Banking Transparency Gone: The Federal Reserve has been Slowly Moving to more Archaic Forms of Creating Credit. New Plan Will Subsidize Casino Loans for Investors with Taxpayer Money.

- 0 Comments

While the public is exercising a Freudian fixation on the A.I.G. scandal, misguidedly thinking that A.I.G. is an American company in the sense of G.M. or Ford (it is not although many Americans see a Rorschach American company), the Federal Reserve just decided to increase its balance sheet by $1.2 trillion. This unprecedented action was not unexpected, like rain in the winter but the speed and magnitude tells us that the Federal Reserve and U.S. Treasury are completely set on decimating any value in U.S. dollar. What is even more troubling is over the life span of the crisis, each new program for injecting liquidity and capital into the markets has been less and less transparent.

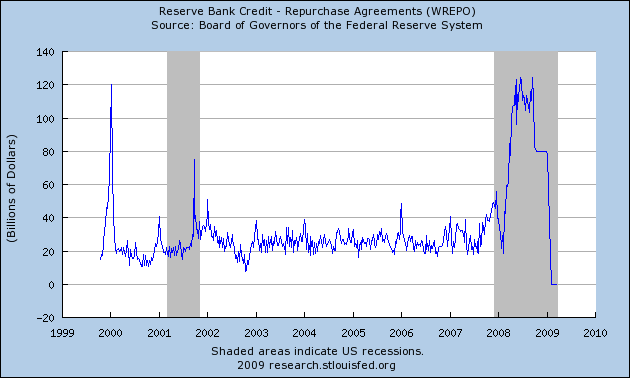

One of the more transparent ways of getting capital in the system initially was repurchase agreements. These were basically short term loans made to lending institutions. These were rather transparent (at least in Federal Reserve terms) and for that reason, they initially had a run in 2008 but have now fallen by the way side to zero:

A repo is similar to a secured loan with the buyer receiving the actual loan and rights conferred by it to protect itself from default. Think of a car loan. If you default, the lender has the right to takeover the car and many consumers are facing this. Now why is this now at zero? Well as a lending institution, would you rather take a loan or a free grant coming from the taxpayer? That is why this lending facility went to zero once other mechanisms of lending were brought about inching closer and closer to free money funded by the U.S. taxpayer. You need to recall that even these minor moves which now in hindsight look like chump change found in the cracks of your couch, had very little political will moving forward. Little by little we went from debating million dollar loans to now discussing a commitment of $9 trillion to the financial crisis, much of it in free money to the banks via the taxpayer.

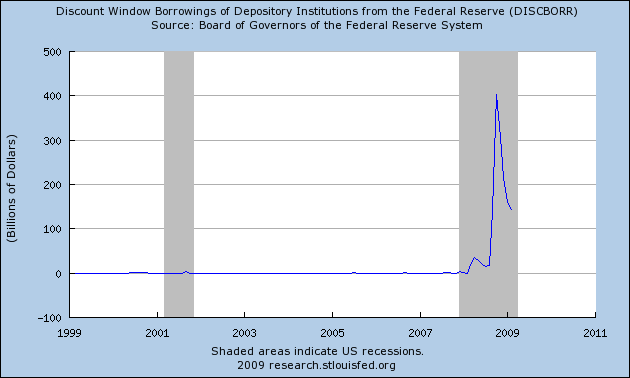

Another chart showing us that lending institutions are now electing to fleece the taxpayer for all they got is looking at discount window borrowing:

Again, borrowing from the discount window required borrowers to actually pay back the initial loans. Of course this kind of borrowing has fallen drastically recently but don’t confuse this with the notion that banks are now healthier. What is now occurring is banks are now electing to use more “free” money sources such as the TARP in which instead of creating a loan, they are given something more akin to a grant. That is, they don’t have to pay it back in any set timeframe. The TARP is basically a 0 percent loan with no due date. That is the taxpayer has given these lending institutions free money to turn a profit whenever they see fit (that is if they do survive that long).

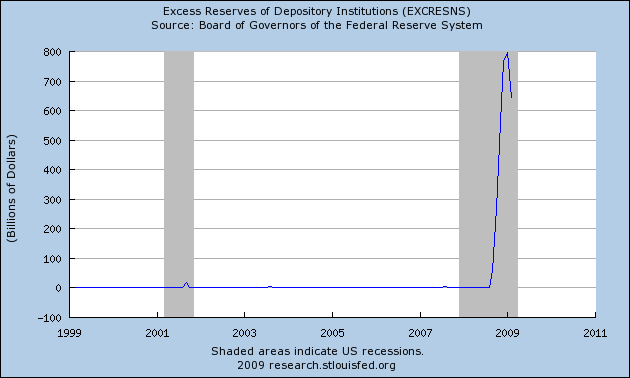

And you have to rewind to what the $700 billion TARP plan was about. The entire impetus of the plan was that we needed to get money flowing to the consumer so they could go out and spend again. Remember that distant promise? That was the thesis of the plan. Consumers needed money and banks weren’t lending. Ergo, we needed to give banks money so they would lend it out to consumers. Instead, banks had destroyed balance sheets that they have held onto the money while making credit tighter for consumers. Aside from the real day proof of tighter credit card terms and more stringent mortgages, let us look at where banks have their (our taxpayer) money:

What is occurring is banks are gearing up for a long winter on the back of our money while the consumer is asked to face the economic headwinds of unemployment and recession with no safety net. That is why giving banks money made no sense whatsoever. With that money, we could have easily created a “good bank” that was unencumbered by any liabilities or toxic assets created by the housing bubble and this money could have gone directly to consumers. But if you haven’t caught on, the solution to the crisis isn’t about you. It is about saving banks and figuring out ways to unload the toxic waste onto the taxpayers.

That is why the newly leaked plan regarding a way of dealing with toxic assets is so destructive. The design of the program is setup to give investors an incentive to buy up toxic assets with your money. In fact, it is a gigantic subsidy to investors which most likely will be banks, to buy up toxic assets with massive taxpayer funded leverage. That is a horrible idea on par with the idea of TARP which was buying up bad assets was going to be good for the taxpayer and would help get credit going again. It never did and has been an abject failure. And that $700 billion allocated with over half already committed, was a waste of nearly $1 trillion. Think about that. And now, we have a plan that will put nearly $1 trillion more at risk with no actual method of helping the consumer. Frankly, a crisis that has destroyed $50 trillion in global wealth will not be solved by adding more debt. Debt is the problem so using debt to solve it is tantamount to a gambler doubling down when he hits a bad streak.

We cannot rely on what we are being told by officials or those on Wall Street. If we look at how poorly the TARP has been mismanaged, should we trust the same people to come up with a better plan? Why are we to believe this next plan is going to help? In fact, this plan from the start is designed more poorly than the TARP. It will be a disaster. Protect your wealth because the Federal Reserve and U.S. Treasury are gearing up to bailout the banking sector on the back of American taxpayers…again.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!