The comprehensive guide on why you will never retire living the way you do: Examining the typical $50,000 household budget and why most Americans have nothing to very little saved for retirement.

- 11 Comment

We are facing an impending retirement crisis of epic proportions. The math is tough to look at. We have a growing population of aging baby boomers hitting retirement age with weak investment portfolios. Many will face increased healthcare costs since most of healthcare spending tends to hit in old age. Many older Americans are finding it tougher to retire and this also plugs up the pipeline for younger workers to move up through the employment channels. Many young Americans are confined to a new low-wage economy where pensions are extinct, benefits are lacking, and wages are far behind that of their parents even after adjusting for the corrosive power of inflation. The idea of retirement is actually a modern one. For most of our civilized history the only people that had time for fun and leisure were the top one percent of society. Life in other words was short and brutish for most of us. The US of course was the first nation to have a large and powerful middle class but this only came about after World War II. We are now trending back to the more historical norm of massive inequality for the bulk of the population. If nothing is done to reverse this trend, we will simply revert to how things were and the notion of retirement is going to disappear along with pensions. Most Americans still believe retirement is in the cards but their saving habits show a completely different future.

Americans make less than you think

It is still surprising to see that the mainstream press rarely focuses on the actual raw numbers for US households. It makes sense since most major broadcast stations are in it to sell you something via advertising. There is little benefit on showing how little most have if your goal is to have people part with the little money they have. Younger Americans tends to spend more on consumption goods yet they are now part of a growing low-wage economy in our country.

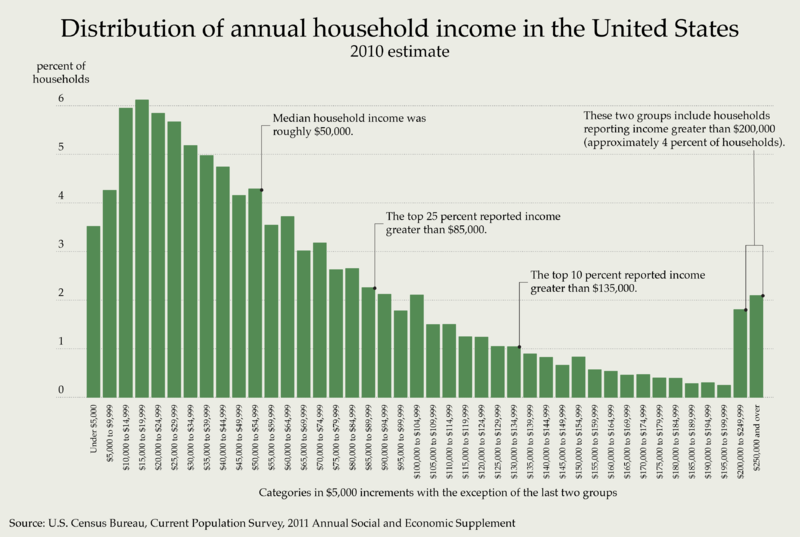

First, let us take a look at income distribution in the US:

The typical US household makes $50,000 per year. This is by definition, the “middle†in middle class. I always shake my head when the media tries to portray those making more than $200,000 as middle class. If you are in a household making $200,000 or more per year, you are in the top 4 percent of US households. This is basic math. A household making more than $135,000 per year puts you in the top 10 percent of households. If you were to watch only mainstream television you would believe that every US household was somehow making six-figures when that is clearly not the case. It might be illuminating to put together a mock budget of the typical $50,000 household.

The $50,000 median household income does not go very far

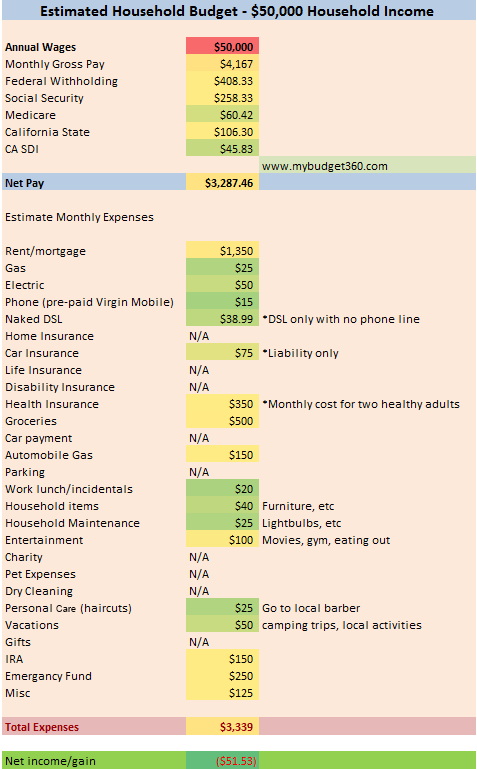

For our budget example, we’ll examine the state with the most people, California:

In California, a $50,000 household income results in a monthly net paycheck of roughly $3,287. At this income level this family is likely renting in the state. Housing consumes the biggest part of net income for most US households. This is why the trend of big investors buying up limited inventory and pushing up prices and rents is somewhat troubling but this is the end result of the Fed assisting member banks with artificially low rates. Higher prices with stagnant incomes eat deeper into household budgets.

We are being very modest here with the budget. We are spending $25 per month on gas assuming we are in an apartment at this rate. Electric at $50 per month since a small apartment in California should consume little energy. For cell phones, we are going with a pre-paid phone with Virgin Mobile of $15. We are stretching the budget here. For internet you can find a cheaper service for less than $40 per month.

Car insurance we are assuming $75 for liability only here on a used or older car. Health insurance for two healthy adults will cost $350 per month. Add a kid or someone with a pre-existing condition and this can add larger costs. Groceries will run about $500 per month if you shop carefully and buy prudently (i.e., less meat, no alcohol, non-chain markets with lower prices, etc). Gas will be $150 per month and we’ll assume one car for this family here.

You should be brining your lunch to work at this income level. We’ll throw in $40 for household items since you are renting here. $25 for regular household maintenance like light bulbs or other minor items since these should be covered by the property managers. We are throwing in $100 for entertainment here. This should cover Netflix, gym, and eating out at a cheaper restaurant. After all, we are talking about $50,000 per year here, not $200,000 per year.

You can get cheaper haircuts for $20 to $25 (for family) and $50 for vacations should be enough for one or two cheaper vacations for the year. These are monthly splits for annual costs. We haven’t even hit any savings for retirement!

Finally, we are putting away $150 per month in a retirement IRA. This is $1,800 per year. We are also saving $250 per month into an emergency account. We’ll leave $125 for other items like a dental fix up, glasses, or other items that pop up.

In the end, we are basically breaking even here. Does this family seem like they are indulging here? A $1,350 rental in California won’t get you much and many households face this kind of budget on a daily basis. Can you see why so few people are prepared for retirement?

Keep in mind this is merely an illustrative example. People differ. Habits are different from one person to another. Yet we absolutely know that $50,000 is the median household income so we can use this as a baseline to work off a hypothetical household. When we run these numbers it is easy to see why most are broke or have very little saved for retirement setting up a big disaster in the upcoming decades.

Most have nothing to very little saved for retirement

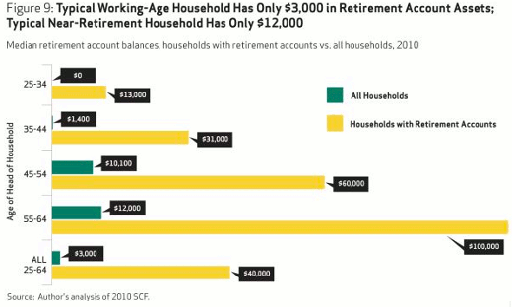

This is why it is no surprise that most Americans have no retirement plans:

This data is incredibly illuminating. First, the typical working-age household has $3,000 saved for retirement while those near-retirement have $12,000. But look at the information for younger households:

25-34 (median retirement account $0)

35-44 (median retirement account $1,400)

If things are bad for those nearing retirement now which would be baby boomers, this is only going to get tougher for younger Americans. Baby boomers had one of the hottest stock markets ever. Starting in the 1980s, we started going off pensions into more 401k like plans. In 1980, the S&P 500 was at 100. Today it is at 1,881. If people were saving diligently they would have money in their nest egg. Guess what? They don’t and I think the above mock budget gives you an example. The above budget is also for a couple living carefully while most have two cars, the latest phones, and spend money they don’t have via debt.

So by default, most are going to rely on Social Security as their primary source of income in retirement.

Typical Social Security payment very low

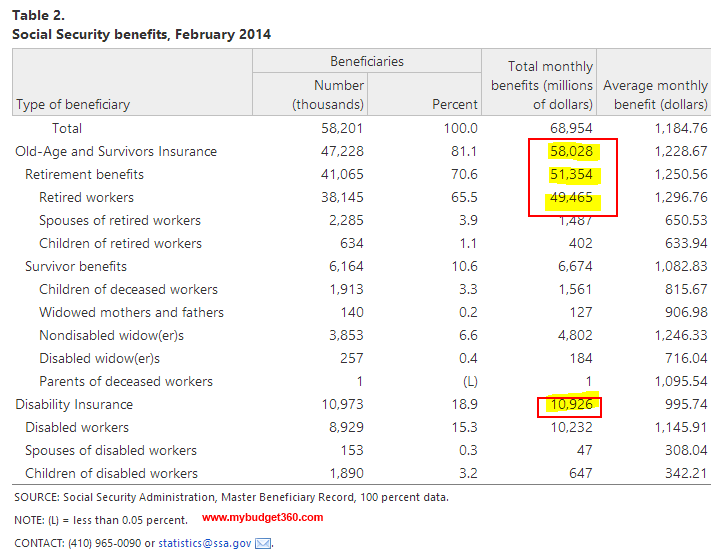

The vast majority of retiring Americans rely on Social Security as their primary source of income. Yet this income is not as big as you would expect:

The typical monthly payout is $1,250 for a retiree. In California that doesn’t even cover rent. It is important to note that you have to reach a certain age to draw on full benefits:

For most people, they are going to have to wait until they hit 67 before they can draw full benefits. This is why it is becoming more common to see older workers at places like Target, Wal-Mart, or many other retail establishments. People need to supplement their benefits with other income. Not exactly the ideal notion of walking on the beach with Margaritas riding into the sunset.

Conclusion

The figures are very clear and most Americans are simply winging it when it comes to retirement. What you can do if you can, is plan ahead. Gear up. Make sure you save if you can. If you live in an area where housing is affordable relative to rents, you should buy. At least this will lock in your biggest expense. You will still have taxes, insurance, and maintenance but these tend to be lower than your principal and interest. Try to have a solid emergency fund. The current system is not designed to protect you in retirement. For many in older age, the only option is to work and scrimp by. For many younger Americans start saving now. Invest in yourself and be wise with your money. Understand the difference between needs and wants. Time catches up on most and unfortunately, many Americans are starring at a retirement cliff with little time to financially change the situation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

Patrick Henry said:

$50 for electrical…………..hahahahahahahahahah try $250 a month in NC!

April 24th, 2014 at 11:22 am -

Patrick Henry said:

$150 for gas…..another joke, minimum of $65 per week for one vehicle!

$15 for a phone……even pre-paid not even close.Groceries pretty close

That budget is not even close to any reality for anyone $50k or $100k!

April 24th, 2014 at 11:26 am -

joe said:

no mention of income taxes in the personal budget. if we could keep the 38 percent in illegal income taxes for retirement that would help, you think?

April 24th, 2014 at 6:35 pm -

Walter Ruggieri said:

Not only are Americans not going to be prepared for retirement, those who are trusting in pension funds are not going to get all they are expecting to get. I read that 85% of pensions will be bankrupt in 30 years. So not only are Americans not saving, what they did put aside will be gone. We are headed for a mess that’s for sure.

April 25th, 2014 at 12:12 pm -

Stan said:

Add three kids to the budget and see what happens? Also I guess car maintenance falls under emergency? It is easy to spend $500 a year on just one used car. Clothes? And I hope you don’t have student loans to pay back…

April 26th, 2014 at 4:08 pm -

emdfl said:

Down here in FL I retired on ~70K. Recently did a monthly budgt. Income = ~$6000/month; outgo = ~$6125/month OUCH… And of course the irs “allowances” for damn near every expense is so much less than reality as to be a bad joke.

April 27th, 2014 at 5:12 am -

AnnJo1 said:

This is a great article, but there’s a major flaw in the budget analysis, and that is that it does not control for SIZE and AGE of households, particularly number of working adults in the household, but calculated expenses on the basis of two adults.

At the young end of the spectrum, a “household” of one 20-year old working a couple of part-time jobs might have him earning only $25,000 a year, but he’ll be spared most of the federal and state income taxes on income, he’ll be renting a cheaper apartment, his health insurance will be covered under his parents’ plan, his food budget should be considerably lower, etc.

Likewise, at the old end of the spectrum, a “household” of one 70-year old widow might have a modest income, but may own her home outright* and enjoy property tax exemptions, bringing her housing cost down dramatically. Her income too will be largely exempt from federal and state income taxes, and also exempt from Social Security and Medicare taxes.

There are also regional variations that could have major effects. Others have commented that the $500 food budget for two people seems about right, but until recently I fed three people, including one voracious 6-4″ teenager, on about $320 a month, with meat at 80% of all lunches and dinners, and while it does take planning and careful attention to sales, bulk buying, meal planning, etc., it is not that hard once you know how – but it’s not in California.

*I remember reading at the beginning of the financial crisis in 2008, something like one-third of all homeowner-occupied homes are owned free and clear of any mortgage.

April 27th, 2014 at 11:28 am -

jaichind said:

I am not sure I agree with $408 a month for federal taxes. If you take a look at

A $50K federal tax bill comes out to $3585 which is $298.75 a month.

April 27th, 2014 at 3:32 pm -

sean said:

Median household income in California is $61,400 according the US Census. You can’t extrapolate figures for the entire nation into a state that pays far higher wages than the rest of the US. And having an emergency fund without homeowner’s insurance is asinine, as is contributing to your IRA post tax.

But most importantly, median household *size* is 2.9 in California, so the kid is something you haven’t accounted for at all.

I also don’t think you’ve taken into account the tax refund that this family would likely be getting with a dependent (could be wrong about that however.) Most people blow that money anyways…

April 27th, 2014 at 4:13 pm -

Todd Voiles said:

One thing left our here is full treatment of federal taxes

I’m assuming 2 adults and 2 kids on this budget? (typical household)

They are living in an apartment so they take the married joint deduct and 4 personal deductions plus the IRA is sheltered. So their AGI for federal is

50,000 – 12500- 4(3950) – 1850 = 19850

Fed tax would be $2,070 but they withheld 408.33*12 = 4899.96 so they would get a refund of 2929.96! That’s >$200/month. Same goes for Cali tax, for family of 4 you woud pay pretty much zero tax so that would all come back (12*106.3 = $1,275), another $100/month.I’m not saying everything is roses but it looks like they have ~$4k/yr to work with

Even saying just 2 persons in the family (filing married joint) you would still get a refund of $1,645 for fed and ~900 for state

I agree with some of the other posters that your utils are to low but some other items are right on. I lived in CA for 8 years.

April 28th, 2014 at 2:18 pm -

Mike Percy said:

I used an online tax tool and put in the numbers, assuming the two 30-something people here were married filing jointly for federal income taxes. As I suspected, they will be getting a $1300 refund, so they should adjust their W4 accordingly.

Instead of $408 withholding monthly, they should have $300 withholding, giving them $108 more per month. Of course, they will end up owing a few dollars or getting very small refund next year.

If I’ve figured correctly, their over-withheld for Ca state taxes as well, and will be getting a $670 refund there. Adjusting that withholding too would provide an additional $55 monthly.

Between the two withholding adjustments, the couple might see an additional $163 monthly.

As an alternative, they could continue letting the IRS and state revenue hold that interest-free loan each year and simply commit to investing every dollar of their refund toward retirement. Or they could forget about retirement and just spend them extra money every month.

Will this make a big difference? Not really, but $150/month is a 4.5% increase in their spendable monthly income. They could double their IRA contribution.

May 1st, 2014 at 7:38 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!