Most Americans are too broke to afford to buy a basic home! The typical family is unable to purchase the standard $221,000 priced home. Home prices up 30% since 2012 while incomes are stagnant.

- 4 Comment

Most Americans still hold tightly that the American Dream involves owning a home. But that dream has come into deep questioning as banks and large investors crowd out the single family home market driving prices to ludicrous levels. Most Americans are scraping by and many need to do their shopping at dollar stores to get by. Your typical home in the U.S. is now selling for $221,000, a rise of 30 percent just since 2012. How did incomes do? They did what they’ve been doing for a decade and that is nothing. Housing is the biggest single outflow of cash for households. So this is a big deal and is also a reason why many more Americans are renting instead of buying. Young Americans are hit the hardest since many are coming out with monster levels of student debt. Studies do show that student debt is impacting home purchases. In reality, most Americans are unable to afford the standard priced home.

You can’t afford a home!

Americans realize something is fishy in the market even though we continually are told there is no inflation. Really? Then what do you call home prices going up by 30 percent since 2012? The biggest expense of Americans goes up by 30 percent in 3 years and this isn’t inflation?

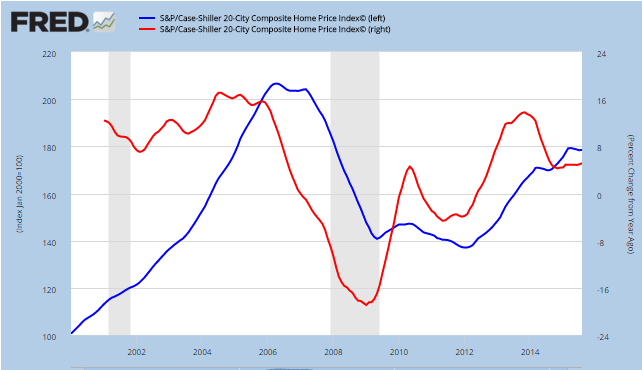

Just take a look at what home values have done in this short period:

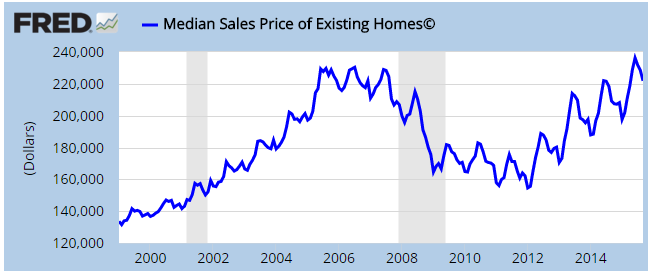

The Case Shiller Index looks at repeat home sales so this is a good indicator of a home being tracked through time. But also look at the National Association of Realtors (NAR) median price of existing home sales:

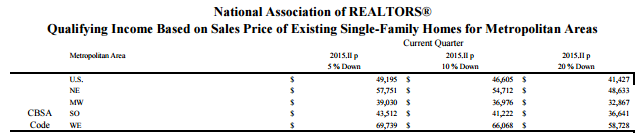

Home prices are way out of reach of the typical family making $50,000 per year. What I do find funny is the NAR nicely says that $50,000 is plenty of money to buy in most areas:

What a surprise. According to the above virtually every typical family qualifies but of course they are going to go into deep debt and will likely save nothing for retirement which is already becoming a crisis on its own.

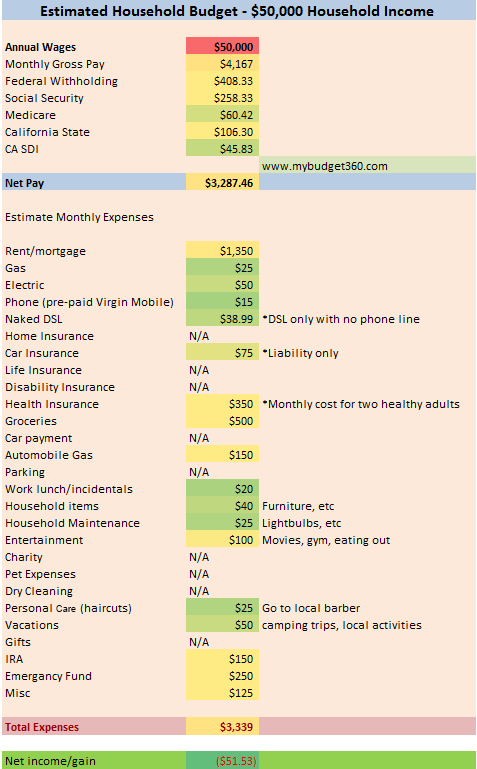

You rarely get a peak into household budgets when these reports come out. Let us look at a household budget of someone making $50,000 per year:

First of all we are assuming this family is spending $1,350 on rent which for California is for something very basic. They are only saving $150 for retirement here and $250 a month for an emergency fund. One major car repair and they are wiped out. This is your standard down the middle family. So how in the world are they going to purchase a $221,000 home? This family is using pre-paid cell phones for $15 per month and basic DSL at $38.99. They are running on a tight budget for utilities and if they live in a large metro area with sprawl, a car is a necessity.

Where are they going to save for that down payment? This is what is rarely shown when people talk about affordability. They don’t show the entire picture but the above is how people actually live.

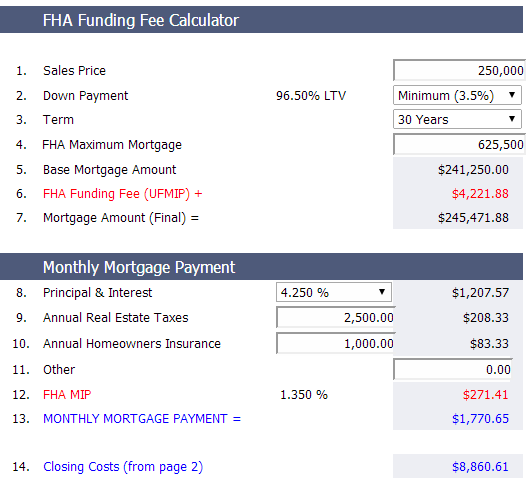

And this is why the homeownership rate has cratered. But let us assume this family found a home for $250,000 since in California, this is a basic property far away from the coast. They go with a minimal down payment which requires FHA insured loans:

So the family is spending $1,770 a month on their mortgage, over half of their net take home pay. If we look at the initial budget again, that means that they’ll eat into their retirement and emergency fund savings. This is simply dumb! Your house does not send you a monthly payment! It has costs like insurance, taxes, and maintenance that never go away. Even for a 10 percent down payment they would need $25,000 saved. Good luck on that.

This is why we now have many older Americans fully depending on Social Security as their primary source of income. More to the point, many households now rent out of necessity and our homeownership rate has cratered. This low interest rate environment is simply creating a larger wealth divide in this country. Buying a home is becoming less of a reality for the American Dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Frank said:

The median California household income is $61,933.

http://www.deptofnumbers.com/income/california/November 5th, 2015 at 7:52 am -

SBay said:

$350/month for insurance? Sign me up.

I’m paying $1000+/month for my family, $800 of which is me and my wife, with a basic HMO. Healthy doesn’t matter anymore because of ACA and no preexisting conditions. It’s all about age and gender.

Time to redo the numbers.

November 5th, 2015 at 9:43 pm -

frederick said:

my real estate taxes in NY are 8K and my homeowners policy just went from 2K a year to 3 and a half grand a year You also left out cable TV which kids cant do without and dental care

November 8th, 2015 at 7:19 am -

Jason said:

These other comments aren’t giving you credit – just shooting holes in your post.

Your bottom line, and purpose, is to show that it’s not affordable to buy a home at average price on an average salary.

All of the situations in the comments are talking extra considerations. That still proves your point. It’s not affordable. Except Mr. “Median income in California is 61,993.” As if that makes a big difference.

Maybe you need to reach out to a more intelligent audience who will appreciate your posts.

December 1st, 2015 at 8:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â