How to Invest Wisely and Diversify: 3 Current Economic Issues. Gold, World Currency Reserves, and World Housing Bubbles.

- 2 Comment

I’ve done my best to remain diversified. I don’t mean simply having 10% in a global mutual fund, 20% in a small-cap fund, 40% in a blue chip fund, and 30% in bonds. You can rearrange the numbers a bit but there is this intense belief bordering on religion that by having your money in different mutual funds you are really diversified. If this economic crisis is showing you anything, it is that across the board stocks can fall and fall hard.

When you think of true diversification, you should think outside of these areas. True diversification means having foreign currencies, rental real estate, a full-time or part-time business, consulting, precious medals, and your career. That is true diversification. The problem that many are now seeing is that their 401(k) was invested in targeted funds that believed the above mantra and really were not diversified. It comes with the territory of investing that you will take on some risk. This isn’t to say you shouldn’t have some stocks in your portfolio but the idea that the bulk of your money should be held in stocks will get a wake up call in the subsequent years.

Here is a look to show you how the three major barometers of Wall Street are doing for the year:

A few of the places of refuge in the last few years has been precious medals. Yet recently, these have been taking a hit. Why is this happening and does this mean that the precious medals bubble has now burst? The trend for precious medals is lower but much of what is happening is large unwinding of positions. You need to remember that gold is a store of value and the belief was that unrelenting pain for the United States and its economy was on a downward trend. The brief surge in the dollar has also pushed gold down. You need to recall that much of the literature has been focusing on the global $13.8 trillion United States economy thinking that we have reached a point of decoupling. This theory is wrong and the bump in the U.S. Dollar is reflecting this.

The belief was that the Untied States would suffer an economic depression yet all other economies would thrive. Well as recent data from the Euro-zone points out and the fact that Japan’s GDP actually contracted, it may be that the United States might be in a better financial position. In fact, our housing bubble is already in full progress while other counties like Spain, Ireland, England, and Australia are only entering the morning of their collapse.

Even with the current correction in precious medals, take a look at gold versus the DOW over the past four years:

Gold is down over 20 percent in a brief time but even given this, over the past four years is up a stunning 73% while the DOW is actually up by only 11 percent. These are important factors to remember since looking at the day-to-day market activity may cause you to step back and look at the overall picture.

The minor jump in the U.S. Dollar also goes to show that when push comes to shove, given all the negative first half news about the world economies the U.S. Dollar is still seen as a major safe haven. Globally the U.S. Dollar is held by 63.3% as an exchange reserve while the Euro is held by 26.5%. No other currencies come close but given the economic condition of many European counties and their own asset bubbles yet to deflate, the tough talk from the Euro Central Bank has recently abated since it looks like they may actually follow in the footsteps of Ben Bernanke and let rates stay or move them lower. The tough talk made the Euro a Cinderella for funds as many left the U.S. Dollar but now it looks like they are stuck. What more can they do?

This isn’t to say that the U.S. Dollar doesn’t have weakness. In fact, unless our own Federal Reserve steps in and raises rates the dollar will continue to face weakness given our current economic condition and enormously large deficits which may surge past the $10 trillion mark this year. Given that our yearly GDP is $13.8 trillion we are now cutting it extremely close.

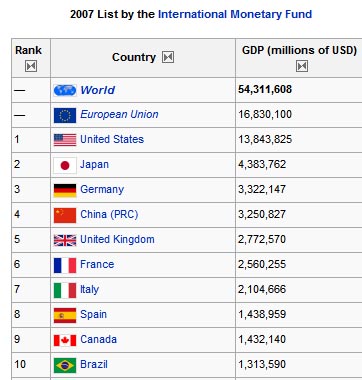

Given our current GDP, the idea of decoupling is a curious one given that the large players of the United States, the Eurozone, Japan, and Germany are all heading to recessions:

*Source: Wikipedia

To think that the world with the four largest blocs entering recessions would somehow boom is mystifying. If anything the recent unwinding in precious medals and the bump in the U.S. Dollar are simply an acknowledgment that if these large economies entered into recession the chain reaction is going to be felt by all.

I still expect the United State economy to face rough times ahead. Recent estimates put the write-downs due to the credit crisis at $500 billion with future estimates of $1 to $2 trillion when all is said and done. Given the large amount of homes in states like California with hundreds of billions in option ARM mortgages that will surely default, these numbers seem realistic.

The United States housing market is gigantic. Over $12 trillion in mortgage debt is outstanding almost the size of our GDP. Actual equity destruction from peak is now looking like $3 trillion. That is $3 trillion in housing equity that is no longer here. And given that we are only 25% to 50% through, we can expect further declines.

Precious medals have been on a long run. They will correct. This correction is simply reflecting the years and false notion that decoupling would really happen. I don’t doubt that sometime in the future this may actually occur but just look at the current GDP and you’ll realize that we are decades from any such talks. The U.S. Dollar may stabilize in the short-term but once the additional losses in the credit markets rear their heads again, it will continue on falling.

Europe, Japan, and Australia will all suffer as well and are 1 to 2 years behind the United States. When you look at their asset bubbles and massive account deficits, especially those counties in the Euro-zone the contraction will be painfully obvious.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Lease purchase agreement said:

Just read some other comments on your blog, and I agree with the general impression, your doing a great job!Keep it up!

March 3rd, 2009 at 1:03 pm -

Sardinia said:

to LPA: you didn’t read sh*t on this blog, you are here just to spam your site, cuz I’m sure you even don’t know what is this site about 😉

March 11th, 2009 at 9:50 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!