Miami condo market acting as if it is 2007: Condo market in Miami is saturated with units and inventory is growing.

- 1 Comment

There is a major leading indicator in the housing market and that involves inventory and sales. These two economic points can signal trouble ahead. And we saw this trend unfold in the last housing crisis when over euphoric builders chased bubbles across the country. The sad part is that most Americans are too broke to afford a home. So the condo market in Miami is seeing a big surge in inventory while sales decline – obviously these two indicators feed into each other. The euphoria in real estate is running red hot and it is no surprise that Florida is at it again. Is this simply an isolated market or is there something larger brewing in the nationwide housing market?

Miami condo glut

There is a major glut of condos in Miami. It might be hard to see this given that virtually every news article on housing is positive. Yet housing turns very slowly and by the time the market reverses it is too late for many. Like a game of musical chairs, once the music stops someone is going to be left out.

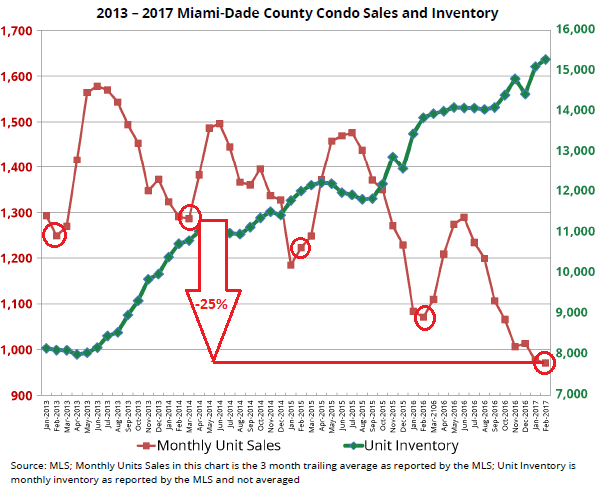

The chart highlighting the situation in the Miami condo market is rather clear:

Inventory is now off the charts. Back in 2013 inventory was very low as investors swooped in to pick up many units and the excess from the bust was being gobbled up. But now, inventory has increased dramatically since 2013. This inventory increase is coming on the back of a massive drop in sales volume.

You have to understand how real estate cycles play out. Builders make plans and start projects during the euphoria phase. These massive projects come online one, two, even three years later and are built around financial models from a few years ago. As we know, the stock market today is hyper inflated and has hit record high levels. We say that it is inflated because price-to-earnings ratios are genuinely out of sync with historical norms. You also see this in real estate where local area rental prices simply do not justify current home values.

Miami is an interesting market because of a few reasons. First, there is a major condo segment of real estate sales. Condos are the thing in Miami. Second, Florida tends to have many booms and busts because the state is an investor haven. Money flows in and out of the market extremely fast. This tends to cause wild rides in real estate values. You also have the “coast†factor which tends to capture the imagination of real estate investors nationwide.

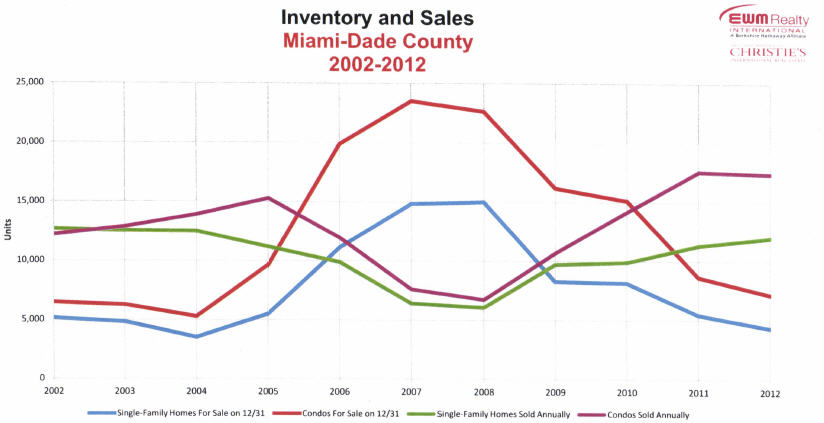

You can see the pattern by looking at how this played out last time around:

You see how inventory soared from 2004 to 2007. Condo inventory then peaked over 20,000. While we are not close to that, there is an unmistakable trend unfolding here.

I am fascinated by the power real estate has on people and how quickly people can forget a big bust that happened only recently. The patterns really don’t take experts to understand. It is rather clear if you look at the two charts above. Yet people are once again chasing a new normal and expecting a different outcome. Maybe something is different this time around in Miami.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

roddy6667 said:

This happens about every 10 years. It is so predictable that it is arguably not the worth the ink, electronic or not.

It can’t be news to anybody who can read and is over 30 years old.April 14th, 2017 at 6:14 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â