Dow and S&P 500: Is 2009 a Redux of 1938 and 1939? Powerful Spring through Summer Rallies. Market on Track for best Month in Decades.

- 0 Comments

The recent market rally is going down in the record books. The S&P 500 is up 21 percent in a matter of 3 weeks, which is one of the strongest short-term rallies in the books. In fact, we are on track for our best month since 1987. Yet this rally has the ominous signs of a short-term spring and summer rally that may fizzle out later. Two other years that had strong spring and summer rallies occurred during the Great Depression. With the U.S. Treasury and Federal Reserve flooding the entire system with money and throwing the long-term security of our dollar aside, the system was bound to react even in the short run. Most of the data coming out is still gloomy. Unemployment is rising and credit for the average consumer is still tight. Yet for banks, things just got a lot better thus spurring the current run.

The market when it hit its March lows had dropped a stunning 27 percent in 2009. Keep in mind for the entire 2008 year which saw $50 trillion in wealth disappear the market had dropped 38 percent. We accomplished our current run in 3 months. The fundamentals of the economy are still unsound. Yet the market was due for some sort of technical rally. First, let us look at 1938 through 1940 for some history:

As you can see in the Dow chart above, the market rallied from April 1938 to July 1938 for an astonishing 45 percent. This rally extended into the fall of 1938 capping out at 61 percent. The market then had another drop of 23 percent in 1939 followed by another spring and summer rally of 28 percent in 1939. It dropped in the spring of 1940 by 21 percent with a modest rally again in the spring and summer. Is this something that stands to be in our cards? Possibly. Keep in mind this was in the middle of the Great Depression here. So a market rally does not mean fundamentals of the economy are getting better.

What were the unemployment rates for these years?

1938:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 19 percent

1939:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 17.2 percent

1940:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14.6 percent

So as the market was rallying, unemployment was still at record highs. In fact, our current unemployment rate measured by the U-6 BLS data now stands at 14.8 percent, a rate higher than that of 1940. Yet these are different times. Take a look at the 2009 rally:

The Federal Reserve and U.S. Treasury are taking a much more active role in flooding the market with money and liquidity. Yet the problem with this move is they are acting on the basis that the market needs easy money and much of the drop has been due to panic selling. This is contrary to the fact that fundamentals are unsound and many banks are simply not lending because there is a limited pool of qualified borrowers. So although this current rally may help the supply side of the equation in the short-term, the demand side with consumers is still getting weaker as we speak.

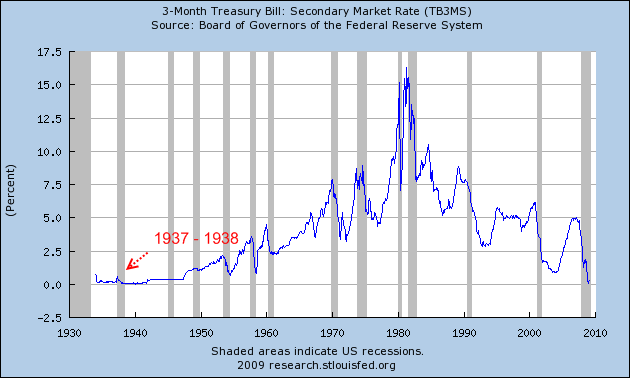

And powerful rallies do occur in recessions. The above spring and summer rallies occurred during a recession:

A recession occurred from May 1937 to June 1938. So we can say that the spring and summer rally of 1938 was because of the market coming out of a recession. That is not the case as of today. This is a rally deep within a recession. GDP final numbers for Q4 final will be coming out tomorrow and Q1 of 2009 will be equally week. We are in this for at least a few more quarters.

Keep in mind this kind of market volatility is characteristic of deep and troubled markets. Remember history and keep an eye on the fundamentals of employment, savings, and the strength of the U.S. dollar.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!