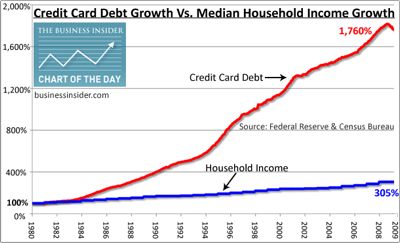

Credit card debt makes up for lack of income growth: Credit card debt outstanding back up to $900 billion. Since 1980 household income up 300% while credit card debt up 1,760%.

- 4 Comment

The middle class started disappearing in earnest in the late 1970s. Massive inflation started eating away at the standard of living for most Americans. Yet much of this was covered up by access to debt. Credit cards, creative mortgages, student loans, and auto debt all allowed Americans to continue acting as if prosperity was only an American Express card away. Credit card debt outstanding is now back up to $900 billion, a number last seen during the Great Recession before the great deleveraging. Americans have used debt as a means to cover up the reality that the middle class is disappearing. Credit cards are probably the clearest example of spending money you don’t have. Credit cards allow you to literally spend future earned money today. We always hear that many pay their balance off each month. Well the data shows something else. There is $900 billion in credit card debt floating out in the system.

The growth of credit card debt

Our entire system is built on easy money. Debt is the spending elixir for many households. Unfortunately as wages have gone stagnant people have found it necessary to be reliant on debt to purchase the artifacts of middle class living.

Here is a sobering thought; household income is up 300% since 1980 while credit card debt is up 1,760%. As the middle class standard of living has fallen, people simply cannot give up on this path and have borrowed their way up:

And Americans have gotten more comfortable going into debt for a variety of things. Credit card debt used to be the number one non-housing related debt class in the country. That award now goes to student debt reaching $1.36 trillion. But as the recession looks further in our past, Americans are quickly going back into credit card debt:

Since the Great Recession hit, Americans have been cautious about going into credit card debt. But now, credit card debt is jumping up dramatically. People are carrying larger balances. We are now up to $900 billion in outstanding credit card debt.

Here is a sobering chart:

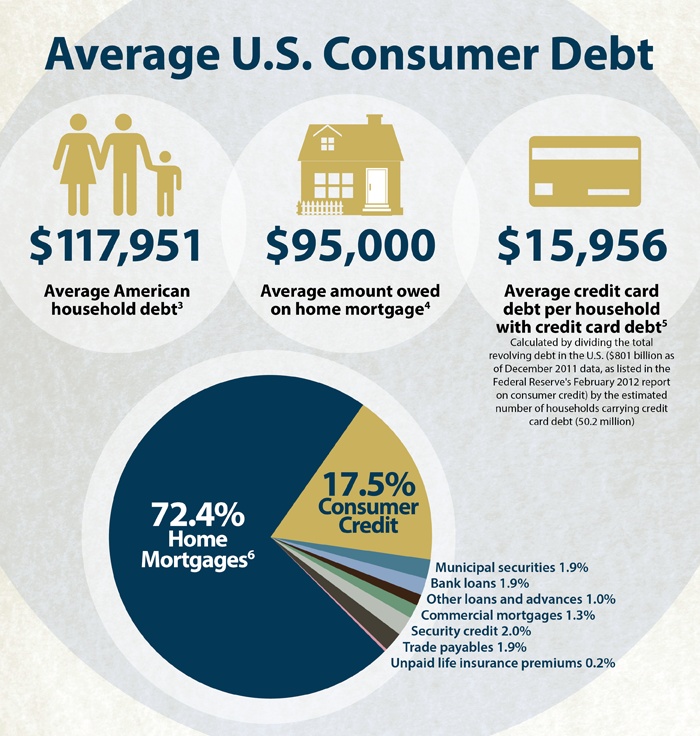

The typical US household with credit card debt is carrying a balance of about $16,000. That is a large amount of credit card debt layered onto the other debt households are carrying:

-Mortgages

-Student loans

-Auto debt

Debt, debt, and more debt. But with credit cards, you are borrowing money you don’t have for consumption today. With a mortgage, you have it secured to a home. With auto loans, you at least have the car. Student loans prove to be more problematic because there is no bankruptcy clause and the amount people are taking out in student debt is staggering. Credit card debt with high rates in this low interest rate environment are just poor financial decisions by Americans. You are locking in high rates in an environment where high rates are hard to find. And for what? To buy things people clearly can’t afford. Trying to hold on to the memories of middle class living.

It looks like people in the US are once again going into deep debt to purchase things they can’t afford. I mean last time things ended well so why shouldn’t it this time?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Joe said:

Decent article, though I question the idea that wages have gone up 300% since 1980. Forget doing any math to prove my point, just look at the year I started working, 1996.

I started in the electrical trade, became a master electrician. Journeymen then, earned between 15 to 25 bucks on average, and it’s still 15 to 25 bucks on average.

Having been in construction, I can absolutely guarantee most other skilled trade wages have been stagnant since the 90’s; it’s as simple as having lived, and known what the wages were, and looking online at job opportunities now; same wage, but hyper inflation.

In the 90’s, homes in my area(central Texas), were going on the low end 70 to 90k, and on the higher end, 200k…..try buying a home for under 200k now. Also, gas was a buck, and now? Fast food was had for under 6 bucks, while a family of 3 could eat out for under 27 bucks with tip at a nice restaurant. Tools have gone up 100’s of percent… list goes on, and on.

Wages haven’t gone up, but have stagnated; another parameter of this article should also look at the very real hyperinflation since 1980.

July 26th, 2015 at 5:07 pm -

gman said:

it’s all theft. the bankers print debt money and loan it to us, paying us in paper to work for them, and we take that paper and use it to make others work for us more than we work for them. everybody’s looking for the ultimate suckers who pay all the costs and work for nothing, while the rest of us enjoy the fruits of their labor. it’s all a pyramid scheme.

well, we’ve reached the end.

“an evil man hastens after wealth”, “a wicked man is ensnared by iniquity.”

July 27th, 2015 at 8:02 am -

alyce greer said:

Now i question you….. Credit cards are a miracle of finance! You don’t have to ask for the cash and pay back is flexible. Hey!!!!! a mortgage is clearly spending money fro the future – even a 3 year car payment is future income – money from mom is future income – college government loan is money from the future – contact your other anti credit card friends and wake the f up! LOL Also pay back at a depreciating currency! I LOVE my credit cards!!! Really you all are nuts.

July 29th, 2015 at 3:03 pm -

shelly weiner said:

debt is not a mistake, or unfortunate result etc

it is deliberate long term policynowhere, ever has man not striven to enslave his fellows wo are weaker and not as smart

this is the modern version

think about it

deficit financing on the personal and government level leads to essential confiscation of all savings and real ownership of property.

your representatives have been bribed into selling you into serfdom thru legislation requiring deficit financing on a scale where we can only keep up with the interest by borrowing more

August 2nd, 2015 at 12:08 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â