What is a middle class income in America? A lot less than you think and Americans are getting poorer by the day.

- 3 Comment

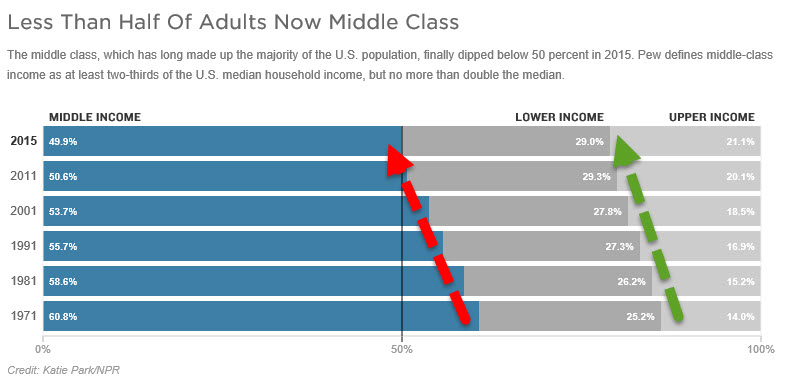

Questions around being middle class are coming up a lot in the last few years. This inquiry is coming up because people are grasping at straws trying to maintain a quality of life that reflects a middle class lifestyle but many have incomes that simply do not support their spending. Americans are set to become poorer this year. As we penned an article talking about the destruction of the middle class economy, for the first time in a generation the middle class is now a minority. The economic engine that made us the envy of the world is now rare. In the US we have a small upper-class that is only getting wealthier while the ranks of the poor and working class is expanding. What is a middle class income in America? The answer may surprise you.

The new middle class in America

It is always surprising to see politicians talk about income because it truly reflects how out of touch they are with the public. Many of them think that $250,000 a year is middle class. That is not only incorrect it is completely incorrect. If you are making $250,000 a year you are in the top 2 percent of earners in the country. So no, that is not middle class.

What most of think of as the middle is the median. In other words, the line where half make more and half make less. Averages can get skewed by ridiculously high income earners (think of hedge fund managers, CEOs, actors, etc).

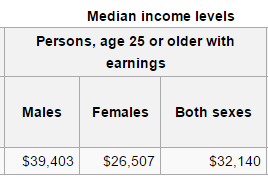

So here is the actual middle class income figures:

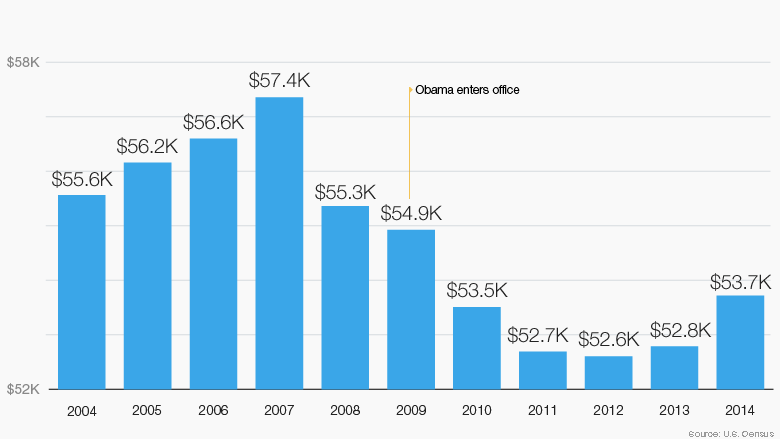

Is this higher or lower than what you expected? Some of these figures are off so you actually have to check various sources. Take a look at median household income which is a good measure of household spending power:

[median householdincome]

[median householdincome]

Source:Â Census

The typical US household has a median household income of $53,700 according to latest Census figures. And for most households, this means two working people living the two income trap. That income level isn’t much when you actually look at a detailed budget of where this money goes. And the bigger problem of course is that the middle class is now officially a minority for the first time in over a generation:

Why is this happening? First, half of Congress is made up of millionaires and corporate policies over the last generation have been designed to strip away any worker protection. Health benefits? Push costs to workers. Pensions? Get rid of those for the working class however high level executives still have gold plated pensions. Job security? Forget about it.

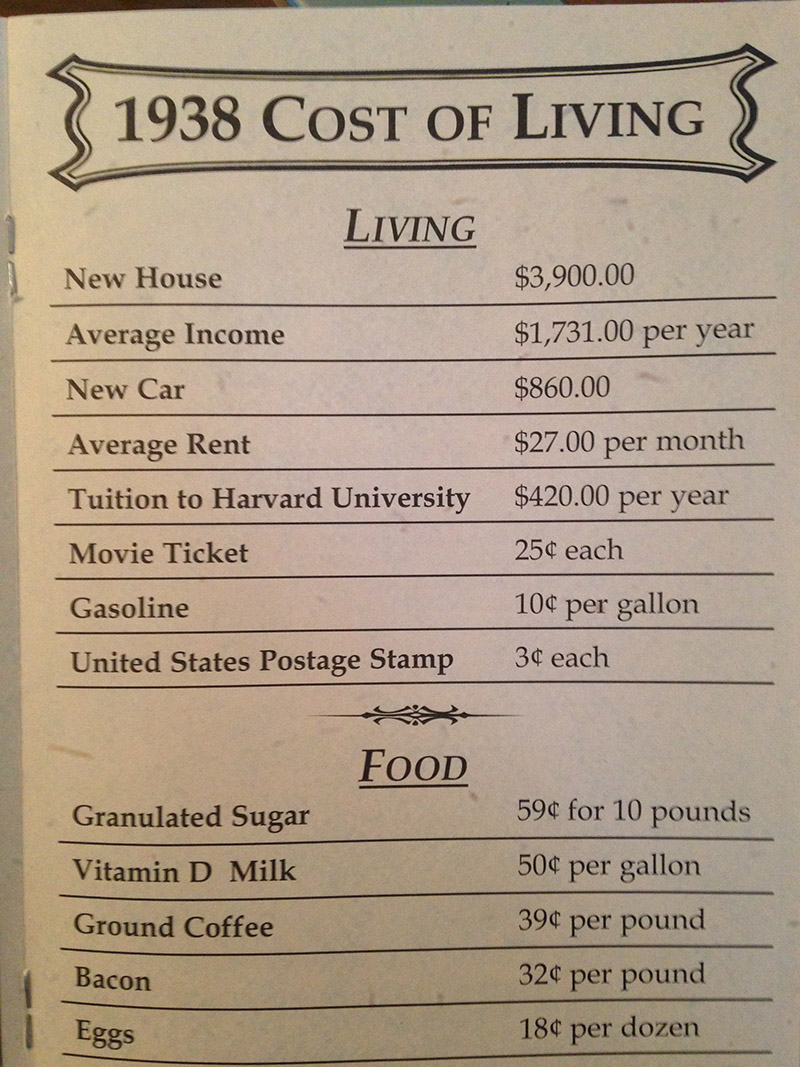

So middle class income in the US is actually fairly low especially when you factor in the insidious nature of inflation. You don’t think inflation exists? Just look at the cost of items in 1938 before purchasing power was slammed:

Inflation is driven around by this digital printing press that we have. Instead of making the middle class grow it has made it into a minority while making the top 1 percent even wealthier. The above data should highlight that a middle class income today is simply not providing a very good quality of life for many and that is why this election season has gotten so rancorous. People need only look at their paychecks and the cost of living to see what is really going on with the economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Mark Nesselhaus said:

Interesting….I am 59 and my wife is 43. She is on disabilty and I work in assisted living food service at 25 hours a week. Combined, we earn about $19k per year and bairly get by. Oh yea, North Carolina says we make too much for SNAP food assist.. Go figure…

January 15th, 2016 at 5:06 am -

sth_txs said:

Inflation is a big deal. The second big deal is taxation. Years ago, my first job was a low $40k’s salary. I paid half my health insurance and put a small percent into a 401k. I lived in a state with an income tax. Before and after my check, I determined that I worked 4.5 months of the year that I could visibly count for local, state, and federal taxes. Sales tax on food, electricity, phone. Car registration. That is only what I could count. Who knows how much tax was in my apartment rent among other things I would buy.

January 21st, 2016 at 7:22 pm -

Edward said:

$32k/year or $15/hour is enough to get by in RI, $50 for 2 people or about $12/hour each, or mininum wage ($9.60/hour) and ~60/hours a week of work. Being healthy I can do that, but it would (did) suck.

June 19th, 2016 at 11:28 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â