosperous corporations as they finance future growth with the goal being the building of a FUTURE economy that can support general affluence for EVERY American citizen. And while we need to extend equal opportunity to EVERY American citizen to share as owners of FUTURE productive capital assets, this does not mean that ALL outcomes will be equal. There will always be the entrepreneurial risks of starting new companies, which in time may prove to be viable and prosperous corporations whose growth is financed in ways that simultaneously broaden employee and non-employee ownership.

To implement such opportunity will require extending insured capital credit to EVERY American to purchase shares of qualified stock in corporations growing the economy. An essential requirement will be that corporations pay out full profit earnings as pre-tax dividends to pay off the insured loans and once paid ALL future dividends would be taxed at the personal tax rate applicable to each owner’s income level from all sources. Corporations committing to this finance mechanism would be exempt from corporate taxes as long as they fully paid out earnings and extended full voting rights to EVERY individual stock owner. The loan insurance would be provided by commercial capital credit insurers and, if necessary the Federal Reserve as a reinsurer.

If we are to create a FUTURE ownership culture and society in which EVERY American owns a viable and sustainable portfolio of income-producing productive capital asset wealth, then tax incentives must be extended. As competitive and diversified sector corporations adopt this new finance opportunity, they will be able to finance their growth and simultaneously create more “customers with money” to purchase the products and services that the economy can create, thus sustaining future economic prosperity and opportunity.

The above is a simplified component of a much larger policy agenda, which is known as the Just Third Way Movement. The central piece of legislation proposed for this implementation is the Capital Homestead Act.

Support the Agenda of The Just Third Way Movement at http://foreconomicjustice.org/?p=5797. Support the Capital Homestead Act at http://www.cesj.org/homestead/index.htm and http://www.cesj.org/homestead/summary-cha.htm. See the full Act at http://cesj.org/homestead/strategies/national/cha-full.pdf

For a broader overview see “Financing Economic Growth With ‘FUTURE SAVINGS’: Solutions To Protect America From Economic Decline” at NationOfChange.org http://www.nationofchange.org/financing-future-economic-growth-future-savings-solutions-protect-america-economic-decline-137450624 and “The Income Solution To Slow Private Sector Job Growth” at http://www.nationofchange.org/income-solution-slow-private-sector-job-growth-1378041490.

November 9th, 2013 at 12:49 pm -

Katie Jwelch said:

A skilled worker is any worker who has some special skill, knowledge, or (usually acquired) ability in their

work. A skilled worker may have attended a college, university or technical school. Or, a skilled worker may

have learned their skills on the job. Examples of skilled labor jobs are operating, servicing, adjusting,

maintaining equipment, perform physical/repetitive taskssoftware development and accounting.

For More Information Please Visit Us: http://lavorjobsusa.blogspot.com/

December 6th, 2013 at 8:09 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!