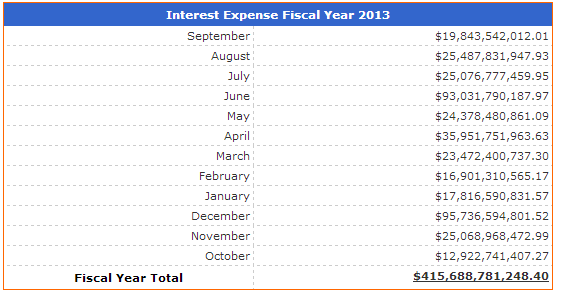

The US cannot avoid a soft default even if a hard default is avoided: Debt ceiling already breached and US Treasury operating in emergency mode while US is paying $415 billion in annual interest expenses.

- 0 Comments

All the talk has shifted from the government shutdown to the US actually defaulting on outstanding debts. The markets were in deep fear but the last couple of days rumors that the debt ceiling would be raised put the rocket boosters on the stock market. Of course, the majority of Americans have little money in stocks so this was more of a spectacle. Yet what isn’t discussed is the US is already in a long-term soft default on outstanding debts. That is, through various financial wizardry, the US is going to devalue the amount it owes through inflation by digitally printing enormous amounts of money. The Fed already has a balance sheet above $3.6 trillion when prior to the recession, it was below $800 billion. The end result of course is that debt based purchases like housing, college, and cars have soared in the amount they cost even though the typical household makes what they once did in 1987 adjusting for inflation. A soft default simply means that debts will be paid but with inflated money.

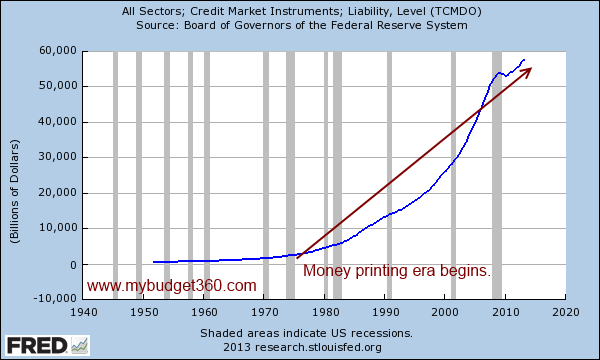

Total debt markets balloon after printing money era begins

We are addicted to debt. The total US debt markets are now approaching $60 trillion:

This wasn’t always the case. Starting in the 1970s as the US and many other nations moved away from the gold standard to fiat systems, central banks were unleashed to print as much money as they wished. For decades we have been on a tremendous spending spree. There is no way we can payback our outstanding debts. Similar to the household that takes on too much debt at some point, even servicing the debt becomes more problematic (i.e., more continual debt ceiling battles).

While the US does have the largest economy in the world the amount of debt we carry is jaw dropping. In many ways, the US dollar has taken on the brunt of this pain over the decades.

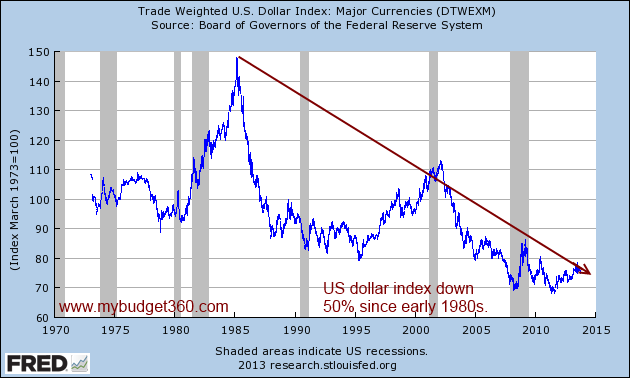

US dollar collapses

The US dollar has lost 50 percent of its purchasing power over the last generation:

This impact is a result of devaluing our dollar but also inflating our way into spending. There is a specific reason why items like housing, healthcare, cars, and college education are now completely out of reach for households without gigantic financing. There was a time when someone was able to work a part-time job and pay their way through college. Try doing that today with the current costs of higher education. Is it any wonder why student debt now tops $1.1 trillion?

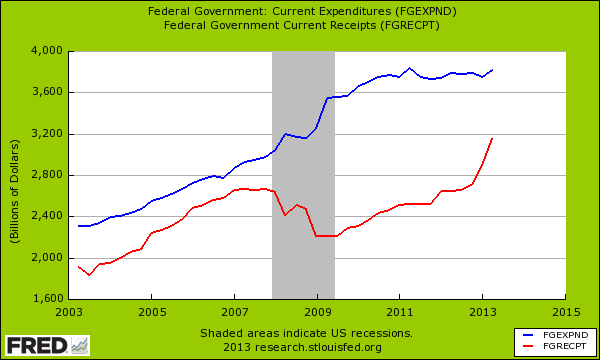

A soft default simply means that the US has no choice but to inflate its way out of this debt. GDP is now growing much slower as we are a mature economy. Yet debt is growing at a much faster pace making up for the gap that we are seeing. Government spending has far outpaced government receipts:

The big jump in receipts recently was built on the back of debt based maneuvers (i.e., QE, bailing out the banks, and massive injections of debt into the economy). This is the reason why receipts increased while government spending remained elevated.

The debt we will never payback

We will never payback the debt that is owed:

This is an interesting situation. Most people realize that this debt will not be paid back. In fact, the markets completely get this. Take for example the Fed’s unprecedented purchasing of mortgage backed securities. Why would the market lock in rates of 3.5 to 4 percent for 30 years with all the incredible amounts of risk present? The answer to that is the market has no appetite for that and that is why the Fed is essentially the biggest player in the mortgage market. Yet the law of unintended consequences rears its head. Because of this setup banks are now leveraging easy access to debt to eat up real assets in the economy in the form of single family homes (and inflating the cost of homes once again for regular Americans).

The interest expense on the debt is already up to $415 billion per year:

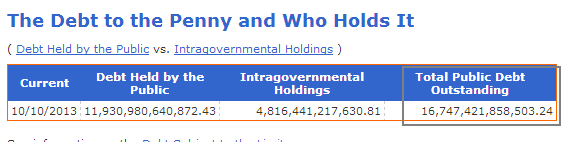

We owe $16.74 trillion. If this were an interest only loan the rate would be 2.4 percent per year (who else can command a rate that low?). What is interesting is The Treasury is already using extraordinary measures to avoid a default. The debt ceiling was raised to $16.699 trillion on May 19, 2013 but we are beyond that. Of course the October 17 date is a big one because we simply cannot be operating in emergency mode for much longer. It is very likely something will be done but a soft default, that is, inflating ourselves out of this debt is likely to happen no matter what occurs in the next few weeks.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!