The young carry the weight of student debt: Of the more than $1.3 trillion in student debt outstanding over 66 percent is carried by those 39 and younger.

- 1 Comment

The compounding problems with student debt are getting louder as each year passes by. Student debt outstanding is now at a whopping $1.3 trillion and most of this is being carried by young Americans. While college costs have soared for most many recent college graduates are working in jobs were wages are low. This has had the unwanted impact of causing student loan delinquencies to rise dramatically. Student debt is now the worst performing sector of loans in our economy. From the outside and inside this looks like a bubble but it is only continuing because the government and banks continue to guarantee loans. Yet momentum is going to catch up on this runaway train and delinquencies are the first cracks in the dam. The young now carry an incredibly heavy burden of debt simply because they went to college at a time when costs are out of control.

The young are saddled with the bulk of student loan debt

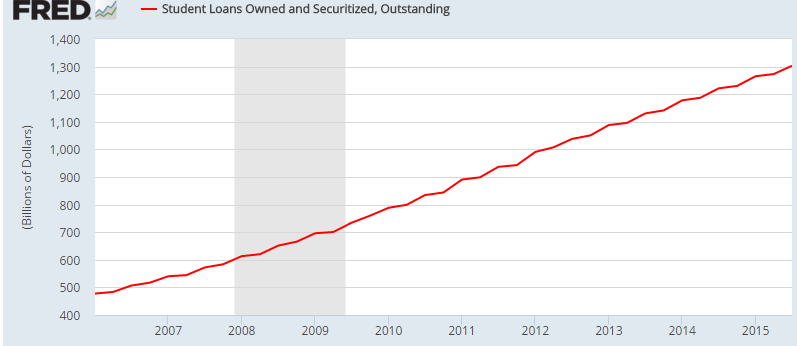

If you are to plot the growth of student debt, it looks like a rocket flying to the moon. It is simply moving up in one straight line. Even the juiced up stock market goes up and down. Not so with student debt. The amount of student debt sloshing around in our economy is simply mind bending.

Take a look at this chart. In 2006 there was $477 billion in total student debt. This was the year the recession hit. Now today, total student debt outstanding is at $1.3 trillion:

The chart above resembles a market out of control. Students are provided loans without ever addressing the actual cost of college tuition. So of course, colleges simply continue to raise fees knowing the government and banks will simply loan students the money. And if you look at many schools, a large portion of this money has gone to non-essential items like gorgeous workout arenas and massive new buildings. The promise of higher wages is not enough to address the even higher debt burden many are shouldering.

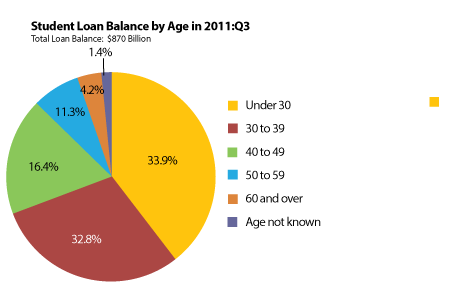

The burden of debt is radically clear and it is apparent that it is falling on younger Americans:

Source:Â Fed

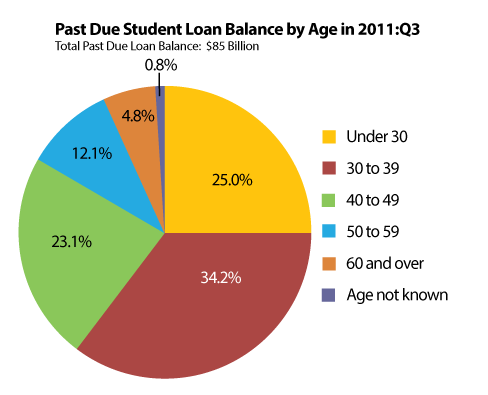

Over 66 percent of outstanding student debt is in the hands of those 39 and younger. So it is also no surprise that the bulk of delinquencies are happening to those 39 and younger as well:

Source:Â Fed

You need to remember that it is incredibly easy to ask for forbearance on student loans. You also don’t begin paying until six months after graduation. So these rising delinquencies show a market that is fully strained but also one in which graduates are simply not earning enough to justify the loans they took out.

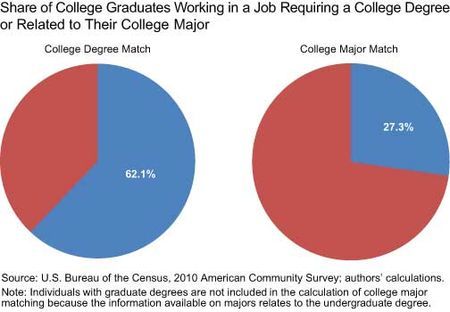

There was also some interesting research showing that only 27 percent of college graduates actually had a job related to their major:

If someone is going into debt of $50,000, $75,000, or even $100,000+ for a degree in political sciences and then finds work in sales, this would be an example of a major and job mismatch (although some would argue otherwise). Also, there is data showing that many college graduates are simply underemployed. You can thank our low wage recovery for that one.

Ultimately the student loan crisis is largely one that is being shouldered by younger Americans with lower incomes. That is a recipe for failure and rising delinquency rates are no surprise.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Tom said:

After watching the Ivies and their wannabes in the last several weeks it seems to me that the Ivies charge to much for what they supposedly accomplish and the students should have never gotten past a high school civics class (if they teach that anymore)…….

November 23rd, 2015 at 3:05 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â