How inflation is purposely underreported as a justification to maintain low interest rates: Two specific examples with housing and college tuition.

- 6 Comment

Inflation is largely misunderstood by the public at large. People for the most part think that inflation is the natural economic order and that prices go up naturally. Official inflation figures play a much bigger role influencing cost-of-living adjustments for things like Social Security but also serve as cover to maintain low interest rates. The CPI is largely underreporting inflation. For many young Americans the cost of college tuition is a big part of their budget yet the CPI allocates a small percentage to college tuition and fees. Another big problem with the measurement is how it looks at housing costs. You would think that the biggest expense for Americans would be reflected accurately in the official measurement of inflation but it isn’t. This is how you end up with the middle class becoming a minority yet in some way, we had continual reports that inflation was nicely controlled.

Inflation since 2000

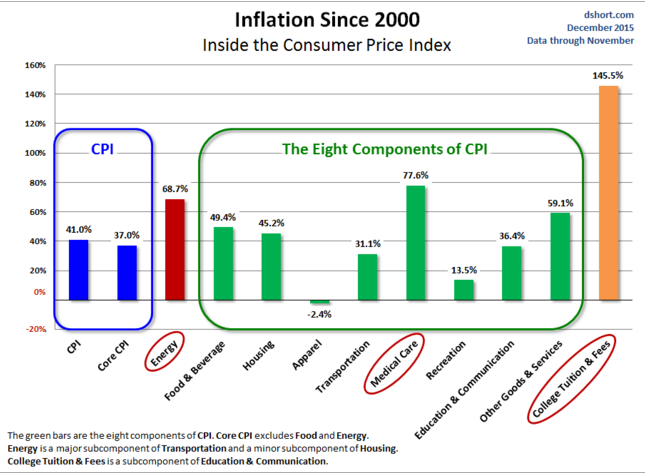

It is worth looking at the buckets in the CPI to see where costs have risen since 2000. Rising costs have driven deep impacts into the wallets of Americans. Your dollar simply does not buy as much as it once did. Part of this has to do with inflation simply eroding purchasing power. The ability to finance purchases with big debt has simply inflated the underlying item. Think of college, automobiles, and housing. It is important to provide reasonable access to debt but we’ve crossed a line into debt addiction.

Take a look at CPI components since 2000:

These are official figures derived from the CPI. Even with these official figures you can see that some categories are outpacing the overall average. In that category you have college tuition, medical care, and housing. The good news is that clothing is now cheaper.

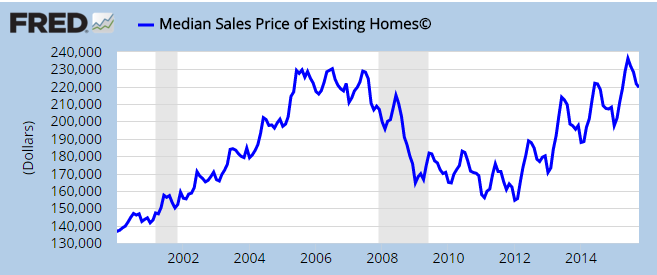

The first item I would like to draw your attention to is housing. According to the CPI, housing is up 45 percent since 2000.  A simple measure would be looking at the actual cost of buying a home today:

This is interesting. According to the actual cost of a home, prices are up roughly 60 percent. This is a 15 percent differential between the CPI and the current median cost of a home. Most Americans own their homes although this figure is now dropping since affordability is becoming a challenge thanks to investors purchasing homes in their desire to chase yield – a byproduct of low interest rates. But what about rents?

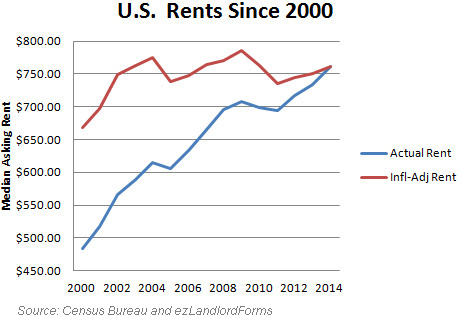

Rents are up about 60 percent since 2000 as well. The CPI simply does not do a good job at tracking the true cost of housing for Americans and that is one reason why we are dealing with a major housing crisis.

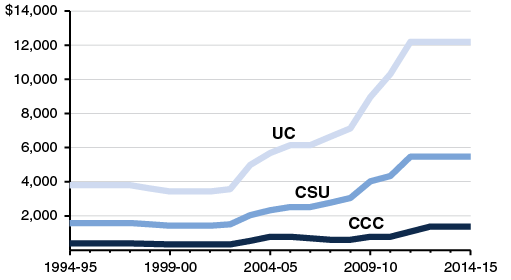

Another area that is being underreported is with college tuition. Although the CPI shows a big change here it is only a small percentage of the bucket. The problem is that current and recent college students are spending a large portion of income on tuition and this is what is driving policy. The CPI has college tuition and fees going up 145 percent since 2000. Let us look the largest public college system in the country to see how that compares:

The above shows the California public college system. The UC and CSU are the 4-year institutions in the state of California. The CSU is the largest 4-year system and in 2000, college tuition there was around $2,000. Today it is close to $6,000 (a 200 percent increase). The UC had a similar 200 percent increase. These are much higher than the stated CPI figures.

No inflation figure measure is going to be perfect but housing is the biggest expense and the CPI continues to underreport it. This was also a problem during the housing bubble when prices were clearly in a bubble yet the CPI kept looking at owners’ equivalent of rent (OER) and continued to provide cover for lax lending and generous interest rates. Keep in mind in monetary policy interest rates are used as spigots for the economy and we had them fully open (we never shut them off). Inflation is a serious issue and this is a big reason as to why regular families have seen their purchasing power erode.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

laura m. said:

I don’t know how young couples can marry and raise kids or even one child now days. Both have to work (like we did and never raised kids) unless they are well healed or parents help out. I thought it was bad in the 70’s, but looking back when younger, we didn’t have all the stuff people buy now, and think they need today. Since America is sliding down the abyss, smart not to have children, both keep working for retirement like we did. Country on a downward mud slide with a zero future.

December 16th, 2015 at 1:18 pm -

welfare.gov said:

can’t outsource rent,food, medical etc.outsourcing to take advantage of slave labor works in the near term to control prices.stuff u can’t outsource to china or mexico prices are skyrocketing to support the massive matastasising welfare state through massive taxation,fees,penalties,interest,garnishment regulations etc forcing cost continually higher

December 17th, 2015 at 6:26 am -

Opiner said:

If you are talking about corporate welfare, then I agree. There are too many tax loopholes (effective corporate tax is 17%), laws, state benefits (open a company in our state and no taxes for 10 years, etc…), subsidies (farm, oil, overseas investing), benefiting corporations (which are many times larger than the welfare to the poor). Do some research into corporate welfare, I believe you’ll be surprised.

When corporations can pay their employees such low wages that they qualify for subsistence welfare I call that corporate welfare. Working people paying taxes are paying to make up for those low wages and enabling that system and I think that’s wrong.

If you are referring to welfare for the poor, I also agree, but, how do you fix that problem? There are not enough jobs to put those people to work productively. How would they pay for transportation to get to and from work? How do they pay for childcare? How would they pay for medical care? Many of those people aren’t able to work due to health problems, mental problems, education, social inabilities, etc… Would you hire some of those people? I wouldn’t. I think the system has evolved where it has because it’s easier to appease them by giving them enough to survive on than put them to work.

I think the corporations don’t need to get the bulk of their money from the low income people to prosper. It’s easier to “pay them off†and that’s why the system has evolved to where it has. The middle, upper-middle and upper class spend more than the bottom folks collectively do. The money from the middle to upper classes and foreign purchases are enough. That’s why many corporations are doing well. They don’t need the poor.

I think the computer changed everything. It enabled commerce worldwide. And, what I really fear is: computerization, robotization, automation, and mechanization. A famous person recently said “what took 40 employees before now takes 4†to do the same job.

December 18th, 2015 at 8:19 am -

Poetry180 said:

Soon all of those that are now so deeply in debt will be literal slaves in a concentration camp, among all of those who resist or disagree with the coming new socialist order of life for any reason. They want your savings and retirement accounts, and to absolutely control your property use. Why else do you think that they want to take your guns from you. Tyrannies of the past tell us the story of the dawning future of America.

December 18th, 2015 at 7:42 pm -

Paul said:

Go to shadowstats.com. This is not a new story. CPI has consistently been underreported as well as the unemployment rate. One of the main reasons for CPI to be underreported is the COLA associated with SS and pensions.

December 19th, 2015 at 8:13 am -

Rascal said:

“…This is how you end up with the middle class becoming a minority yet in some way, we had continual reports that inflation was nicely controlled.”

Continual reports. You mean continual lies. Continual lies about everything. Just painting a rosy picture for those stuck in the Matrix. Feeding the blue pill to the masses.

Don’t believe a word on nightly news!

December 19th, 2015 at 10:01 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â