Too damn broke to afford a house: Americans are largely missing out on home equity gains and there is little they can do about it.

- 6 Comment

The housing market is once again too expensive for most American families. During the last housing bubble, many Americans were able to partake in the mania and enjoy equity gains even if they were as fleeting as a petal in the wind. This time around most of the gains are going to investors and large institutional buyers that have crowded out the regular buyer. This is a first in history at least on this large of a scale. The homeownership rate is the lowest in a generation as many young people saddled with student loan debt are living at home.  Home prices surging with incomes being stagnant is a recipe for problems down the road. We recently saw a report showing total wealth in the U.S. is at a record level again. Too bad most of the gains are in the hands of the very few. And even fewer Americans own homes today. Why? Because they are too damn broke to buy a home.

Erasing a generation of homeownership

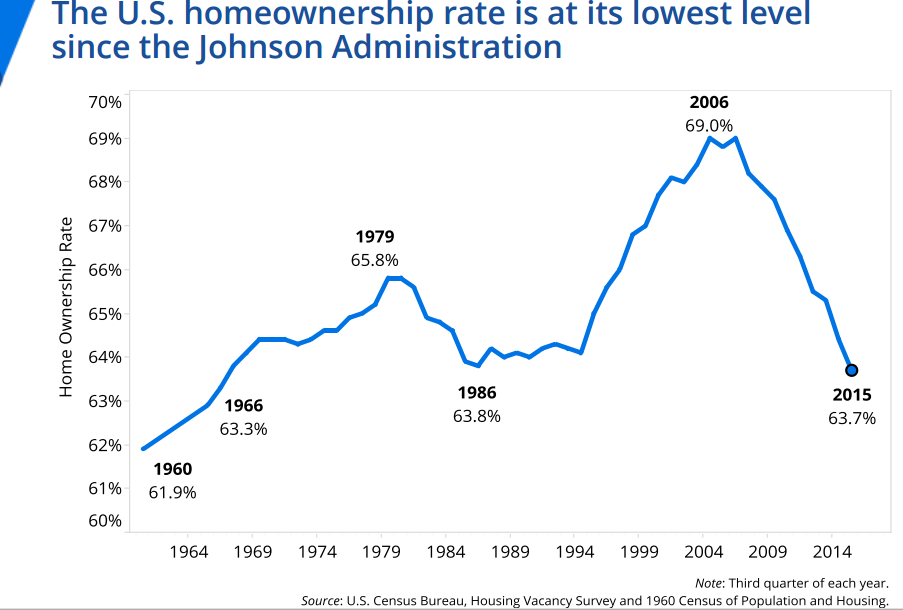

We are taking the homeownership rate into a time machine that leads us back to the Johnson Administration. Many are too young to remember this but the reality is, the cornerstone of the American dream is largely becoming a fantasy.

Here is a chart showing the homeownership rate:

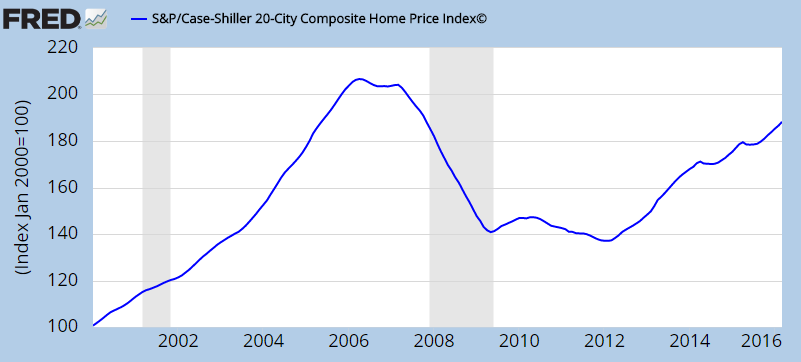

While fewer Americans are able to afford homes, home prices are doing this:

Fewer Americans own their homes. In many cases, there are now millions of additional property owners that are large investors. These were the big buyers during the crisis – a crisis largely developed by our financial institutions creating ridiculously risky products. These same institutions bought up the homes while people were being booted out of their homes. Now they are reaping the rewards and this is on the backs of those bailout funds. Weren’t the bailouts here to assist regular families?

Americans are too broke to buy homes because the current system would rather they be in deep debt with auto loans, student debt, and credit card debt. At least with a home, you do build up some equity over time. But in a low rate environment, big investors are chasing yield wherever they can find it even if it means crowding out regular families from buying homes.

Even places like Boulder Colorado are seeing home prices that look like Vancouver or New York:

“(Denver Post) The average list price for a four-bedroom, two-bathroom house in Boulder has crossed above $1 million, a rarefied altitude that places the city among the country’s most expensive housing markets, according to a new survey from Coldwell Banker.

Each year the real estate brokerage firm surveys list prices on that home type, popular with growing families, and offers comparisons across different areas.â€

Yet the typical American family isn’t earning more. Right now you have big money inflating multiple markets across the world. This crowding out effect is basically hurting the majority of people in the form of higher rents and home prices.

The American dream is difficult to achieve when you are broke.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

roddy6667 said:

The American housing market is no longer a steady gain in value. It is strictly a boom-or-bust situation. Today’s people who don’t own a house are being spared the huge financial losses of the collapses of the housing market. In the times when home prices went south, owners first lost their equity or down payment, then became upside down in their mortgage. They were unable to sell their homes to take a promotion or make any career move. Considering housing busts correlate with a similar environment in employment, a person would want to be more mobile, not chained to a depreciating asset.

Owning a home is like going to the casino now. Some people walk out counting money and bragging about how much they made. Most slink out the side door and drive home as losers.

Participating in a casino is not a good plan to build wealth or plan for retirement.June 16th, 2016 at 1:27 am -

Donovan Moore said:

Owning a home is a money pit. Look at the profits of Lowes and Home Depot. The cost to replace or fix anything in your home has skyrocketed the past decades. Not to mention, property taxes have also risen much faster than inflation. Kids are smart. Owning a home is not a sound investment. The lie has been exposed.

June 16th, 2016 at 9:05 am -

Pat said:

Tell me about it. I live in an area where there are a large number of homes that I can afford easily. The problem is coming up with a sizeable downpayment. The fact is that is what is keeping me (and many other Americans) renting at DOUBLE what I’d pay as an owner.

If you are paying rent, you are likely to be in the large group of Americans who can’t save in a reasonable amount of time to keep up let alone get ahead or make a large purchase of a home. It’s been proven time and again that those who own their own homes amass greater net worths and wealth. I’m really curious about the rates of suicide tied to finances since the “recession” began. Too many Americans have been working with no upside for YEARS.

June 20th, 2016 at 12:23 pm -

Nichole said:

I am a young entrepreneur. I broker trash all over the mid atlantic region which keeps me on the road for site inspections. If you think renting or owning is expensive look at the cost of a 1 week hotel stay in a safe area. $1000+, dont forget the hotel tax which can be 10%!

I resorted to buying a truck camper so I can take my bed and kitchen where ever I go. If I don’t like the neighborhood I leave. If I need to start over in a new market, I drive there and do it. If a hurricane is coming I just drive away! There are a lot of benefits to being self contained on wheels. RVing is an American thing. It was very popular when the west was being settled. There was a lot of volatility then and there is now. Being flexible and a nomadic it a good skill to have.August 10th, 2016 at 7:56 pm -

Sue said:

@ Nichole, you gave some good advice about living in a RV, but not all that glitters is gold. There is something called “RV discrimination.” Google it.

October 28th, 2016 at 9:13 pm -

Anonymous said:

I hate being a renter, but what choice do I have? I can’t afford even afford a basic $100,000 home, & the price of those homes are starting to skyrocket to $200,000 as of 2020. It’s ridiculous.

May 30th, 2020 at 8:52 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â