Labor force catastrophe with more than half a million dropping out of the labor force: Record 94.6 million Americans not in the labor force.

- 1 Comment

The latest employment report was a complete disaster. The only reason the unemployment rate remained unchanged was because a stunning 579,000 people dropped out of the labor force in one month. We now have a record 94.6 million Americans categorized as not being in the labor force. This massive drop cannot be explained by the weak narrative that many people are simply entering retirement. We’ve already gone into great detail how retirement is a pipedream for many and the new retirement plan for many older Americans is working until the wheels go flying off. To demonstrate how insane the stock market is, there was a surge because now market players sense that the Fed is going to continue its low rate policy that essentially keeps distorted interest rates going. What we are witnessing in the employment market is simply statistical shenanigans that even the public doesn’t believe anymore.

Half a million Americans drop out of the labor force

The unemployment rate remained unchanged at 5.1 percent and for most other times in history, this isn’t a bad rate. Unfortunately this is not a typical time in history.

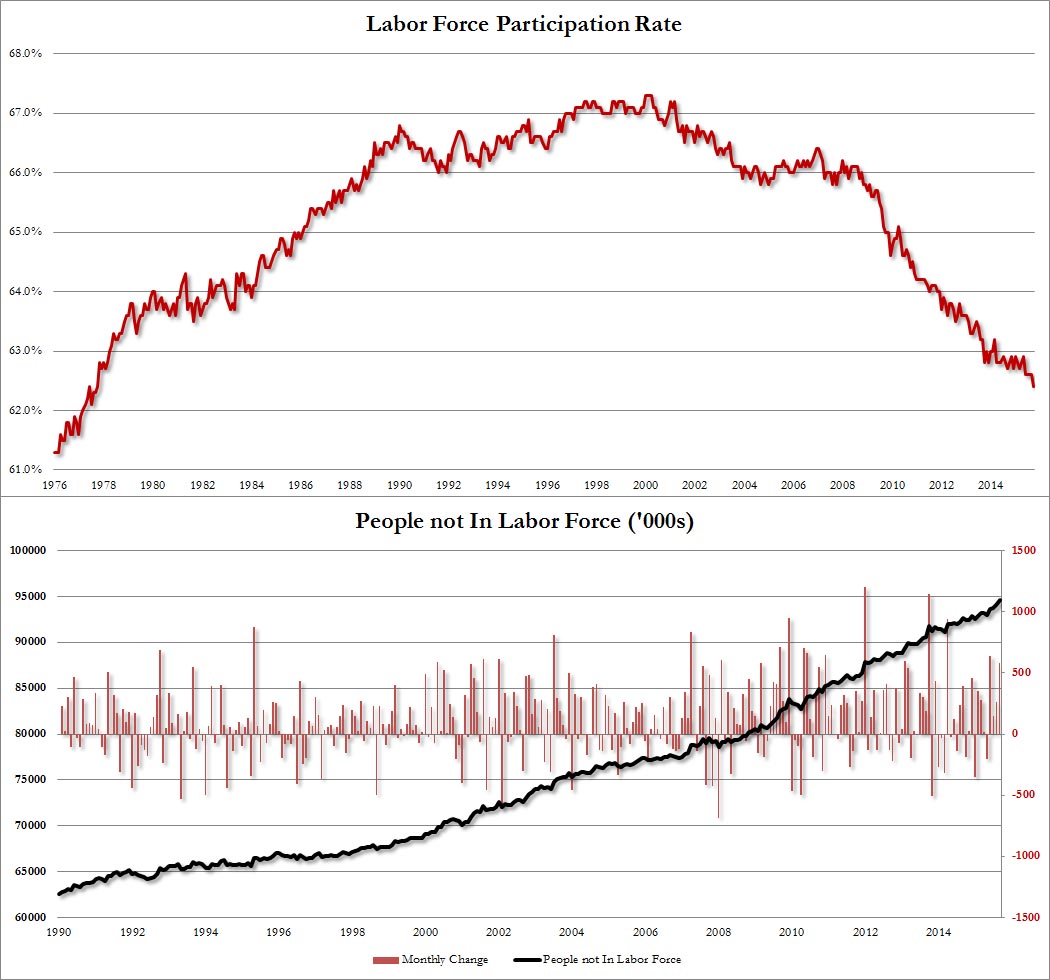

Those not in the labor force has grown by more than 2 million in just one year.

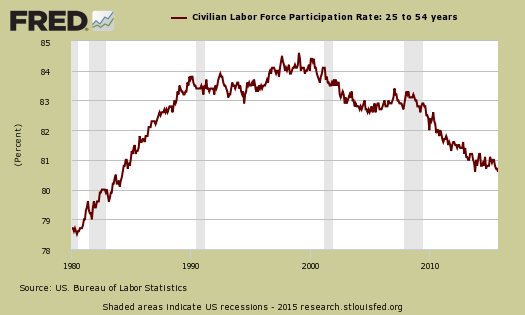

This massive growth cannot be explained away by simply looking at those retiring. In fact, look at prime working aged Americans:

The participation rate for those aged 25 to 54 is at generational lows. This is largely the age range when most Americans should be working in a healthy economy. But the ranks of those not in the labor force continues to swell:

94.6 million Americans now count as not being in the labor force, a new record. And many of the new added jobs are coming in the form of low-wage employment with scant benefits. My theory is that this atypical political year is being driven by people not trusting the mainstream press and the machinery that usually keeps the blinders on are now off (the bread and circus events that usually snows the public).

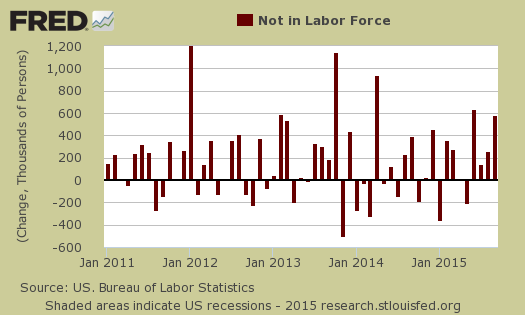

The recent jump in the “not in the labor force†category continues to show a strong trend for this group of people to grow:

Again, this cannot be explained away by old people entering into retirement age. Most older Americans by all accounts don’t even have the means to retire. Social Security is the primary source of income for retired Americans and half would be out on the streets begging for food if it were not for Social Security. The mainstream press makes it seem like all the people retiring are somehow going off into the sunset with massive nest eggs and resort filled vacations. The exact opposite tends to be the case.

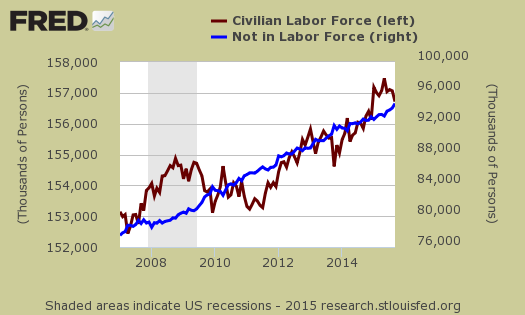

This chart should give you a sense as to what is occurring. The civilian labor force increased by roughly 4 million since 2007. However those not in the labor force has increased by nearly 17 million! Again having nearly 600,000 people dropping out of the labor force in one month cannot be accounted for by people retiring. There is something amiss with the numbers. The latest jobs report was a disaster on every front.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Rachel said:

The reality is that many people get downright depressed when they hit a significant amount of time as a job seeker rather than employee. For some that mark may be 3 – 6 months while for others it may be 6 months to a year or more.

I imagine that the hit to one’s self esteem of continuously applying for jobs and never being hired could lead some people to give up and settle for less than they ever thought they would prior to having this sort of self-esteem bruising experience.

When you take into account these facts and the fact that many people having the most difficult time finding jobs are those who are most in need of the income and often the least in demand as far as skills & experience, it becomes easier to understand why some of them will give up and live off of others (family/friends/government programs).

October 12th, 2015 at 2:50 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â