The two income trap and the myth of high American wages: 50 percent of wage earners had net compensation of $28,851 or less.

- 2 Comment

If you can sum up the sentiment among the American public in two words it would be economic frustration. The public is frustrated that inflation is eating away at the quality of life many have come to expect. While families don’t need bankers or politicians to tell them about this, it is especially infuriating when the Fed and other policy makers jabber on that inflation is very low. From 2000 onward the cost of housing, healthcare, and education has far outstripped any true income gains. In other words households are feeling poorer because they are. And we are living under a two income household trap as well. The only reason people feel like they are keeping up is having dual lower wage earners. Social Security data highlights an economy that is doing a great job of producing low wage jobs. The two income trap is also magnified because little is discussed about the cost of raising children (it is extremely expensive when you factor in daycare and then try to save for college). The myth of US high wages is slowly taking a hit and the public is becoming more aware.

The low wage machine

Some people are surprised when we dig deep into the wage data. It is always humorous to watch politicians talk about middle class households that “only†make $250,000 a year. A household making that much would be in the top 2 percent of households. That is not the middle. Let us see what Social Security data has to show for it:

“(SSA) The “raw” average wage, computed as net compensation divided by the number of wage earners, is $7,050,259,213,644.55 divided by 158,186,786, or $44,569.20. Based on data in the table below, about 67.2 percent of wage earners had net compensation less than or equal to the $44,569.20 raw average wage. By definition, 50 percent of wage earners had net compensation less than or equal to the median wage, which is estimated to be $28,851.21 for 2014.â€

Half of wage earners in the US make $28,851 a year or less. So when we see the median household income of roughly $52,000 we can understand why so many people are living paycheck to paycheck.  This is where the two income trap hits:

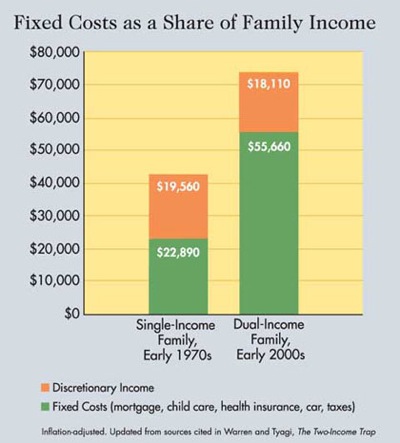

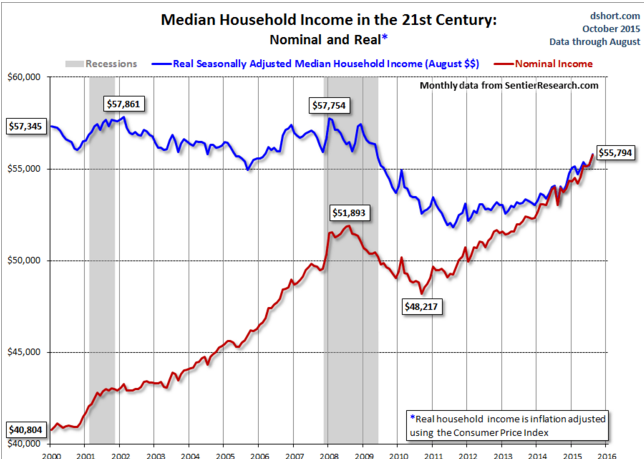

The chart was adjusted in the early 2000s but household income hasn’t changed much since then adjusting for inflation (in fact it has fallen).  While net income is up, discretionary money left over paying the bills is less. And this is considering the fact that we now have more dual income households:

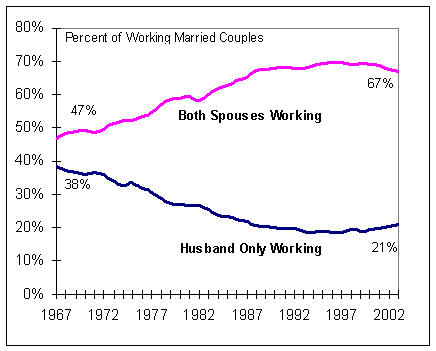

Basically men have been crushed with wages but the rise of working women has swept under the rug the destruction of the middle class. Inflation is absolutely real and has had a deep impact on how people perceive their quality of life. Take a look at the following chart:

Since 2000:

-College tuition and fees are up 145%

-Medical care is up 76%

-Housing is up 45%

-Energy is up 79%

How much has household income gone up?

Household income is up 36% over this period. And this is why Americans are economically frustrated. Most have little to no savings and many are chasing the dream of a middle class by going into deep debt: mortgages to purchase inflated homes, big student debt to go to college, and questionable loans to purchase cars. In the end, you need to pay it back and the bill is slowing coming due.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Roddy6667 said:

A few things have changed. The average house is much bigger, everybody has 2 cars, cable TV, smartphones and their attendant $50-100 a month costs, video games, Netflix or some service that provides the latest movies at home, etc. College is crazy expensive because the non-educational costs have skyrocketed. What used to be classrooms, professors, and textbooks have metastasized into buildings of previously unneeded staff and support personnel. Sports facilities cost many millions and serve only to suck money and attention from academics.

As mentioned, medical care has also turned into a bizarre circus of dollars that benefit only the health care industry, not the people it is supposed to serve.October 21st, 2015 at 4:22 am -

Roland said:

@Roddy

1. Two workers in the household often demands two automobiles, given the layout of many N. American urban areas. Without the extra auto, you might not have the second income.

2. The credit-fuelled inflation in housing and education not only inflates prices, it also distorts markets. People are encouraged to buy too much house, and students in school “just add it to the tab.” The choices made by such people then distort the market for everybody else.

Proportionately smaller demand for modest homes means developers don’t build as many modest homes, so people who want modest might not be able to find something modest. And once a university has built itself a deluxe campus, the students who didn’t want the deluxe campus still get stuck paying for it.

It also affects the auto market. For instance, try to find a simple base-model compact truck today. You can’t. Such vehicles are no longer sold in N. America. If people were buying according to real income, there would be a bigger market for modest vehicles. But since credit is easy, and a substantial body of consumers thus buy too much vehicle, everybody else’s choices get impacted.

All this distortion, courtesy of the inflationary policy pursued by the central authorities.

October 24th, 2015 at 10:12 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â