The Perfect $46,000 Budget: Learning to Live in California for Under $50,000.

- 65 Comment

What if I told you that you can live well in California with an income of less than $50,000 a year? A budget of this kind is not some sort of financial bait and switch but a realistic budget that many frugal people use on a daily basis. California has one of the highest costs of living and if you can figure out how to live here making $46,000 a year, you can live anywhere in this country.

While many working professionals in California struggle with the ability of buying a home, there is a large class of people who are simply dealing with the day to day items of life. In fact, if we look at a county like Los Angeles, the most populous county in Southern California 52.1% of households actually rent. This is significant given the population of this county is approximately 10,000,000 people.

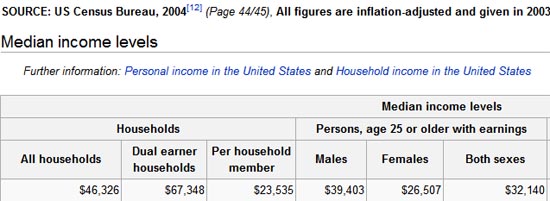

This is not as far fetched as you would suspect. The median household income for the entire United States is $46,326.

*Source: Wikipedia – Census Bureau data

The median household income for Los Angeles County in 2004 was $43,518 so our hypothetical budget of $46,000 could apply to 5,000,000 people living in this highly populated area. This probably goes against the wide perception that most people in California are wealthy and live in Beverly Hills, Brentwood, or Laguna Beach but this is a very tiny part of the population. This is not the reality. Many of these working families are simply getting by and have little way of accessing the media to discuss their struggles.

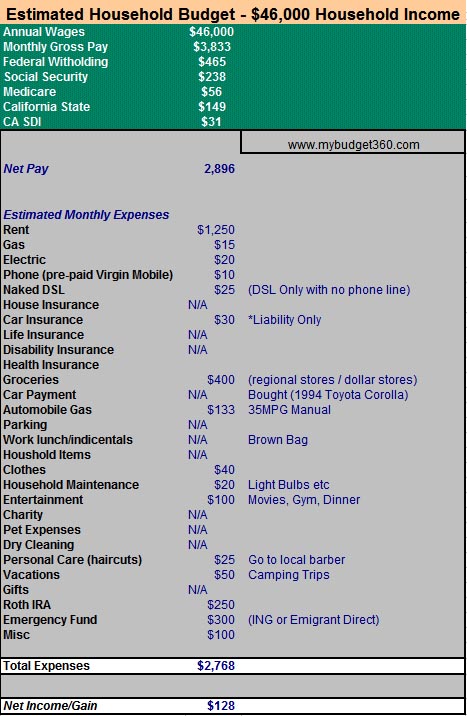

In this article, we are going to provide a full monthly budget for either a single person or working couple that pulls in $46,000 a year. Many families live on this amount. In fact, this works out to be about $11 per hour for 2 full-time workers or one worker pulling in $22 per hour. First, let us provide the full monthly budget and discuss the line items in greater detail:

Now I know there have been many budgets put out on various finance and housing sites yet they really do not point you in the right direction as to where to find information. After all, where do you find a fuel economical car for $3,000? Or where can you shop for groceries and pay $400 a month to take care of breakfast, lunch and dinner? We will go into the details of the budget above. Make no mistake, this is a minimalist budget here. You won’t be buying a McMansion here but you won’t be drowning in debt either. With this budget, you are even saving! So if you find yourself in a situation like this, you may want to consider some of the items on the list.

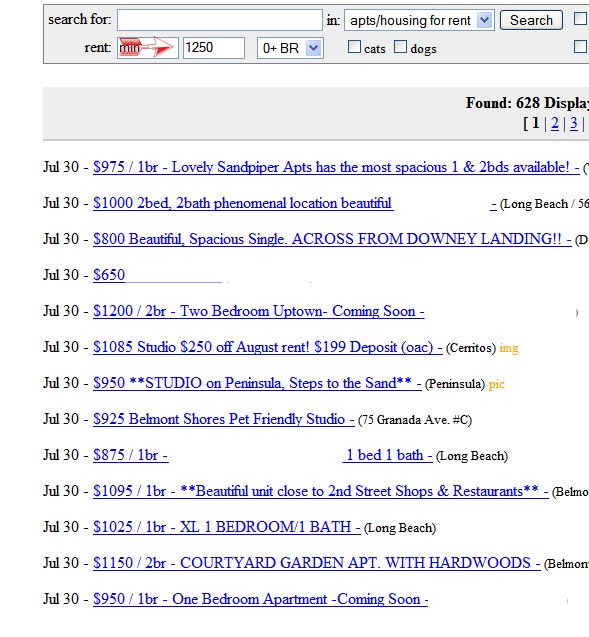

The most expensive line item of any California resident is housing. With $46,000 you shouldn’t even consider buying a home since it will sink you. In fact, many people did buy homes with this kind of budget and now find themselves part of the problems the state is facing. With this kind of budget you have small room for errors. We are giving this person a $1,250 a month allocation for rent. Believe it or not there are many nice 1 bedroom apartments for this price. Craigslist will be one of your tools for investigating rental properties. Take a look at what I found with a quick query:

As, you can see there are plenty of places in safe neighborhoods for this price range. Now you have to manage your expectations. You won’t be renting a beach front home in Newport Coast but you also won’t be living in unsafe neighborhoods. Your quality of life will depend on whether you want a studio, 1 bedroom, or 2 bedrooms home. Also, how close to your work would you like to be?

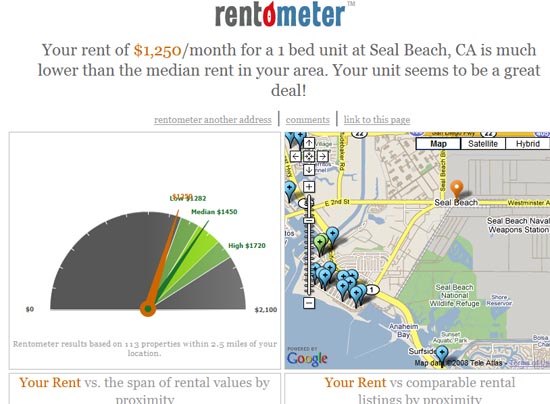

The next tool you’ll be using to find out whether you are paying too much or getting a good deal is Rent-o-meter. With this tool, you simply put the address of the potential rental and it will use Goolge maps to give you a rough estimate of other rentals in the area. For example, let us take a quick look at some rentals in Seal Beach:

After running this quick query, we can determine the market price of homes in this immediate region. Since our budget is sensitive to housing prices, it is important we first manage our expectations in regards to price. But with 88 Cities in Los Angeles County we do have some room for flexibility. It will take some time to research but you will find something safe and comfortable for $1,250 a month.

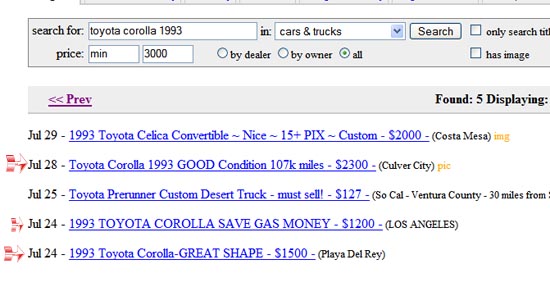

The next major line item we’ll look at is automobile costs. It is hard to get around California with no car. With the cost of fuel soaring, we won’t be purchasing a Hummer. But you can get a reliable fuel efficient car for $3,000 that will cost no more than $133 a month in fuel even with current gas prices. Where can you find such a deal? Once again we’ll look at Craigslist:

First, you need to realistic about what you can buy. For our example, we are looking at purchasing a 1993 Toyota Corolla. You can probably get a 1994 or go with a Honda Civic of the same year and still fall under your $3,000 budget. These cars if you go with the manual version will get you 35 miles per gallon. You are almost getting the efficiency of a hybrid! Plus, if the car is well maintained these things will last you forever. Let us assume you drive to work 15 miles each way. So you put in 30 miles per day 5 times a week. We’ll give you the same for weekend driving:

7 x 30 miles per day = 210 miles per week x 52 weeks = 10,920 miles per year

Monthly miles 10,920 / 12 = 910 miles per month

910 miles per month / 35 miles per gallon = 26 gallons of gas needed

Cost per gallon $4.25 x 26 = $110.50

We’ll give you another $23 bucks in your budget in case you took a longer trip or added a few additional miles. Or, if prices go up, you have a bit of a cushion up until gas hits $5.11 a gallon which is still a distance away. Liability insurance on these cars is minimal and if you have a good driving record, you can get by with $30 a month.

So now we covered two big line items, your transportation and your housing.

Eating is another major item. With $400 you can feed yourself well for a month. Here in California we are fortunate enough to have regional markets that compete with your common supermarkets. What you’ll find in these regional markets is that produce is nearly 40 to 60% cheaper than your common chain markets. Also, you will find better deals on meats. So this is where you will do your shopping. For items like toothbrushes which can go for $6 at a pharmacy store or supermarket, you can go to the 99 Cent store and get a couple. You will also find that these dollar stores carry many items that you’ll need around your house like tools, cleaning supplies, and snacks. These snacks (like yogurts and nutrition bars) can be part of your brown bag lunch.

For breakfast which you shouldn’t skip, you can have a nutritious cereal with fruit or buy some whole grain waffles for the go. You can make sandwiches for lunch with some chips and fruit and you’re good to go. For dinner, with the produce and meat you can make yourself a solid dinner. Listen, you aren’t going to eat Lobster each night but you aren’t eating Top Ramen either. This is doable if you know how to manage your budget.

Most phone companies are trying to sucker people in trying to have them keep their land lines. They’ll do package deals with DSL or cable which make no sense. You can request to have “naked DSL” which is strictly DSL alone. Many companies provide this and you’ll find reasonable rates where $25 per month will keep you connected to the internet. For phone service you are going to have a pre-paid service with Virgin Mobile or T-Mobile which can be as cheap as $10 per month. Places like Virgin Mobile require you to “top-off” your account each few months but is much cheaper than say going with an iPhone and running yourself down $100 for the service. With one month of iPhone service you can pay for nearly a year of pre-paid service with Virgin Mobile. Again, it is learning to control your spending here.

Many apartments will pay for your trash and water service. Electric will be minimal in most cases since our weather in California is perfect nearly year round. If you must, by a fan or go outside. That is after all why you live in California!

We’ve even provided a line item for clothes. Places like Ross and even Old Navy, provide quality clothes at discount prices. You are not going to be shopping at Macys or Nordstrom’s so get used to it! But it doesn’t mean you have to look poor either.

With $100 for entertainment you have some leeway for what you want to do here. You can go to a few movies a month, eat out a couple of times, or even take a nice camping trip. There are many places in Southern California that are actually free and great. You can go to the Getty (free) or go to the great beaches (free as well).

With this budget, we also haven’t forgotten saving for retirement and also building an emergency fund. We are putting away $250 a month into a Roth IRA since many people that are making $11 an hour don’t have options of saving with their company or employer. If you do, this would be preferable since it is taken out before taxes and will increase your take home pay a bit. It is important to remember that you will need to set something aside for your protection down the road.

With your emergency fund, you will save $300 per month in an ING or Emigrant Direct account. There are other online saving accounts but these places have strong balance sheets and aren’t at risk of going belly up like some institutions here in California. After 1 year, you will have approximately 1.5 months of living expenses saved and after 2 years, you will have 3 months saved. Given that you are also saving in your IRA you should have a minor safety cushion after 2 years. Again, we are emphasizing minimalism here.

This budget is put together from personal experience. I know how hard it is to live in California on a tight budget. Any starving college student will tell you this! In fact, many families are living this on a daily basis. The purpose of this article is to offer at least some hope that you can make it on a lower income. There are ways and resources free of charge that are available to you in helping you reach some form of financial stability. This article isn’t intended to cover every unforeseen circumstances since life itself is unpredictable but it should give you a blue print of living life on a tight budget and not feeling like you have to go into more and more debt. Of course to move higher, most likely you will need to further yourself via an education and fortunately through the community college system and our state schools, education is still relatively affordable and there is financial aid. Knowledge is power and given the hard economic times, regardless of your income you should feel in control of your life.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

65 Comments on this post

Trackbacks

-

Craig said:

Where in your budget is health insurance? I see it, but it’s not marked N/A and doesn’t have a price listed.

Also, your car insurance rate seems quite cheap for California. Granted I wasn’t living in Southern California, but for the Bay Area my car (from the 90s) was much much higher when I left last year.

Btw, I cut my own hair, only used my cars on weekends (work paid for my transit pass), used dial-up instead of DSL, etc. However, if you cut back on things like food, etc. (I’m talking about groceries, eating out is a waste of money) you are only asking for health problems down the line.

However, all that being said, … since I made the opportunity to do an internal transfer and leave the state of California I find no sensible reason to try to put myself on such a budget that seriously affects me and virtually every human I know in a negative manner, especially after busting my butt to become an engineer, BS from a top 10 school, MS finishing (at employer’s expense, etc.).

July 30th, 2008 at 10:22 pm -

jimmy said:

This budget doesn’t take into account the cost of health insurance. I would assume you plan on going to the emergency room as an uninsured for all your medial needs. This is the reason why many hospitals are closing their emergency rooms, especially in the Los Angeles area.

This budget calculation is only doable if you are married and don’t plan to have any kids and your wife share the same car with you. That’s not a typical family here in Calif. It’s idealistic but not realistic.

I am seriously thinking of moving out of California. Any suggestion? I am sure the $46,000 would get you a much more comfortable life outside of CA. You ONLY LIVE ONCE – there is no coming back after you died – so enjoy life to it’s fullest. Move!!!

July 30th, 2008 at 11:11 pm -

Steve said:

Beaches are not free, $10 parking a day is the norm, and that’s if you can find a space on a nice day, good luck. Having to return to the parking meter every 2 hours is not a good option but its cheaper.

Little or no insurance is a very bad idea in Lawyer Town CA.

I also agree with Craigs last paragraph. I was making a decent but average wage in HB at a young age (born and raised 21 years) and still had to budget wisely to stay there. I felt like a chump knowing that budgeting would not even be an issue if I lived elsewhere. And contrary to popular belief, there are nicer places to live in the U.S. than SoCal. So I moved to Maui for 10 years and lived like a king, then to Washington State where I found it also a truly nicer place to live than CA, UNTIL, the California exodus arrived. Rents Jacked up, traffic, and the California attitudes came with it an wrecked it. So here I am on now on Alaskas beautiful Kenai Peninsula working as a Programmer Analyst (yes there are tech jobs). The funny part is that I make around 60k, yet bought a very nice 30 year old 2400 sq ft home on a large lot ( for $200k), and my wife stays at home with the kids, and I come home for lunch from 1 mile away. I drive 4 miles a day on average and fill the tank once a month. We have no State taxes and also collect a State Dividend for every man woman and child. This years will be over $2,000 each (our family will get over 8k).

South Central Alaska is not cold (relative to the midwest, northeast and Seattle areas) if you live on the coast (we do). Nearly everyone has a view of the ocean, and when comparing beauty, California doesn’t even rank. There are lots of outdoor activities here and the people are truly better than any place I have ever lived. Most Californians don’t really know what class is, driving a BMW is not proof.

So, weigh the option:

Work hard at an above average CA pay so you can drive around in an old Toyota coffin, live paycheck to paycheck and live in a studio apt.

-OR-

trade in great weather (I admit CA has it if its not smoggy that day), the “oh I am so cool” factor with your paid for ZIP code;

And instead work in a gorgeous relaxing environment own actual land, live within your means while saving money?It was a no brainer for me, I feel like I am retired at 38 years old. My young kids are going to grow up in an amazing place.

This is just one story, and much only my opinion, but I now have friends from all over the country and have traveled. CA is NOT the best place to live, there are too many problems there to make life comfortable, even for the wealthy. INSANE traffic, crowds, high gas prices, high taxes, and crime areas that one always has to pass through to get anywhere there. Summer heat and cold ocean water almost year round (OK Maui spoiled me) not to mention the amount of superficial people and scammers you have to deal with in business, its counter productive. It just overall isn’t work the cost or headaches. The cost of living there is inflated and has been for a long time.

Alaska may not for you, but there are many other options.

Oregon, Washington State (away from Seattle), Cour D’ Elaine/Northern Idaho, Wyoming, Montana, Utah, all offer a much better quality of life without overextending yourself to the point of budgeting or living on credit.

Californian’s, enjoy your little slice of heaven (and please stay there, lol) ;-P

July 30th, 2008 at 11:40 pm -

IGotthis said:

My girlfriend and I lived in Costa Mesa, we kept a spreadsheet of all expenses, because we divided it up 60/40. The total for 1 year was 39K.

Now we moved up to Fremont, and the total is 40K / year. This includes 2 cars, 1 vacation, and all sorts of household items that we purchased starting out as a new couple.You people talk like 40k / year is torture, yeah, if you drive stupid expensive cars, go out to eat all the time, boob jobs, party, whatever else.

50k a year and a family of 4 qualifies for government help (example FERA, discounted electricty in california).

And Craig and Steve, if you are so good with your top 10 school engineering degree, you would be making more than 50/60k. Engineers these days make 100k+, whom I don’t think are going paycheck to paycheck unless they spend like idiots.

July 31st, 2008 at 1:29 am -

nedm said:

No offense but you HAVE to have health insurance. In my state (mass) it’s mandatory to have it. If you get sick then what? Even if you think you can take care of yourself you should at least put down a gym membership

July 31st, 2008 at 5:26 am -

SP said:

Hmmm…. Interesting. It isn’t that far from my true budget, except I make 70k, save 8% in 40k, and end up with about $3200/mo after retirement savings, taxes, health, and deductions. Oh, and my rent is currently $1425 (!), so taking that into consideration, my budget is not all that different than the one you post. Yet my salary is much higher.

It is important to decide if it is one or two people. $400 on groceries is lean, but fine, for two. I spend $145, plus another $60 going out. For one, $400 is extravagant.

Many engineers do make $100k, but not immediately, no matter what school you go to. It takes time. Some beaches you can find street parking if you are willing to walk.

The great thing is, my rent is temporary due to recently moving. Once I move again, I’ll be paying about $500 or $600 for my share (with bf, not crazy craigslist randoms) in a decent area, yet I’ll still have the salary bump. And 70 and sunny every day. And if you live close to work (I do, and will) traffic won’t get to you.

July 31st, 2008 at 7:48 am -

The Analyst said:

SP, You’re right on many counts. Engineers don’t make $100k starting out and anyone who thinks this needs a reality check.

At $70k single income supporting two people is tough and rather tight if you are trying to save for retirement.

This budget rundown needs some tweaking to be more realistic. If one consideres living in the high desert the figures for fuel($300+), electric (air-conditioning, $150+) and natural gas (heating/cooking $20+) will be much higher. Rent will be the same or marginally less ($800-$1600).

The author must be very resilient, impervious to disease and injury, have excellent teeth and eyesight and a vehicle that never needs maintenance.

The emergency fund and misc should go into savings for 20% down on the purchase of a home only after the market comes around.

July 31st, 2008 at 8:50 am -

Matt said:

I like your line on charity, N/A. I just wish someone here could tell me how I convince my wife to stop tithing on a $55k income.

July 31st, 2008 at 9:32 am -

steve said:

Gothis, I am not an engineer, if you read, I am a Programmer Analyst (level 2). The going rate in Socal for that is 60k, I make the same in Alaska, and I am only in my third year of that. 60k strectches A LOT farther in small town Alaska than SoCal, how could you even argue that?, And if you will also continue to read my post, I stated of the places to live, Washington (away from Seattle, as in dont go there) I would agree that that is another expensive place, so yes if you are talking Freemont Washington, it too is another expensive place to live (and crowded, I lived in Ballard briefly).

July 31st, 2008 at 9:35 am -

Early Retirement Extreme said:

Very similar to ours except we are two people with one (paid off ~31mpg) car. Also, how do you manage to spend $400/person on food? We spend $150 for two people (massive bags of staples + fruit and vegetables – whatever is on sale this week determines the recipe, very little preprocessed (mostly tomato sauce), meat maybe 6-8 times a month). Little on entertainment (since discovering the library and using swaptree et al.). Also, you could possibly cut your own hair? I do. For “vacations” we usually take a fishing trip to a state park. Costs about $4 for a day. And do get health insurance .. depending on your tax bracket a HSA might be a very good idea.

July 31st, 2008 at 10:38 am -

Early Retirement Extreme said:

Oh, and we live in CA too (the east bay area).

July 31st, 2008 at 10:41 am -

chu said:

This is not living well. A nice meal for two in LA can easily push $100. You have not accounted for a mobile phone or comprehensive car insurance. Just gas to leave LA will cost more than 50$.

July 31st, 2008 at 2:55 pm -

mybudget360 said:

I appreciate the thoughtful comments. Keep in mind this is simply a hypothetical budget for a person or two people here in California. Are you rolling around in a Mercedes or living in Beverly Hills? Of course not. But you are not living in a slum eating rocks.

In regards to health insurance, you can see why so many people go without coverage. Keep in mind that this is the median income. There are people living on $25,000 a year. Coverage for a healthy couple can go for $250 to $300 so there is money in the budget for this. They would have to chop back a bit on the emergency fund or the Roth IRA.

Either way, the overall arching point is you can live on $46,000 a year in California with no debt. I keep hearing people that make $75,000 a year say it is impossible to live in California with no debt. Well, here is the proof. All the other nuisances are simply personal quality of life items (i.e., new car, McMansion, or iPhones).

In addition, some of the commentators mentioned leaving the state. You also mention you have advanced college degrees. Many making $46,000 do not have this luxury. The top fields for mobility are engineering, accounting, and health care. So a person wanting this mobility will have to go to school (included in this budget though financial aid). Keep in mind only 1 in 4 Americans have a bachelor’s degree.

July 31st, 2008 at 7:43 pm -

A. Alex Bryant, Brooklyn, NY said:

One big gap I see is in retirement savings. There’s no indication of the age of the person who is living by this budget, but at any age other than,say, early 20s, $250/month into a Roth IRA is not going to cut it. You need to double, triple or quadruple that amount (esp. given the rates of return in the past few years).

I live in an equally (or perhaps more) expensive place, and have adopted many of the elements of Steve’s budget (for example a ’92 Honda), but, in fairness, am 45 y.o. and have a higher income. I try to fund a max. 401(k) and a max. Roth IRA contribution each year, which is 5 or 6 times what appears here. Many retirement planners will tell you that that’s not enough either, and that it needs to be be supplemented with taxable savings.

Bottom line: despite your good efforts, $46,000/yr. where you live is not sustainable if retirement is taken into account.

July 31st, 2008 at 10:00 pm -

PeonInChief said:

The glaring omissions: you can’t go to the emergency room without insurance. They will bill you, and then they will send collection agencies after you. At $46K, you have an income and the hospital is not going to treat you as a charity case. Further, you probably will not be able to afford or get private individual insurance. This only works if one or both partners has employer-paid insurance. Second, going without renters’ insurance is dumb, although it’s frightfully expensive compared to homeowners’ insurance. But most likely is that your valuable stuff will be stolen (much more likely than fire, earthquake etc.) and this budget will not allow you to replace it. Third, if you bought the car new, a 1994 Corolla is fine. (We have a 98 Civic.) But it you’re buying one used, it’s probably not been cared for very well and you’ll have to put a substantial amount of money into rehabilitating it. Most economical is to buy a new car, take care of it, and drive it until it dies. So this household would have a car payment. (But please do not encourage people to buy manual transmissions. I firmly believe that the reason our car hasn’t been stolen is that no young people know how to drive a stick.)

August 1st, 2008 at 10:51 am -

AKSteve said:

Mybudget360, good post, but the people living in SoCal on less than 25k are called aliens (legal or not). In 2006 and 2007, CA had a mass exodus of folks that got tired of the overpriceyness of good weather and left the state. The massive influx of immigrants from Mexico outweighed the folks that left, so CA actually had population growth. BUT only because of the Mexican immigrants.

Now with the “State of Emergency” of the California budget deficit crisis, it will be interesting to see how this all pans out. I am glad I am on the sidelines and moved away when the gettin’ was good.

August 2nd, 2008 at 12:21 am -

Jo said:

Actually you can live on that budget. I have for quite some time. I live in Bay area, which is even more expensive. Between my wife and I, we make close to 200k (we both work in hitech)… We decided to live frugally because we do plan to buy a McMansion, put 50% down and pay off the loan in about 6-7 years… We live in a modest apartment… We managed to use 1 Honda Civic for years (our jobs were close to each other). Just recently we purchased a Toyota Camry even though we can easily afford a merc or a BMW. The only thing we really splurge on is travel… We do have lavish vacations every year (costs us 10k/year on an average)… But if you leave that extra 10k aside we do manage on that budget maybe couple grand over… As far as retirement goes, I dont contribute anything to 401k… My wife only contributes to the extent her company matches. 401k are a big scam because of the limited options for investment… I like Roth IRA better and we contribute max to Roth… I dont believe in “investing for the long term”… thats BS fed to us by main street wall street… I am more of a trader… I do technical analysis and macroeconomic environment to make my stock picks… Its amazing how much money you can make just by avoiding bad days in the stocks.. I like California and wouldnt want to freeze my ass off to Alaska for sure… In the end, I guess its an individual preference…

August 3rd, 2008 at 2:05 am -

JOe COOL said:

Where is the cost of Health Insurance here? I make cost to $70k a year and my take home pay is only $2,800 a month because of Health Insurance and 25% in my 401k. And I think $1,250 is too high for rent for someone making $46k. I’m paying $1,300 for an apartment in Los Angeles and I think I’m paying too much! I’m looking to move to a cheaper apartment for around $1,100, maybe a studio as I realize I’m wasting my money since I don’t need a 1 bed room. A single person can easily live in Los Angeles making $25k a year. It’s called roommate. Many people do it in LA and in San Francisco.

August 3rd, 2008 at 7:36 am -

Nikki said:

To all the people who replied,

The person who had worked out the budget was pretty good. There are many of them who doesnt even have a budget. There may be somethings missed but at the end look at what he is trying to say. Do not be sarcastic or think you know better. Appreciate it because you havent posted it.

Thanks,

August 5th, 2008 at 1:56 pm -

Jerry said:

To Budget360:

First of all, I would like to state how I got to this site. I am a x-college student, who just “dropped” out of college. To this end, I am deeply depressed and shameful of myself. However, life is life, and I need to get on with it, and make everything come back. There’s no use sulking in depression. Also, I am about to lose my job, because the company is about to go out of business, as a result of management failures to allocate the appropriate amount of money to the right technology.

For those of you who are thinking how I made it through college, I have to say I am a spoiled brat living on my parents, at the age of 23. At this very moment, I am in regret and am trying to find my way back up, step-by-step of course. I would like to stop relying on my parents ASAP and crawl up the ladder with my very own hands, since it seems that I won’t learn how to become independent otherwise, for me at least (I just haven’t been grateful enough to realize the harshness realities of life).

Therefore, as a young, unknowing college drop-out, my first concern is how much I need to be making, etc. That is how I found this site, while searching on Google. While, to many of you, this budget sheet may be lacking, I would like to give Budget360 (I can’t seem to figure out the real author’s name) a lot of thanks. I needed some guidance to figure out how to budget my life and to realize just how much money I really needed; this site provided me a exactly what I was looking for, after hunting through 10’s of other links.

It is through information/sites like these that I can make decisions on how to live on my own, and figure out how much money I need to be allocating for expenses, in what ways, etc.

Much appreciated!

– Jerry

September 9th, 2008 at 12:03 pm -

Princomr said:

First I Must say this is a really good post. I stumbled upon this site because I am contemplating going to this country to work on a 50K salary. I had no idea the cost of rent, insurance, transportation or anything else for that matter. Even though the actual values might not be dead on balls correct but at least it still gives me some idea.

For all the critics, try to look at the bigger picture.

This has helped me.

Good JobOctober 1st, 2008 at 12:25 pm -

Angela said:

Much of this budget seems to assume a lack of kids. Previous to having twins (no we did not do fertility treatments), I could almost see scraping by with this budget. Cell phones hadn’t really taken off, gas was cheap, I went to a community college + cheap state college, and simply used the student health center for the little health issues I ran into. I skipped car insurance also.

And on these points I have to say this budget is laughable. Even with brownbagging it and never going anywhere or doing anything, this just doesn’t cut it. Car insurance is much more than you budgeted (what, did you look up the prices for a 65 year-old woman?), even with a good record (mine is spotless). And one vehicle? Most families have more than one; you have to. One car has problems and then how the hell do you get your kids to the doctor with it in the shop? And we hardly have fancy cars…a simple Honda van and a Mercury I inherited for free from my family.

It also assumes perfect health. I have a manageable, but chronic disease that requires pills that cost up to $3 a DAY. While I got away with no insurance in college, I certainly could not now. I have joked with my husband that the real reason I married him is for his state health insurance. I’m kidding but it’s not really a joke; I’d be screwed without it. Yeah I know…too bad for me, but there are a lot of people in my position. (I’m not old or abusive of my body. I’m 33 and it’s called bad genetics).

Shopping at dollar stores is okay, but there are problems even there. Aside from the fact that half the stuff is cheap, chokable, lead-painted crap (a bit of a concern if you have kids?), the food is an even bigger problem if you are vegetarian or have diet restrictions. I have both issues: the vegetarian part is by choice, the diet restriction thing is not. If I eat anything with preservatives in it I will be in a world of pain for days. And guess what cheap dollar store “food†is chock full of? Frankly everyone is better off spending their pennies at farmer’s markets instead. Way better food and you support a local economy instead of China.

Another assumption? No student loans. I went to a cheapass Cal State and graduated with very little debt. Which is good, because while some employers seem to care that you have a degree, they don’t care enough to pay you what you need to pay for that degree. Sad, but this is reality. And the Cal States aren’t so damn cheap now.

And the car thing…my God. With the mileage you picked out, even a Toyota is going to start needing some serious maintenance…soon, if not immediately. More mileage = more trouble. That’s just the way it is. I have a lot of friends who ignored that simple fact and went through cars like Kleenex in SoCal. Also? Socal is VERY hard on cars. This is another factor that is ignored…the accident rate and just plain wear and tear on cars in that environment is insane. You will wear out your brakes in no time along with everything else. This is why I took the train to college as much as I could. And this wasn’t easy—as everyone knows, the public transportation system in SoCal is kind of a cruel joke.

Lastly: you assume no cell phones, no internet. If you work in the tech industry as I do, these are not things you can skip. Hell, these days you need a cell phone just to call and say you’re stuck in traffic…AGAIN.

I love California…but I think people should investigate *other* parts of this huge state besides SoCal. It’s a miserable, losing battle and I’m not at all sorry I left.

October 28th, 2008 at 8:38 pm -

V said:

What about water/sewer/garbage?

November 21st, 2008 at 8:14 pm -

Wishing said:

PG&E for $35 a month? What color is your sky?

December 16th, 2008 at 8:53 pm -

BakinMama said:

Personally, I commend the efforts of MyBudget360. A lot of time, thought & work went into this post. For the most part its pretty good. He makes a valid point – you can work in soCA making 46K/yr and not be homeless, living off of cat food or going into significant debt every day. Point noted.

However, it is important for all parties taking this post to heart to seriously consider several expenses real life most definitely entails.

1. Are you 22 and single? Or do you have a family? Children are NOT included in this budget. Its an obvious point, but make note. And a “room mate” doesn’t usually work out when you have a wife and 3 kids… hmmm.

2. Health insurance does not fall under “basic necessities” here (a.k.a. food, shelter, clothing…). HOWEVER – most all of us are likely to become ill or injured at some point in our lives. If you go to the doc for a sinus infection and you have no insurance the whole thing including prescriptions could run you a few hundred dollars, and a little sinus infection is the least of your worries. How about a car accident that leaves you seriously injured? If the goal of this post is to show how you can live *debt free* – just remember – a medical bill you can’t afford quickly turns into debt. Whether it is $200 or $200,000.

3. Car maintenance is a reality, especially if you drive a 10 yr old car. sometimes the repairs are $75 and some times they are $1500+. This is something to budget for – because if you don’t- you will have to finance your car repairs, and that is debt.

4. Retirement is not an immediate need. However, you will probably grow old. If you are being realistic your budgeting will have include more retirement savings then stated here. So, this budget will work for a few years, but not forever.

There are other budget problems here, but we can leave it alone. Over all, this post is helpful in pin pointing the base-line cost of many living expenses. You won’t be homeless or on welfare (although, maybe people on state services actually live better…). You will have food and a roof over your head. You can hypothetically live free of consumer debt, however, there are a host of other costs (medical, legal, etc) that can quickly turn into a mound of debt.

I’m not trying to bash the post – its pretty good! Just keep in mind that not all parts of financial life are accounted for here.

February 19th, 2009 at 9:51 am -

EX-Californian said:

So I had a good chuckle at this budget.. not because it is not doable but simply that there are some items that @ 45k a year your not going to care about and some that were so far off base it took me a few minutes to wipe the tears from my eyes…

Mainly it’s the costs for Internet (needed these days) , phone, Heating, power, and the oft mentioned lack of insurance. My last year in CA (2005) My Internet was $59 (not the fastest but not the intro rate), my phone was a land line but $10 for a cell phone? if thats your only line good luck with that!, my gas bills during the winter were $100+ , and my power even in nice temp months was over $100 let alone the summer months where no AC = hospital visit, which ends with health insurance… Without heat and or cooling and no phone to call a doctor your looking at an ER visit 2-4 times a year @ 300-5000+ per visit for payments that could reach $1500 a month… (worst case scenario besides death).

March 2nd, 2009 at 3:38 am -

Jordan said:

Re: Matt and convincing wife not to tithe on 55k income.

I, my wife, and our newborn daughter live on 32K a year, we pay a full tithe and are very glad that we do. If you can’t pay tithe on 55k, it will only be twice as hard at 100K, and you are much less likely to get there.

Health insurance is a must for the budget.

May 6th, 2009 at 5:02 pm -

andrea naylor said:

I live in California, and you are crazy. Electricity alone, in almost ANYWHERE in So. Cal is going to run you way more than your estimate. 🙂 So will car insurance, depending on where you live,

and a few other things.June 5th, 2009 at 2:56 pm -

Bud said:

I’m guessing when you say “Groceries” you mean just what you put in your mouth. I have kept a ledger and used money management software for the past 20 years but never took grocery store recepts and split groceries from laundry and kitchen supplies. I could live on $150 for food but I’m married and my wife does the shopping. She doesn’t like big bags of beans or rice. Like Angela she has medical problems preventing her from working. Her pills are costly like Abilify and WellbutrinSR. My take home was less than $24000 but we have no debt and own our home and car. I’m currently unemployed so living on as little as possible is a must.

June 17th, 2009 at 6:53 pm -

Biff said:

Sorry guys, but living at that budget in LA means living in poverty. Anybody who says otherwise is either full of shit or lives in the slums.

July 4th, 2009 at 11:35 am -

tgsf said:

I see several legitimate criticisms of the otherwise very good post, but I also see everyone – not just here, but all over the country – missing the core point: the idealized leisure-society of comfort living is just that: a lofty ideal. A myth. We’ve successfully brainwashed ourselves into buying this sack of B.S. for the past 60+ years or so because we want it, and we want it bad, but it’s A PRIVILEGE. We can’t sit around all day and complain that cars and housing are too expensive, and how can I afford even cheap entertainment like a Netflix subscription unless “austerity” forces me to eat “cheaply” by cooking beans & rice at home, etc. etc…..

If you have a solid roof over your head, a paying job, some vestige of health insurance, and decent food on a daily basis – maybe, just maybe, you should count your damned blessings. Add a decent car and a nice tv and computer, and you’ve got it made. Seriously.I’m not saying we should all take a step back and live like the Amish, blessing each grain of rice we get to eat, but I am saying that complaining that life is too expensive, while largely true, also amounts to whining that you don’t get a pony too just like the kid down the road got.

The leisure society, surrounded by creature comforts and conveniences, is NOT a right, and life is NOT fair.

(And I’m not a Republican either.) 😉August 12th, 2009 at 11:31 am -

TheLadyatHome said:

I manage a budget for a family of four on a very similar income. We live in Texas, not California, and we own our home. Our mortgage payment is much cheaper than that rent, but for phone, gas, and electric, we pay SO much more. Around 400/mo total. I wish we had money for saving and entertainment, but we’re having to pay off credit card debt from when we had a lower salary and worse budgeting skills.

My point is this. Yes, it’s possible. It’s just not always easy and I think the poster had this same point.

And tgsf, I agree!

August 17th, 2009 at 11:24 am -

Jeff said:

I stumbled upon your website and this article. I give you and your readers/those that posted a comment credit. You are quite insightful.

Thanks

September 6th, 2009 at 9:17 pm -

Steve said:

Beaches are not free, $10 parking a day is the norm, and that’s if you can find a space on a nice day, good luck. Having to return to the parking meter every 2 hours is not a good option but its cheaper.

Little or no insurance is a very bad idea in Lawyer Town CA.

I also agree with Craigs last paragraph. I was making a decent but average wage in HB at a young age (born and raised 21 years) and still had to budget wisely to stay there. I felt like a chump knowing that budgeting would not even be an issue if I lived elsewhere. And contrary to popular belief, there are nicer places to live in the U.S. than SoCal. So I moved to Maui for 10 years and lived like a king, then to Washington State where I found it also a truly nicer place to live than CA, UNTIL, the California exodus arrived. Rents Jacked up, traffic, and the California attitudes came with it an wrecked it. So here I am on now on Alaskas beautiful Kenai Peninsula working as a Programmer Analyst (yes there are tech jobs). The funny part is that I make around 60k, yet bought a very nice 30 year old 2400 sq ft home on a large lot ( for $200k), and my wife stays at home with the kids, and I come home for lunch from 1 mile away. I drive 4 miles a day on average and fill the tank once a month. We have no State taxes and also collect a State Dividend for every man woman and child. This years will be over $2,000 each (our family will get over 8k).

South Central Alaska is not cold (relative to the midwest, northeast and Seattle areas) if you live on the coast (we do). Nearly everyone has a view of the ocean, and when comparing beauty, California doesn’t even rank. There are lots of outdoor activities here and the people are truly better than any place I have ever lived. Most Californians don’t really know what class is, driving a BMW is not proof.

So, weigh the option:

Work hard at an above average CA pay so you can drive around in an old Toyota coffin, live paycheck to paycheck and live in a studio apt.

-OR-

trade in great weather (I admit CA has it if its not smoggy that day), the “oh I am so cool†factor with your paid for ZIP code;

And instead work in a gorgeous relaxing environment own actual land, live within your means while saving money?It was a no brainer for me, I feel like I am retired at 38 years old. My young kids are going to grow up in an amazing place.

This is just one story, and much only my opinion, but I now have friends from all over the country and have traveled. CA is NOT the best place to live, there are too many problems there to make life comfortable, even for the wealthy. INSANE traffic, crowds, high gas prices, high taxes, and crime areas that one always has to pass through to get anywhere there. Summer heat and cold ocean water almost year round (OK Maui spoiled me) not to mention the amount of superficial people and scammers you have to deal with in business, its counter productive. It just overall isn’t work the cost or headaches. The cost of living there is inflated and has been for a long time.

Alaska may not for you, but there are many other options.

Oregon, Washington State (away from Seattle), Cour D’ Elaine/Northern Idaho, Wyoming, Montana, Utah, all offer a much better quality of life without overextending yourself to the point of budgeting or living on credit.

Californian’s, enjoy your little slice of heaven (and please stay there, lol) ;-P

September 24th, 2009 at 5:30 pm -

Deejunk said:

While I don’t live in Cali, I spend less than $800 a month for everything for my personal lifestyle……. course I grow my own food and meat and bought my house for under $3K… I think the whole living in Cali is highly over-rated… One could live where I am living by buying a gym membership at the Y for $30 a month. They have free camping, showers and facilities. Laundry and shopping w/in walking distance – quarters for laundry and free wi-fi. Could get a crappy magic jack phone to saddle with the free wireless for like $20 per YEAR!… One could get by EASILY under $800 if you had a $100 a week food/grocery budget. — I spend less than $500 total in expenses for the luxury of two other huge self sufficient homes… crazy living in Cali! – Come to Western Maryland!

October 12th, 2009 at 7:09 pm -

Nigel said:

So, I enjoyed this read including the comments quite a bit, and I’m digging up an old thread. This is how I see California. If it wasn’t for family I would move do to politicians and their policies.

Here we go;

I make 36k a year before taxes

Luckily the place I work for pays my health insurance which is great insurance, but still cost me around 8 grand to have my first child from prenatal through to delivery room.When I was single my energy was between $12-$30 a month. My gas was around $80 a month, I’m on a well, and I dump my trash in the work dumpster. cable $70, phone and internet around $75. And cell the office paid for also. Mortgauge with tax and insurance around $1600. I took home $2800 a month roughly and owned my truck. Truck insurance with full coverage around $120 a month. I barely made it and even did around 10k in little jobs throughout the year for fun money.

Got married, energy went up to $50-80 a month, food went from $100 a month to $300 a month. And bought a 2nd car with insurance of $140 a month. She was doing school and eventually stay at home mom.

Had my first kid. Couldn’t afford hose payments let house go. energy up to $110 per month. Wife had an accident and insurance went up $240 per month for hers, cell for her $75- 80 a month. soon moving to rental.

Going to be selling her car and my truck for 4 door truck to cut costs, thinking about satellite to cut tv cost. Hopefully budget food to $400 including all other store bought items to live on. I’m still going to need more under the table jobs to get by. And that is with no retirement funds.

I am the in between income. I make too much for help, and too little to pay for my family. I want 2 kids. which will help after I have them considering a family of 4 with a house income of 36000 a year can get on energy programs ecetra that a family of 2 or 3 can’t get on.

When both the kids get into school, my wife will be able to work during school hours. But this is in 7-8 years from now.

Social security has been abused and I don’t see it in existence when I am older. I don’t ever see myself retiring. My wife on the other hand will hopefully be able to be the stay at home mom that all mom’s should be able to choose to be. And hopefully our kids will help make the next generations lives easier.

I would like to cut costs of having a second vehicle by getting a pre 1975 car, this would mean no smoging, smaller registration per year, and smaller insurance rate.

We live in a great country where being low income or poor has more then one TV, usually more then one car, and a nice roof over our heads. It just sucks that the word vacation means having the time to be at home with the wife and kids. If I made 46k a year, I could cut the extra jobs and have more time at home. When I hear of these people making 5-8 grand a month I dream of how you could save doing what I’m doing 1400 – 4400 per month a year which is 16800 – 52800 for 4 or 5 years and own a nice home. once you own it straight out then you have that much extra cash to throw out to a retirement or some other investment.

May 18th, 2010 at 3:24 pm -

sharonsj said:

How about living in rural Pennsylvania on $12,000 a year? Most of it comes from early Social Security. I have no health insurance, no homeowner’s insurance–can’t afford it. If my house wasn’t paid for, I’d be out on the street. By the way, I pay almost $2000 in school and property taxes. The rest goes to food, energy (the biggest expense), car, phone, TV and internet (which I need because of physical limitations and because I have discovered the only way to save money is to not leave the house). Finally hitting 65 and getting Medicare freed up enough money to get homeowner’s insurance. To be honest I think my living standard will be the new normal for most of America.

June 14th, 2010 at 8:30 am -

Karl said:

The flowbee (laugh as you may) saves me the cost of a hair cut each month. It has paid itself off multiple times over the last 8 years of ownership.

July 29th, 2010 at 7:34 am -

Bay area said:

My mother lives on $35k a year in the SF Bay area, a very nice town in fact where the avg house still sells for over $1m.

How does she do it? Rents a $1500 2 bedroom apt, pays for medicare gap insurance, car insurance, cell phone, cable, internet, 1 trip a year back east and lives frugally.

It’s having a family that’s so expensive. I have 2 kids in preschool for $3000 a month, and a highly educated husband that can’t find work. Add $200 for maids because I work all the time, and my husband refuses to clean a thing. Are maids in your $100k+ budget? Add daycare, preschool, after school classes, clothes for growing kids, food, and my budget is shot. Then there are gifts for friends and family and kids’ friends and classmates… and can you believe our public elementary school is asking for $1700 per child annual donations to cover all the things the district/state can’t?

September 10th, 2010 at 4:17 pm -

Jane Doe said:

When was this budget created? 1982? $25/month for local barber? If your a female add at least another $50 to that for a hair cut you won’t be ashamed of. $40 a month for clothes? Are you kidding me? What is this person buying every month — a Fisherman’s Warf fleece? Movies, Gym, and Dinner $100 for the entire month? A discount gym membership at the YMCA is $65/month. That leaves $35 for movies and dinner. The average movie ticket is $11, plus popcorn and coke $15, plus the bart ride to get to the moves $3 that leaves you with $6. The Big Mac value dinner at McDonalds is $6.49. Congrats, you still have 29 days left of only going to work with your brown bag lunch and then coming home. Which, if you have a car in SF add either $25 a day for the parking garage at work or $5 for the bay bridge toll ($6 for GG) — which is left out of this budget. Of course if your not driving to work than you will have to buy a muni pass which is now running $75 dollars, but again you have no room for this in your budget. It looks like you’ll have to take it out of your housing line item which drops you down to $1,100 for rent. In SF that will get you a lovely studio in the outer Richmond or the Tendernob. A kitchen may or may not be available, which would then mess up your line item for food. $400 would allow you to eat like a king at the grocery store. But if your eating out every night due to no kitchen expect to spend $10 per meal (unless you order off of dollar menu). I’ve lived in SF off of $40,000 a year but the budget is more like this:

Rent $800 (studio all utilities included — dodgy neighborhood though)

Car: Ha! NOT..a free hand me down bicycle maybe, but get a good lock or it will be stolen.

Bart: $70

Grocery: (I’m a girl, $60 every 2 weeks) $120

Entertainment: (your living in SF if you don’t want entertainment move to a less expensive area): $275

Clothes/Hair/Hygiene, etc: $200

No Cable

Internet: Starbucks, the library, or if you sit in the middle of union square you can pick up a strong wifi signal.

This still leaves you with $1,265 which I usually use to pay off my student loans, buy a plain ticket home for christmas, donate to a cause, savings, or any other emergencies which always seem to crop up.Oh but be prepared, all landlords want $$ up front to rent anything. This usually consists of First and last months rent plus security deposit. So for an $800 student in the tendernob without a kitchen, your probably putting up $2400 on move in day. (That’s usually what happened to my extra $1200, it payed off my move in deposits, because I kept moving around due to answering bad craiglist postings and getting terrible roommates).

However it can be done. But I stress again, if you don’t want to enjoy the city than don’t move here. It’s silly to spend thousands of dollars to live in an area teaming with events if you can’t enjoy it becuase you only allow yourself to brown bag lunch. If that’s the life you want to lead move to the burbs 🙂 Good luck!

September 20th, 2010 at 12:33 am -

San Diego said:

Living in SoCal, expecially in San Diego is NOT an easy task.

I am a married engineer with 2 kids earning about 100k a year.I’m not arguing either way about the 46k budget. I feel I’m an average person with a family and would like to put some actual real numbers to the “budget” list above. Very few of the following items and be reduced or removed. (ie: cable is not necessary and nor is a data package on the cell phone) However, gas, utilities, rent, insurance, food are as low as they can go.)

A quick breakdown:

Gas (honda civic) = $120-150 month. Driving to work, dropping and picking kids up from school (no school buses!!!!)

Water = 80/mo.

Elec. and Gas = $220 (not in summer with AC)

Rent = 1800/mo (3 bedroom apartment on the outskirts)

Internet = 45/mo

Food = 400-600 month. (albertsons)

Heath Insurance = $650/mo.

Car Insurance = 120/mo.

Tv Cable = $50/mo (basic cable)

Cell phone bill = $150/mo (2 cells phones with data packages)

Student Loans = $200/mo

Car Loan = $200/mo

My monthly expenses not including any entertainment is around 4k/mo. Of course there are many things that aren’t required, but needless to say most people have similar monthly expenses. People will usually have cable and cell phones and car expenses…. I grew up thinking that I could go to college to get a good education, get my career going, get married, have kids, own a home, buy a boat, atv, etc……. enjoy life and have fun toys. The truth in socal is that you’re just going to get by on a 100,000k/year budget. I feel like I’m at the top of my ladder by living here and feel I shouldn’t feel like I’m only “just getting by” making 100k a year. Like other’s mentioned, moving to a new location will make the bang for your buck go a whole lot further. I’ve recently looked into Colorado and I would feel like a king there. I can’t wait to move!September 20th, 2010 at 2:28 pm -

Darkitec said:

I don’t see any information about pets. I currently have 4 dogs. 1 large at 65lbs or so and 3 at under 12lbs each. There are several jobs in the LA area that I qualify for, but I’ve had no luck finding an apartment that will accept pets without ridiculously high pet rental fees and outlandish deposits. And what about storage, I had to sell my 2 bedroom house with a garage and a one bedroom studio is not going to hold my furnishings and classic automobile. I’m going to have to put this stuff somewhere.

November 19th, 2010 at 11:03 am -

Jenny said:

I lived on less than 30K until I was 26, then on 50K until I was 28. In So Cal. You do what you have to. No health ins, cell phones, internet or cable. Rode the bus, cooked from scratch. It’s poss, just not fun. Now I make 100K and I LOVED your “how to go broke on 100K” budget article! That described all of my friends who are in massive cc debt and can’t understand why. Cut the cable, my friends. Ditch the iphone!

March 28th, 2011 at 3:17 pm -

Monique said:

I’m in dreary Toledo Ohio and I’ve been researching living costs in California lately. Honestly it sounds like a headache yet heaven. This may be dated and it depends on where you live and may be even where you come from but honestly what life like for a cop in Cali?

March 11th, 2012 at 2:02 am -

Tara said:

You can make it on 46K easily in CA (okay, maybe not near San Diego, Bay Area, or other super overpriced areas but just about anywhere else – even LA area which is somewhat overpriced). There’s a bunch of studios and 1/1’s in LA in the 800-1000 range. Better yet, if you’re paying that sort of money on rent, you might as well buy if you can – lots of great home in the valley and northern CA for under 150K. Luckily, my situation is marginally better than 46K, but I know lots of people who make it here on less than 40K. I know I could do it if I had to although the iphone would have to go

🙁May 19th, 2012 at 5:20 am -

Chelsea said:

Here it goes…..I feel rich making $50,000 a year! I live in San Diego, a few blocks from Mission Bay. The secret is, I work at a hotel! They provide health insurance, vacation pay, free meals in our caffeteria, and cheap hotel room discounts. My rent for a 1 bedroom is $850. The rule of thumb is, you should never pay more than 30% of your income towards rent…period! I have driven the same car for 10 years…who cares. My friends make fun on my car, but I’m the one that can afford to go on vacations whenever I want. As for retirement savings, I don’t agree! Saving money “forever” ensures you to stay in your same financial situation “forever”. The only way to get out of your $46,000 budget, is to invest your money( into your dream business plan, rent out property…ext) Don’t allow yourself to always see the glass half empty, or it will be! Come on America, think outside the box 🙂

July 16th, 2012 at 2:00 pm -

CarolAnn said:

This article is laughable! 20 for electric….where? 30 for car insurance…you have got to be kidding me! This article only applies to singles who 1) do not student loan debt 2) have yet to have children 3) don’t pay for their own groceries or don’t have to feed more than themselves. I make this and have 75 dollars disposable income after I pay for the bare minimum. I don’t eat out, ever. I don’t go to even matinee movies, go out to events (who has the money for admission let alone parking!). It’s a treat for me to have the gas to get to the beach and pay for parking! I eat more peanut butter and jelly sandwiches than I probably should. Who wants to live in California and not be able to enjoy what California has to offer? Tara said if a person is paying 1000 dollars for rent then they should buy…I live in the Valley….where are these 150K homes? Foreclosures are BID on and that is the beginning asking price…..plus you have to have 20% down and no blips on your credit, not even a late payment to anything in the last 7 years. I can’t wait to move from this state! Problem is. how to save to get the hell outta here!

August 9th, 2012 at 1:05 pm -

Dave said:

for 85k with 401k matching maxed out income is around $4200/month after taxes

rent $1100

internet $50

iPhone service on cheap MVNO, $50

electric $50

food $600

car $500 (insurance $100, gas $200, $200 repairs/maintenance)

dining out $200

clothes, misc purchases $200

other entertainment $200comes to $2950 with $1250 extra. If I cut out spending anything on going out, spending on entertainment, and misc it’s $2350 just to live alone, eat healthy food, and drive.

so I should have between 15-22k left for savings, larger purchases, and vacations. it’s an okay amount if I were to spend it but it’s not enough for savings!

August 14th, 2012 at 12:41 am -

Nightvid Cole said:

You need to put a reasonable number in for health insurance, co-pays/deductibles, as well as car maintenance, repairs, registration, and depreciation. Also your utility bills seem unrealistically low to me and omit water and trash collection. Additionally, I see no offspring-related expenses such as child care, vaccinations, after-school , weekend, and summer activities, books, tuition, etc.

September 18th, 2012 at 12:54 pm -

Dean in MT said:

AMAZING how many supposedly intelligent people with above-average incomes have read this article and then posted such idiocy as, “where is the health insurance?”

There IS no health insurance on a budget this size in SoCal, morons!I’d like to know which employers are doing so well in this economy that they can afford to pay 60-100+K to people with NO reading comprehension skills whatsoever…wait, let me guess-financial sector-

Posting that you’re making 70K and taking home only 2800/mo and then picking the author’s budget apart is just laughable. Your 401k is soon to be taken over by Big Brother to “protect” you in case you’ve been under a rock. You can’t afford to stash that much for a retirement that ain’t gonna happen, bro…

December 4th, 2012 at 11:43 am -

AP said:

Bottom line, it does not matter how much or how little you make if you dont have a plan and stick to it you will go broke, I make twice as much as I did 7 years ago and you know what my bank account still has the same balance in it, ya the sample budget aint perfect but at least somone is taking the time to put some facts together that might help sombody who needs it. When my family started out (Me, my wife, our duaghter and my little sister) my yearly income was around 25,000 if factor in side jobs I did on the weekends we were prob closer to 30,000 but the point is we made it work, granted they didnt have a rich life but we made damn sure they had a good one!!! Parents rather watch their childs smile than that new HDTV anyday so figure out what really matters to you and your own and cut out the rest you dont need it

January 9th, 2013 at 3:03 pm -

capitalkid said:

Electric @ 20$? That’s not even enough for the ongoing “distribution charges”. Gas at 15$? Neither of these figures applies unless it is tied to local subsidies(Lifeline,FERA,ect). DSl w/o contract, line only is around 50$ mo. A normal cell phone bill for 1 line unlimited(because it is the household phone too) is around 50$ prepaid.

re-figure estimation:

Electric: 200.00$-500.00$ month depending on family size 2-4 people

Gas: 100.00-300.00 month depending on family size 2-4 people

DSL:50$ month

Prepaid Phone:50$ month

This will increase said budget by =

Electric between 200.00-500 month = 2400.00$-6000.00$ year

(the budget is set at 20$ month,240 year for electric. The realistic electric bill is calculated between 1800.00$-5400.00$ year. This means a shortfall between 1560.00$-5160.00$)Gas between 100.00-300.00 month = 1200.00$-3600.00$ year.

(The above budget is set at 15.00 month, $180.00 year. A realistic gas bill is calculated at between 1200-3600 a year, which means this budget will fall short by 1020.00$-3420.00$ per year)DSl averages 50$ month. This brings yearly total to 600$, this budget will fall short by 300.00 per year.

cell phone realistic bill is 50$ month, which is 240 yearly, a vast difference from 120.00 year that also falls short.

I think this budget needs an increase of about 12,000.00$ to even be borderline. And a rent reduction by half at least. you cant rent for $1200 month and pay an electric bill for 20$ and a gas bill for 15$, that wont even keep an account dormant while you are”away”. car insurance at 30$ might work for 1 person and give you basic coverage but California basic coverage is written for the insurance companies, not for the consumer, eventually if your odds run low and you get unlucky you may find yourself in debt.

We carry 300/500/300 and are maxed out on everything, we are former California residents (left in 2011) and are now Montana Residents and for the insurance I listed above we pay 73$ month. We were paying about 100.00 month for 15/10/30 coverage on our 1 ton truck in California before we left, our last registration bill was in March of 2011 and was 498.00$, up from 398.00$ the year before and 298.00$ in 2009, and cost us $900 to register when we bought the flipping truck originally. We bring in around 33,000 year and are able to live well outside of that godforsaken political nightmare. But we have to return to visit family.

California cant even afford itself, much less any of its residents affording a decent life. We never had an entertainment budget when we lived in California or Roth IRA or emergency fund, camping, movies any of that. The last electric bill we had with So Cal Edison was for 471.00$, that was for 900 watts for a family of 4. The same KWH’s with our electric co-op in Montana runs about 60-75$ month. Diesel is about a $ cheaper per gallon, and there is no tax. We stretch way farther and stress way less out of our birth state. Too bad but it is what it is.

Good luck.

February 5th, 2013 at 11:23 am -

Jim said:

@Steve

I was also born in raised in HB, Ca. I moved to the Seattle area in 2006. What defines this area as nice? It sure the hell isn’t the 20 shades of gray you get from mid-lat Nov thru early April or so. And summer? If you even have one here in Seattle. The locals will tell you summer doesn’t start until August.

In terms of raising a family? Yes, the area in Seattle is better than southern California, that is if you can get past the rain (35-40 inches per year) and the dreary winters.

But Washington has a lot of negatives aside from the weather. Taxes, they love taxes here. Going out costs more as well. Example:

In N Out Burger $6.XX for a Double Double, fries and large coke. Here in Seattle most burger joints (Triple X, Dicks, Redmill, Kidd Valley etc…) want double or triple that and it’s not anywhere near as good as In N Out.

I rent and my water bill is between $100-$115 per month (Water & sewer)…Outrageous! Thanks to Washington taxes. No we don’t have a water shortage in this state either.

July 6th, 2013 at 4:18 am -

Destiny said:

“Biff Said:

Sorry guys, but living at that budget in LA means living in poverty. Anybody who says otherwise is either full of shit or lives in the slums.”Apparently Biff doesn’t know what poverty is. As Americans, we do not realize how fortunate we are in comparison to other countries that deal with a much more significant amount of actual poverty. We think if we’re not driving a luxury car, living in a mansion, or vacationing in the Bahamas, we’re poor while BILLIONS of people around the world wish they had a roof over their head, food to eat, and clothes on their back. Even in LA, if you are making $46,000 a year you will NOT live in REAL poverty.

July 6th, 2013 at 1:02 pm -

Destiny said:

@ capitalkid I’m sorry, but a $471.00 electric bill is WAY to high. I am a Southern California native and I live with my parents who have a 5 bedroom house a little over an hour EAST of LA and even during the summer our bill is not that high. You and your family obviously needed to practice CONSERVATION.

July 6th, 2013 at 1:16 pm -

Mona said:

Ok– reading all of the ignorant comments on here has been beyond annoying. I live in Los Angeles — in the heart of Los Angeles, by larchmomt village. Look it up tool– it’s not the slums whatsoever it’s actually next to one of the more expensive neighborhoods of LA called Hancock park. I make less than 40k a year and I survive — take that back I LIVE just fine. There a few little changes id make to the budget to fit my personal needs but his point was to show you can live in beautiful California — without “living in poverty” or ” an illegal alien” my bills are around 2200 a month. I am a single female rent is 1200 power (electricity and gas) 60-100 depending on time of the year, car payment 281 insurance full coverage 140, gas(car) 150 cell phone 150( friggin att is the worst) groceries I buy all my produce from farmers markets and then the rest at pavilions and I don’t eat “bags of rice or beans” so I spend about 200 a month on groceries.I don’t have cable I have an Apple TV … So all the misc stuff like netflix spotify Internet gym pass household is all probably 80. After I pay my bills I have about 500/700 a month left. I spend some on bars, shows bdays and what not. I save the rest. Would I love to make more of course. But I dont even have a credit card bc i don’t need it, I have a savings and yes I went to college but times are tough and good jobs can be REALLY hard to land. I don’t have health insurance– I know I know … I really just hate the whole concept of in case shit happens here is my money every month for the rest of my life. ** my best friend works at a salon she does my hair for 20 bucks. I easily could live with a roommate and knock down my rent too. But I prefer to live on my own. I go on trips with my gfs … I went to vegas, Miami and Hawaii last year. I’m not in poverty– I don’t have to eat shitty food, I can have fun and shop a little, see movies go out to eat here and there–and you know what the age range I’m in 22-28 all my peers basically live in the same financial bracket I live in with the same budget. There are some exceptions of course but it’s very normal. You can live more than fine with making less than 46k. If you don’t think it’s possible I’m more than happy to send you a personal email with an excel sheet of my earnings and my monthly living expenses — and I will send you 6 friends as well with pictures you can look us up on Facebook and see that we are real people — living comfortably. Just be blessed that your life is that fortunate for you to think making 46k a year is poverty. Just in case any of you care or are judging me– my car is almost paid off– so that will be about 300 savings— and I KNOW I have to get health insurance– mm

February 28th, 2014 at 2:42 am -

Brian said:

@Mona

You’re spending $2261 (best case scenario) each month and make less than 40k? How, respectfully?

At 40k, one nets roughly $1923.33 after taxes. (2013 CA tax rate) Those numbers just don’t add up. And you have $500-700 left a month? Again, how?

August 1st, 2014 at 3:28 am -

Stephen said:

Mona,

I am interested in hearing more about your journey budget-wise there. I lived there for 10 years, and would like to move back in about 4. I know I can do it, but would like to hear more about your figures.

Thanks,

StephenSeptember 15th, 2014 at 3:36 am -

Andrew said:

I’d rather commit suicide then live on 45k a year. 45k a year is living under the poverty level. You might be able to scrap through with 45k a year if you live in a shelter, eat mostly at soup kitchens.

October 11th, 2014 at 11:01 am -

Joseph said:

Wow, I feel for you guys in California. I live in Michigan, metro Detroit area, and quite honestly, $35k will afford you independence, probably less than that. When I did make $45k, and I have horrible money management skills, I was able to rent an apartment/renters insurance, I had two cars (both v8 gas guzzling cars at that)…both insured, health/vision/dental insurance, 5% 401k contribution, 5% roth ira contribution, cell phone, cable/internet, and a son who I bought the most ridiculous things for.

March 18th, 2015 at 6:51 am -

nik said:

Hello

I am single planning to move to san jose california and earn 50k per annum , assuming i spend minimum on myself can i survive on the same ?

i mean to spend only on a home , food and a very little spending on outings !!!!thanks a ton

NikDecember 17th, 2015 at 2:22 am -

David said:

California is a very big state and not everywhere is as expensive as SoCal. I live in the Central San Joaquin Valley, make 76k a year, a family of four, and literally live like a king. My house is 3000 sq ft, with swimming pool, 3 car garage and rv parking. We have an rv, 3 cars (one of them is a brand new Lexus) and 3 motorcycles (we enjoy trail raiding as a family). We travel at least twice a year and never for less than 1 week at a time (mostly camping). We don’t eat out much, but that is our choice since my wife and I enjoy cooking. And by the way, my wife doesn’t work, per her choice, she does voluntary work.

San Jose is a different story. It is probably as expensive as SoCal if not more. Lots of people commute to nearby cities like Modesto or Stockton because rent is cheaper.

March 1st, 2016 at 3:19 pm -

Brandon Wood said:

Interesting post. But seriously I left CA for NV for graduate school 5 years ago and when I graduated I stayed. I make double the salary reported here by myself and would never come back to CA unless our family income was 200K + and had limited debt. I realize this article is targeted at someone who has less formal education and probably can’t leave the state that easily. However, to skimp like this and fumble and bumble through everyday life is not living in my opinion. By living I don’t mean materialism I mean comfortable. If I want to take my girlfriend or wife to dinner on Friday night then I am gonna do it. If I want to go play a round of golf then I am gonna go. 46K in So Cal? No way. That’s not living life that’s avoiding life and cutting corners.

April 18th, 2016 at 9:56 pm -

Daniel said:

What about median income per worker?

I make around 37k year….i hear thats around median for both m & f.

I am doing fine.

Nkw married and doing well as my wife makes double that.December 23rd, 2016 at 9:12 am -

karen said:

Ok, I have to laugh at the $20 monthly budget for electricity. Also the $25 per month for DSL. With electricity prices starting at .19 cents per kwh and going all the way up to .32 cents per kWh, good luck with a $20 electric bill. On months were we use no a/c and no heat, turning lights off during day and only having lights on where we need at night. Most of day no t.v. and running dishwasher and washing clothes during off peak hours our lowest bill is $235. As far as DSL, there are only two providers and the cheapest is $60 per month. Also, we are stuck with propane where we are and that comes out to $100-$150 per month, and we don’t use it for heating-it runs the hot water heater and the oven/stove only. Also my husband and I have had our same insurance company for 20 years, no incidents or tickets against us, and we pay $70 per month for one 10 year old car. Looking around we cannot find anything cheaper than what we have.

The one thing that is realistic is the $400 grocery budget for two people, we make it on $1000 month for 5 people-we never buy anything expensive like seafood, but with ground beef at its cheapest for most of the year at $4 a lb., milk being almost $4 per gallon, and other costs of groceries its hard to go below this $1000 per month, though if we are well stocked we get by on a little less.

We don’t have reliable public transportation where we are at either, and it doesn’t run around the clock, and every store and doctor’s and dentist offices are at least a 20 minute drive one way and others an hour one way. We go through about $200 per month on gas, unless there are no appts or places we need to be or go to for fun then I can get by on around $140 for gas per month.

You also have bi-monthly water bills of $100 and ti-monthly bills for trash at $115, which are not included in your budget.

For our family of five (well six, but one recently moved out) we are just making it at $86000 per year, if you divide that by 3 that would be $65,000 for two people, but that doesn’t really work because rent won’t be a third of what we pay but only about $500 less than the $1635 per month we pay for a small 3 bedroom.

As for health insurance we use the Health Spending Account though my husband’s work, we are lucky that they will match what we put in 100% if we at least put in $2000 per year. This along with our health, dental, and life insurances costs us $260 per month. The $4000 is almost enough to equal our deductible of $5000 per year. This all gets taken out before taxes.

Honestly, after having lived in California for the past five years, I cannot wait to get out of here. I don’t understand the appeal really, high cost of living, too many people, and you can’t really enjoy any of the fun things to do unless you are “rich”. Even then with the crazy hot summers ( we went over 100 degrees this summer and our a/c went out it took our landlord a week to get it fixed because there was a back log of people needing theirs repaired), I just don’t understand what is so appealing about living here. There are much more beautiful places to live, that have seasons, things to do, lots of beautiful outdoor places to visit, why spend so much to live here? Unfortunately my husband’s job is what brought us here, but we are looking for opportunities for him to transfer out of here.

October 6th, 2017 at 8:59 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!