Bear markets happen more than people think: Since 1940 we have encountered 12 bear markets.

- 0 Comments

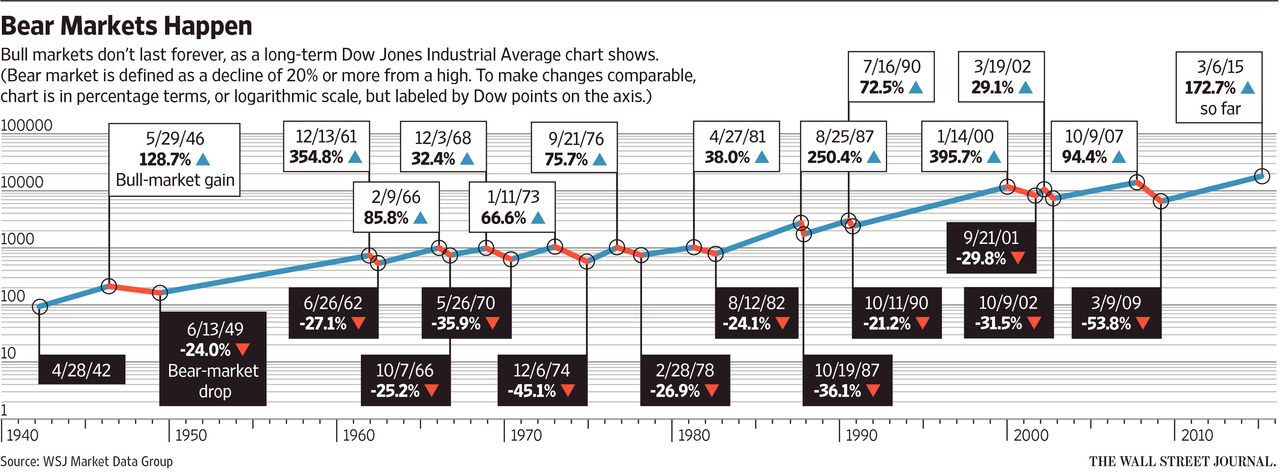

A bear market is defined by a 20 percent drop in the stock market from recent highs.  For some, the memory of the last crisis is now but a distant echo.  After all, we’ve been in a rather strong bull run for 6 years.  But bear markets happen more than most people think.  Since 1940 the Dow Jones Industrial Average (DJIA) has had 12 bear markets.  On the flip side we have had 13 bull runs.  This current bull run has been particularly strong.  A good portion of this rally has come in easy money flowing into Wall Street courtesy of the Federal Reserve and from cutting employee benefits and wages keeping profits flowing up.  The market is looking extremely frothy.  Easy credit is permeating into the economy in all corners including subprime auto debt, a massive amount of student loans, and people tapping into credit cards to get by.  Why?  Half the country lives paycheck to paycheck despite the loud stock rally.  If we look at a chart of bear and bull runs, we are due for a bear market.

The bulls and the bears

There is something in our DNA that makes us forgetful of financial history. Â The pangs brought on by the last financial crisis seem to be far in the rearview mirror. Â Yet the issues that brought on the last crisis including risky financial instruments and too much debt not only still exist, but are more pervasive in the economy. Â The latest rally in the DJIA puts it up over 170 percent from the lows reached in 2009. Â That is a dramatic rally considering the deeper challenges still facing the economy.

We see the cracks revealed when there is a minor hint that the Fed is going to take the punch bowl away. Â Here is a chart of bear and bull runs dating back to 1940:

It should be clear that bull runs do not last forever.  In fact, there seems to be a natural ebb and flow to the stock market.  We’ve had a very solid 6 year run and the fact that wages are still not keeping up with inflation, we know that something has to give.  Either stock market gains trickle down (unlikely) or a correction is bound to occur.  The market right now is fully hooked on the Fed’s easy money policy.  Any hint that the Fed may raise rates is met by sudden minor corrections.  At some point, the market is going to fully wake up and a bear market is likely to emerge.

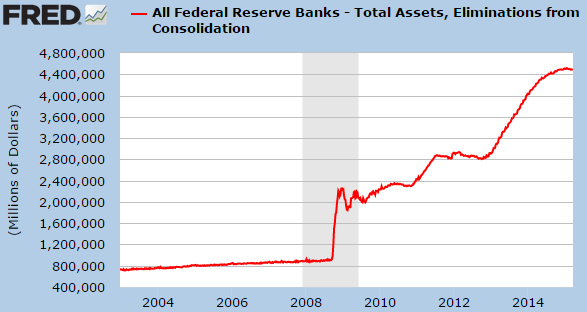

People may want to believe in permanent bull runs but this one has come at a hefty cost. Â Just look at the balance sheet of the Federal Reserve:

The Fed’s balance sheet is up to nearly $4.5 trillion (from $800 billion pre-crisis and this was in the form of cash equivalents). Today, we have a mixture of shadow bailout funds and many other convoluted programs that basically helped banks offload their bad bets onto the public – the slow corrosive power of inflation has slowly washed away the financial sins of the crisis.

Price-to-earnings ratios are also out of whack.  We see this dramatically in the tech sector where current stock values simply do not justify current prices.  Once again, take a look at the bear/bull chart earlier in the article.  To think we will not face a bear market is not only naive, it doesn’t jive with recent history.  Then again, memories are short when it comes to the stock market.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â