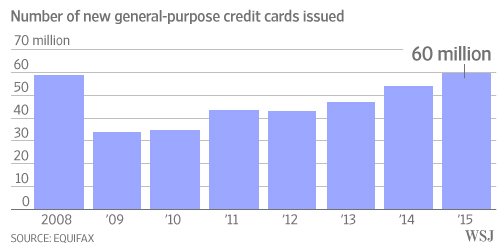

Putting it on plastic again – Record number of credit cards issued in 2015 surging 90 percent from 2009. 60 million credit cards issued last year alone.

- 0 Comments

We love credit cards as much as we hate paying bills. As a nation we have an addiction to instant gratification. In the not so distant past, Americans actually had to save money before making a purchase. Seeing that many Americans have nothing in their pockets except lint and cell phones with hefty monthly payments, this isn’t a surprised. You fire up your phone and open up Facebook. You see all of your friends posting great photos of eating out at fancy restaurants and pay day is a few days away. What to do? Just go out and load it up on the credit card! Let us not forget that the financial meltdown came about because of economies which are made up of people spending way beyond their means. After the crisis, the number of credit cards issued collapsed. Today we are at a peak with 60 million credit cards being issued in 2015 alone. Happy credit days are here again!

Put it on plastic

The credit card industry makes money on interest. This industry of course is tied to the Wall Street financialization of America. There is a new rentier class. Collecting money on rents from single family homes bought by big investors, collecting interest on credit cards, taking interest on auto loans, and mega interest on student loans. Given the low rate environment, the spread between what banks can borrow and current interest rates offered to consumers, the profit is large.

First, take a look at the giant surge in credit cards being handed out to the public like crack to an addict:

Make no mistake, this is an addiction. People are unable to live within their means and the government sets the example! Instead of saving and planning out purchases the majority of the public goes into ridiculous levels of debt. With credit cards, you are basically overpaying today and will need to pay for that item with future earnings.

That chart above is scary because we are now issuing a record number of credit cards. And from many indications the balance sheet of most Americans hasn’t gotten all that better since the Great Recession ended on paper. Yet here we are sending out plastic financial crack so people can pretend they are still part of the middle class.

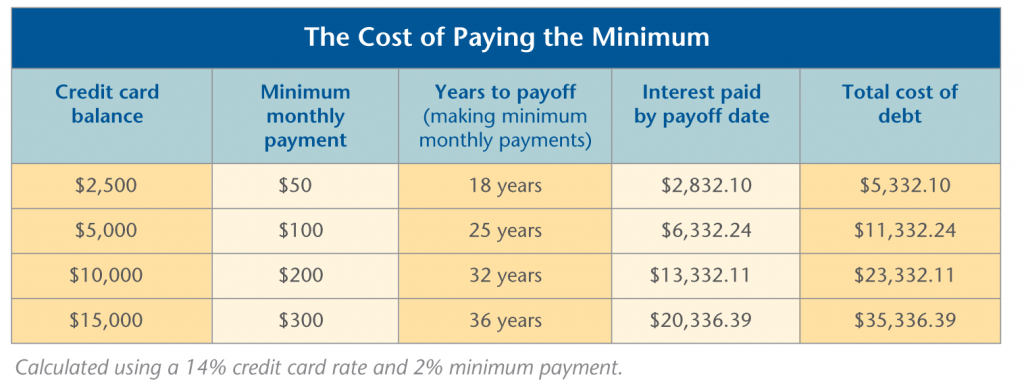

Here is how ridiculous things can get. Let us look at some scenarios:

Say you have some unexpected expenses of say $5,000. Half of the country can’t afford an emergency expense of $1,000 so we can safely assume if they have credit cards, some will opt to go here. Paying the minimum of $100 per month it will take 25 years to pay this off and the total amount paid back will be $11,332.24 assuming the standard 14% credit card interest rate. In other words, you are paying more on interest than the actual expenses you took on! Plus you need to pay off the original principal.

Of course paying the minimum seems appealing especially when times are tight and wouldn’t this be the case if you put emergency spending on a credit card? But look at how ridiculous things can get. And since many Americans have poor financial literacy, banks are taking advantage of this. Just imagine if you could get 14% interest on your investments! Even rock star fund managers have a hard time beating the market which basically gives out a 7% annual return looking at historical records. Yet credit cards charge nearly twice that and here we are giving out a record number to Americans.

Of course no one is forced to sign up for credit cards but no one is forced to take crack as well. Now that the middle class is a minority, expect more people to keep up with the Joneses by going into debt. Next time you see that Instagram post of your friend eating at that expensive restaurant it is very likely that they are charging it up on plastic.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â