A recession is imminent: 5 charts signaling an oncoming recession. The market is overheated with debt and the public is anxious about the economy.

- 4 Comment

A recession is imminent and millions of Americans already live in an economy that feels like it never left the Great Recession. Low paying jobs seem to dominate this weak recovery. Younger Americans are realizing that they may not have it as good as the baby boomer generation where good paying jobs were plentiful and wages actually kept up with inflation. Benefits in the job market today are low to nonexistent and the new retirement model is work until you die. This might be a good motto if we were living in the Middle Ages. Instead, we live in a self-imposed modern day Gilded Age where Congress is bought and paid by the wealthy in our country. It is troubling that the government continues to spend money it doesn’t have yet continues to ask Americans to live a life of austerity. There are five signs that are starting to point to another recession.

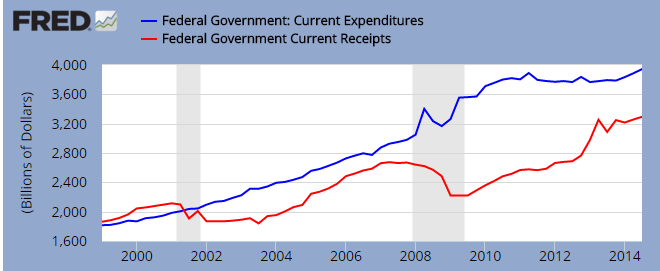

Government spending and taxes

The first chart will look at government spending versus tax revenues. The government continues to spend money it does not have. Government spending is quickly reaching $4 trillion per year yet total tax revenue is roughly $3.3 trillion. The end result is an epic deficit.

Having this massive deficit is only adding to our national debt. Should rates rise, we will have more of our funding going to simply servicing the debt instead of paying any of it down:

Government spending completely disconnected from tax revenues during the Great Recession and we have not looked back since. The spending was supposed to be a sign of tough times and it was only to be temporary. We are now spending a record amount. Does the government know something we do not?

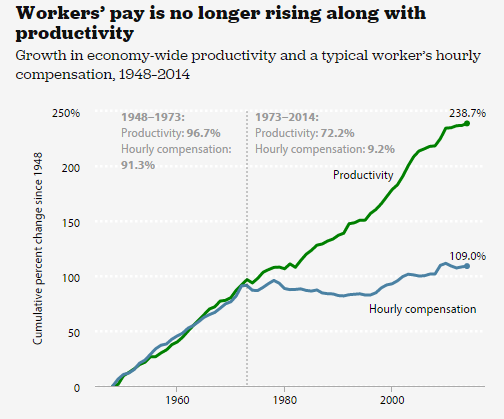

Workers productivity                                                                   Â

Another myth that is out there is that American workers are simply not productive and therefore, they should earn less. Unfortunately American workers are productive yet most of the gains have flowed into the hands of a few:

While productivity has continued to grow, hourly compensation has gone stagnant starting in the 1980s. People are producing more but are not seeing any gains to their hourly compensation. This is why you see companies cutting benefits and slashing wages. Yet at the top, salaries are at record levels. This is part of the new Gilded Age philosophy: we can always pay you wages like those in China, India, or Latin America. It is a race to the bottom for most and that is why the middle class just turned into a minority this year.

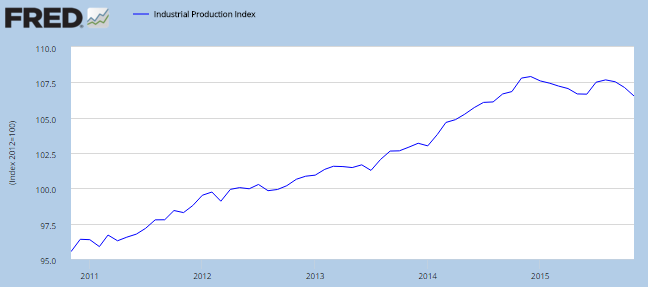

Industrial production

Another good chart to look at is industrial production. You would think if things are good, people are producing more and buying more. The population after all is growing. Industrial production went up since the recession officially ended but has gone stagnant in 2015 (and is trending lower):

This is a big indicator that something is amiss in the economy. But things are looking good if you are a CEO.

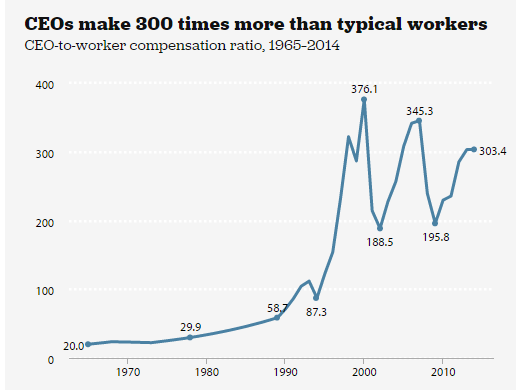

CEO pay

The typical CEO now earns over 300 times the pay of the regular employee:

Compare this to the 20 times regular worker pay measure of the 1950s and 1960s when the middle class was actually thriving. And you have a new class of predatory capitalism going on. You have CEOs like Martin Shkreli who basically exploits loop holes in the system to profit and actually cause harm to regular people by jacking up prices on drugs for example. He was recently arrested for fraud. And what about the bankers that led this economy to the brink of depression? What are they adding in value? You have a vampire like system extracting real wealth from workers and filtering it to the top to a new rentier class.

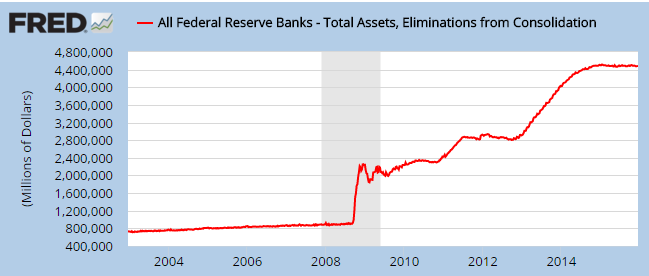

Fed Balance Sheet

The Fed recently raised interest rates for the first time in many years. The Fed now has to stay the course otherwise it will appear as if it truly does not believe in a recovery, which is why it raised rates in the first place. But in reality, the Fed never believed in the recovery. The Fed balance sheet which was supposed to be unwound during recovery never occurred:

The Fed’s balance sheet is still near a record $4.5 trillion. This is where the banks got bailed out and never really had to pay for their sins. The Fed doesn’t really believe in a recovery but had to raise interest rates because the market has already lost faith in their Wizard of Oz like powers. People need only look at their paychecks and the true cost of living to see that things really aren’t benefitting working class families. In reality, there are now many signs showing that a recession is imminent and these are only five that stand out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

TL said:

You want to cure the budget deficit tomorrow? Cut defense spending by 40%. It’s obscene spending this much on defense, especially on a worthless program like the $1.5T F35. The F35 is so worthless, it gets outmaneuvered by the F16 in dogfights, the plane it is supposed to replace.

Then, eliminate the Bush tax cuts for everyone, Sure, I would love my taxes to be lower, but if it puts the economy and fiscal status of the country at risk, I will pay more.

December 23rd, 2015 at 11:13 pm -

Dave said:

So… you’re saying that cutting defense spending ($600 billion per year) by 40% ($240 billion) will correct our trillion dollar plus deficit? Defense expenditure needs cut, I agree, but the total expenditures on social security and welfare exceed total federal receipts, so even if you love those programs, they very literally need cut or there will never be a surplus or neutral budget.

December 24th, 2015 at 5:25 pm -

TL said:

Correct. The deficit this year is $435B and you are right, cutting the defense alone by 40% will only save 1/2 of this. If you lift the FICA cap on social security and Medicare, then your problem is solved.

Make the Bush tax cuts permanent costs $340B a year.

Doing those three things alone makes us a surplus nation.

December 27th, 2015 at 11:04 pm -

S said:

chip welfare recipients, to ensure that, they are not double, triple, quadruple, quintuple dipping as many of them do. Also a good way to track prisoners, parolees, and elected officials.

January 3rd, 2016 at 8:04 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â