Graduating with a Degree in Debt: The Average Student Debt Balance for Seniors is now $40,000.

- 2 Comment

The runaway cost to attend college just continues to sprint ahead. The average student loan balance for graduating seniors is now $40,000. This is astronomical considering the per capita wage of Americans is in the high $20,000 range. The math behind this astronomical debt is rather clear and simple to follow. Student debt is one of those categories where your ability to pay said debt back is completely devoid from reality. For example, you can go into one hundred thousand dollars of debt for a degree in art that has little earnings potential in the market. Is that wise? Depends on who you ask but you can’t walk into a car dealership and purchase a $50,000 car without some financial backing and ability to pay it back. This applies to most things but the way we fund college is somewhat dysfunctional.

The indebted student

Average student debt continues to spiral out of control. There is now $1.4 trillion in student debt floating out in the system. People are having a harder time paying it back as demonstrated by the astronomically high delinquency rates for student loans. You would think that we would be undergoing some deep analysis of the issue but we are not. It is simply a train that continues to roll down the tracks crushing students one by one.

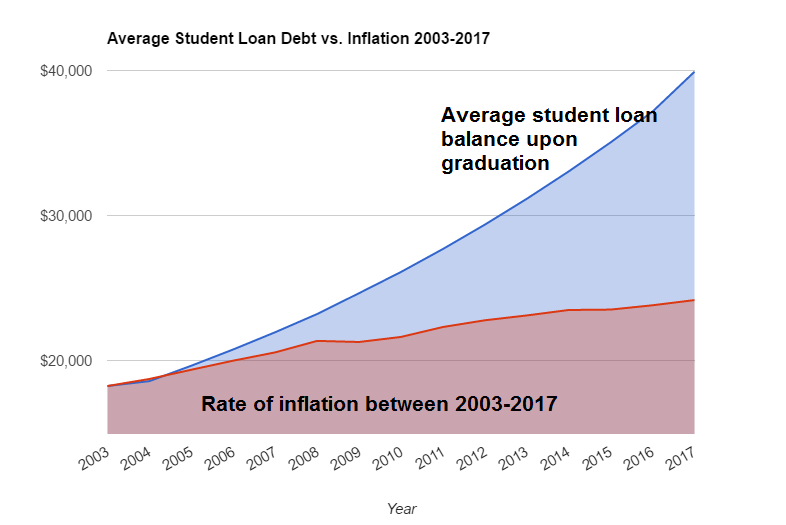

The fact that the average graduating senior is now coming out with $40,000 in student loans is nuts:

Things are now completely detached from reality as you can see from the chart above. The cost of college is completely disconnected from the overall rate of inflation since it is not connected to anything. It is merely connected to the willingness of young people to go into massive debt for a college education. And there is little doubt that people are willing to take on extraordinary levels of debt to finance their college education.

Part of it is because most student loans are government backed. The government is essentially bankrolling thousands of colleges by using students as a method of funneling money through them into the coffers of larger universities. The system works like this:

-Student wants to go to college

-Finds a college

-Fills outs a FAFSA (for aid)

-Financial aid office at said college comes back to student

-Loans are usually part of package

-Student signs on and goes to school

-After school gets its fees out, excess funds are popped into student’s account

-The bill isn’t due until student graduates

In essence that is how the funding flows through the system. So students accumulate debt over the typical four years of college and don’t have the bill hitting them until they enter reality. At that point, your income will need to service the student debt you’ve accumulated. Having $40,000 in student debt before even starting a job is a big burden to carry.

The way we finance college in the United States needs a bit of an overhaul.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Scott said:

If the newly minted degree is in Engineering or the Medical arena, as opposed to one of the “soft subjects” such as history or psychology ( to say nothing of women’s studies or the minority empowerment stuff), the 40 k will vanish like a small Kansas town in the rear view mirror when actual earnings begin to manifest.

The young graduates with problems were badly advised, or wilfully wasted their time and money garnering knowledge and a skill set for which there is (and was) no market.

To paraphrase Ron White, you can surgically fix ugly but there’s no cure for stupid.March 20th, 2017 at 1:21 pm -

DearSX said:

$20k per year is not uncommon for any degree. About 10-12K for a public college is the number, not counting room and board, book and transportation. $40k sounds about right.

Even with a good degree. $400 a month for 9 years or so will be the norm. That is a lot of money. Smaller houses and cars will follow.

April 3rd, 2017 at 9:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â