Spending it all on rent: 11 million Americans spend half their income on rent. Another 21 million spend over 30 percent of their income on rent, a record high.

- 1 Comment

The financial raiding of the American middle class is moving full steam ahead. The ridiculous structure of the banking bailouts and artificially low interest rates caused hot money from banks and big investors to crowd out regular families in the housing market. Now here we are 7 years after the official conclusion of the Great Recession and regular American families are financially struggling while banks and big investors thrive. Today 11 million Americans spend half of their income on rent. Another 21.3 million spent over 30 percent of their income on rent. With millions of properties being bought by investors since the Great Recession hit, all that has happened is a mega transfer of wealth. You don’t build equity by renting but many people are simply priced out from buying a home.

The great bailout scam

Most Americans have a hard time saving money. This is why housing has been a big plus in the net worth column for many households for more than a generation. This is seen as a forced savings mechanism. Yet the homeownership rate is at a generational low and we have a record percentage of families now renting building no equity. And the problem in big cities is even more pronounced.

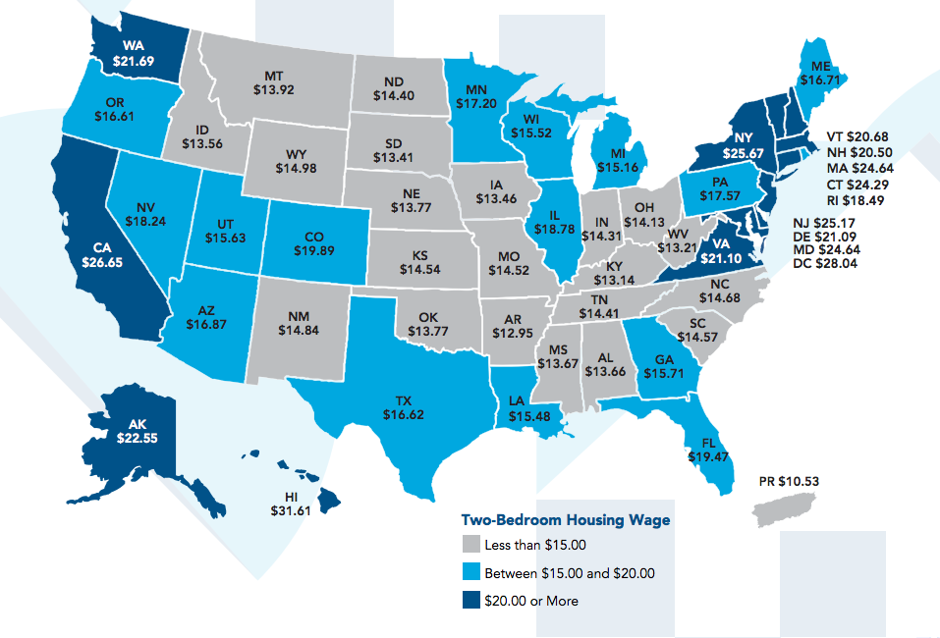

Here is a map showing how much you need to earn to afford a regular two-bedroom apartment:

So it should come as no surprise that many young Americans stuck in low wage jobs are unable to rent a place and end up living with parents or roommates. Others simply spend a wild amount of their income on rent. In the past, this would be the prime age to buy but that is not happening.

Unfortunately there are two big issues here:

-1. There is a lost decade in homeownership growth. Meaning many people missed out on building equity.

-2. Banks and investors continue to hoard homes causing an abnormal distortion to the market. This is manipulated because the Fed is forcibly keeping interest rates low.

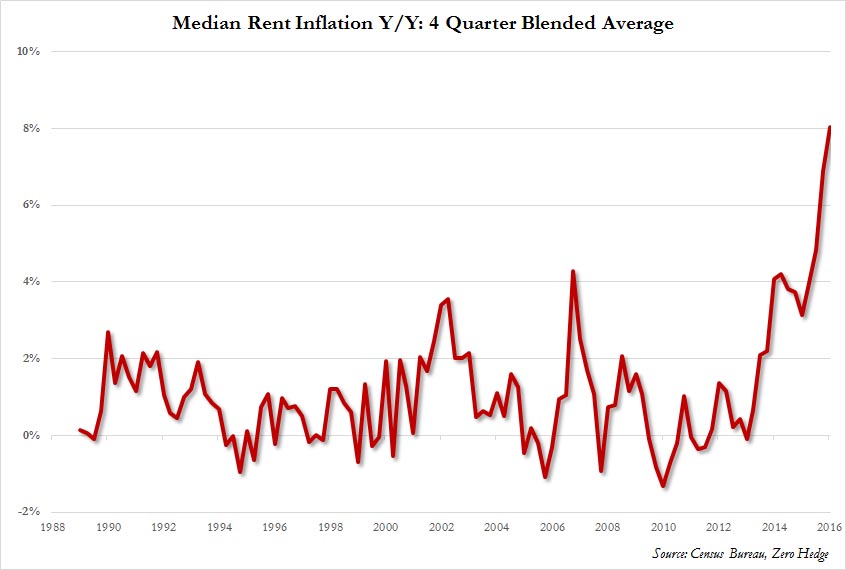

The end result was that investors dove into housing chasing yields in rental properties, a segment of the market that was largely left to mom and pop investors in the past. The amount of buying over the last decade was a new trend especially with big money flowing in – even though returns are low with zero percent interest rates, banks and big investors had little risk in loading up on rental properties. And rents continue to go up while incomes went stagnant:

Rents are going up faster than wages and are far outpacing the overall inflation rate. So it is no surprise then that a record number of Americans are spending half of their money on rent. This makes it less likely that they are consuming on other goods or also saving for their own retirement. All it means is more money is being siphoned off to banks and investors.

This is largely shuffling digital money around but Americans are now understanding who really has the power in this country. Large financial institutions are dictating how things play out even if it means things are worse off financially for regular working families.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Kelly said:

Don’t forget to include the cost of mandatory insurance premiums or “fee/tax” for not having a policy. Add $2/hour to these rates to pay for that inconvenient truth.

June 27th, 2016 at 2:48 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â