The Menace that is Deflation: 5 Specific Areas Where Deflation is Already Showing up.

- 9 Comment

Be very afraid of the “D” word now making the rounds in economic circles. Today the Federal Reserve hinted that we are now tipping into the prospect of deflation. This is very bad from their perspective. In fact, it is a horrifying prospect for the Federal Reserve since every action they have taken in this decade has had the desired outcome of inflation. Why would the Fed want inflation? Inflation would make our structured debts cheaper as time goes by since the price level of most items in the economy would rise and the debt would remain static. First, let us get our definitions clear.

Inflation in the mainstream media is normally associated with a general price rise of items and goods in the economy. Conversely, deflation would be a general price drop in items in the overall economy. Many people from the classical school of economics or Austrian school refer to inflation or deflation when the money supply and credit move up and down. For our purposes, we will refer to the mainstream reference since most people are familiar with this and generally speaking in most normal times they usually go hand and hand.

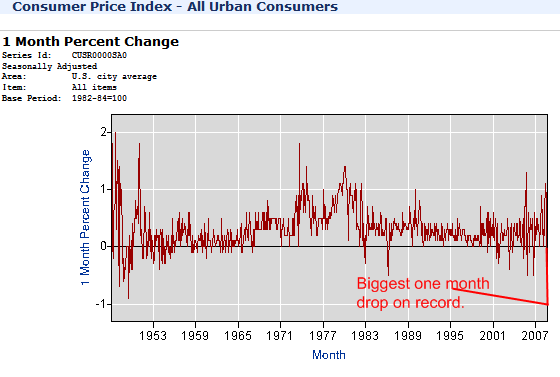

Deflation is a troubling prospect especially for a society with so much debt. Why? What happens during a deflation is debts brought onto the books during high priced times are now more expensive as the general cost of other items in the economy goes lower. This is exactly what is occurring. Take a look at the Consumer Price Index (CPI) which just showed the largest one month drop on record:

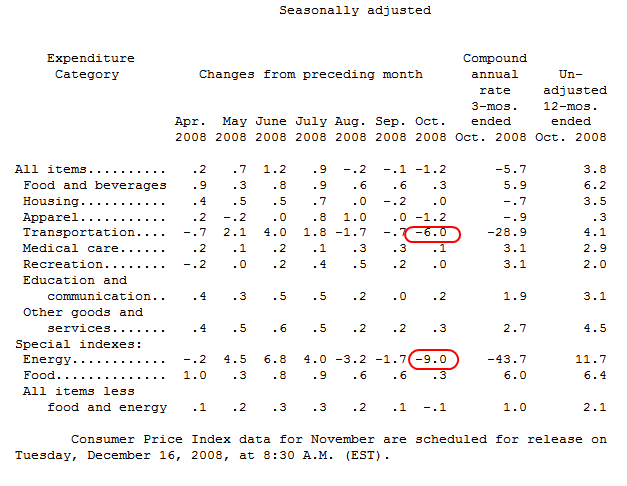

The CPI measures a basket of consumer goods bought in our economy. This one month drop was enormous as you can see from the chart above but was largely due to the drop in fuel costs. Energy dropped a stunning 9% while transportation dropped 6%:

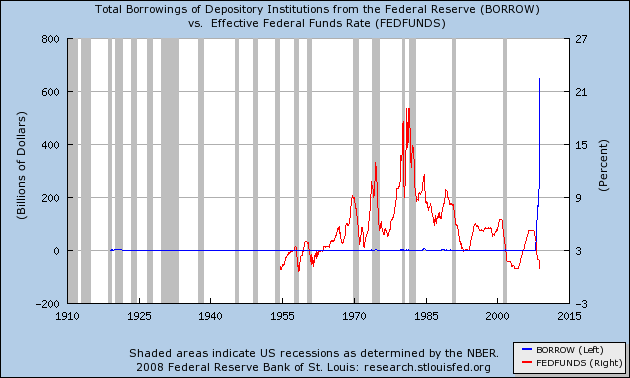

The fact that the Fed is only acknowledging this publicly now is a complete misnomer to the public. The true reality is that they were wishing deep down that inflation would make its way into the economy by the historical rate cuts and also, the injection of off balance sheet purchases. Take a look at the growth in the Fed’s balance sheet:

Keep in mind this is only based on depository institutions which are supposedly the safest of the safe. That puts us well over $600 billion in that quick jump you see above. If we throw in non-depository institutions the number jumps to over $2 trillion. Now take a look at the Fed funds rate. We are now back to 1%. All these actions at their heart are to get credit flowing into the system and get people to spend. The idea of course is to get people to spend but how are they going to spend money they do not have or have allocated to servicing current debts? The only bullet left in the chamber is for the U.S. government to start literally printing money. With the amount of debt we have, this is not a good idea.

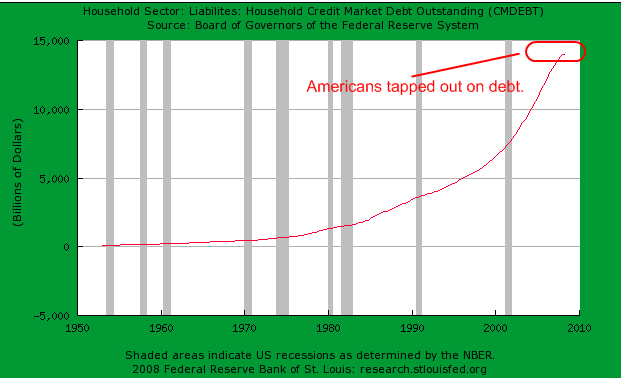

So why haven’t these actions helped recently? Well, people are essentially maxed out. Let us take a look at total debt outstanding:

Americans are at the end of the rope with debt. With over $14 trillion in household debt outstanding, we now have as much household debt as our annual GDP! And keep in mind GDP is contracting so it may be the case by the end of the year that there is more debt than actual GDP. Deflation will do this because of the destruction of money. Let us now look at 5 areas that have been seeing deflation for a long time.

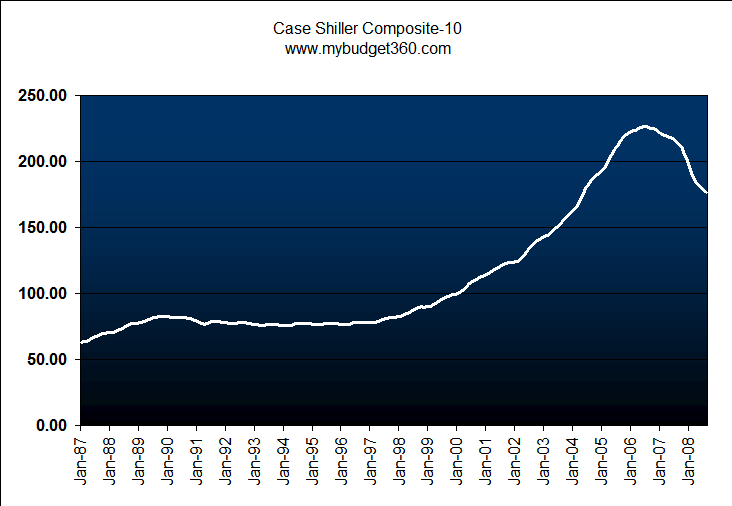

Area #1 – Housing

Nothing highlights the deflationary menace like declining home prices. In fact, it can be argued that every foreclosure that occurs is deflation in action. The lender no longer has the prospect of collecting the face value of the loan. Therefore, they have to writedown the loss. Which leads to even more cheaper homes on the market. It becomes a vicious feedback loop. As you can see from the Case-Shiller 10 composite, housing prices are clearly declining. There is heavy deflation occurring in this sector.

Home prices are now down 22% from their peak. That is a significant drop in prices. The issue that makes deflation more ominous is this. It creates hoarding behavior. After all, why would you buy a home today when chances are that in one year, it will be cheaper. It gives an incentive for people to save and not consume. That can be a problem when 71% of our economy depends on consumption.

Area #2 – Automobile Costs

This is probably the most significant story in the mainstream media at the moment. The prospect that the big 3 automakers are on the verge of bankruptcy. For the most part, much of their problems are self-initiated. They were riding high when gas was low and the demand for gigantic trucks and SUVs seemed to be insatiable. Well that bubble of course has also burst. Many times, you can find these cars now selling on Craigslist for insane prices. Take a look at this 2004 Escalade selling for $18,000:

This thing sold for nearly $40,000 brand new. That is deflation. There are many other cases like this on eBay as well. You can also look above at the CPI report and see that transportation costs for the last 3 months are running at a jaw dropping -28.9% compounded per year. That is simply incredible. This of course won’t continue forever but the big 3 automakers have saddled themselves with manufacturing equipment for vehicles that are dropping in price on a daily basis.

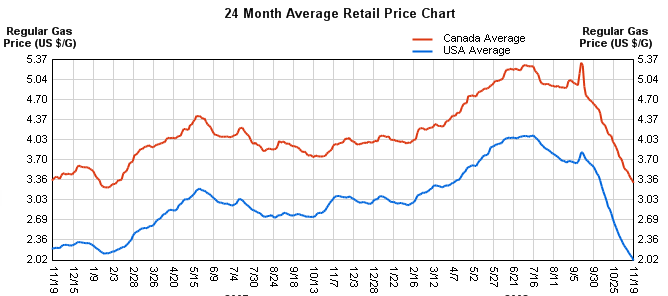

Area #3 – Fuel

Gas prices have fallen off a cliff. From a peak of $147 a barrel we are now hovering in the $50s only a few months later. This has sent a shock in many world markets like Russia that are heavily dependent on oil revenues. Some have tried to say this is a good thing and it is but not for the right reasons. It would be one thing if prices fell in good economic times. Prices have fallen because of demand destruction. Demand destruction from where? Americans are traveling less and buying more fuel efficient cars.

Gas is now half off in a few short months. This is another sign of deflationary forces. You can expect this to be passed on to prices at the grocery store. You will also see this in products at retail outlets. Retailers are already in a fury to cut prices to attract consumers. This will only feed that cycle again. Look at what occurred with Circuit City and Mervyns. Fuel dropping like this is simply another deflationary sign.

Area #4 – Wages

Wages have remained stagnant throughout this decade. The median income for an American household is $46,000. After taxes that is not much. Given the cost of homes in many metro areas that would eat up a major part of take home pay for any household. Add in the absurd prices of automobiles and you essentially have a small chunk left for food and utilities.

And one thing that is insanely deflationary for wages is unemployment. Unemployment is flying off the charts:

The rate now stands at a 14 year high and only shows more signs of increasing.  The intense market volatility, which is not a sign of health, is only assuring us of more layoffs for at least for 1 or 2 years possibly more. There is nothing more deflationary than unemployment. In addition, many state governments have already frozen yearly pay increases and have already implemented hiring freezes and are laying workers off. Citi announced layoffs of 52,000 people this week. This is more signs of deflationary forces.

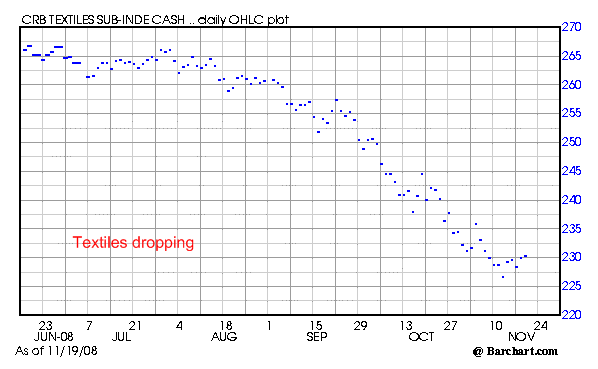

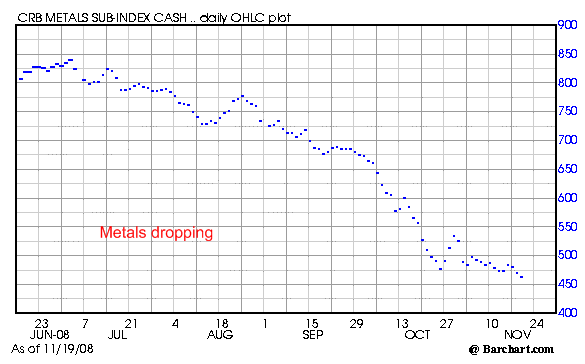

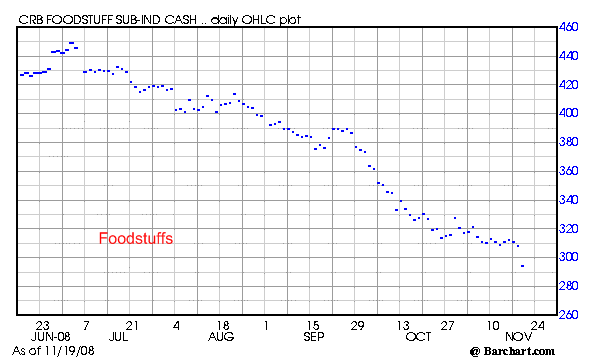

Area #5 – Commodities

Finally, commodities are dropping like a rock.  Once thought to be a saving grace these areas are now collapsing.  Take a look at oil. Gold has fallen from the peak above $1,000 to the current $740 an ounce price.  Let us take a look at a few markets:

Taking a look at these markets, you wonder why in the world was anyone even worrying about inflation.  It is true that many of these actions may in the far future lead to inflation but at the moment, there is one clear winner and that is deflation.  We are clearly in a deflationary spiral much like the one that occurred during the Great Depression.  That is why the stock markets now reached new lows and are all off nearly 50% in one year.  That is a crash. No doubt about that. Yet the stock markets are only following in lockstep with housing, autos, fuel, commodities, and wages.

We are really in uncharted waters.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

loren said:

I disagree that deflation is the menace. I think it is #1 the total debt load, and #2 the fact that the debt is tied to wasted resources. The debt is a menace and it’s already here. It’s like blaming the radiation or chemo treatments for your 2 pack a day lung cancer.

The question is how do we rid the system of the debt. The natural process is deflation, the punish the innocient process is inflation. The central bank gets to choose. My guess is that they’ll do whatever they see as benefiting their cronies the most.

We haven’t got a free market, we’ve got a kleptocracy, and it shows.

November 20th, 2008 at 8:03 am -

mybudget360 said:

Agreed Loren. However, I think we are experiencing deflation because of the debt destruction we are seeing. You simply cannot squeeze anything else out of this turnip. The consumer is broke.

The central banks would love nothing more than inflation. They would love a weak and broken dollar. But that isn’t happening. They are one step away from flying off a cliff. The markets already know this.

Ben Bernanke hinted that he would drop money out of helicopters before letting a deflation hit. Can you hear the propellers yet?

November 20th, 2008 at 5:29 pm -

john of sparta said:

deflation?

ok. i like it.

what’s the problem?

stocks? don’t own ’em.

gold? don’t have it.

gasoline is down 60%.

butter and bread is

Buy One get one Free.

stuff Costs LESS.

i can live with that.November 21st, 2008 at 6:17 pm -

Alex said:

The focus of trying to bailout all these sectors of the economy is wrong. Company’s exist because we as consumers purchase their product or service so the bailout should be the consumer and not the corporation. it’s more Reaganomics same old trickle down bullshit that got us into this mess to begin with.

We need to find a way of putting everybody back to work by taking the trillions of dollars we’ve been putting into these corporations and instead putting it into infrastructure programs like rebuilding the Gulf States that have been battered by Hurricanes or replenishing our roads, and electrical grid’s that have been left to the corporate community who have done nothing more than let it run down so as to maximize profits.

Corporations left to their own devices will do the least amount of work for the most profit including as above, limiting new investment outsourcing to offshore nations with lower labor costs and moving to part time rather than full time employees that cost less and don’t require benefits or pensions. In the short term we need to mandate a shorter work week of 35 hours with minimum overtime for all employer’s. This will force new employment and spread the hurt equally amongst everybody. Second we need to review all free trade agreements to ensure that they are also fair trade, having a free trade agreement with a country like Canada or England is good their labour rates and purchasing power are equal to ours so they can buy our product as easily as we can theirs but Mexico or China which has 1/10th of our labor cost well how fair is that. Third Mandate a national medical plan that doesn’t bankrupt people when their hit by an unexpected illness. And fourth start to rebuild this nations infrastructure, roads bridges railway power grid.

Nothing creates hope more than having a job a home and a future to look forward to, to many things we’ve taken for granted in our pursuit of greed and easy money. My dad always said theirs four of us they have to get past if we work together as a family otherwise if we don’t we all struggle alone.November 22nd, 2008 at 7:54 am -

hu? Jin DOW said:

see Bill Boner, TDR, deflation now, soon inflation later.

If funds, money, are disappearing where do they go?December 2nd, 2008 at 5:48 pm -

jomama said:

I’m out of debt. Bring deflation on.

OTH, if you’re not out of debt, you won’t like deflation as the man

says.December 23rd, 2008 at 3:08 am -

Andy Clarke said:

I didn’t moan and groan during inflationary times when my dollar was devalued, making things cost more for me. Of course that was good for banks.

Party’s over Mr. Bankster. Deflation is here and I’m lovin’ it!January 20th, 2009 at 7:28 pm -

Jubilee Year said:

Being without debt is really nice right now, but don’t get too smug, because it also means you be without a job real soon.

The only solution to debt deflation, other than the destruction of the economy, is debt cancellation. We need a modern Jubilee Year! Reset the financial system, before it takes us all down with it.

February 6th, 2009 at 10:07 pm -

please no Alex said:

Alex said:

In the short term we need to mandate a shorter work week of 35 hours with minimum overtime for all employer’s. This will force new employment and spread the hurt equally amongst everybody.This kind of thinking makes companies look more to overseas resources that are not as controlled. Please see how well this has worked for France. Part of what keeps me employed is that I can work a longer set of hours and produce more that way. Restrict how much I can produce and all that will be left are service jobs that can not be moved. Try to think what the business will do when you make these rules.

February 13th, 2009 at 6:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!