Get used to an America where owning a home is not part of the dream: You cannot afford a home on that income!

- 7 Comment

Well congratulations America. Signs of another housing bubble are as clear as day. Loans with nothing down are back in the market. Incomes are stagnant so creative financing is necessary to buy more expensive homes. And homes are more expensive. The current home price data shows that across the country we have now surpassed the last bubble peak. Yet incomes are not keeping up with wild movements in prices. The end result is that the homeownership rate has collapsed yet somehow home prices went up. How can prices go up with fewer families buying homes? Easy, since the bailout funds allowed banks, hedge funds, and investors to pickup foreclosed homes from families and then turned them into rentals. Now we have many more people living in rental homes accumulating no equity and barely scraping by. Yet somehow with housing prices soaring, college tuition at crazy levels, and stagnant incomes we are led to believe that somehow we have no inflation. The current model of the American Dream involves no homeownership for the already shrinking middle class.

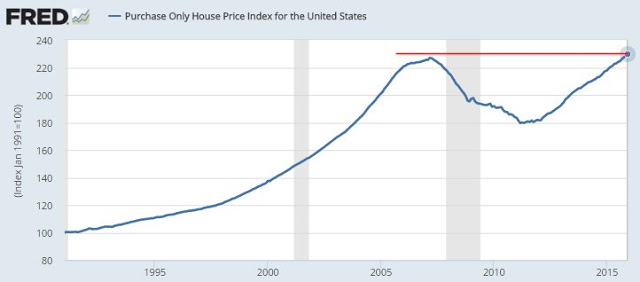

Housing prices hit new peak

First, it is worth noting that housing prices have now reached an all-time peak. This is worth noting because the last peak was clearly at a point where we were massively overpriced and the entire world economy came close to Great Depression II:

Source: St. Louis Fed

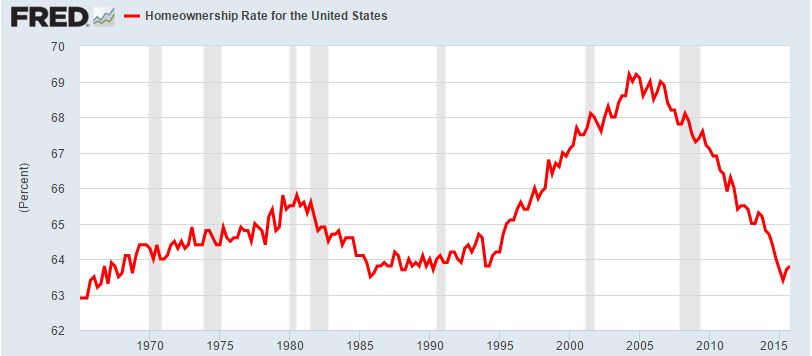

This is great news right? Well not if household income is stagnant. We have clear evidence that this wasn’t driven by families hungry to buy homes. Just look at the homeownership rate:

Source:Â Census

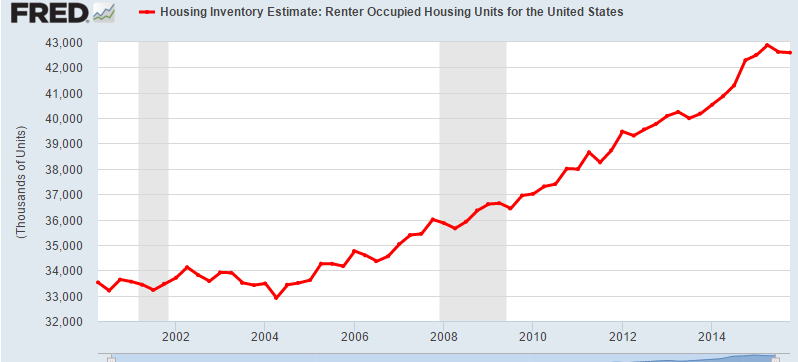

Well someone was buying homes but it wasn’t your typical family. Homes were being bought by large investors to convert into rentals. And this is where the bulk of the price increase happened. This is why while net household formation for owners is neutral, we’ve added 10,000,000 renter households since 2004:

Source:Â Census

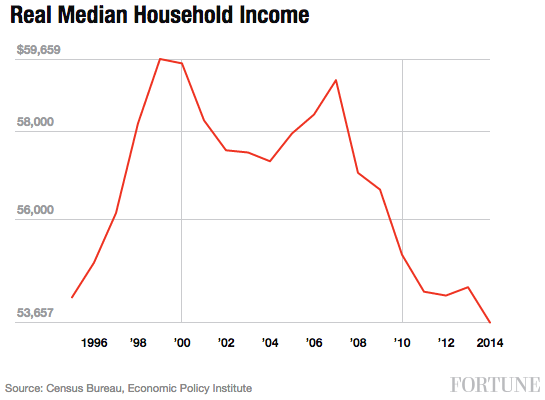

So that is where the growth has happened. Has it been that bad for income growth? Yes:

The average home price for a home sold in the US is $257,000. With a household income of $50,000 this is much too high. You need to factor in additional expenses like insurance, taxes, and maintenance and your budget is going to be extremely tight. The middle class has now become a minority so having the cornerstone of the middle class, the family home disappear seems to go with the new financially rough territory.

So what do people do when they can’t afford to buy a home? They rent. 10,000,000 new renter households paints a very clear picture. And then you wonder why anger is the fire that is moving the political structure in 2016. The American Dream is literally disappearing before our eyes.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

james said:

Or move to Omaha…average price home $140,000, unemployment 3.5%

Rent 2 Bedroom Apt $800February 29th, 2016 at 4:19 am -

Justsayin said:

I own 5 houses. I have never paid more than 15,000 for one of them, they are all in rural, decent areas. I have never taken a lone to get one of them. when I first started buying them 5 years ago I only made 14,000 a year and have 5 kids. Oh I also don’t have student debt, I don’t use credit cards, don’t have cable, buy my cars used with cash. So this idea that the “average” American cant buy a house, yeah if by average you mean a person with 50,000 in student debt earning 35,000 a year with a car payment of 300.00 a month and their cellphone bill at 75-100, entertainment bill at 75-100 a month, yeah it really just depends on what your priorities are. If a person wants a house they can get a house, it might mean trading off some of the other stuff. Or moving to find a better job, or moving to a neck of the woods where a house that cost 250,000 also comes with 50-100 acres. But if you live in California (your either a fruit or a nut) and your trying to make it on 50,000 a year, well if I had 50,000 two years back to back i would never have to work again, with just 100,000 I could buy 6 houses. I would rent out 4 flip two for a profit enough to buy a couple more of which some would be rentals and then the other flipped. As soon as i had a total of ten rental houses i would be earning 8-10,000 a month or about 80-100,000 a year. And because I have done what I have done without credit I Own the houses (well I rent them from he government int he form of property tax, but that is an altogether different story) so I dont worry if one sits empty or i can take something because its all profit above taxes and maintenance. All that to say, the real deal is this most Americans are not that smart.

March 3rd, 2016 at 6:19 am -

eeinnc said:

The rise of housing prices is skewed by east coast (NY – new banker bubble) and west coast (new dot com bubble). Everywhere else prices are flat and not selling.

When the boomers retire all of them will be trying to cash out on their homes at once (their only source of savings) and all prices will drop for years.March 5th, 2016 at 10:55 am -

Rachel said:

I have to say that it is quite irritating to hear people tell others to move, for example as James said, to Omaha. First off, you have people so bad off they cannot afford to move. Second, most people would actually be worse off because they literally cannot get a new job in a new city quickly enough to keep themselves afloat others may not pass a credit check (their fault or not) and still others may have relatives, work, or other important things tying them to one area.

To just say that people should move is illogical and ignorant. Not all folks can move and that increased demand in the new area will just raise rents and make competition for employment that much higher. Perhaps those saying this nonsense need to work for a non-profit that helps the homeless and hungry or at least volunteer. That saying really gets under my skin because their answer shows their lack of thought yet they want to come off as know-it-alls. Ugh!

March 16th, 2016 at 3:14 pm -

Rachel said:

EEINC has stated a very important reality. Justsaying has a decent idea however his “solution” is not going to work for most people. There are many, many millions of Americans who must live in non-rural areas for health related reasons as many rural areas do not have adequate healthcare especially for those who have chronic or serious conditions. Even those who don’t know about these conditions typically will move away from rural areas due to the lack of healthcare.

Also, in rural areas, jobs are often hard to find and the pay offered is lower as well. It’s not only about priorities as Justsaying incorrectly stated. There are many factors going into where someone lives or works, even one’s training/experience/trade/degree can tie them to non-rural areas so Justsaying’s “solution” is not really feasable for a quarter of Americans struggling to make ends meet and there are many millions who are.

March 16th, 2016 at 3:31 pm -

Rascal said:

I’ve noticed a lot of homes in our rural area have recently gone up for sale. Apparently, they must think that housing prices have rebounded and now they can cash out. I guess they are wondering about now why they aren’t getting any buyers! This article explains it perfectly. Since most places I’ve seen here for sale have a fair amount of property included with a house and barn, outbuildings, etc., it’s really not surprising those places are not appealing to the investor to turn into a rental.

March 17th, 2016 at 1:56 pm -

Nichole said:

Justsayin- you make real estate investing so stupidly simple. Im not sure a seasoned professional could make such comments. It’s NOT that simple. There are ALWAYS factors that come up after you buy the house, rent it and/or flip it. The reality is the constant volatility. Buying a house for profit or for long term investment is a coin toss.

August 10th, 2016 at 8:28 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â