Student debt apocalypse: Median wages up 1.6% over last 25 years while median student debt is up 163.8%.

- 0 Comments

Student debt is out of control. Over $1.3 trillion in student debt is floating out in the current economic system. Most of this debt is saddled firmly on the backs of younger Americans who coincidentally are also entering into a job market with incredibly low wages. This idea of high tuition with low wages isn’t some made up propaganda to distract you. This is reality. The math behind this is all clear cut because inflation has eroded the standard of living of Americans to the point that the middle class is now a minority. Student debt carries larger implications than merely paying for a college education. Many younger Americans are unable to buy homes because of the amount of student debt they carry. Many are also delaying bigger purchases because of the large debt they already carry. This path is clearly unsustainable. Just take a look at wage growth and total student debt growth over the last 25 years.

Student debt versus wages

One good way to look at student debt is through the lens of wage growth. You would hope that student debt was growing at a pace similar to that of wages. That is not the case.

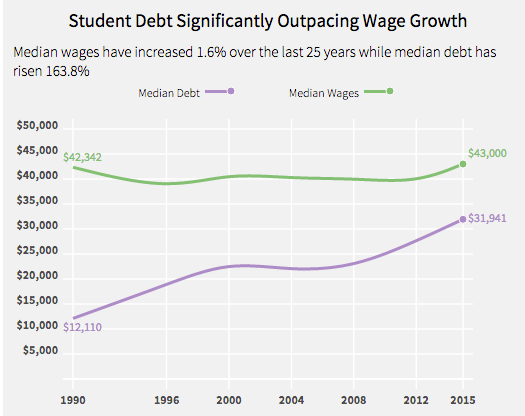

Here is a chart showing wages and student debt over the last 25 years:

While median wages are up 1.6% median student debt is up a stunning 163.8%. This is why we are seeing so many young Americans struggling and also why so many are rallying behind the cause of free public higher education. Of course the question as to how this gets paid is yet to be seen.

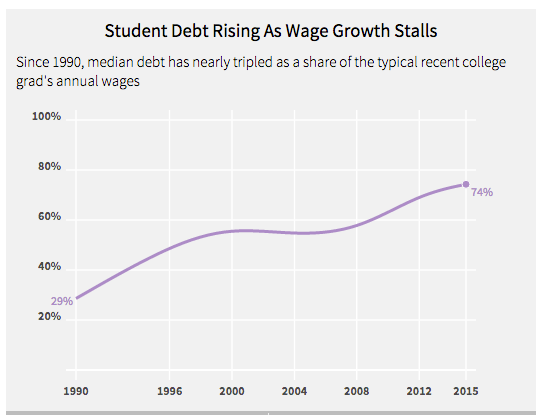

Over this period of time wage growth is simply not supporting the amount of debt being taken on:

This is not good. Since 1990 debt has nearly tripled as a share of the typical college graduate’s annual wages meaning it is tougher to service that debt. Sure rates are low but who does this benefit? Lower wages merely inflate the underlying asset, in this class a college education on the back of easy financing.

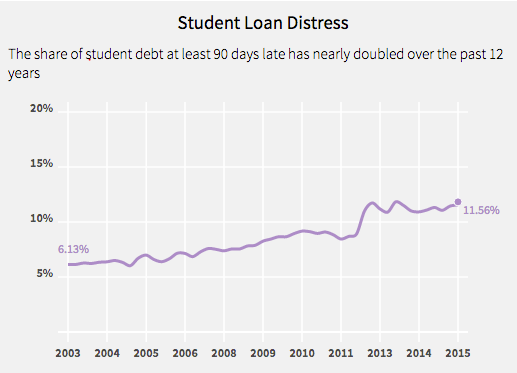

This is a problem. All you need to look at is rising delinquency rates:

Student debt is now the worst performing debt sector in our entire economy. This is a big problem and is something that needs to be examined more closely. Student debt has allowed for a large growth in poor performing schools that merely seek to take in federal funding. One perfect example is the for-profit institutions. There are many that have come under fire recently for essentially serving as vectors to siphon off federal loans and leaving students with a worthless piece of paper.

Beyond the for-profits, many schools simply are underperforming for what they are giving to students. Students continue to take on inordinate levels of debt simply to stay competitive in the current marketplace.

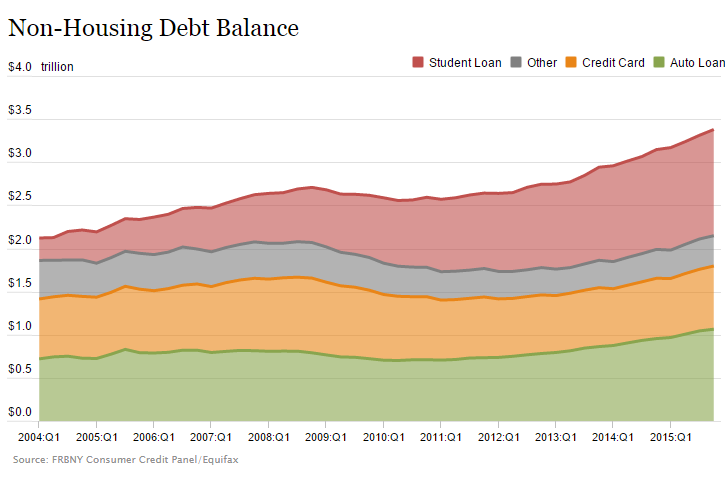

The student debt problem is a big one. Back in 2004 total student debt stood at $260 billion:

Today it is at $1.3 trillion. So in a matter of 11 years student debt has grown by more than $1 trillion. And some will try to argue that we don’t have a debt problem.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â