Half of Millennials live at home with parents: The economy still feels like it is in a deep recession for millions of Millennials.

- 2 Comment

The Great Recession officially ended in the summer of 2009. That was a long time ago. Yet somehow along the windy road, Millennials are not feeling the love from this so-called economic recovery. Millennials continue to graduate with mountains of student loan debt coming out with an average of $30,000 per graduate. Millennials are struggling to find good paying jobs in a sea of low wage employment that in many cases is a mismatch for their degrees. You also have a large number of Millennials living at home with their parents unable to move out into a rental or to purchase a new home. Part of this stems from lower incomes but also the inflated cost of housing brought on by an artificially low rate environment and big investors crowding out regular first time buyers. In many ways, the recession is still very much here for Millennials and this is the next big cohort to move through the economic system.

Living at home with parents

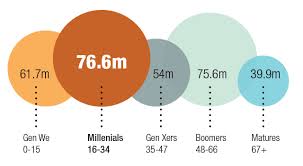

The number of Millennials in the United States is large, only second to the baby boomer cohort. This cohort is already a few years into the prime home buying years but many are unable to launch into the marketplace.

The ability to move out into an apartment and then purchase a home is a big deal. This usually spurs on construction and home buying but that simply hasn’t materialized. First, a look at cohorts in the United States:

“(Kansas City) Nearly half of all millennials still live at home with their parents. But Norris and her teacher husband, Bryan, own their home north of the river.â€

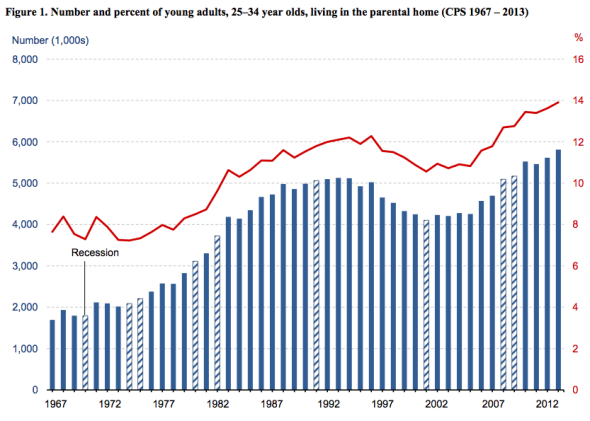

It is stunning to think that half of Millennials are living at home. But even if we look at the 25 to 34 age range we find that a large number of young Americans are living at home:

What is going on? First of all, incomes are simply not keeping up and many are saddled with large levels of debt:

“The economic news for Americans ages 18 to 34 hasn’t been rosy for quite some time. As a group, millennials are poorer than the young adults of past generations.

Census statistics show that a large group of millennials — about 28 million out of 70 million in all — are not enrolled in school and are making less than $10,000 a year at their jobs.â€

28 million Millennials are not enrolled in school and are making less than $10,000 a year at their jobs. In other words, they are in poverty. The struggle is real and it also highlights why many Millennials are frustrated with the current sea of political candidates. Yet the situation of housing for Millennials is troubling because it signifies deeper economic problems.

Millennial Housing

Millennials are in the market for cheaper and more affordable homes because that is what their incomes can support. Unfortunately builders are either chasing higher profits on costlier new homes or are building multi-unit housing:

“For one thing, a growing overall demand for inexpensive, starter homes has diminished the supply available to younger Americans with less money to spend.â€

So the homeownership rate has plunged for this group at a time when it usually rises sharply. There is little evidence showing that this group is going to somehow create a large sea of pent up demand because their incomes are simply not there. Having half of Millennials living at home is not exactly a vote of confidence for the current economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Rascal said:

Living in a multi-generational household is turning out to be life as they know it for Millennials and their parents and grandparents for the foreseeable future.

The grandparents cannot retire and many sell their assets to make ends meet, and the grandkids cannot get a job that pays their expenses and debts.

The Gen X’er is in the middle; providing monetary and housing support, as well as health care for themselves and their children and parents. The Gen X’er is being squeezed here. Sandwiched between two generations that are suffering. The Gen X’er also contends with job loss and cuts in pay while trying to provide for their loved ones.

Oh, and about housing… All those Gen X’ers who demanded “open concept” homes are kicking themselves now that their adult children and their aged parents are living with them. So much for privacy. If home builders want to make some money on these people, they need to market “open concept to closed concept” home remodeling!

October 27th, 2015 at 12:54 pm -

fuariz said:

it is because of the housing bailouts.

November 6th, 2015 at 6:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â