FHA Loan Elgibility Tool: Fantastic Gimmicks to get you to Purchase a Home.

- 0 Comments

I love gimmicks. It didn’t take long before a tool was available for people to see if they qualify for a FHA loan.  Since the new housing bailout bill has been signed into law, the new rage is FHA loans.  People are now gearing up for the purchase of that new McMansion.

Gimmicks, like increasing savings rates at WaMu to lure customers in even though they are posting quarterly losses are just one of the many reasons our system is so backwards. Â If you really cared about savings, you would encourage people to save through savings bonds instead of closing down the limit and decreasing the rate.

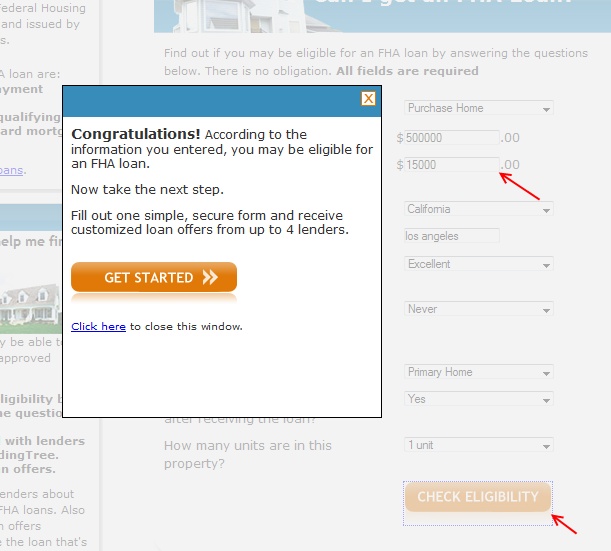

The government essentially wants you to be a spender for the rest of your life. Now this tool put out by LendingTree.com is essentially a 3% calculator and is simply a gimmick.  How so? Well I took the time to run a few numbers and according to this, I can qualify for a FHA mortgage in Los Angeles of $500,000 with only $15,000 down:

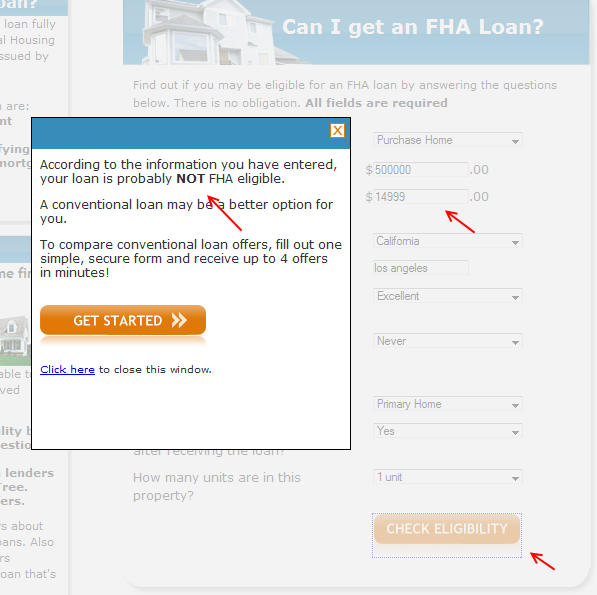

However, let us keep all the variables the same but decrease our down payment by one dollar:

Â

So is that really the only difference between qualifying for a FHA loan and not qualifying?  One dollar? $15,000 is only a 3% down payment on a $500,000 loan. From reading some of the other qualifications, you will still need to verify your income and show reasonable credit.

So this tool from what I gather is basically a 3% calculator.  Do you qualify for a FHA loan? Do you have 3% of the purchase price?  Then yes.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!