Federal Reserve and U.S. Treasury Fleece the American Public: Total Market Cap of TARP Participants is $336 Billion, We Can Buy Them Out Completely: Enough with TARP and Nationalize NOW.

- 4 Comment

As we now are realizing in growing agony, the first $350 billion in TARP funds were poorly managed and did very little to improve the economic conditions of this country. In fact, I have argued that the U.S. Treasury and Federal Reserve through various market actions have taken actions to make saving money a very unattractive proposition for most Americans. Ironically, the only institutions saving any money right now are those participating in the TARP since they are holding onto the money with a clenched fist.

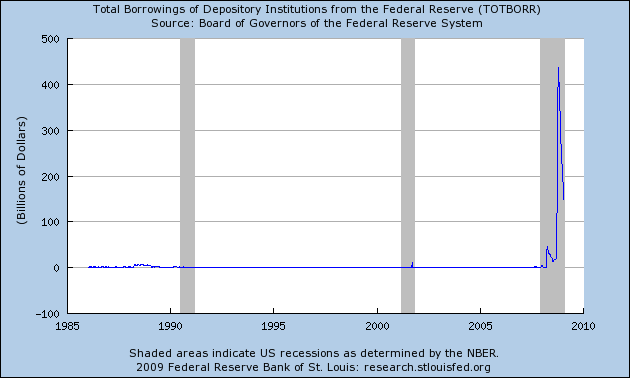

First, let us look at a chart that can be very misleading:

At first, you might think that banks are doing so well, that they have decided to stop borrowing any money from the Federal Reserve. Just look at the major decline. Yet this is occurring because these institutions have shifted their focus from taking loans with the Fed, and are now looking for free money from the TARP program. After all, the capital injections are a watershed for participating institutions.

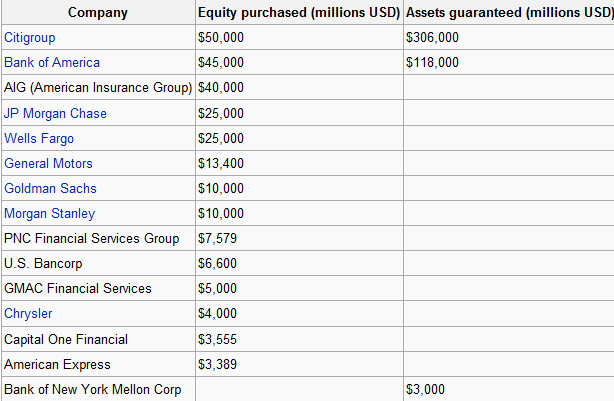

This program is such a joke and is a reason why we are now hearing rumblings of full on nationalization of a few of these organizations. First, let us take a look at those participating in the TARP program:

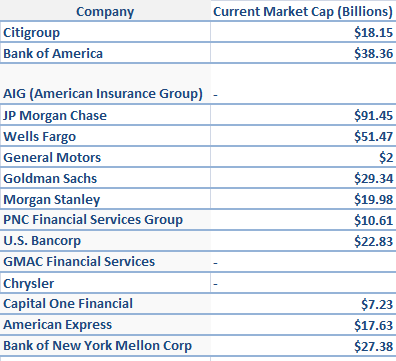

Now, let us look at the market cap of these banks:

Total market cap of TARP participants (those we can value) = $336.4 billion

Think of how absurd this is. We can flat out purchase all these institutions with the additional $350 billion tranche and still have $14 billion to buy gold plated commodes for many Americans. Instead, it is hard to believe the argument is still left on the table about injecting more capital in banks that are simply holding tighter to the money. This above back of the napkin calculation shows you how patently absurd the TARP has gotten.

It is time to nationalize these banks. They are insolvent. What we need to do is not exactly a great option but it is the best option we have. We need to take over the organization. Once we own the place, we need to separate the good, the bad, and the ugly. At this point, we own the bank so we’ll deal with the consequences and we’ll also take the incentive out of hiding poor earnings such as level 3 assets and other toxic mortgage backed securities. Right now, the tax payer is getting the worst of all worlds. First, we get a tiny fraction of the bank upside and the bank gets free tax payer money. What is the benefit in that? How does that help anyone else aside from the bank?  The fact that the $350 billion is larger than the market cap of these TARP participants is stunning. We might as well create a new “good bank”, free of any problems and simply start lending the $350 billion directly to consumers.

The housing market is going to be in shambles for many more years. The fact that existing home sales perked up today is simply a reflection of 30 or 40 percent of the REO and foreclosure re-sale inventory clearing out of the market at rock bottom prices. The Case-Shiller report will reflect these massive price declines.

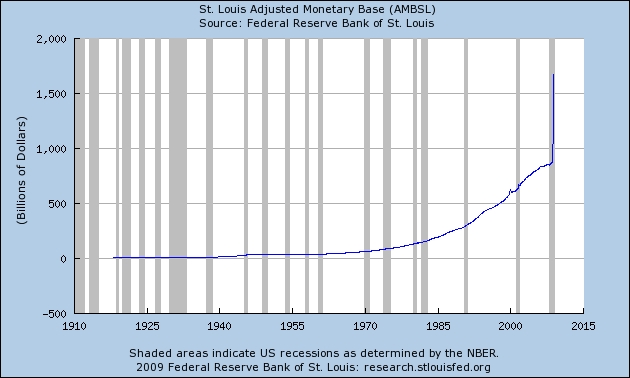

Some people have been pointing to the adjusted monetary base as a sign that yes, this money is making its way out to the public:

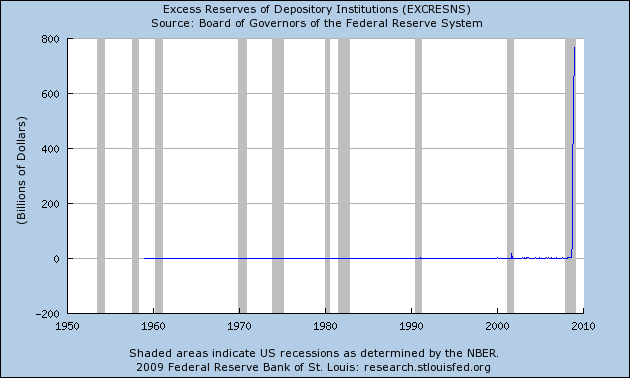

The monetary base from August of 2008 to December of 2008 shot up by $800 billion. You would think that this money is now floating out there in our economy. It is not. We need only look at the excess reserves of depository institutions:

Interesting. Excess reserves went from $1.9 billion in August of 2008 to $767 billion in December of 2008. Banks are simply sitting on free tax payer money or using the money to repair their broken balance sheets. Yet this money is not being funneled out to the consumer in the form of loans. Why would banks lend money to consumers? People are flat broke anyways with $49 trillion in debt in our country. That is why giving this money to banks, the wolves guarding the hen house money was absurd and expecting this money to be thrown out to consumers was such a waste.

If you can, you should contact your congress person and let them know to give up the TARP plan and let us nationalize a few of the banks. At this point, we are already committed and nationalization is the best policy. We already know how corrupt these Wall Street banks are so why in the world are we going to trust them to save us at this point? The first $350 billion is out the door but that second tranche isn’t. Let us admit the TARP is a failure and use that $350 billion more wisely by strategically nationalizing a few of the banks and finally, cleaning out the books of these companies.

The bad bank idea is simply a stupid pipe dream for these banks. Now after receiving all this capital (your money by the way), want to create a bad bank to dump off the most toxic of toxic assets and then, want the tax payer to pay for that mistake. That is absurd! They took the risk in good times and now, want to keep the profits while passing off the losses. No. What we need to do is take over these banks, oust management, and any profits will come to us. If they don’t like that, then they are on their own. Banks will participate because they have no choice. They are insolvent as it stands.

Nationalization is the best policy. Here are the 3 options we have:

1. More TARP. All this will do is suck more capital into banks with little upside for the economy and tax payers. Reminds me of the Christopher Walken SNL skit of “we need more cow bell.” Banks think they need more TARP.  Â

2. Bad bank. Dumbest idea. This will allow banks to slough off god knows what kind of assets and force tax payers to foot the bill of their massive incompetence.

3. Nationalize. Not ideal but at least we as tax payers own and control the institution. If we want to lend, we do it. It is absurd that we are hoping these institutions lend when we are giving them the damn money!

4. Do nothing. Economy implodes.

Either way, times will be tough and this will be the worst recession since World War II. Time to get smart about this.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

8020 Financial said:

Hi mybudget360,

What do you think would happen if the USG did nothing (option 4)? Would love to see your analysis on this. My view is that yes, while there would be a deep recession (which is on the cards anyway), at least it would ensure similar mistakes are not made again. Surely this is how capitalism is supposed to work?

PS. Been a long time reader of your blog, always enjoy your articles.January 26th, 2009 at 7:47 pm -

Fred said:

Nice article but clearly you havent called or written your Congressperson or Senator. They could give a flying crap about what you think, by witness of their off topic, form letter responses. They are already owned by the banks and Illuminati.

They will do nothing except what they are told to do by them. The only thing that will change the state of affairs of the Government is a revolution that kills all the members of both Houses of Congress and Judiciary(especially them) and a real Constitutional government reinstated with term limits and outlawing PAC and lobbyists(while were at it eliminating them and cutting the military budget in 2/3 and bringing home the troops would help reduce the outflow and continual devaluation of the USD)January 27th, 2009 at 3:58 am -

No Name said:

Actually some of the banks on your list borrowed money from TARP because it was a sound business decision, not because it was necessary. Borrowing from the Fed Reserve vs TARP… well, one costs a whole lot less than the other, and the banks would’ve been stupid to not do it.

Assuming that all recipients of the TARP funds are insolvent is a dangerous path to tread.

January 27th, 2009 at 11:48 am -

steve said:

I agree with fred. Obviously congress’ priority is to prop up the whole corrupt mess while they take care of themselves and their families………nothing is going to change until there is massive civil unrest. Now I know why our forefathers thought it was so important to have the right to bear arms….so that when this situation develops we can do something about it. Hang the bankers.

January 27th, 2009 at 3:05 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!