The bailout of the wealthy: stock market sham, income inequality, and crushed consumer sentiment. Peak debt, peak Dow, peak inequality.

- 6 Comment

In the midst of the stock market reaching record levels the Federal Reserve has increased its balance sheet to well over $3.2 trillion. The Fed continues to be the primary buyer of mortgage backed securities. This strategy has caused a flood of easy money from big banks into residential real estate as funds start chasing yield from under every rock. Yet the results are rather clear that this new stock market high has done very little to improve the lot of most Americans. Sure, we have a peak Dow but we also have peak food stamp usage, peak student debt, peak federal debt, and peak inequality. This is probably making many people rethink their notion of what constitutes a recovery. The bailouts have been incredibly expensive but the clear winners have been a very small fraction of Americans. The bailouts are also ongoing. While some of the bailouts have trickled down to some Americans most of the gains have been concentrated to a very small number of people.

Peak inequality

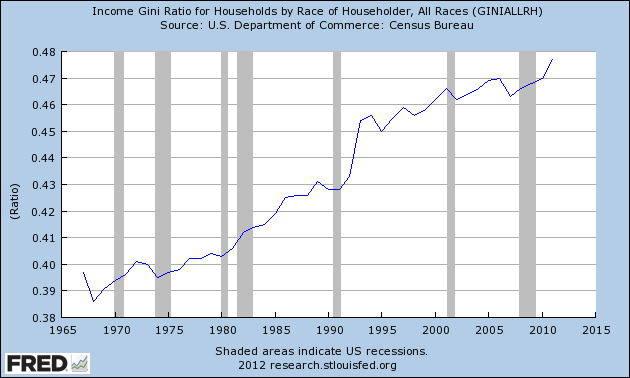

A measure of income inequality for a nation can be found via the Gini ratio. As you can see, income inequality is at a post World War II high:

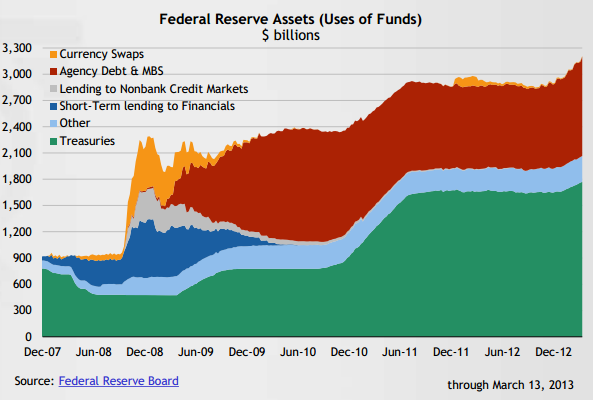

Most of the disparity started in the 1980s and hasn’t let up since. The Fed has also increased its balance sheet deep into uncharted territory. The current bailout dish of the day is QE3 with the Fed buying up mortgage backed securities. This has pushed the Fed balance sheet above $3.2 trillion:

Yet this has done very little to improve the economic landscape for average Americans. There is little hiding that inflation is hitting in very important areas including college tuition and healthcare. Even housing is getting expensive again but is hidden under the guise of low rates that mask the true underlying cost of a home. The Fed is betting that most Americans will ignore the sticker price and simply examine the monthly payment. The Fed is purchasing some $85 billion in MBS each month with no signs of stopping:

“(Bloomberg) Obviously, there has been improvement,†he said at a news conference in Washington today after the Fed decided to leave the pace of asset purchases unchanged at $85 billion a month. “One thing we would need is to make sure that this is not a temporary improvement.â€

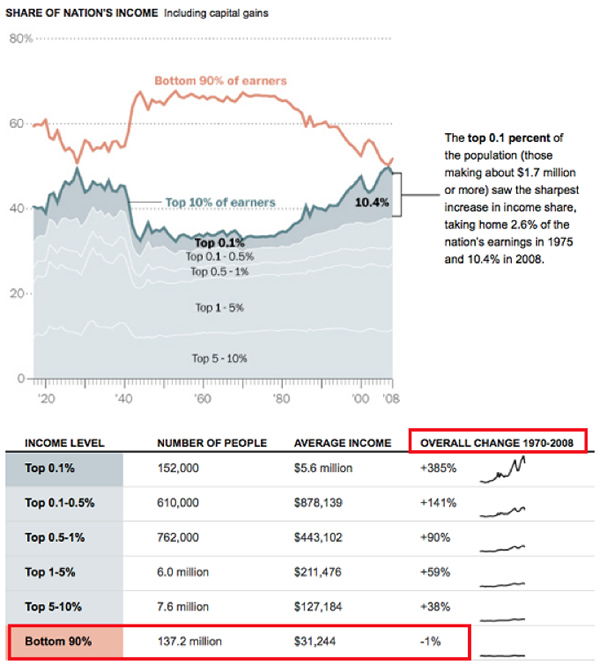

Yet a growth strategy based on debt has not helped the vast majority of Americans:

From 1970 to 2008 the bottom 90 percent of Americans have seen no real gain to their incomes. This may be surprising but also helps to explain why we have some 47+ million Americans receiving food stamps at a time when the stock market is reaching new highs.

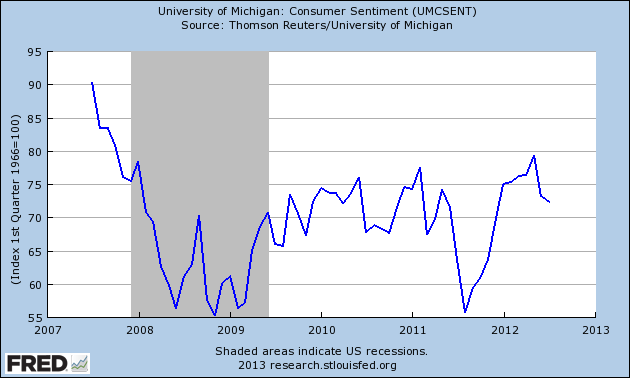

It also helps to explain why consumer sentiment is at levels that were last felt during the middle of the crisis in 2008:

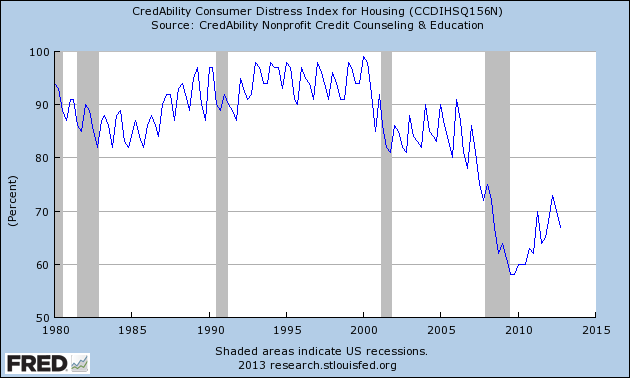

First, most Americans do not own any significant amount of stocks. Many organizations have boosted their profits by slashing wages and jobs. Good for stock prices but not good for workers. Also, many organizations now make a large amount of their profits abroad. And finally, many Americans derive the largest part of their net worth from housing. According to the CredAbility Distress Index things are still tough for many:

The Index score is tied to one of 5 general rating categories, which reflect the strength and stability of the consumer’s position.

Less than 60 Emergency / Crisis

60 – 69 Distressed / Unstable

70 – 79 Weakening / At-Risk

80 – 89 Good / Stable

90 and Above Excellent / Secure

Low rates have not cured the 10 million homes that are still underwater. Prices might be rising in certain areas but this is a reflection of low rates courtesy of the Fed and this play might be played out. The Fed has pushed rates to negative territory. What is now happening is large investors are purchasing homes throughout the country for investments. Many looking to buy are finding very little inventory and are having to compete with large money investors. The Fed has made it easy for member banks to access easy money. Ironically access to credit for most Americans is still tough.

Wealthier Americans derive their wealth from stocks. So this resurgence in stocks is definitely increasing their bottom line but one out of three Americans has no savings and half are one paycheck away from being on the streets. The bailouts started occurring nearly five years ago so we can now look at the track record of what has occurred. What has happened is that for most Americans, a low wage system has been pushed into their lifestyle. No method of privatizing gains and socializing losses. Yet this is the current system that still reigns for a few. A peak for the Dow and speculation in real estate coming again thanks to low rates from the Fed. Are we to expect that this time around things are going to get better for the middle class?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

What the so called elite are missing is that we have a population implosion here in the US and nobody can make a profit from the elimination of the core population can they? The elite in the days of Jesus was reserved for those who loved one another enough to lay down their lives for their friends and had nothing to do with money! This country, on the other hand today, has slipped into the cathection side of the ledger; believing that things are the measure of one’s wealth instead of friendship and the price already and to yet be paid is far beyound measurement in the elitists’ terms. They have fallen into the pharisee trap, by believing that the measure of a persons’ importance is their monetary wealth which of coarse has always led to the type of inequality we are now exhibiting in The United Snakes Of America; while Jesus for example had an unlimited and eternal wealth of friends; although he didn’t have many things and or money. His disciples also fell into this same trap, as found in Mark 7:23-27….And Jesus looked around about and said to His disciples, How hardly shall they ht hve richs enter into the kingdom of God. (24): And the disciples were astonished at his words, ut Jesus answered aain, and said to them. Children how hard is it for them that trust in riches to enter into the kingdom of God. (25): It is easier for a camel to go through the eye of a needle, than for the rich man to enter into the kingdom of God. (26): And they were astonished out of measure, saying among themselves, Who then can be saved? And Jesus looking upon them said, With men it is impossible but not with God, fo with God (love) all things are possible. There are many realms of consciousness into whih we can all enter but only the consciousness of lovng OUR friends can be enough to actually SAVE the entire world from worshiping materialism. The United Snakes has chosen to deviate and decline which means that the price to be paid will be great. I remember the dusty old book I once found in a back room at my grandmothers’ place several decades ago which read: “Love Or Perish!”

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.comMarch 26th, 2013 at 2:10 pm -

rich said:

Free Trade and Unrestricted Capital Flow: How Billionaires Get Rich and Destroy the Rest of Us

There’s a straight line between “free-trade†— a prime tenet of both right-wing Milton Friedman thinking and left-wing Bill Clinton–Robert Rubin neoliberalism — and wealth inequality in America. In fact, if the billionaires didn’t have the one (a global free-trade regime) they couldn’t have the other (your money in their pocket). And the whole global “all your money are belong to us†process has only three moving parts. Read on to see them. Once you “get it,†you’ll get it for a long time.

What does “free trade†mean?In its simplest terms, “free trade†means one thing only — the ability of people with capital to move that capital freely, anywhere in the world, seeking the highest profit. It’s been said of Bush II, for example, that “when Bush talks of ‘freedom’, he doesn’t mean human freedom, he means freedom to move money.†(Sorry, can’t find a link.)

At its heart, free trade doesn’t mean the ability to trade freely per se; that’s just a byproduct. It means the ability to invest freely without governmental constraint. Free trade is why factories in China have American investors and partners — because you can’t bring down manufacturing wages in Michigan and Alabama if you can’t set up slave factories somewhere else and get your government to make that capital move cost-free, or even tax-incentivized, out of your supposed home country and into a place ripe for predation.

Can you see why both right-wing kings (Koch Bros, Walmart-heir dukes and earls, Reagan I, Bush I and II) and left-wing honchos (Bill Clinton, Robert Rubin, Barack Obama) make “free trade†the cornerstone of each of their economic policies? It’s the song of the rich, and they all sing it.

I’ve shown this video before, but it bears repeating. When you think about “free trade,†you probably think of the Walmart heirs (or Apple owners) wallowing in wealth from the world’s slave factories. But it’s a joint project by all of our owners (sorry, major left- and right-wing campaign contributors and job creators).

This is Barack Obama making his case for campaign funding to Robert (Hi “Bobâ€) Rubin and others in 2006:

Read more atMarch 27th, 2013 at 12:19 pm -

chris said:

My understanding is the reason the Fed lowers the rattles is to generate economic activity which will create jobs. They are doing what they can. It is a tough situation. The article implies low rates are not helping many. I don’t think this is true. What else could be done?

March 27th, 2013 at 8:01 pm -

Mark said:

Thanks for a great blog and keeping us updated with some great commentary and awesome graphs, charts, and tables.

March 28th, 2013 at 4:12 pm -

chris said:

The fed is pumping all this liquidity into the system in an attempt stimulate the economy. The idea is this will result in companies hiring more employees which would help most people. Yes, a by product is a stronger stock market, but that is not their primary goal. What else would you have them do?

March 28th, 2013 at 6:40 pm -

supertech86 said:

revolving debt has taken the place of wage growth, rates are kept to to fuel debt based consumption by basically those that can’t afford it. as the income increases the amount of revolving credit as a % of household debt decreases. those that have an excess of income after paying bills, etc. typically pay off those balances every month. non-revolving debt is harder to obtain for the majority of workers in the US of which 45% only work part time and are being paid low wages.

the US economy will never be “good” again, not with the majority earning low wages and seeing wage increases at 50% of the real inflation rate and not the bogus CPI. the next recession that occurs will have been preceded by another period of weak economic expansion. more than likely it will be worst than the economic downturn of 2008.

April 5th, 2013 at 8:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!