McJobs for McAmerica – Fastest growing jobs in low wage sectors. Of 10 largest occupations in US only one pays more than $35,000 per year.

- 1 Comment

The end of the Great Recession has done little to protect the middle class. The largest employment growth has come from low wage positions. According to Social Security data on wages the per capita wage for Americans is $26,000. Your typical household is pulling in about $50,000 per year. The growth in low wage jobs reinforces a continuing trend that is pulling chunks of the middle class apart. Income inequality in the US is at its highest level since the years prior to the Great Depression. This rift in the economy allows for paradoxical situations to occur like peak food stamp usage and a peak in the stock market. Little good this does for the average worker with virtually no stock wealth. There was a time when some of the top occupations actually paid good living wages. Those days seem to have disappeared as McJobs dominate the top 10 occupation fields.

Top US jobs

Here is a list for 10 of the top occupations in the US with their corresponding wages:

Retail sales, cashier, and food preparation round out the top three occupations in the country. Unfortunately the Great Recession destroyed many good paying jobs only to replace them with lower paying employment.

“Roughly 58 percent of jobs created since the Great Recession ended have been lower wage jobs.â€

Only one occupation in the top 10 pays more than $35,000 per year (nursing). These kinds of wages will make it tough for families to get by especially with the cost of many items rising. For better paying jobs a college education or specialized training is becoming more of a necessity. Yet many are pursuing careers with little marketability and ending up battling it out for some of the “top†occupations. Is it any surprise why so many young Americans are leaving college with a degree but are unable to repay their college debt? The worth of a college degree is also coming into question.

In spite of this, Americans add fuel to the flame by keeping up the party by spending more than they earn.

Median income and spending

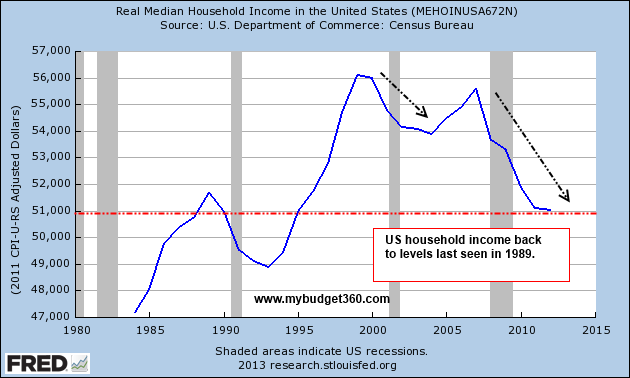

Adjusting for inflation, household incomes are back to what they were in the 1980s:

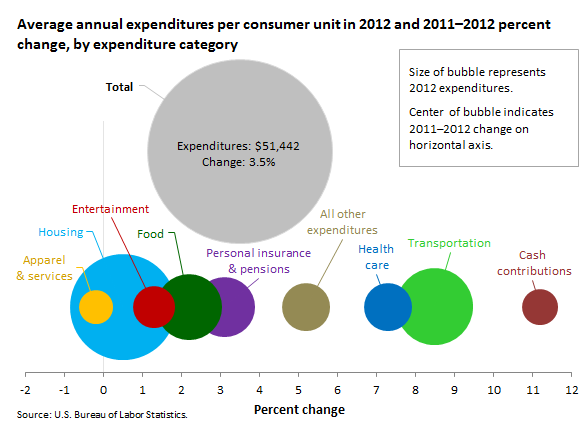

This is an important metric. Given the wages of these jobs, it is no surprise that many two-income households exist merely out of economic necessity. What is interesting is that while the median household income is roughly $50,000 annual household spending is higher:

Average household spending is at $51,442. A large part of consumption is being done on the back of the following:

-Student debt

-Mortgages

-Credit cards

-Auto debt

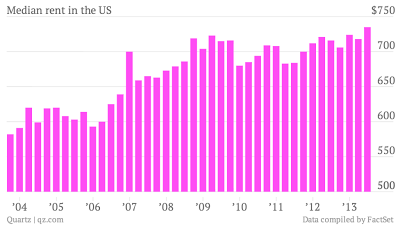

American consumers are merely taking a page out of government spending. As we discussed previously, while the US government avoided a hard default, a soft default is unavoidable. Any items that have readily available access to debt are ballooning in price (i.e., higher education, etc). Even real estate is rising quickly because of easy money. The problem is of course that many households with tight budgets are also facing higher rents:

Since housing is the biggest expense, this is going to cut away from other spending sectors. And look at the top jobs again. These employment sectors rely on consumption and spending. Rising rents come out of stagnant wages so all this means is that more money is going to be allocated to housing versus other discretionary spending.

McJobs for McAmerica. There doesn’t seem to be a unifying fight to preserve the middle class in America. Little by little the middle is being hollowed out. So we now have nearly 48 million people on food stamps and the top 1 percent controls the largest share of assets going back to the Gilded Age. It isn’t any surprise then that the top growing employment sectors post-Great Recession are coming in low wage fields that cater to tighter household budgets.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Dean Carder said:

These jobs pay that much if you are lucky enough to work full time in any of those fields. However there are more and more people barely making a living working part time in one or more of those sectors.

October 27th, 2013 at 2:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!