Homeowner Affordability and Stability Plan: California and Florida you are Financially on Your Own.

- 5 Comment

I was cautious about the details in the new Homeowner Affordability and Stability Plan which was announced on Wednesday. It is going to use $75 billion from the additional $350 billion in TARP funds while accessing the $200 billion in backstops to Fannie Mae and Freddie Mac. Yet one key point, and probably a reason the market ended neutral on Wednesday, is that the plan inches closer at isolating the toxic mortgage waste found in California, Florida, Nevada, and Arizona. In the mean time, it would also seem that California is still unable to have any effective government and is embarrassing itself on the world stage. One of the largest economies in the world and you have politicians brushing their teeth in the halls of Sacramento.

The plan being far from perfect, does offer at least a better outcome than say the $350 billion in capital injections to banks, which were an utter waste of money for the American public. This plan is estimated to help 4 to 5 million homeowners although very few in California and Florida will be helped. And rightfully so. Most of the toxic mortgage waste resides in these two states. What this plan will do, although not explicitly, is start isolating the most troubled assets while targeting those loans that do have a chance of being saved. You are not going to save 90+ percent of Option ARMs in California or Florida and those loans will not fall under this plan (thankfully).

Yet the plan is expensive and at best, will only help buffer the major problems we are facing in our economy. A housing recovery it is not. Let us first dig into the details of the plan to better highlight what it will and will not do.

One of the key components of the plan is lowering the mortgage rate. However, this will only apply to borrowers who have loans that are owned or guaranteed by Fannie Mae or Freddie Mac. This in itself rules out much of the Alt-A and Option ARMs in California and Florida. From a nominal perspective, these 2 states have the worst of the worst mortgages and this merely reflects the magnitude of their housing bubbles. Previously, loan caps on refinancing were set at 80% but under this new plan they will extend to 105% of a homes value. This is a big increase.

Many homes in California even if they were backed by the GSEs (which they are not) would not have a chance even under these more lenient guidelines. Think of a zero down Option ARM borrower who bought a $500,000 home with no money down and the home is now worth $300,000 (the state is now down nearly 50% from its peak values). At most, they would need for their loan to be $315,000 on a $300,000 home. Not going to happen. Many of the toxic lenders are still holding on to this stuff waiting to unload it and this plan does not give them this avenue.

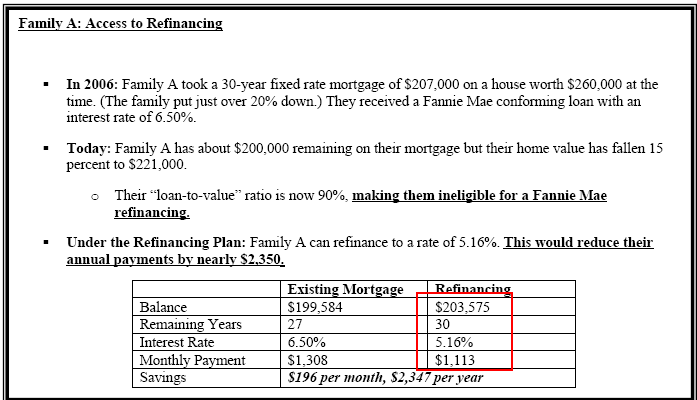

Let us look at an example given by the Treasury regarding the plan:

Let us look at the above carefully. First, what you’ll notice is that the new balance actually increases after the refinance. Extending the life of the loan will also drop the monthly payment. The interest rate is dropped which is where the government is subsidizing the loans. And finally all this combined decreases the monthly payment which honestly, is the ultimate goal of the plan.

It really isn’t a free pass. Let us say this borrower that has been helped wants to sell in the future. The balance still needs to be paid off thus keeping the asking price at a higher level which ideally will keep the borrower living in the home. This is possibly designed to mitigate any one trying to refinance and then flip the home because there are many home buyers who speculated or bought more home than they could afford. This argument might have held water in early 2007 but it is hard to say that with a straight face when $9 trillion has been committed to banks and Wall Street and the average American family is left to deal with the worst recession since the Great Depression.

Another key point in the plan is $75 billion that will be used to lower debt-to-income ratios for homeowners. This will be something important to follow. The gist of the plan is that the government will match dollar for dollar the amount the lender will lower a loan to ideally get ratios down below 38% – 43%. Again, this rules out California and Florida where there are many now spending 60 to 80 percent on their loan payment even before the loans recast. To sweeten the pot the government will provide a $1,000 incentive to lenders who successful modify a loan under these guidelines.

This part does bring up some issues because you will undoubtedly get some people who bought too much house or behaved imprudently. Yet given the guidelines, I’m not sure how many would fall under this purview. This is probably one of the more distasteful parts of the bill but at least seems to be a more reasonable proposal.

One of the other sticking points in the bill is accessing $200 billion to shore up Fannie Mae and Freddie Mac to offer cheap mortgage credit. Given that we already own these two giants this is rather unsurprising. The two giants are virtually the only game in town already.

The plan is one of the better ideas put forth so far but given the crap we’ve been seeing, that isn’t a bar too high to jump over. The bottom line is home prices are still too high given our national family incomes. That is the ultimate market stabilizer. Figure out how to make Americans richer through wages (approximately 70% earn money through wages from working for an employer) and that will stabilize the market. Yet with rising unemployment it only makes logical sense that home prices will also drop to reflect the change in the economic conditions of American households. My initial fear was the plan was going to try to put a bottom on housing prices and this does not.

Another push which finally makes sense is that of allowing bankruptcy judges to rework loans. Given that bankruptcies are soaring this only makes sense since Wall Street and lenders are useless in helping since they were all betting on a plan like the pathetic bad bank idea, where they were going to be able to dump all their worst assets onto the backs of tax payers. With this plan, you can expect to see a slow destruction and isolation of the most toxic mortgage assets and hopefully, those institutions that made those loans while helping some homeowners.

Ultimately I see this plan like the above example. It will help some Americans lower their monthly home payment by a few hundred dollars but their balance will not go away. But until we address employment, we are simply putting band-aids on a broken bone.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Terrance Stuart said:

Has anyone considered the possibility of simply adjusting the pay out period on mortgages from 30 years to say 50 years, I believe mortgages in Europe are keyed much longer than they are here. Banks could get the boost to refinance and those who like a lot of house can pay the extra interest over time.

February 19th, 2009 at 5:48 am -

Tobby said:

This plan is but one weapon in an arsenal. It is aimed at those on the cusp of survival. It should help quite a few given that this economy will likely worsen during the year. The upside down loans are out of luck. Although the Hope for Homeowners I plan is still in effect, there are (still) few lenders willing to write down these (barely) performing loans.

Your are confusing the simple FNMA interest rate modification (no subsidy, just a lower market rate) with the other program which requires lenders to subsidize anything over 38% debt to income, and the taxpayer picking up 7%DTI (38-31). Both of these are really very inexpensive given that they do not force a loan balance write down. Regardless, I can’t see it helping more than a million or so unless it is very simple to do.

February 19th, 2009 at 10:41 am -

Jubilee Year said:

I don’t know who will be eligible for the program, given that they will only cover 105% of home value.

Phoenix home prices just fell to $130K, the same as 2001!!! Even if you bought in 2004, at the then median of $140, you might not be eligible.

Until the gov’t gets serious about principal reduction, nothing is going to stop the real estate collapse.

February 19th, 2009 at 3:18 pm -

Bill said:

You-know-u-make-me-want-to-SHOUT!

C’MON-NOW!C’MON-NOW!

C’MON-NOW!

Whoa-oh-OH-oh!February 19th, 2009 at 5:22 pm -

Lawn Care Tips said:

The plan will not address all homeowners in trouble. Only loans insured or owned by Fannie Mae and Freddie Mac will be part of the program. Borrowers can call their lender and find out if that is the case with their loan.

June 8th, 2009 at 10:01 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!