9 charts showing Americans never recovered from the Great Recession: If you are wondering why people are so angry look no further.

- 1 Comment

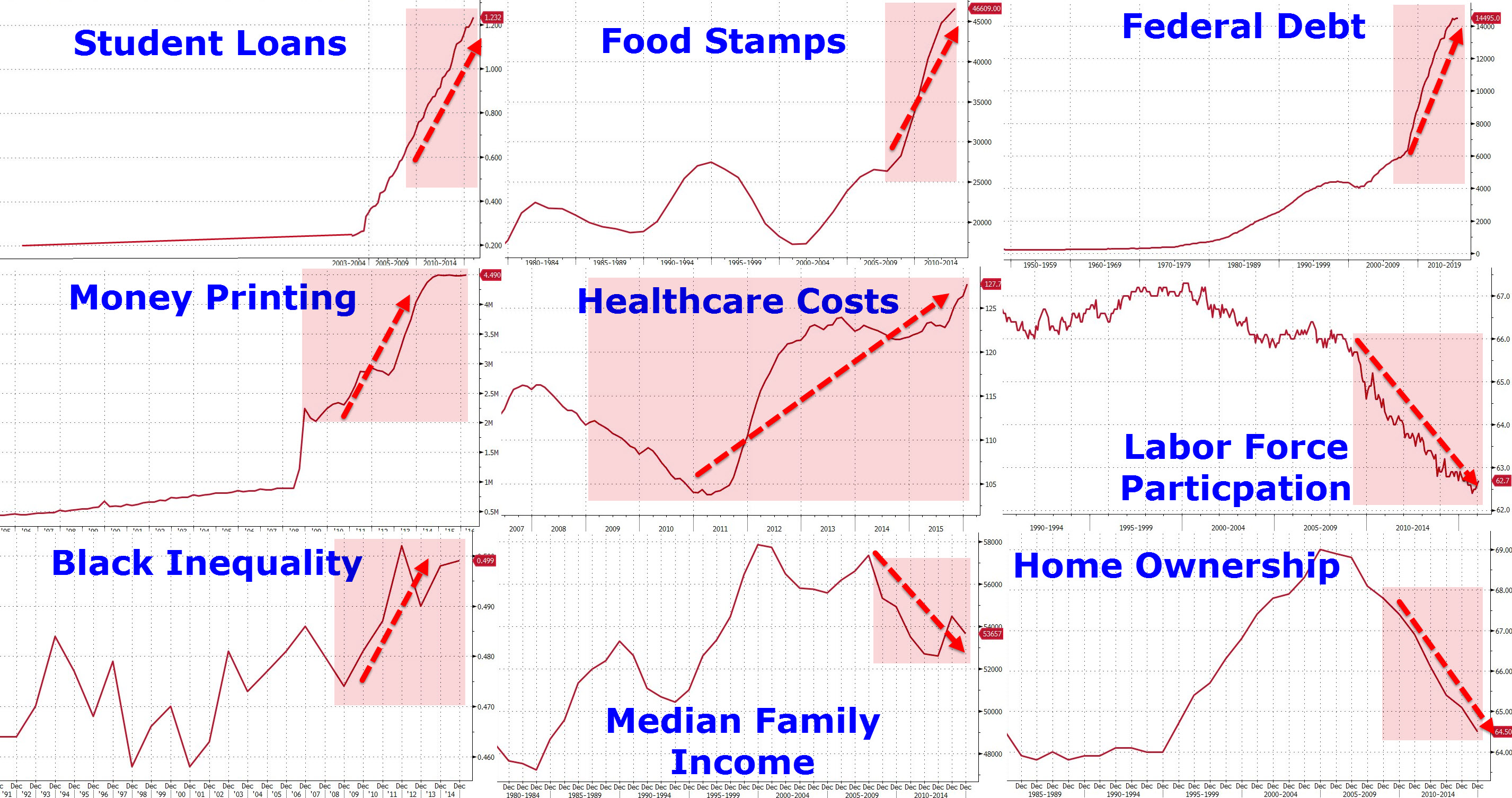

The press is somewhat baffled as to why Americans are so angry this year. The stock market seems to be doing fine (too bad most Americans don’t own stock). Jobs are being added (too bad most jobs are in the low wage service sector). Housing values are up (too bad the homeownership rate is down because Americans can’t afford home prices at current levels). This is the state of our current economy. One that is mired in stagnation for the majority of people and the mainstream press is largely seen as a megaphone for the wealthy and connected. You don’t have to look too far to see that things are not all that great in the real economy contrary to the headlines. Let us look at a few charts to see how things really are.

9 charts show the economy isn’t doing all that well for many

There are many reason why the disconnect from Wall Street to Main Street is happening. Many large companies make profits overseas and we already know that large companies have cut wages for most workers while profits have risen directly to the top. Americans feel poorer because they are.

Here is a chart that shows 9 reasons why the economy isn’t doing so hot:

I’d like to talk about a few of the items here.

Student Loans

We absolutely have a student debt crisis. Over $1.3 trillion in student debt is circulating in the economy. Student debt is the most delinquent debt class in America. The cost of attending college has left many people with a mortgage sized debt before even owning a home. This is a big drag on the economy.

Federal Debt

We owe over $19 trillion and we will never pay this back:

The amount only continues to grow and people think that somehow, governments are beyond the laws of mathematics. Things are fine until they are not. This is not an issue that will go away.

Labor Force Participation

We have close to 94 million Americans that are flat out not part of the labor force (not including children). This not in the labor force army is massive and only growing. The argument that this is only being made up of recent retirees is bogus. First, many can’t retire because they need to work until they die. Another point is the rate is going up much faster than the number of people hitting old age.

Median Family Income

Americans feel poorer because they truly are. Inflation has had a big impact on purchasing power. Even though it is understated on the CPI, Americans have been blinded into the negative interest rate shell game where the underlying asset costs zoom up but the debt is restructured as to make people feel they have more buying power. Where do you go when rates are already in negative territory?

Homeownership

The homeownership rate has fully collapsed. Since the Great Recession hit, a large part of buying came from Wall Street and institutional investors. They bought homes to convert into rentals since this was how they used their bailout savior money. The money kept them afloat and what do they do? Buy up homes in a tight market and drive prices higher when working Americans already have stagnant incomes (see last point). The net result is that fewer households now own property and this is the one vehicle where most Americans build wealth.

So if you are still wondering where the anger is coming from, take a look at the chart above and you’ll have 9 clear reasons.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

laura m. said:

There are older folks near my house, late 60’s into 70’s. Greedy, selfish geezers! They need to get out of the labor force so younger ones can fill positions. I’m not talking about the self employed either.

March 5th, 2016 at 11:26 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â