Household debt first increase in 4 years largely driven by massive increases in student debt. Auto loans showed increase volume in sub-prime loans.

- 1 Comment

In a recent post we discussed how personal income growth is having tough go at the current economy. However, with incomes largely stuck in the quicksand of a mediocre economy for the working class, we see that the elixir of spending is back at the table again. Debt spending is making up for the lack of income growth. Unfortunately major consumer debt growth with no subsequent increase in income is a recipe for disaster in the long-run. Yet people live for the short-run like a sprinter so the party goes on. That is why the recent Fed report on household and consumer debt is important because it shows a first quarterly increase in debt in four years. While this may be good for a consumer based economy it merely masks the underlying issues with income growth. Also, the media is running with the “consumer is back†meme yet a large reason why debt increased like it did was because of incredible jumps in student loan debt. We also saw that auto loans increased dramatically and our friend the sub-prime loan is now creeping back into the industry. I make no qualms that our economy is fully fueled by easy debt. Since the recession ended in 2009 much of the access to debt has been given to large banks and Wall Street finance. This has done a miraculous job boosting the stock market to record highs and also allowing for investors to crowd out households in the single family home market. It appears now, at an apex in the stock market that consumers are getting a bit of the nectar of easy debt.

Household debt first quarterly increase in 4 years

Households have faced some strong austerity since 2009. Much of the decline has come in the form of foreclosures wiping out billions of dollars in mortgage debt. The mortgage market now using a tiny bit of due diligence had to examine actual household incomes before lending money out. As it turns out, not many Americans were able to take on any additional debt and certainly not in the form of buying a home. Wall Street and investors were fully willing to fill this gap in for the last half decade thanks to easy money from the Fed.

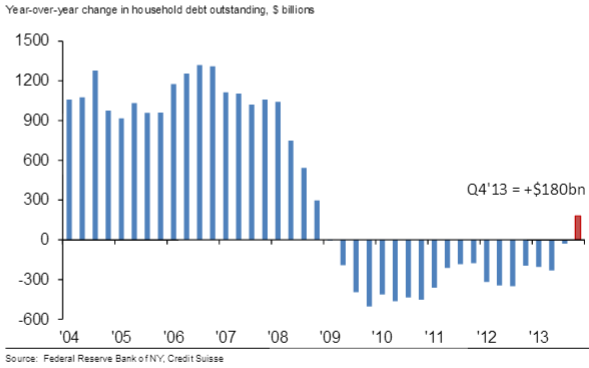

It appears that the easy money is now flowing to households:

Source:Â Credit Suisse

This is an important chart. During the last bubble, household debt was increasing at an annualized rate of close to $1 trillion during some quarters. Those days are long gone. Yet for the last quarter of 2013 we see that household debt increased by $180 billion. Good news right?

Well there are some key points in the data:

-For housing, mortgage balances remained flat as investors crowd out the market and existing home sales still remain weak

-Credit card balances grew a bit, but not by much

-Auto loans are showing some improvement but we are also seeing a growth in sub-prime debt here

-Finally, the big jump came from student loans going up $114 billion for the year

In reality what we are seeing is that loans disconnected from income verification like student debt are growing by leaps and bounds and loans connected to income like mortgages and credit cards having a slow time to rebound. Banks are the frontline for mortgages and credit cards. Student debt is all based on the government. So of course, just like what occurred with Fannie Mae and Freddie Mac easy government financing is once again fueling a massive bubble in the student loan industry.

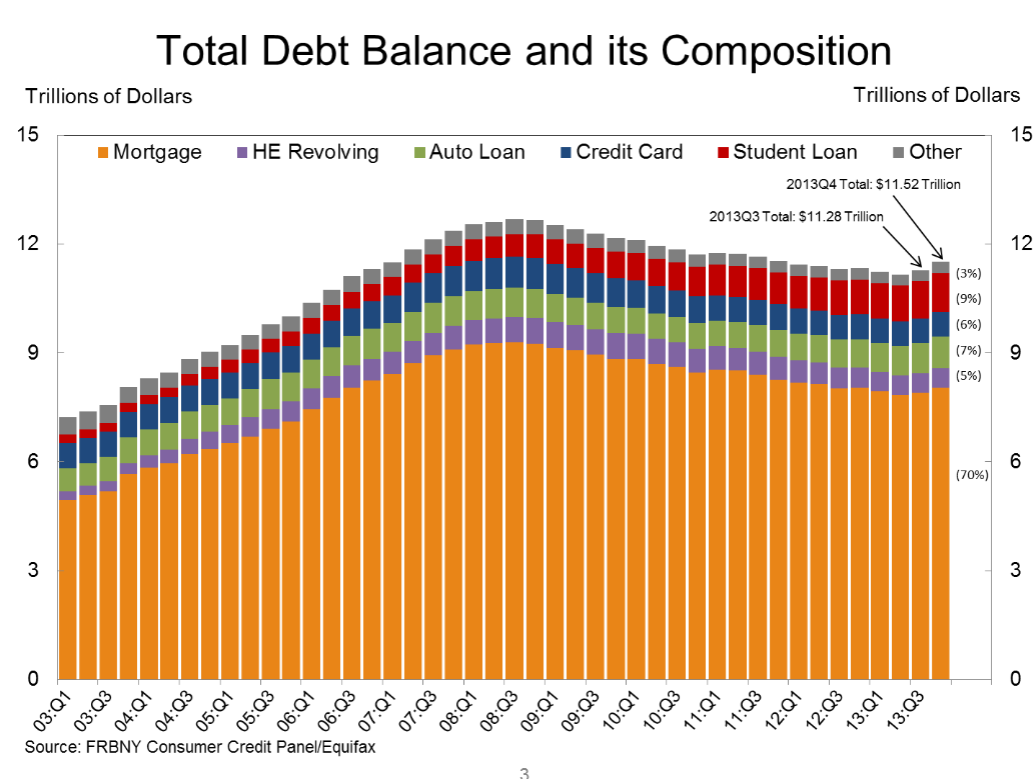

You can see this clearly when we expand the actual debt segments out:

10 years ago, student debt was a tiny portion of all debt outstanding. Today, student debt is now roughly 10 percent of all household debt. It is also the most delinquent debt sector of them all. So why would the sector with the highest delinquencies see the largest increase in debt? For the most part, the government is fully on the hook here. So lenders have no issue dishing these things out. With our low wage economy with little good paying blue collar work, college is virtually the only opportunity for some Americans to move up into the shrinking middle class. Young Americans are struggling to find their career footing also with back breaking amounts of debt.

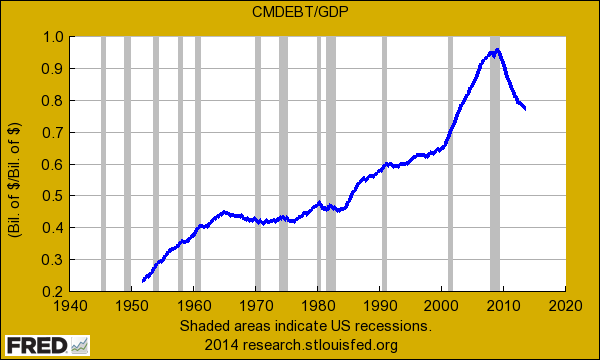

There is some dispute as to whether this increase in debt is positive for the overall health of the economy. In the short-term, it is. More spending on cars, colleges, and access to credit cards will allow Americans to spend the money they clearly do not have. For how long can this go on? It looks like we de-leveraged from the peak but it now appears that we are once again, re-leveraging:

Once we hit a 1 to 1 ratio between annual GDP and household debt, it appears that things can go out of control in the economy. Since more than 5 million Americans lost their homes via foreclosure many balance sheets quickly shed themselves of an underwater asset. That asset in many cases was picked up by banks that are now seeing a renaissance in the housing market (largely pushed by low inventory and edging out regular buyers with full offers). This may be of little benefit for regular households that are witnessing virtually no increase in income.

The large amount of easy money has also caused inflation to occur in these important segments of the economy. It is no coincidence that the college sector has seen the biggest jump in debt given that this segment of the economy is fully motivated by easy government money. Student loans have the highest delinquency rate of any household debt segment yet here we are, adding more fuel to this flame.

The first increase in household debt in four years and largely driven by student debt and auto loans (with an increase in sub-prime debt). Does any of this even sound remotely familiar?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

tom swift said:

We have been struggling with our daughter’s college loans for a number of years. She graduated 5 years ago, hasn’t found a job despite 100’s of CVs being sent out, and we have been paying Sallie Mae $1,800 per month. And will continue for at least 8 more years.

The college loans are 8-9% (our mortgage is only 3.4%!! Our car loan is 0.8%!!). We could walk away from the house, give the car back to the dealer, but do nothing with the college loans. We could default on credit card debt, but not college loans. This is wrong.

And of course we make just enough money per year to prevent us from getting ANY tax benefits on education loans from the IRS.

The only way to survive is to escape the country, it appears! I write that with tongue in cheek, but WTF.

March 2nd, 2014 at 12:53 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!