Renters are paying too much and their burden is only going to increase: How financial policies gouge working class Americans.

- 11 Comment

A recent report by Harvard University’s Joint Center for Housing Studies showed an absolutely dismal housing situation for Americans. Housing is unaffordable for most working class Americans. Sure you can take on a gigantic mortgage with a low interest rate and pretend all is fine but you are simply chaining yourself to the bank for 30 years if you don’t run your numbers correctly. In large part the homeownership rate has fallen because home prices are out of reach to Americans. Many are relegated to renting. The study from Harvard found that renters are being financially squeezed at unprecedented levels. How is this measured? The study looked at how much household income was being used to pay for monthly rents. As it turns out, Americans are paying an ungodly amount of money in rents per month and much of this is flowing to new corporate landlords thanks to banking friendly bailouts.

The rent is too damn high

The homeownership rate dropping means people are living somewhere else. Sure some Millennials are moving back home with their parents but others are opting to rent. Let us be clear here: you never fully own a house contrary to all the housing propaganda out there. Even if you pay off your mortgage to the bank, you still have nonstop taxes, maintenance, and insurance. Buying a home makes sense in many cases but this blind adherence to purchasing a home is what led many into the fires of foreclosure. While the public was left to fester at the torture chambers of austerity, banks got off easily and suddenly found their niche in becoming large landlords. Now the rents are soaring. A shocking revelation, I’m sure.

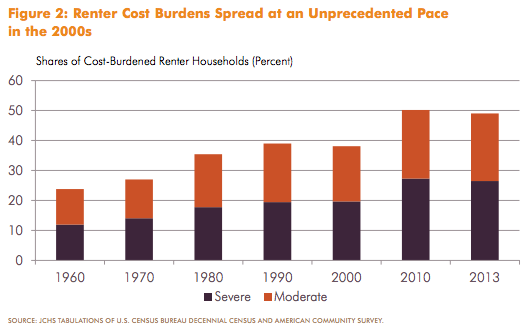

Take a look at this chart:

11.2 million households that rent (26.5 percent of the total) are severely burdened by the amount of rent they are paying. What this means is that rents are consuming half of their monthly household income. Housing is the biggest expense for Americans so this is an important line item to follow.

This is problematic because inflation is occurring in real things. There is this constant narrative that inflation doesn’t exist so therefore central banks can continue on this wild uncharted experiment in monetary policy. So far, it looks like banks are doing just fine but the public isn’t. Rents are going up but incomes are not.

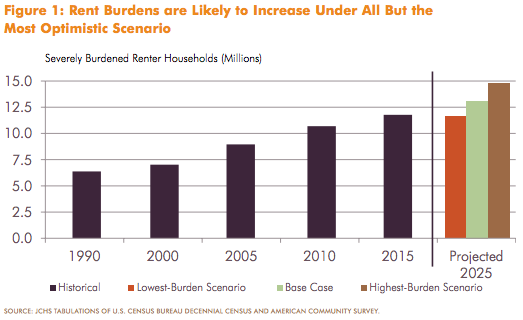

And the problem is likely to continue:

It looks like over the next decade those severely burdened by rents will rise by 11 percent reaching 13.1 million households. This problem will continue for a variety of reasons including:

-1. Banking policy has incentivized financial institutions and big investors to chase after yields. This led into a rush to buy single family homes as rentals, an option largely unattractive to big money in the past.

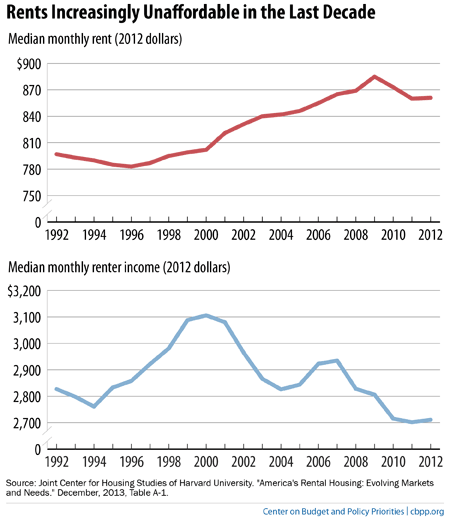

-2. Stagnant incomes. Household incomes have been stagnant for nearly a generation now. Rents are outpacing any gains in income:

-3. Builders are not building housing at fast enough rates, especially affordable housing. Builders realize the market is being juiced by the Fed and American households are cash strapped. Why would you build new homes which tend to be more expensive?

-4. Fed’s low interest rate policy. The Fed can say what they want but the entire global central bank mantra is about chasing rates lower. There is too much debt to entertain higher rates regardless of what is said.

So you are left with incredibly high rents:

Fewer homeowners, higher rents, and more disposable income flowing to banks. And you wonder why Americans are angry. The subsidies to banks are too damn high.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

Chris said:

Charles Hugh Smith has an article that explains this perfectly. The banks gave loans to their buddies for millions of dollars at 1 or 2 percent interest. They then used that cash to squeeze out the mom and pop buyers of rental housing by paying cash for the distressed houses. Voila – a corporate boom in rental housing. From corporate landlords who give a new definition to the term “slum lord.” Want to have your plumbing fixed? Now you have to go through a call center and hope and pray you get someone who speaks English. They’ll contract out the job to the local plumber for you when they get around to it. Want to negotiate a late payment one month? Corporate masters have no mercy.

October 8th, 2015 at 10:03 am -

kookooracharabioso said:

Common sense guidelines that your housing costs should never be more than one quarter of your monthly income – are no longer taught. Low wage workers not only must pay 1/2 their monthly income for housing, then they must pay 1/4 for utilities. Even the bank teller shares with me that he also has to get into predatory lending schemes to keep his utilities on in the cold months (or lifesaving AC in the desert southwest. ) there’s no margin left for TV, internet or paying for all day kindergarten at your local public school or paying for quality licensed childcare while you are working.

October 8th, 2015 at 12:13 pm -

kookooracharabioso said:

Curiously I have noticed that foreign born landlords are able to rent properties for only 2/3 what US born landlord must charge for equivalent rental property. What’s that about? I don’t know the answer but I’m still mad about it.

October 8th, 2015 at 12:17 pm -

M. Ward said:

As a landlord, I can tell you that taxes tend to go up nearly every year. Maintenance costs go up. Even the gardener that I used to pay $150/mo is now over $300 month (in five years a 100% increase). I once got a rate of return on our rentals of about 11% per year plus the tax benefits. Not great but not bad either. Today, I’m LUCKY if I can squeeze out 5% return on invested capital after I pay the costs/maintenance/etc. Lately I’ve been converting my units from “middle†to “upper-middle†as my target tenants. That means Sub Zero fridges, Miele Dishwashers, upscale faucets and sinks, high—end kitchen cabinets, under-counter lighting, granite or marble on the countertops and floors, and hardwood in the living areas and bedrooms. We also put in new windows, new AC and heat, and new hot water heaters as well as instant hot water under the sink in the kitchen and R/O filters feeding the icemaker and water tap in the kitchen. We let the tenants choose their wallpaper/paint color scheme from four decorator designed choices. We paint anew after every move-out. And wall paper is changed in the MBR accent wall, MBR Bath, and hallway with each new tenant on a 2 year or longer lease.

I’ve had to increase rental rates by 20-25 percent to cover it all and i am still not making money on it. But I do have a much better class of renter and they seem to appreciate the extras and the effort that goes into it all to make and keep it very upscale and nice.

The calls for maintenance have gone way down, and the tenants are asking for 2 year and 3 year leases once they see the place and their prices. After 18 months at the higher prices and I’e covered the cost of the redo mostly, and from then o I begin to make a few bucks… but have about 16 months to go before that happens!

October 8th, 2015 at 1:23 pm -

Apollyon said:

Join the growing movement by buying a RV and hit the road. Advantage is, that you can flee disaster areas like the North East and sleep comfortable in you own bed no matter what happens to peoples homes around you.

October 8th, 2015 at 4:46 pm -

Beano said:

The rent is UNBELIEVABLY too high. IT goes back to whatever the market can bear.

The only way to lower it is people start moving out but the demand is there so it is going even HIGHER!

October 8th, 2015 at 4:50 pm -

picomanning said:

Meanwhile, developers who would like to innovate must deal with city planning departments who have become utterly inflexible. There can be no innovation to systems run by bureaucrats. And those stale bureaucracies are suffering under the same dysfunction that the private sector must contend with. The problem is, the public sector is guaranteed its growth by committee perceived ‘needs’ whose costs are satisfied by greater tax burdens on the private sector. Take notice of the age and quality of government vehicles on the highway and compare them to the poor schmucks who are struggling to make a living. Dysfunction is the soul of America today.

October 9th, 2015 at 1:26 am -

AC said:

Look for low end sporting goods stores to do well – as an increasing number of people become homeless, and buy cheap camping gear.

We’re seeing, first-hand, how an empire disintegrates.

October 11th, 2015 at 10:47 am -

Ame said:

Did anyone see the Keiser Report about money laundering? Money is being laundered through the housing market. YouTube Keiser Report: Money Laundering and Bitcoins.

Wondering if this is happening in the United States as well.

October 11th, 2015 at 5:21 pm -

Rachel said:

First off, if people buy what they truly can afford and have an emergency fund, foreclosure is not likely. Secondly, if people are forced to rent to keep a roof over their heads and truly are spending 45% and beyond to keep said roof over their heads and utilities running, then it’s VERY likely they have little to no emergency fund and VERY likely the shite will eventually hit the fan and they will be caught with their pants down leading to an eviction.

Lastly, there are homes, condos, and town homes in many areas of the country that truly are affordable if only renters can come up with the down payments. Thing is, there truly are good state based programs that help buyers out with down payments and REQUIRE their participants to actually LEARN about becoming owners rather than renters prior to buying.

SO, people have a choice of paying high rental prices making landlords rich or choosing to buy a home that requires a mortgage payment that is less than what they would pay as a renter. Sure in some markets, the buyer may be “taking a step down” but they will also come out ahead financially and get off the renter’s treadmill.

October 12th, 2015 at 2:42 pm -

Brad said:

there is a lack of realistic choice in what people want to rent. If the rent is too high for someone’s income, then there is a need to look for more affordable property. Smaller house? Apartment? It might be hard to go from a 3+ bedroom house to a 1-2 bedroom apartment but that is a decision many people need to make.

If enough renters made that decision then it might drive the market down. – hopefully.

October 14th, 2015 at 3:37 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â