The Middle Class in America has just become a minority: For the first time in over 50 years low-income and high-income Americans outnumber the middle class.

- 2 Comment

It was only a matter of time but we can now officially say that the middle class in America has reached minority status designation. Recent figures show that there are more low-income and high-income Americans versus those in the middle class. Most of the growth has been fueled by the trend in adding low wage jobs. At the other end you have a small pool of Americans that are controlling a larger piece of the economic pie. It used to be the case that Americans for the most part were proud about our robust middle class. Now there is this temporarily embarrassed millionaire attitude flooding the nation all the while the system becomes more of a corporatocracy. Half of Congress is made up of millionaires so don’t expect them to have any idea what is happening in the lives of paycheck to paycheck Americans. Does losing the middle class matter?

Middle class minority

I knew that it was only a matter of time before the middle class was pushed into minority status. What is more shocking of course is the speed in which our economy is becoming split. The biggest growth has occurred in the low income category. This is why even with the stock market near all-time highs and real estate bubbling over yet again, we have 45 million Americans on food stamps. The number is near an all-time high because the middle class has shrunk.

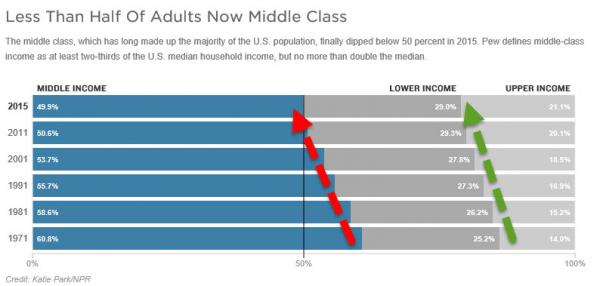

There seems to be a massive disconnect between what is presented in the media and what people are actually living. Take a look at the shrinking middle class chart:

In 1971 the vast majority of working Americans clearly fell in the middle class. Slowly but surely the pool started dwindling as we added more lower income Americans but also, created a small wealthy minority that controlled virtually all real assets in the country. In fact, one of the stepping stones to middle class living, home ownership has been slowly trampled on by speculative banks and large money investors.

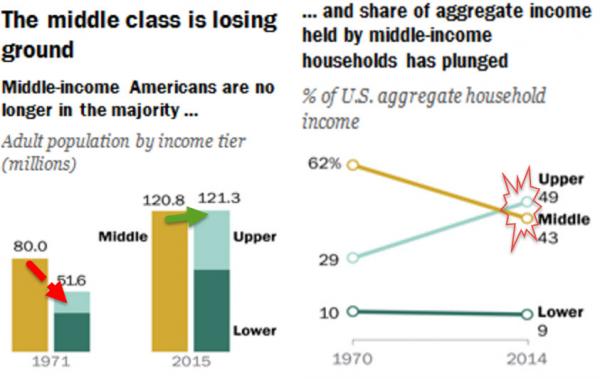

Share of income earned

It is useful to also examine the share of aggregate income earned by each income bracket as well.

In 1970 the middle-class earned 62 percent of all income while the upper-income bracket earned 29 percent. Today the upper-income bracket earns 49 percent of total income while the middle-class earns 43 percent. Sadly, lower-income households dipped from 10 percent in 1970 to an even lower 9 percent today.

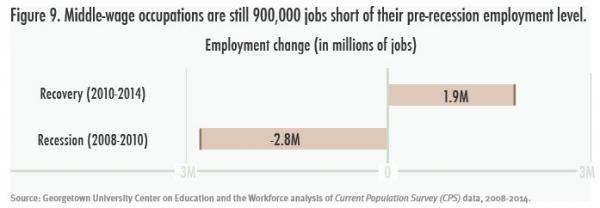

At the core of this issue is the low wage epidemic where we are trading the role of building cars to mixing drinks. We are still well short on adding all those good paying jobs we lost during the recession:

While we keep adding jobs, many of these jobs are in low wage service sector fields. Many of these jobs provide little to no benefits and really keep people in the cycle of living paycheck to paycheck. In fact, the only reason people don’t feel poorer is because people are going into crazy levels of debt pretending to hold onto a middle class lifestyle.

People are truly frustrated because of the economic situation. But you are already seeing the bread and circus show appear to distract people from reforming the economic system just in time for election season. The status quo remains and it has led to making the middle-class a minority.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

GF said:

Welcome to the Third World America.

December 11th, 2015 at 5:14 am -

Sam from The Nude Investor said:

Very interesting article. This phenomenon has long been known, and inequality levels do move in cycles, just like everything else in the economy. We’re now at levels seen around the time of the great depression.

Historically, the motivation to solve the imbalances has only been conjured as the result of a crisis (think the great depression). Unfortunately that narrative is likely to repeat itself, in my opinion.

Interesting times we live in indeed.

December 15th, 2015 at 1:12 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â