Commercial real estate transactions collapse 90 percent from 2007 to 2009. The next taxpayer bailout in the $3.5 trillion CRE market. From $522 billion in sales to $52 billion. CRE market over 4 times the size of the entire credit card market.

- 3 Comment

The massive commercial real estate market is already plaguing the weak balance sheets of banks. It is the case that each Friday, we are likely to see one U.S. bank fail because due to high levels of commercial real estate (CRE) debt on their books. This market is likely to cause the failure of hundreds of banks and put the economy down into another real estate funk. The amount of commercial real estate transactions shows no sign of recovery in this market. And why would there be any recovery? This is an area for hotels, strip malls, condos, and other projects that usually reflect a healthy and growing economy. We do not have that and the problems embedded in CRE are going to stifle any growth for years to come.

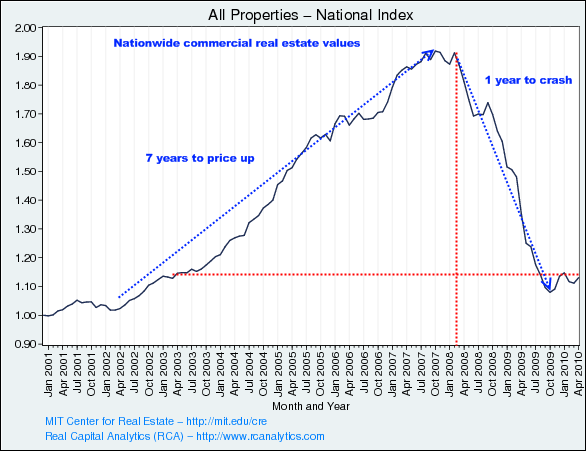

First, we should look at the trend in commercial real estate prices:

Source:Â MIT

The above chart is extremely helpful in showing how quickly bubbles can grow but also, how fast they can deflate. It took 7 years for prices to peak and only one year for prices to collapse. We have seen similar trends in the residential real estate market. The crash is rather obvious but why did it happen?  The reason prices collapsed so fast was that it was a speculative boom. Lending became much too easy with the Federal Reserve flooding the system with easy capital trying to find a home. In more sober times, CRE deals were scrutinized with a due diligence and it was inspected to produce cash flow from day one with sizeable down payments and strong financial reports. But this is not the case and many of these giant deals ended up going the way of the little to nothing down world of residential real estate.

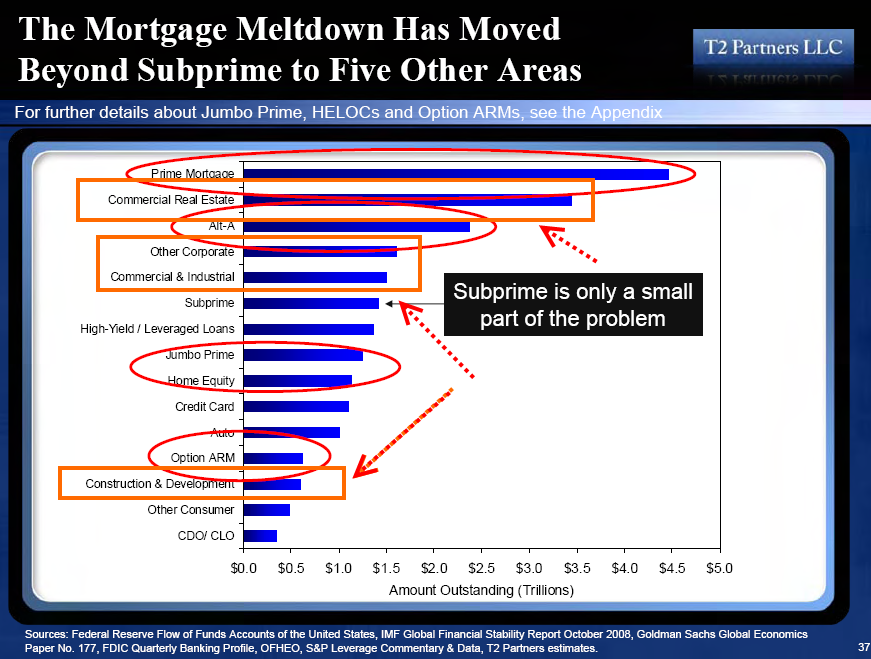

The market in CRE is enormous. This market is over $3.5 trillion and is likely to damage the regional banks much more deeply than larger banks that have a taxpayer safety net:

Source:Â T2 Partners

The current weakness in the economy is a realization that problems are still deep in the system. Think of how large the CRE market is. Roughly $3.5 trillion in debt secured by casinos, strip malls, empty condo projects, and other real estate that likely is underwater. Keep in mind that at one point this market was over $6 trillion in value. The CRE market looks to be valued at $3.5 trillion to $3 trillion with the same amount of loans outstanding.  In other words, the market sector is underwater.

The problems with commercial real estate have shown up in prime locations like San Francisco to Chicago. These CRE debt problems are not a reflection of poor areas as we are at times led to believe. These were high flying speculative bets that were only successful as long as the pipeline to greater fools was in place. When that line quickly dried up, so did the system and all the funding that kept the game going. It was the perfect definition of a bubble.

If we really want to see how quickly things have dried up in this market take a look at the following:

Source:Â Real Estate Channel

“At the peak in 2007 $522 billion in sales transactions took place. In 2009 it collapsed to $52 billion, a drop of 90 percent.â€

This is why the CRE market is the next shoe to drop and with so much debt outstanding it is going to put an incredible amount of pressure on already weak balance sheets. What is even worse is that the U.S. taxpayer is going to be likely on the hook for all these speculative bad bets. If you haven’t noticed the bailouts don’t do much for the real economy except shoring up the investment banks on Wall Street.

The amount of lending in this market has dried up and so have profits in this arena. Now the piper needs to be paid but with what money? How can you service your commercial real estate debt if you don’t have any money coming in? This is where delinquencies are spiking. It is also the case that the peak years for CRE debt maturities won’t hit until 2011 and 2012:

Source:Â Real Estate Channel

Unless CRE prices miraculously recover the problems are only going to get deeper in this market. Commercial real estate unlike residential real estate has quicker turnover rates on their loans. That is, many of the loans need to be rolled over every 5 to 7 years. Normally on a cash flowing property this is no problem but with trillions of dollars underwater, this is a major issue coming down the road. The FDIC with a negative deposit insurance fund is taking over banks on a weekly basis and is having a firsthand look at the tremendous amount of bad debt on bank balance sheets.

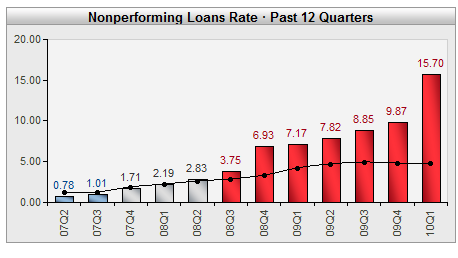

Banks clearly understand what sits on their balance sheet and if anything, nonperforming loan volume has shot up:

Source:Â Bankregdata

Throw in CRE debt, troubled residential mortgages, defaults with credit cards, auto repos, and all other debt instruments and you can understand why the chart above is spiking. But think of it this way; the credit card market is approximately $850 billion in debt outstanding while CRE debt is up to $3.5 trillion. What do you think is going to cause bigger pain down the line?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Dubai Blog said:

What more can you expect when the global market is facing credit crunch? This was to happen but now it is time for growth again and soon the real estate transactions will show some positivity in them all around the world.

July 2nd, 2010 at 12:23 am -

wheedle said:

Job creation will stimulate growth as workers spend money.The government’s injection of borrowed money into the system creates the illusion of growth and recovery.You can’t borrow your way out of debt.And you can’t pay your bills without income.It doesn’t take a college degree to form the conclusion that the current economic cycle of boom/bust is being manipulated.We have not seen the bottom of this cycle yet.

July 5th, 2010 at 10:33 am -

drymocke said:

While the financial meat-puppets and talking heads repeat their role as shills for the 1%ers at the top some of us are taking steps to prepare for another significant collapse. There is no significant jobs growth… people are not spending money they don’t have any more… and my optimistic view is we are only 1/2 way to the bottom of this particular economic cycle. I recommend buying guns and planting gardens.

July 15th, 2010 at 4:32 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!