The financially forgotten generation: Economically raising the Millennials in a debt strapped financial world. Over half of Millennials have no savings.

- 0 Comments

Millennials, those roughly 18 to 34 years of age are growing up in the financial shadow of their baby boomer parents. This group of Americans is more diverse in what they perceive to be a good quality life. They prefer to live close to work and shopping, they are not big on suburbs, and many are massively in debt. It seems to go against the grain of what we expect, that a future generation of Americans will have it financially tougher than the current generation but that is the path we are now walking on. Student debt is a large burden for many of the Millennials. Total student debt outstanding is now over $1 trillion and continues to be the fastest growing segment of non-housing related debt. Are Millennials a forgotten generation when it comes to their financial success?

A survey of Millennials

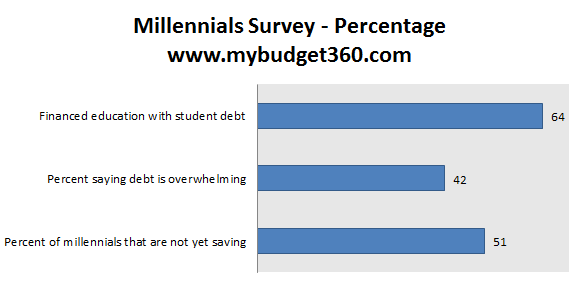

Wells Fargo conducted an interesting survey on the financial situation of Millennials. What the survey found was an interesting mix of values and perceptions:

Source:Â Â Wells Fargo

First, the survey found that Millennials are largely financing their education with student debt. Many see their education as a great investment but what is interesting is what another item in the survey found. 42 percent say their current debt is overwhelming. A Lexus or a Mercedes is better to drive than say a Honda or a Toyota but that doesn’t mean you can afford one over the other. The easy financing for student debt allows many young Americans to go into deep debt before earning their first penny. So you can see that there is certainly some cognitive dissonance already in the survey here. This isn’t to say that young people should avoid college but be more careful in choosing schools (say a state school over a private and expensive school with a sports team).

The next point is that 51 percent of Millennials have not started saving. That is a problem. When asked why they are not saving the following responses were given:

-87 percent say they don’t have enough money to start saving

-81 percent want to pay down debt first

This coincides with the reality that one out of three Americans does not have any savings and the fact that half of America is living paycheck to paycheck or worse. The traditional path for Americans to build wealth in the past was largely though purchasing a home. That is becoming a more challenging prospect for young Americans.

Homeownership

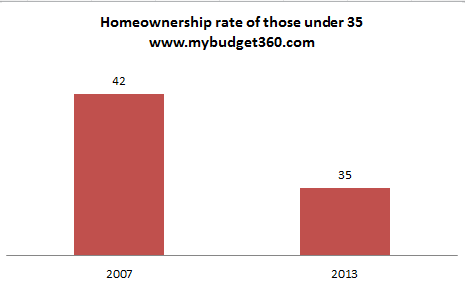

The homeownership rate for younger Americans has fallen since the housing bubble popped and has yet to recover:

Source:Â NY Times

The vast majority of wealth for the working and middle class comes in the form of home equity. It takes time to build home equity. Yet the above chart shows that fewer and fewer young Americans are purchasing homes. The stock market is largely a wealth machine for the very wealthy and not many Americans derive their wealth from this asset class. This is interesting because 52 percent of Millennials are actually skeptical when it comes to the financial markets.

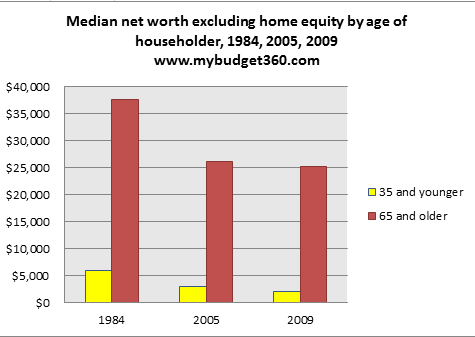

To assume that that this recession only hurt younger Americans is incorrect. Take a look at net worth for various years adjusting for inflation:

The gaps are enormous when you remove home equity. Yet Millennials largely have little to begin with and given the low homeownership rate, many are years away from having any decent net worth. Many will be facing challenging times for Social Security and pensions are largely becoming a thing of the past. What the survey found is that Millennials want the same opportunities for success as the previous generation and many unable to pay for it with actual savings, are going deep into debt for this.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!