A wing and a prayer retirement plan: Two-thirds of Americans are not saving enough for retirement. Income inequality at record levels in the US.

- 5 Comment

It is interesting to see what passes for financial journalism in the press. This morning a guest was on one of the major news stations and she was mentioning that Americans need to save $1 million or more to retire comfortably. In the next sentence, she mentioned that two-thirds of Americans don’t even save enough and in this group, about half don’t even save. So think about that. How in the world is this group even going to come close to saving one million dollars for retirement when they are living paycheck to paycheck? 47.7 million Americans are on food stamps and they are talking about saving a million dollar as if this was some kind of easy task to achieve. Is it any wonder then that the vast majority of the country is by default going to rely on Social Security as their main source of retirement income as if the government had a secret touch that turns everything into gold like King Midas? Pensions are becoming a thing of the past now. For most of this country retirement consists of closing your eyes and hoping something will be there when old age hits. Well many are opening their eyes and realizing that not much of a net is now left for retirement.

The rise of income inequality

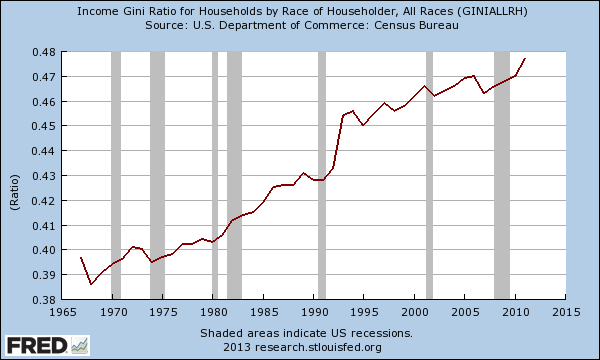

The record levels in the stock market have not trickled down to the vast majority of Americans. In fact, income inequality is now at levels last seen during the Great Depression:

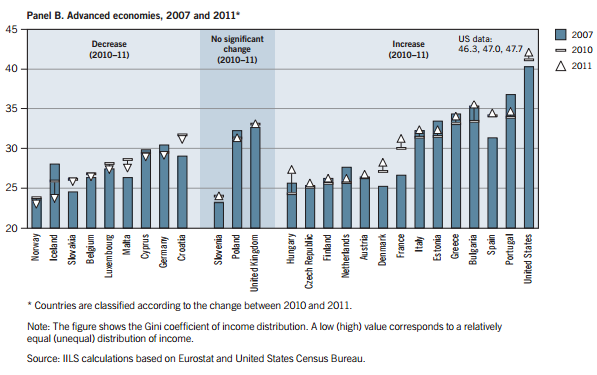

What is interesting is the trend has been consistent, recession or no recession. The middle class and working class of the US has taken the brunt of this reshuffling of financial fortunes. A recent study showed that income inequality in the US literally went off the charts in the last few years of stock market prosperity:

This increase occurred during one of the biggest stock market bull runs in modern history. So what then is the regular worker to do? The current savings rate is below 3 percent so for the median household income of $50,000 they are saving (if they are lucky) something like $1,500 a year. So how long would that take to reach $1 million? Let us look at a few cases with compounding:

So what does saving $125 a month ($1,500 a year look like) after 30 years:

@3 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $73,024

@5 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $104,465

@7 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $153,385

@9 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $230,559

The above is interesting because $1,500 a year to save is modest but even with a hot stock market returning 9 percent for another 30 years you will have $230,559 saved. Baby boomers had this information in the early 1980s and had one of the greatest stock market runs of all time. So why is it then, here in 2013 that two-thirds of Americans have very little saved (and half of this group has nothing saved?).

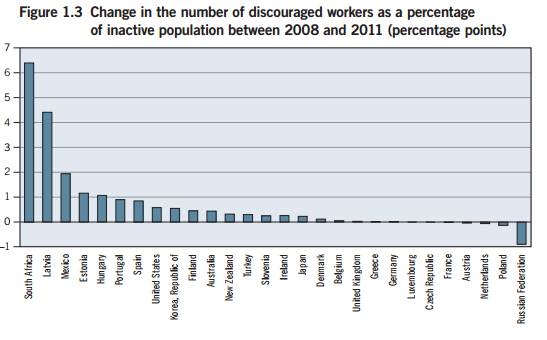

Little by little the cost of living has gone up of course. This is the problem with inflation, even a modest amount can cause major issues when wages are stagnant or falling. We’ve also increased the number of discouraged workers in our economy:

We’ve seen a noticeable jump of discouraged workers. This also ties in with the jump in food stamp usage in our country.  If you are in a position to save, you must. There is no magical solution to solving this problem. However, the problem we do have is when corporate welfare is given to large banks offering them near zero percent interest rates while the public is gouged for credit cards, student loans, and mortgages. Can you directly borrow from the Fed? Of course not. Yet this is the game that is setup and that is why you have large hedge funds flooding the real estate market buying up properties to flip or rent out.

The bottom line is that most Americans don’t have a solid retirement plan in hand. It doesn’t appear to be from lack of knowledge. It is likely that most are simply just getting by. The per capita average wage of $26,000 a year won’t get you very far in many large US cities. If you can, start early and plan wisely. The system is designed to extract every penny from you and to also put you into perpetual debt. If you don’t save and plan, you will likely find yourself like millions today completely relying on Social Security for their retirement. This is less of a retirement plan and more of a wishful delusion.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Eric said:

Being a 30 year old male with two kids living on a single income family of less than $80k I can tell you that putting away 1500 a year could be a challenge even for me. Right now we are just trying to pay our debt off (student loans) so some day we will be able to buy a house and stop renting. Either the world goes to hell in the second revolution or I work until the day I die.

June 11th, 2013 at 5:27 pm -

Donovan Moore said:

Not true. You’re making the assumption that retired people will want to continue to buy shit when they are old. If you don’t buy shit, you can live very cheaply.

June 11th, 2013 at 10:36 pm -

Don Ross said:

Some American with half a brain needs to start a movement to expose the huge disparity of civil service and US government pensions, as opposed to the terror of the private sector.

Now we can accept police and fire department pensions and benefits, but white collar government wonks and bureaucrats. No way!June 12th, 2013 at 3:55 am -

Khannea Suntzu said:

It amounts to the “three bottles of sleeping pills” retirement plan.

June 12th, 2013 at 7:45 am -

John said:

We’ve got to get back to the gold standard, abolish the Federal reserve, abolish the income tax, arrest all involved with “Quantitative Easing”, and institute term limits for all judges and politicians. Until then, there is not much hope.

June 13th, 2013 at 1:34 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!