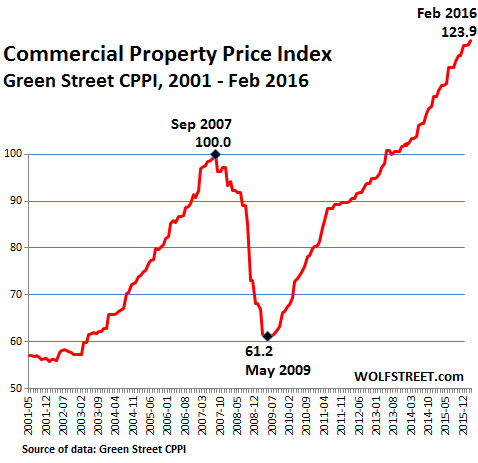

Commercial property bubble gets out of control: Commercial real estate is now up 102 percent from the lows reached in 2009.

- 2 Comment

We live in a system were bubbles grow and pop at an increasingly faster pace. This is largely due to massive market intervention by central banks and their masters with investment and commercial banks. The goal is to always create more liquidity if you are a bank. However there is no clean mechanism to filter liquidity into the appropriate areas of the economy so enormous waste occurs typically in the form of asset inflation. The bailouts were largely a “trust the banks†operation and here we are almost one decade since the Great Recession hit and we’ve basically made the middle class a minority in the United States. In the mean time banks are doing fantastic. One area where a bubble appears to be ongoing is in commercial real estate. Commercial real estate is going gangbusters even though the typical family is barely scraping by. So what gives?

The bubble in commercial real estate

Commercial real estate took it on the chin last time alongside residential real estate. Obviously with the economy contracting there is going to be some fallout with commercial real estate. Businesses need to make income so they can pay their leases. Business dries up and so does the rent payment.

We are seeing the price of commercial real estate soaring while household incomes are stagnant. Take a look at this chart:

Commercial real estate values are up a stunning 102 percent since the low hit in 2009. There is a lot of silly money rushing into the game at this point. Valuations are ridiculous and you are also seeing money from abroad, in particular from China rushing into U.S. markets.

Does any of this sound familiar? It should because we went through this scenario in the last bubble as well. When central banks are entering into negative interest rate territory hot money is going to seek real world assets. This happened in the U.S. with large banks deploying their funding into residential real estate which of course pushed up the value of home prices and locked out many families from buying. In other words, all you do is make things more expensive with profits going to lenders and bankers. This doesn’t really improve the bottom line of a household budget.

And one of the typical signs of a bubble is the need to build more based on fairytale projections of demand:

“(WSJ) Demand for giant tower cranes leased from Morrow Equipment Co. of Salem, Ore., has grown to nearly 500 from less than 200 after the financial crisis, said Peter Juhren, the company’s vice president of operations. His best markets, he said, are New York, Miami, Seattle, San Francisco and Los Angeles.â€

And of course the Fed is already stating the obvious while it is too late:

“The worry has turned more concrete. Commercial real-estate prices are soaring and Fed officials face the conundrum of what, if anything, to do.

“Signs of valuation pressures are emerging in commercial real-estate markets, where prices have been rising at a solid clip and lending standards have deteriorated, although debt growth has not yet accelerated notably,†Stanley Fischer, vice chairman of the Fed, said in a speech Thursday.â€

The machinery that created the last bubble never went away or got reformed. So the reason this story sounds very familiar is because we just lived it. The Fed and other central banks are only accelerating this wasteful spending and creating a world of debt bondage. The problem is, valuations are out of whack and trillions of dollars in debt are not going to be paid back. And I think we know what happens after that grim realization hits.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Jessica Parla said:

Good lord, that graph is terrifying. I haven’t seen a bubble this insane since the bitcoin bubble!

March 16th, 2016 at 3:49 pm -

Mr.B said:

Great article. Remember just a couple of years back buddy of mine kept telling me how much money one of his employees was making on silver. A couple of months later silver crashed. Recently all I hear people talk about in my area (large city in the southeast)is commercial real estate and how its the perfect play. I know this time is different….

April 3rd, 2016 at 8:51 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â