Baby boom or bust: Retirement withdrawals now exceed contributions. Since 2008 US public debt up by $10 trillion, nearly the same as the Russell 3000 Index.

- 1 Comment

You knew it was only a matter of time before baby boomers started taking out their money from retirement accounts in mass. If you think boomers were rebalancing every year carefully, think again. We have now crossed an interesting threshold where retirement withdrawals exceed contributions. Part of this has to do with a younger and more broke generation of Americans.  You also have older Americans being stretched financially thin so they need to get additional funds from retirement accounts. This also means that there is likely going to be more forced selling from this massive market. After all, that is the point of a retirement account in that it should throw off income when you retire. But for every sell you need someone willing and ready to buy. The market hasn’t been necessarily tested in this regard with tens of millions now utilizing the sell side of a retirement account.

The baby boom generation is now cashing out

Baby boomers are hitting retirement age in mass on a daily basis. Those fortunate enough to have a retirement account are planning on how to receive their funds into old age. The majority of older Americans are relying on Social Security for their retirement income.

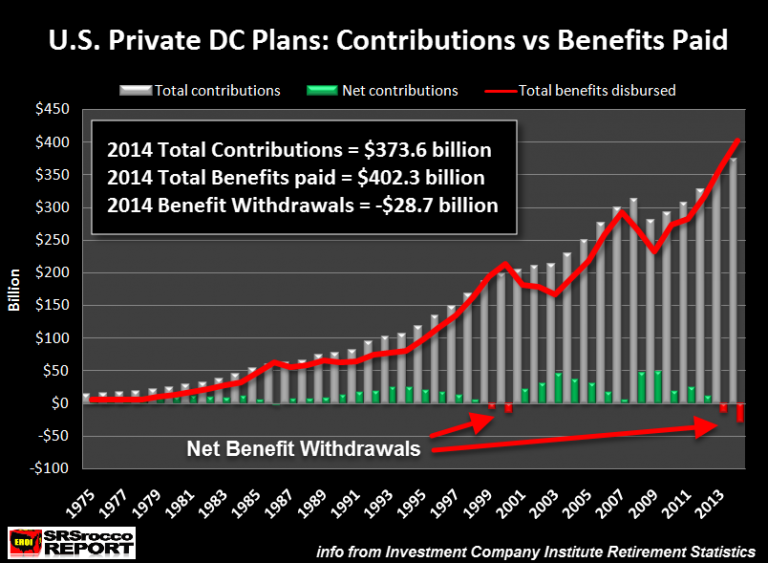

So how does this play out? Someone sent over an interesting chart highlighting withdrawals and contributions since 1975:

As you can see, it is rare for more money to be taken out than being put in. But this is to be expected since those hitting retirement can’t wait decades for their investments to be cashed out. Many now need that nest egg to replace their monthly income. Thankfully for this group, the stock market is hyper inflated so this is a good time to liquidate chunks of your portfolio. But what happens when more and more is yanked out of the market?

It almost seems like there is a pressure valve that is about to be opened up and there isn’t much that can be done here. Getting old is simply part of life and the volume of baby boomers hitting retirement age doesn’t seem like it will help the above trend. You have young Americans that are cash strapped on student debt and also fighting against the sky high costs of housing. Younger Americans are investing much less of their income since many start out their working lives in a substantial negative net worth situation.

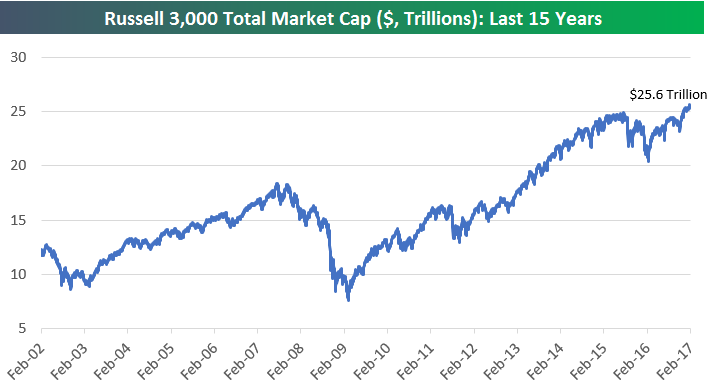

If you look at the Russell 3,000 index and its total market cap, we are now nearly $10 trillion higher than the peak that led us into the Great Recession:

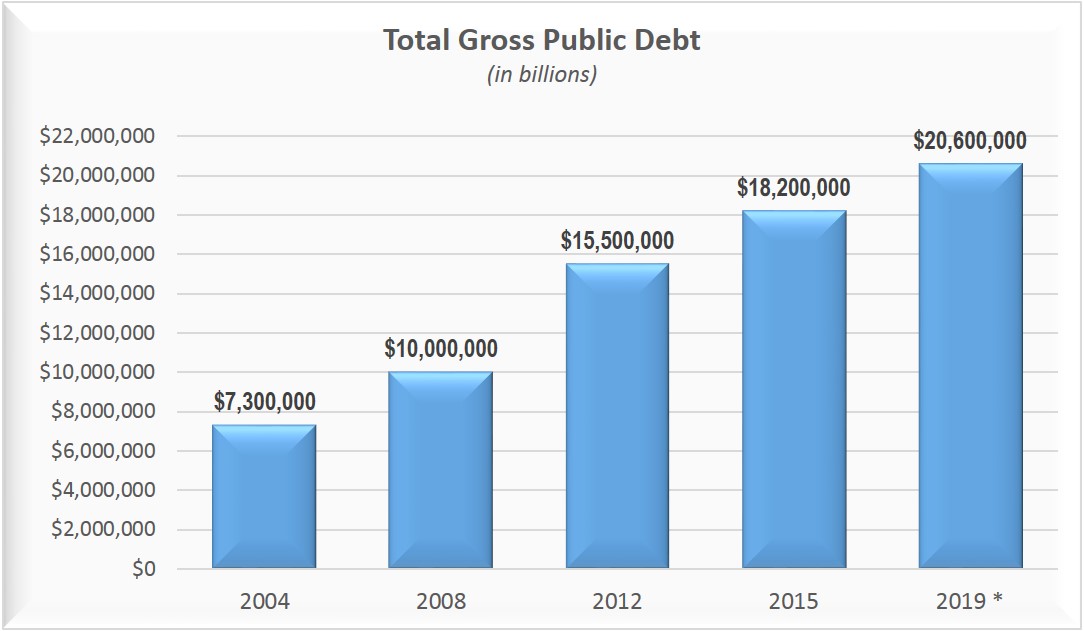

And here is total US public debt:

It is interesting that over the last 10 years since the market last peaked, US public debt went up by $10 trillion and so did the market valuation of the Russell 3000 (it seeks to benchmark the entire US stock market). Seems like perfect timing for baby boomers to make a large exit if they want to.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Beenthere said:

You should follow up with article on on the public pensions that are either going bust and into govt. receivership (paying a max $1,200 month benefit) or about ready to go bust. In next 5 to 10 years going be lot of older people in world of hurt for having trusted liars with their retirement.

April 5th, 2017 at 6:02 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â