Nothing left to financially lose: Biggest drop in confidence since Lehman Brothers and why some are unmoved by government shutdown.

- 1 Comment

The government isn’t the only thing that shutdown.  Economic confidence in the US has also apparently shutdown as well.  Many people, in particular those in the media, seem perplexed as to why and how this can happen.  Unfortunately the current financial system has disenfranchised a large number of Americans.  Enough to the point that politics are fully dysfunctional in Washington.  What do you expect from a Congress run by millionaires?  Some in the media seem to think that all Americans have giant stock portfolios and have mega wealth to lose.  Sadly, one out of three Americans has nothing to their name.  47 million Americans are on food stamps.  Those 25 to 34 have a median net worth of zero.  The fact that the stock market has taken a hit since the shutdown has no impact on most Americans (or that it has rallied by 100+ percent since the lows in 2009 for that matter).  However, Economic confidence which is more important has take a major hit falling at the fastest pace since the collapse of Lehman Brothers.  When you have nothing to lose, that is when things get volatile like a cornered tiger.

The fall in confidence

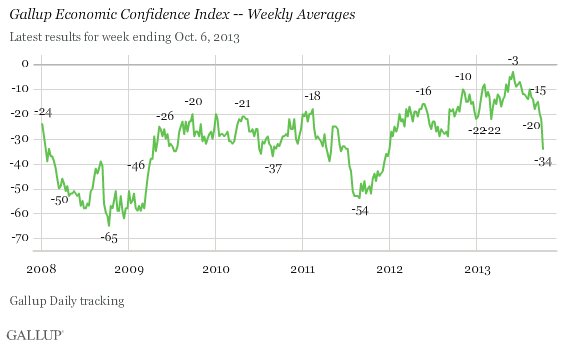

The fall in economic confidence is dramatic. Â This is the biggest fall since Lehman went under:

Source: Gallup

Some have a hard time seeing why this is happening and the psychology behind this is worth examining:

“(SoberLook) Amazingly, there seem to be countless Americans who are rooting for this to happen. Emails are pouring in arguing that a US default in fact is a good thing. They really believe this will magically solve the US fiscal deficit problem and/or somehow “punish” the Obama administration. They don’t seem to realize that this is akin to wishing for another 2008, while US government deficit would only worsen as a result (with tax revenue collapsing while entitlement liabilities growing just as fast). Alternatively these people just don’t seem to value their jobs, homes, pensions, and bank accounts – all of which will be at risk should the US government fail on its obligations.â€

I think there are many things to consider. Â Many have lost their homes during this last crisis only to see rents rise and banks get favorable treatment in purchasing these properties. Â Bank accounts? Â A large part of our country has zero dollars in their bank account. Â Pensions? Â As we have noted only about 10 percent of the population now has what amounts to a pension. Â The issue of course is that a large portion of our country is still living in the deep pains of a recession. Â They have very little to lose so what may seem illogical and downright insane, may make total sense to many. Â And people vote. Â In our representative government this is how gridlock is developed. Â We have hollowed out the middle and now are fully divided to the point of the government not being able to function. Â That is very troubling. Â A strong middle would likely provide more common ground but that middle has eroded to a shell of what it once was.

Nothing in the stock market

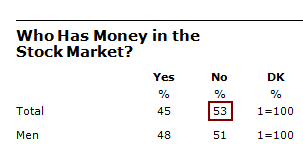

As we noted before, Americans have very little invested in the stock market:

While bankers may be fretting about this, sadly, a large portion of our population feels left out of what has been a slow and methodical destruction of the middle class.  So this financial and political brinkmanship makes complete sense through that perspective.  Is this good?  Of course not.  Congress has a job to do.  Yet they don’t have the motivating factors that the unemployed person or the massively indebted college student have.  The reason economic confidence has fallen so dramatically is because people see how little is being done for them.  Banks and the government seem apathetic to the needs of working Americans.

Here is another good summary of our boom and bust culture:

“(NY Times) The boom-bust-flip phenomenon is just one of the most obvious ways that research suggests the financial crisis has benefited the upper class while brutalizing the middle class. Rents have risen at twice the pace of the overall cost-of-living index, partly because middle-class families can’t get the credit they need to buy. That means “landlords can raise rents with impunity,†says Glenn Kelman, chief executive of Redfin. And according to a report by David Autor, the M.I.T. economist, job losses during and after the recession were concentrated in midskilled and midwage jobs, like white-collar sales, office and administrative jobs; and blue-collar production, craft, repair and operative jobs. Employment for higher-skilled workers, on the other hand, has grown substantially. As the Earlls can attest, the consequences of job loss go far beyond the spell of joblessness. Research shows that layoffs can worsen earnings, health and even mortality rates for up to 20 years after the initial displacement. Not to mention homeownership.â€

So sure, home prices are rising at dramatic speeds but little of this benefit is landing in the hands of average Americans. Â The bulk of the gains, just like the stock market, are going to the top 1 percent. Â Keep in mind that this group was bailed out so they were very apt to go down the corporate welfare line when it came to their wealth, but after that they have forced austerity down the throats of Americans to bail them out.

All of this really ties in with the “nothing to lose†mentality that is running the country at the moment.  Wall Street is thinking “why would people want this?†when they have been so out of touch with many working and middle class Americans.  Sadly, this path is unlikely to yield positive results but this is the best government money can buy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Chris said:

what a joke…….I like the statement….. ” Alternatively these people just don’t seem to value their jobs, homes, pensions, and bank accounts ……and ” Amazingly, there seem to be countless Americans who are rooting for this to happen ”

My own bank account has $4,000 in it it and who employs a 54 year old white male who does not live on welfare but is willing to work ?, as for jobs, well what jobs ?, oh wait I forgot, I have something to lose by backing a shut down of the Government ! ( I am having trouble seeing what it is I will lose ).

I say let the morally corrupt, lying , thieving ones we call politicians pay for bowing to their money God.

October 13th, 2013 at 5:48 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!