Family Budget: How to go Broke on $100,000 a year. Why the Middle Class has a hard time Living in Expensive Urban Areas.

- 55 Comment

One of the challenges during this economic crisis is budgeting. As much as we hear about the housing collapse or the stock market seesawing like a playground, we rarely get a glimpse into the actual budget of real live Americans. Sure we know housing is expensive. We all intuitively knew that $147 a barrel oil was not going to be good on our economy. But how does this translate into the monthly budget of a family trying to get by?

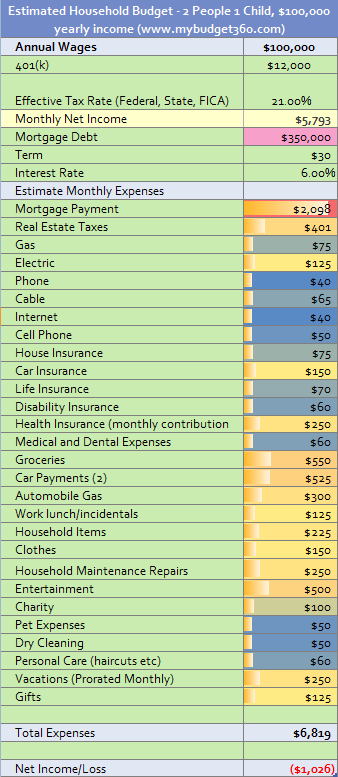

A few months ago I put together a budget for a family/person living on $46,000 a year here in California.  Many people doubted this was even possible. It is possible because I based the data from friends and family members that live on this amount. I had requests to put together a budget for a family in the middle to upper-middle class. Today we are going to look at a detailed budget I put together for a family making $100,000 a year and trying to live here in California. Let us look at the budget:

Let us go line by line and discuss each specific area. This budget is based on a family trying to live here in California. We’ll also show areas we can trim down to make up for the monthly deficit they are running.

401k

We are putting away $1,000 per month into our 401k plan. Many right now may be questioning why we would even do that given the poor market conditions. Keep in mind that many funds allow you to put money away into savings funds that bring in 3 or 4 percent per year but are guaranteed. In addition, this money is pre-tax so you have more money to invest thus boosting your savings power. I’d be cautious about what funds to invest in given the current climate. If you are not sure just put it into a savings fund until you have a better idea.

Mortgage Debt

I’m basing this off the median home price in Los Angeles which is $355,000. That is for a basic starter home. You can now find a “nice” place for $400,000. So let assume this couple bought a nice $400,000 home here in Los Angeles County. They now have a mortgage of $350,000 and put down $50,000 which is about how much you need in today’s tight credit market. Let us now go through the line items for each expense.

Mortgage Payment

At 6% on a 30 year fixed note, they are looking at a $2,098 payment simply for principal and interest.

Real Estate Taxes

In California, many of the nicer areas have city taxes on top of the state tax which is low hovering around 1%. With the additional items you are paying about 1.25% to 1.75% on the very high end. With taxes are payment is now up to $2,499. Throw in insurance and you are looking at $2,574.

Gas

I’ve averaged out gas payments for a family that does cooking and also uses internal heaters during the winter (which are mild here in California). You may find this line item different for your family.

Electric   Â

For electric we are spending $125 per month. This is about right if you consider a household that has a child and an income of $100,000 probably also has the typical suburban amenities. Televisions, computers, and other items do suck electricity. Again, you may find this item lower on your budget.

Phone

A basic land line with the ability to call long distance will cost you anywhere from $30 to $40 a month. Many people are cutting this out and going strictly with a cell phone. This family chooses to have a landline. [save $30]

Cable

A basic cable package will cost $65. Many people spend upwards of $100 to $150 a month on cable programming. I think that is a waste to go beyond the basic cable but this is where folks spend their hard earned money. This is an item we can completely trim out. [save $65]

Internet

DSL or cable modem coverage will cost you about $40 a month. Most people now go with broadband for the home so this may be a necessity especially if you use the computer for work at home. Not much to trim here. You can go with “naked dsl” which is service without the phone or cable attached but it may be limited in your area.

Cell Phone

A basic cell phone plan will cost you $50 a month. If you get an iPhone or Blackberry expect to pay $100 or more a month for decent service. You can get a pre-paid phone from Virgin Mobile or T-Mobile and they usually don’t even require a credit card. I know with Virgin Mobile, you can pay as little as $10 a month for service.

House Insurance

We already factored this item above. In California this may increase if you are looking at fire or earthquake insurance.

Car Insurance

For car insurance, we have a family with 2 cars and good driving records. They have modest cars and have full coverage on both. Assuming they are in their 30s we are looking at $150 a month. Keep in mind this is for modest cars.

Life Insurance

A person with a family should definitely not skimp on this item. It is important to ensure your family is covered no matter what. For a younger couple, this shouldn’t be too expensive.

Disability Insurance

Given the tough economic climate, you’d be smart to have some disability insurance in case something happened to you on the job and you were unable to find work for some time. Again, this should be minimal if you are younger but the premium will increase with age.

Health Insurance

This is where it can get tricky and prices are all over the map. You can get a basic packaged for $250 a month but this is barebones. There isn’t much we can cut here but if your employer covers this, you can find savings here.

Medical and Dental

We’ll throw in co-pays and dental visits here. In this assumption we have your employer covering your dental insurance but a lot of coverage is basic and you’ll have to have a deductible.

Groceries

For a family of 3 you can get by on $550 a month. I know in the previous budget people flipped out and said that it was impossible. Well yeah, if you are shopping purely at Trader Joes. Here in L.A. we are lucky to have great diversity in our stores. You can find great deals and many other local markets have great cuts of meat and much better prices. You may need to shop at 2 or even 3 stores.

Car Payments

We are assuming the couple has 2 cars they are still paying. Let us say a Civic and a Focus. The payments are slightly above $250 for each car. If they accelerate and pay the cars off, this will be a net savings of $525. My suggestion for a young couple with this level of income is hold off on the luxury car and buy a nice used car. This is so crucial. The big mistake in L.A. many people make especially when they have a low 6 figure income is they buy a very expensive luxury car. Well that pushes up your payment, insurance, and gas. Many people spend $1,000 to $1,500 a month simply on one car! Insanity. Potential savings here. [save $525]

Automobile Gas

Gas has dropped quickly due to the collapse of the oil markets. Now, you can get a gallon of gas for $2 a gallon. So with the recent knock down in gas we can say that this family will spend $200 a month on gas. With a Civic and Focus that is enough. [save $100]

Work lunch/Incidentals

If you are really frugal, you’d price in your brown bag lunch from your grocery budget. This family is spending $125 a month on eating lunch at work. This can easily be shaved down. [save $125]

Household Items

This is for things like vacuums, furniture, and other items that go in your home. Over time these do add up. For example you do need a microwave and stove. So over a year you are looking at spending say $225 a month. A new refrigerator will cost you $800 to $1,000. At least a good one will cost you that much. So this outlay is only for the first few years and should taper off. We can assume this couple is new to their home and needs new items. Next year, they’ll need to close that deficit so they’ll need to cut back here at least by $125. [save $125]

Clothes

People in L.A. love shopping so this is hard to resist for many. We are allocating $150 per month here. Some people want to dress their kid in GQ clothes but they really don’t care or even realize what they are wearing. Many times the clothes are more a reflection of the parent’s wants and desires. Cut this back by $50 a month. [save $50]

Household Maintenance

Owning a home is expensive. Anyone that owns property knows this. The toilet screws up. You need a new roof. You kick the door down after partying too hard. Yeah, things like that come up all the time. So this budget allocation seems about right. It isn’t monthly but keep in mind a roof can cost you $5,000 so for 2 years that works out to be $208 per month.

Entertainment

Okay, this is much too high here. You like movies? Hook yourself up with Netflix for 9 bucks a month and you’ll be able to get as many movies as you like. Do you really need to buy every DVD you see? Free museums, gorgeous beaches, and nice parks are all over L.A. County. Use those. If you have a deficit you can certainly cut back here. Yes, you’ll go out and have a nice meal and watch movies. So we won’t be draconian but let us cut this in half.  [save $250]

Charity

I’m a believer that you should give a little bit each month to those less fortunate. Some may have religious requirements here so this will vary. But my feeling is a family with a $100,000 income has a bit of wiggle room to help others.

Pet Expenses

Pets are expensive especially dogs. Vet bills and food are additional costs. If you have no pet, this is easy to save but many families here have pets so we’ll leave this line item.

Dry Cleaning

If you work in a professional environment, you may need to have some of your suits dry cleaned. Understandable. Just don’t take your Metallica t-shirt here. $50 is plenty for once or twice a month service on important items.

Personal Care

Let us be honest that the genders are not equal here. For guys, a basic haircut is cheap. For the ladies not so much. So this area will vary. If your bald hey, you’ve just saved some dough here.

Vacations

Working families like to take vacations. I can’t believe how some people in this income range take $20,000 vacations and put it on their credit card. Absurd. That is why even these people are going broke. We are saving $250 per month for a nice mini vacation per year. $3,000 should go a long way here. You won’t be going to Monte Carlo but a $100,000 income isn’t enough to take that trip anyways. $3,000 can be a great camping trip/equipment, a nice week long cruise, a flight to a nice place in the United States. You get the picture.

Gifts

Birthdays, Christmas, and other holidays. This family is spending a little too much here given their monthly deficit. Let us cut this back by $50 per month. This still gives them $900 a year to spend on gifts. [save $50]

Total Savings Above

With very modest cuts above, we were able to trim $1,195 from the budget, plenty enough to cover the deficit of $1,026. These weren’t even draconian cuts. You can trim more money but I’ll leave that up to you. The point is, many people that I know are within this range and struggle but it is because they have cars that are too expensive or bought homes that they simply could not afford. $100,000 does not go far in Los Angeles. This family above is comfortable but they certainly aren’t living like Trump.

Hopefully this gives you an idea on how to budget. If you live in an expensive area yet make the median income of $46,000 please take a look at the budget I put together for that. People need to be realistic and live within their means.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!55 Comments on this post

Trackbacks

-

bluetrolls said:

Add 1000+ day care for one child and you are back in deep red.

November 21st, 2008 at 8:32 pm -

Michael said:

You are putting money into a 401k? Don’t you know saving for the future is unAmerican?

November 22nd, 2008 at 9:31 am -

sampaw said:

Unfortunately, you left out some important line items:

Guns : 1000

Ammo: 500

Frze Dried Food: 200

More Ammo: 500

Water filter: 1000

More Guns: 1000April 8th, 2009 at 3:49 pm -

AnnInFL said:

Yeah, you forgot a few things, like day care, saving for college, and diapers and formula, and what about when baby #2 comes along? Your proposed grocery budget is a little tight. Also, you only budgeted for one cell phone for this couple. What if this family has extra travel expenses to visit out-of-state relatives? What about paying back their student loans?

My husband and I tried to live in California with two children on $200K. We had a similar type of budget as this example. Our rent was $2400 a month for a decent 3 bedroom, 2 bath house in the San Francisco area. My husband’s medical student loans were $800 a month. We drove old cars and lived modestly. We wanted to buy a house but had a very hard time saving for a down payment, and decent houses were going for $600-700, twice what we could afford. That was 10 years ago, well before the peak of the bubble. I never understood where people were getting the money to pay those crazy prices. After two years of struggling, we made the decision to move to Florida and never looked back.

April 10th, 2009 at 8:16 pm -

gasoline cards said:

@sampaw why would you need to budget money for guns, and other items related to guns? That’s just silly…

-Randy

June 21st, 2009 at 9:46 pm -

vivo said:

sampaw:

That was hilarious!

July 3rd, 2009 at 3:34 am -

David Smoot said:

A great article – Family Budget: How to go Broke on $100,000 a year. Why the Middle Class has a hard time Living in Expensive Urban Areas.

I believe if you keep a budget you will not go broke, but create wealth. Basic Budget today, Balance Bills tomorrow.July 8th, 2009 at 8:55 am -

Optimator said:

That car(s) is going to need maintainence for the unexpected including things like tires, oil changes, registration.

July 30th, 2009 at 6:16 pm -

JR said:

Your great post propmted me to create a spreadsheet for my budget for this year. How did you come up with an effective tax rate of 21%? I was basing my calculatons on 60K per year and my average tax rates were as follows:

Federal = 12.28%

State(CA) = 3.40%

Fica = 7.65%Total = 23.87

The federal rate (married) going over 67K is 25%. If the average is roughly 25%, that is 4K a year out of the budget.

December 26th, 2009 at 8:02 pm -

Reverend Lex said:

Also consider the burden of student loan debt. Heck, Our student loan debt is higher than our car payments.

December 28th, 2009 at 6:56 am -

leigh said:

If you make 100K there is probably a good chance you are paying student loans $100 (and thats low), saving for college $50 and childcare for 2 kids $1000+. I live in Massachusetts we have to pay for heat here too! Forget entertainment or vacations!! 100k and a modest 175k home…people on welfare w/ housing subsidies have a better standard of living!

January 20th, 2010 at 3:13 pm -

JP Merzetti said:

Let’s face it….

100 G’s just isn’t middle class anymore, folks.

Let’s take this family and squeeze them into a 1-bedroom apt.

Drive one clunker, and pare everything else down to the bone.

Then they’re living high on the hog as yer basic working class

family.

To some – a very depressing turn of affairs………

but I betcha they’d sleep better, nights.June 29th, 2010 at 10:11 pm -

Donnie said:

Add to this the logistics of a trans city commute in Los Angeles.

The scenario: You live in the “Sin Fernando Valley” but your engineering job is in San Pedro – Port of Los Angeles. A walk in the park many say, but, like an aviator, you check your fuel, tires, and the general condition of your new BMW coupe. It’s instinctual.

Because, just as a wealthy dude flying his new Mooney back from Vegas to Bob Hope in Burbank, he wisely pre-flights his Mooney before the Mojave Desert, our cautious engineer also checks the basics of his BMW before the Long Beach Freeway run.

The reason; your if your car dies on this run (the LAPD use this posting as kind of an “Outland” posting) you’ll be dog meal as soon as you hit the streets.

Drive safe…

July 20th, 2010 at 4:43 am -

Workingmom said:

Try daycare for two kids. It’s brutal. These numbers are very very close to our household budget. Slightly higher income, but proportionally higher mortgage, so it’s a wash there. And you gotta add $1200/mo for daycare for two kids. I’m counting down the months until our first daughter goes to Kindergarten.

July 21st, 2010 at 9:14 pm -

realy said:

To buy a 2 bed house budget $400,000 min, and add $300 a month for the home owner’s association. And groceries are too low too. So is gas, the lowest price you will find is $3.00 per gallon.

August 1st, 2010 at 9:45 pm -

robs104 said:

“what about when baby #2 comes along?” Simple, don’t have kids. It wont kill you, the world doesn’t need more people.

August 12th, 2010 at 9:36 pm -

milo said:

mistake one..350,000 household owernership debt vrs 35,000 north winter lands for the pride of having a job rather than of having HAD a job, thereby add the costs there of working for someone else rather than onself and the decrease of individual productions for a community rather than internationalists.and forcing others into huge debt by borrowing to buy and thus jacking up the prices…..had to have it now……………

August 18th, 2010 at 1:12 pm -

milo said:

daycare 1200 a month…brother and i , played in the north woods…..

August 18th, 2010 at 1:13 pm -

milo said:

had seen very nice doublewides some on the beach last year in florida for less than 50,000 what was selling before at way more with borrowings……………. taxes high at 2500 fruit trees planted…

August 18th, 2010 at 1:18 pm -

Wes said:

Don’t forget that the upcoming generation is graduating college with $60-$100k debt. For a married couple, that’s easily between $1-2k a month payments for 20 years.

August 25th, 2010 at 2:39 pm -

AlabamaSnape said:

I was interested to read your budget. However, before I even started, I had problems with line #3. You provide details on most of your line items, but omit line #3 (effective tax rate). By my calculations your effective tax rate should be around 29%, not 21%. See below for $100,000 annual income:

Federal Income tax: $21,720 (based on 10%, 15%, 25%, and 28% 2009 graduated tax brackets

Social Security: $6,200 (516.67 x 12)

Medicare: 1,450 ($120.83 x 12)

Total Taxes: $29,370

Effective Tax Rate = 29.37%Note that this is for a tax free state like Texas. Most states will be above 30% since most states have income taxes. My Soc Sec and Medicare taxes were estimated from payroll-taxes.com online calculator for a $100,000 income paid monthly. I did not take into account 401k savings, but still my figure is around 50% higher than yours, so there is more than 401k to explain this discrepancy.

(Note: I reran the numbers with 401k and get > 25% tax rate, but this is a little deceptive because you are only DEFERRING taxes with a 401k, not eliminating them as you would with a Roth). But still your 21% figure appears to be too low.

Also you are basing your expenses on California but are not including state taxes, so this isn’t really apples to apples.

October 13th, 2010 at 2:44 pm -

IMakeThisAndImBroke said:

Add two kids and make them all three teenagers and then tell me you can live on $550 for groceries a month. You also have no line item for paying off any debts, so I can’t relate this to my life unless I declare bankruptcy. Also, I live in Texas with long hot summers and short cold winters and $200 for electric/gas is a fantasy. Try more like $500 to $600.

October 26th, 2010 at 8:42 am -

Victor said:

I get by on around $85K/year in The Silicon Valley. I saved up enough to purchase a low end home, too (what people used to refer to as “starter” homes). For savings, I put in 9% into my 401(k)/month. The company tosses in another 4%. I figure if I am 12% or above I am doing ok. I save 10% of my net going into an employee stock purchase plan. I look at this as my forced savings. In fact, it is what enabled me to save up to put money down on a home, with money left over for some remodeling and repair. I bought my last new car in 1992. And my last vehicle was used, which I bought in 1999. Only in 2009 did I purchase a new car (and this was because my mom needed a reliable vehicle so I willed her my old Toyota truck). I spent less than $25K on that (not including tax, title, fees, etc.). I also timed it to take advantage of the new car purchase tax credit, and also just before California raised its sales tax again (saving me a few hundred dollars). I have not had a landline since 1999. And I have never had cable or satellite tv, viewing that, no pun intended, as largely a waste of time. So I saved myself around $50/month there. I also lived in a small, old studio apartment for around $1000/mo.

Now, I have a $2000/mo. mortgage (including taxes and insurance). I am living at the edge of my budget, but I still put that 10% net away into stock, which I periodically sell for at least a 20% gain. I put away extra cash into a high interest savings account. I know that is laughable these days, but my credit union pays 2%, which is better than nothing. Before the financial meltdown, I put the cash into a 5% return bank account. When they took away that teaser rate, I moved the bulk of it to my credit union, which had at the time a 5% APY account as well (before the Fed’s monetary expansion dropped interest rates). I made around $3000 in just interest in a few year period before I took out the bulk of it to put the down payment on the car (almost half of the purchase price, 1/3 of the out the door price— this is CA after all and we have high fees and taxes). During this whole time, I paid down and off my credit cards, where I seemed to be perpetually carrying a $3000 debt— some of this was from saving my mom’s home from foreclosure in 1999/2000. For a few years now, I always pay my card off within the grace period. And I resist the temptation to go out and get “this” or “that” for only a few hundred dollars. People still think we’re crazy for not paying for tv, but I refuse to pay for something I might watch at most an hour a day. It is a complete waste of money for a working person.

October 27th, 2010 at 2:43 pm -

Michelle said:

How come you can get insurance for a $400,000 house in CA for LESS than what it costs me in Arkansas and Texas for a $100,000 house??? And, where are their student loans or cc debt? Or emergency fund???

December 4th, 2010 at 8:05 pm -

J. Potts said:

Pets cost A LOT more than $50 per month. Food, supplies, flea medications, yearly vet visits and other health issues that come up – not $50 per month.

Cell phone plans – also not $50 a month for this household budget. $50 a month would pay for one phone for the household with basic talk and text and that’s it. Definitely not realistic.

Based on just these two items, it’s safe to assume the entire budget is unrealistic.

January 10th, 2011 at 10:26 am -

CA said:

My buget is similar with an income about $110K or a bit higher (commision based) We do quite well but live with in our means. No kids but also…only do what we can afford. Some of thes posts tend to forget we don’t NEED all the extras….and a cell phone data plan is extra. Like some mentioned heat is not extra but in most parts of the country it will balance out with the CA fees/taxes. When baby #2 comes along…you should sell your house for a smaller one. Don’t have baby #2 unless you can afford more children. I don’t have kids because we don’t feel like we can afford them yet. Basic money mngmnt…if you can’t afford it then do not buy/do it. If you need to charge it then you simply do not make enough money to have it…end of story. Get a smaller house, older car, get rid of the pet (again if you can’t afford the dog/cat get rid of it). If daycare is part of your budget then you need to trim someplace…get rid of the car that you can’t pay for in full, do not save for a vacation and do not take a vacation, get a smaller house, no pet and find free entertainment …or get a 2nd job and save on entertainment because you don’t have time for it. Simple rules of life…if you must use your credit card then you are pretending to have more money than you actually have. If you can manage your lifestyle with out your credit card then you’re good but if you require your credit card….you’re causing/supporting the financial issues in America.

March 1st, 2011 at 10:31 pm -

Randolph said:

Like CA said. If your wife gets pregnant, have her get an abortion. That dog you had and the cat she had before you were married can easily be put under.

After you’ve cut everything to the bone (no cable, no fancy phones, planned toilet flushes); you’re still short on savings, but your job is no longer available. Be sure that selecting who dies to collect the insurance from for retirement is done fairly. And be sure to make it look like an accident.

Maybe it’s time this topic is revisited. Wages are stagnant, but the cost of living somehow keeps up with if not beats “inflation”.

September 8th, 2011 at 12:45 pm -

Jason said:

$100g’s isn’t middle class? Where the heck are you living dude? Maybe it’s not in San Francisco, but in most of the US a six figure income and a reasonable amount of intelligence and discipline means you are living the American dream. I make $110K and my wife makes $20K. We live in a $250K house that carries a $1300 mortgage. One car is paid off, the other is new. One kid in college, the other in the military. We have almost a half million in retirement. No credit card debt at all. No other loans or debt besides the car and house. Am I braggin’? Heck no. Just stating that it’s a good income in the right market with the right lifestyle. We live modestly…very modestly. Save for our vacations. Have very old furniture. Rarely buy anything expensive. It’s all about where you live and how you live. Thank God, we have never had to deal with extended periods of unemployment or uninsured medical bills, which I know can knock out savings in a heart beat. But again, the point wasn’t to brag, but to state that if you are frugal and disciplined and willing to live within your means, over time you can build some degree of financial security even in a sucky economy.

February 22nd, 2012 at 5:38 pm -

lana said:

I feel like we are treading water. We have no car debt and little cc debt, our home is almost paid for and we have two sons in college. That is the trouble. If colleges weren’t charging so much and the associated fees are ridiculous. We pay for insurance on four cars, gas, parking and maintenance. We have three cell phones at $27 a month each. We eat out frequently, mostly to keep tabs on each other. We also pitch in for my son’s condo rent. Our family insurance is over $500 a month. Our medicines are $200 a month. I guess things will ease up when the kids are done with school. God willing, my sons will graduate college debt free. That is the best gift we can give them. We aren’t paying 100%, but we are helping with the difference that they can’t swing. To me, family is more important than having 1 or 2 million sitting in a retirement fund.

March 5th, 2012 at 9:28 pm -

Scott said:

If you cant afford to live in L.A. or the Bay Area move!!!!!!! You can get really nice house in the midwest for 150k. I’ll say it again, if you dont have enough income to live in California, move to a more reasonably priced part of the country. Not that hard to figure out, Sheesh!!

April 4th, 2012 at 4:31 pm -

CeeCee said:

Scott-what about all of the low income jobs? I suppose companies should just start paying burger flippers 20 dollars an hour, huh? The reality is, especially when you compare it to other parts of the country, SoCal has overpriced rents and a lot of the area is still in a housing bubble. When people think it’s the norm to spend 250k on a shack in Compton, and yet wages remain the same, how does that make sense? By the way, a LARGE number of people in SoCal have these low paying jobs. People need to stop acting like places like these are somehow an exception and if you don’t like it get out. Middle class and low class areas aren’t luxury properties, and need to be priced within the means of the people that live here.

April 30th, 2012 at 5:54 am -

myth buster said:

Randolph, what’s the matter with you? You’d murder your own flesh and blood over money?

May 2nd, 2012 at 5:24 pm -

Buddy said:

@Scott If everyone who couldn’t afford to live in L.A. or the Bay Area moved, you would have no one to serve you fries, fix your car, sell you clothes, or pick up your trash.

May 24th, 2012 at 10:36 am -

SuzyQPA2 said:

I don’t make 100K but this is pretty much my budget.

– replcace Entertainment budget with Debt payments

– increase pet costs

– cut cable, consolidate phone/internet

– cut dry cleaning use wash and wear clothes

– cut car payment to 0, drive an old car

– cut house maintenance, housing items

– increase tax costs but reduce mtg (so i’m paying 2150 a month)

my taxes are 450 mo so mtg is 1700 ( i bought the best cheapest house i could find and lowballed them – but i wish now i’d looked harder for something cheaper even)I’m a Single parent – my kid gets depressed because we are so close to wire and broke all the time. I plan to sell my house when she’s done HS and buy something a lot cheaper. My parents live with me and help and i rent out a room to a student to make ends meet.

If it weren’t for child support – which i only started getting when she was 15, and the mtg tax refund i couldn’t sustain this house.June 6th, 2012 at 6:55 am -

gracie said:

They need to learn how to save better.

July 11th, 2012 at 4:42 pm -

Stacey said:

Estimates on utilities is EXTREMELY low. I live 50 miles north of L.A. and my gas/electric utility combines to about $300.00 a month and I live in a 3 bedroom, modest ranch-style one story home. Estimates on insurance are EXTREMELY low. Our life insurance is $150, car insurance well more like $90 per month, per car – health insurance? For basic, barebones? Try more than double your quote of $250. Gasoline is NOT $2.00 per gallon, it is hovering around $4.00. What if you want your kids to have music/dance lessons or participate in sports? Even in school it costs big bucks…high school football here is over $500. a season. And sure, you can certainly eat fruity ‘o’s and hamburger helper on $550 a month, but fresh fruits and vegetables, low-fat dairy, lean meats and chicken, cleaning supplies and toilet paper? 🙁

August 30th, 2012 at 10:55 pm -

amy said:

We bought an independent 20 year Million Dollar TIAA Cref life insurance policy for $44 a month for husband. An extra $12 a month through the company pays for me at a $450,000 (he makes more I am staying home now with a small baby). Most people don’t need this much life insurance. $75 is very high.

Living in SoCal for years, we have never used heat. Gas bill is at most $20 a month, that is if I cook a lot of over foods in a month.

Yeah, the house gets down to the 60’s and high 50’s. We put on sweaters and I make a pie.Your health insurance number is low. We pay $200 a month as a monthly co-pay with the company plan through CalTech, which I assume provides more generous benefits than for profit companies. I cannot see how $250 can buy a whole plan for two, even a bare bones plan. A bare bones plan should be combined with a huge emergency fund.

December 4th, 2012 at 11:25 am -

AP said:

Bottom line, it does not matter how much or how little you make if you dont have a plan and stick to it you will go broke, I make twice as much as I did 7 years ago and you know what my bank account still has the same balance in it, ya the sample budget aint perfect but at least somone is putting a little info out there thant might help sombody who is just looking for a few ideas they havent thought of yet to reduce their mothly bills before they loose there home. When my family started out (Me, my wife, our duaghter and my little sister) my yearly income was around 25,000 and we made it work, granted they didnt have a rich life but we made damn sure they had a good one!!! Parents rather watch their childs smile than that new HDTV anyday so figure out what really matters to you and your own and cut out the rest you dont need it

January 8th, 2013 at 12:43 pm -

KK said:

Here are some cash flow guidelines that can improve financial balance for a middle class family. Working to get your “budget” within these guidelines may be difficult and take some time to work towards but it is the only way to ever have financial security. There is a hierarchy to cash flow – not all expenses have the same importance… this is one problem with conventional budgeting – it gives the same level of importance to a cable/internet bill as it does insurance and savings. So, here is the proper hierarchy: 1st: Earn it – Income 2nd: Protection First – proper property/casualty & excess liability protection, health and disability, proper legal documents and your human life value fully protected with life insurance. 3rd: Save 15 to 20% of your Gross Income (there is a difference in savings and investing. You should not engage in risk based investing until you have become a world class saver). 4th: Liabilities – no short term bad debt; proper mortgage selection; reduce impact of future taxation (don’t overdue qualified plans such as 401ks). 5th: Lifestyle expenses – living on what is left after protection, savings and liability payments.

If you have debt then you should get on a plan to eliminate the short term bad debt. Pay the minimums on all debt until you get your short term capital built up (emergency savings of 6 to 12 months living expenses). Savings before debt payoff – this is the big mistake people make. Do NOT invest while you have bad debt. Remember there is a difference between saving and risk based investing. Your house payment (P&I only) should not exceed 15% (20% max) of your Gross Income. A 30 Year mortgage is in your best interest from a safety/security standpoint. There is a lie going around that a 15 year mortgage is cheaper some how – that simply is not true. And if you are using 3rd grade linear math to try to prove me wrong you are not going deeply enough in your calculations. You can pay off that 30 year mortgage in a lump sum in the 15th year if you want to with other “saved” money.

If you are properly protected (everyone shortchanges themselves here), are saving 15 to 20% of your income (investing after you have core savings), have no bad debt, a proper mortgage — then you have permission to spend the rest HOWEVER you want and you have financial balance.

Unfortunately, most households look like this: 1. Earn Income 2. Lifestyle (live beyond means) 3. Liabilities (high interest bad debt) 4. Protection (minimal, improper and huge gaps in coverages) 5. Savings (thus the 2% to 5% average savings rate in America at best – and probably in risk based investing asset classes without the proper savings cushion).

Folks- this is the best advice you will get. It will change you life. If you aren’t there then begin taking action in your life that will get you there over time. The alternative is to continue to be a statistic of failed financial advice focused on trying to earn high rates of return, based on hype and misinformation. The traditional financial thinking of the 80’s and 90’s will not serve you well going forward. Wake up!

KK

March 10th, 2013 at 4:18 am -

Reynaldo said:

Do not put money in a 401K. Unless of course you like rewarding wall street, the drug companies, Monsanto, the big banks, etc. The stock market is a rigged casino anyway, where the big boys (that’s not us) use machines to game the market using machines and algorithms. You’re better off putting your money under your mattress or buying PMs. Don’t get sucked in by the matching benefit.

August 14th, 2013 at 11:06 am -

duckcrap deluxe said:

I would LOVE to make 100K a year…our 4 person family makes about half that a year. Dave Ramsey would look at our budget and say, “Just give up and look for the nearest FEMA Camp!”

January 20th, 2014 at 3:02 pm -

Barbara Saunders said:

To the people who say move. What happens if your $100K job is of a kind that is not plentiful except in the expensive city where you live. Sure, many people live above their means. At the same time, people take on student loans to get the high-paying jobs, the rents in many places all over the country are high *relative to the salary in that area* (not just in the Bay Area), insurance payments are through the roof, etc. Even thirty years ago, retirement was not a line item on the budget consuming 10 percent of the income. This is not all an irresponsible-people problem; it’s also the case that the amount of *cash* people need for the basics is much higher than it used to be while wages are not.

My health insurance premium in 2010 was not only six times my health insurance premium in 1988 but also more than three times the cost of my rent in 1988.

July 27th, 2014 at 4:43 pm -

Mike said:

Look at how much you (and the rest of us who work) are paying in taxes. Your tax bill is the single greatest expenditure in your budget by a long shot. It’s nearly the size of all of your other spending combined (mortgage, car payments, etc.) And what are we paying it for? So that

A.) A large portion of the population that contributes nothing to society can have free housing, free health care, free food, free cell phones, free education, free school lunches.

B.) We can pay the interest payments to banks and other very wealthy interest on loans the government borrowed from them. Oh and don’t forget we lend the same banks money at 0% interest so they can turn around and lend it back to us at 5% or more.

C.) We can fatten the pockets of companies like Lockheed Martin, Raytheon, Haliburton, and so on through ‘defense’ spending.

D.) Another large portion of the population can work in cushy government jobs where you are paid modest salaries with fat pensions and benefits, to do, God knows what.This is the reason you and me and everyone else in this country who is smart, responsible, hard working, and trying to improve their lives are NOT getting by anymore. Imagine how different your budget would be if you didn’t have $5,000 or more per month (don’t forget all the sales tax on everything else you spend money on) going out the door.

This is not America. We are not free. We are slaves to a fat, corrupt, and bloated government and to a new aristocracy of corporate oligarchs. Obama was supposed to change all that, but all he did was punish the working class even further by taking more of their money and giving it away to free loaders.

September 1st, 2014 at 8:05 am -

Jtette said:

well, mike, what would happen to you and your family if you got sick and was physically unable to work anymore? You wouldn’t become what you call a free-loading non-contributor?

And what does a narrow-minded, bitter jerk like you think would happen if all government benefits cease? The short simple answer is that crime would increase many-fold. And what would become of your elderly parents then, especially when they lose their health insurance, and nursing home subsidies?June 16th, 2015 at 4:35 am -

Thankful said:

Just came across this article–just wanted to say thanks, and don’t mind the trolls.

As far as my budget, I don’t live in CA and my electric/gas seem more expensive than you have. Most importantly for me though, I have student loan debt which forces me to get pretty creative with the budget. Nevertheless, thanks for throwing this together because it’s a lot more detailed than government budget guidelines done by the EPI and others.

July 6th, 2015 at 2:23 pm -

nate said:

You can get by with $100k/year in Los Angeles only if you have no more mortgage. With a mortgage, need at least $130K/year.

September 13th, 2015 at 4:11 pm -

doreen said:

can i have some money my mom need it like today for debts my dad dont have a job and my mom is a teacher but her paymens aare not enough to pay them. so please if someone out there have a kind heart to help us please. we need about 100k

September 15th, 2015 at 1:10 pm -

Peter said:

I’d love to see this redone for 2016. $250/month for health insurance is a pipe dream. Not to mention putting money aside for the deductible/coinsurance/copay.

I found it doesn’t matter if you take out a low-deductible or a high-deductible if you assume that you’re family will actually use the insurance (and eventually hit the deductible limit). For my family of 5 living in the midwest, premium+deductible for 12 months is $24,000.

January 23rd, 2016 at 9:47 am -

Rob B said:

I found this to be very educational. The person who wrote this tried hard but missed the hidden expenses. Car registrations, tolls, car repairs, oil changes, parking, new tires, and tickets. So auto expenses 20-30 percent understated. Gas more than $75. I don’t have time to write full post.

February 7th, 2016 at 11:24 pm -

Brian said:

My budget for San Diego, CA on a $110k/yr salary:

take home $5,702.00 after 5% 401(k) contrib.

rent $1,220.00

utilities $60.00

groceries $125.00

eating out $125.00 (this invariably goes up)

gas $40.00 (deliberately living close to work)

health insurance COVERED BY WORK

student loans PAID OFF

15% buffer $235.50

Roth IRA $458.33

fun money (5%) $285.10Comes out to about $2,500/mo even if you end up spending the emergency buffer and fun money (which I usually don’t). I sock away at least $3,000 a month, to be invested in index funds once the market turns sour.

I get car insurance from AAA, which was about $650 for a year (to go down from yearly dividends) — should be cheaper once my accident point goes away.

I’m not sure where all the weird extras are coming from in the budget in the article. $500 for groceries to feed 3 people? Seems like overkill. $500 for entertainment? Admittedly, your article says you can definitely cut down on that.

Many of these expenses are NOT recurring and need not be taken into consideration. Clothes, for example, do not take $150 a month.

Also, a lot could be saved by renting instead of buying and paying extra in interest, taxes, maintenance.

Yes, if you have kids your expenses will go up, but you can really eliminate a lot of these expenses by not buying what you don’t need. You can splurge once in a while but not monthly (or not so big that you need to amortize it over the 12 months).

April 22nd, 2016 at 9:53 am -

RM said:

I am paying over $700.00 per paycheck for health insurance for my wife and son. Mine is covered by my company. I am going broke. Over $700.00 per paycheck is still better than the over $800.00 per paycheck they charged me for two months.

June 1st, 2016 at 6:11 pm -

Curt said:

How about a little diversification in savings? All to 401k? Congress can and will change rules to the 401k’s, IRA’s, etc. Sorry…can’t take anyone seriously when this is ignored in a budget with long term savings plan.

September 2nd, 2017 at 4:47 am -

Kork said:

Hello, I would LOVE an updated budget to reflect how ridiculously EVERYTHING went up, here in California. I would guess the income is relatively the same, but the expenses probably have doubled. Califirnia is getting outrageous and we are barely here on 90k a year.

June 18th, 2018 at 4:50 pm -

SaRah said:

Above you say “If they accelerate and pay the cars off, this will be a net savings of $525.”. – Question: How do they accelerate their payments when they are in the red $1,000 each month? Also, you did not include the interest and late fees accrued when you prioritize paying bills (as required when you are -$1,000 each month). If you do not have the funds incoming, you will not be able to pay all bills; therefore, you will need to choose which ones to pay and which ones to defer to the next month. I am a single parent in Southern California making $105K/year (with no child support/other additional income). I live paycheck to paycheck and am forever juggling payments. I have times where I have to choose which bill to pay based on the interest/late fee. If one bill has no late fee, or a lower late fee than another, it gets put to the side for the next month.

October 13th, 2018 at 2:54 pm -

kbMinn said:

112k salary in Midwest (minneapolis):

Gross Pay . $8,612.60

Federal Income Tax 12with (4kids) $150.62

State Income Tax $319.94

Social Security Tax $483.30

Medicare Tax $113.04

Health Ins Premium (fam $1500d) $478.60

Dental Ins Premium (family) $37.04

Vision Ins Premium (family) $28.72

HSA Account $302.42

401K contribution $861.26

—————————————————-

Net Pay after above deductions $5,837.66Mortgage 15yr @ 3.625 $1,620.00

Property Tax $283.39

Home Insurance $142.04

Student Loan-K $308.00

Student Loan-B $150.00

—————————————————-

Total Fixed Long Term $2,503.43Miscellaneous Expenses

Electric $115.00

Natural Gas $55.00

Water/Sewer $35.00

Cable/Internet $55.00

Trash $32.00Life Ins $131.40

Cell Phones $130.00

Car Insurance $94.00

Gasoline Budget $200.00

Entertainment Budge . $100.00

Food Budget/HouseHold $1,000.00

Clothing Budget $180.00

—————————————-

Total Misc Expenses $2,127.40

=======================

Total Expenses $4,630.83Net remainder per month $1,206.84

House value $300k, $225 mortg – 4 beds, 2.5 baths, 1900 SQ ft. Built 1989

Two vehicles (Honda Odyssey and Toyota Camry) – paid offProperty Taxes are $3200/yr, but qualify for refund of ~$890 due to household with 4 kids,

resulting in effective property tax of $175/mo.Natural gas higher in winter months $115 vs $25 in summer months, averages $55/mo thru year

Life Insurance is $1 million on one spouse, $500,000 on the other

Cell Phones with T-Mobile 4 linesSeptember 26th, 2019 at 3:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!