Washington Mutual: WaMu Bank Offering Great CD Rates and Encouraging People to Come in Person?

- 0 Comments

Washington Mutual, the Seattle based S & L is recently facing market stress with their second quarter earnings report showing that the company lost $3.3 billion. Today the nation’s largest thrift sold off again on concerns that they may be losing some of their sources of funding. The challenging aspect of this is that Washington Mutual employs 45,883 employees. Compare this to IndyMac who employed slightly under 9,000 employees when taken over.In addition, IndyMac had $32 billion in assets while Washington Mutual has $320 billion. Take a look at the stock price for the past year and you’ll see that there has been tremendous volatility:

As you can see from the chart, Washington Mutual is down 89% from last year when shares were trading above $40. In perspective, that modest rally from the Fannie Mae and Freddie Mac bailout has done very little in helping WaMu.

But there are some more challenging obstacles facing the institution:

“(MarketPlace) Credit default swap spreads on WaMu’s debt widened dramatically on Thursday. Contracts are now trading “upfront,” which means investors seeking protection against a default by the thrift must pay fees immediately. These contracts usually require only annual payments.

But when concerns reach extreme levels, sellers of protection demand money upfront too.

CDS on WaMu are currently trading roughly 13% upfront. That means investors seeking protection on $100 million of debt would need to pay $13 million up front and $5 million a year.

Such spreads imply a roughly 50% chance of default in five years or a 24% chance in one year, according to Credit Derivatives Research.

“The market is starting to say when these guys will default rather than if. It’s a much more negative stance,” Tim Backshall, chief credit strategist at Credit Derivatives Research, said in an interview. “This is the first major, well-known financial name that’s gone upfront.”

This is tied to much of their losses on mortgages. Keep in mind that WaMu over the past year or so had 40 to 50% of their mortgages in California which has seen the median price of a home decline by over 30% in one year. Many of the loans are the Pay Option ARM variety which are recasting in large numbers over the next few months. The bailout will do very little for these loans.

The reports today only signifies that WaMu may need to rely more on deposits:

“Many of WaMu’s unsecured creditors are “quietly” reducing their exposure to the troubled bank, according to a report by Kathleen Shanley, an analyst at Gimme Credit, citing information in the company’s second-quarter earnings report.

That means the thrift has to rely more on insured deposits and borrowing from the Federal Home Loan Banks for funding, she wrote in a note to investors.”

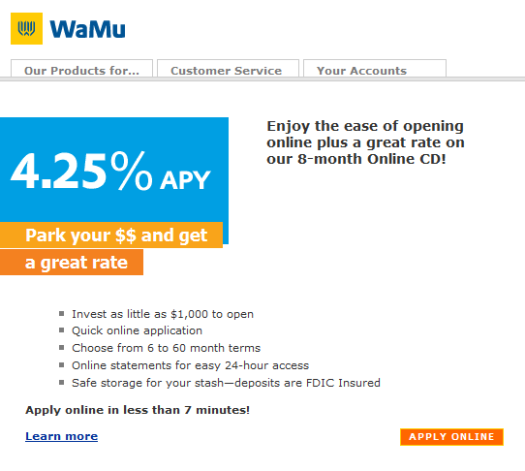

Which brings us to a couple of interesting points I saw today. Â First, they are offering amazing rates on their certificate of deposits:

I have a WaMu account and when I logged in this morning, I had an interesting message that I had never seen before. Â It was an invitation to come and sit with a banker in person. Â This was the first message I have ever seen and I have been banking with WaMu for sometime. Â I tried to find the message again but was unable to find it. Â My guess is that they took it down for any reason. Â I did find a link on their site encouraging people to come in to talk in person regarding retirement savings:

http://clients.mapquest.com/wamu/mqlocator?link=findusmain

The link however is not active. Clearly after today’s market action, the concern would be starting an onslaught of people dropping by the bank.  By the rates they are offering, it is rather obvious that they are seeking depositors funds.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!