How the mortgage interest deduction subsidizes the spending of wealthy families at the expense of middle class families. Average California mortgage deduction for filers is over $18,000 versus $9,900 in Texas.

- 11 Comment

One of the sacred cows of our economy revolves around the mortgage interest tax deduction. Home buying is heavily subsidized in the United States. The Federal Reserve has injected trillions of dollars in purchasing mortgage backed securities and other questionable assets all for the purpose of keeping interest rates low. Yet this is one area of misunderstanding by the public because when the data is sorted out it becomes clear that the mortgage interest tax deduction heavily subsidizes the home buying of wealthier Americans and those who live in more expensive states. The golden goose is expensive to maintain. The median household income of $50,000 garners very little benefit from this deduction because the standard deduction is already high for half of U.S. households. Let us carefully examine the details of this expensive subsidy and visualize how costly this subsidy is but first let us look at the failed home buyer tax credit.

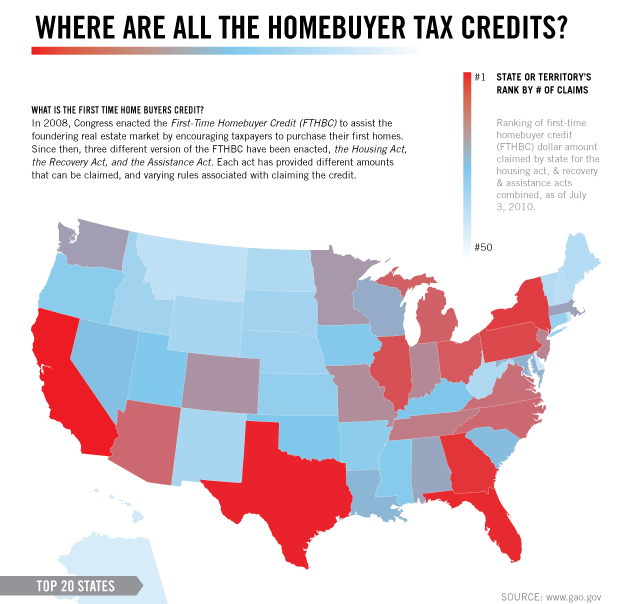

Homebuyer Tax Credit

Source:Â Intuit

The home buyer tax credit had a hand in boosting sales when it was enacted. Sales have fallen since that time and it has now been realized that this was merely an expensive subsidy to pull home sales forward. In California $814 million was claimed for this tax break. Texas claimed $682 million and Florida claimed $455 million. All in all the home buyer tax credit cost the U.S. taxpayer $7.2 billion for really only pushing sales forward. The market has now collapsed and the failure of the subsidy has been apparent. But this was a unique deal. The mortgage interest deduction has been a staple of our economic discourse for many years now but has failed in increasing homeownership or making homes affordable for working and middle class Americans. This is where the heart of the issue really exists.

Home Mortgage Interest Deduction

There are many reasons why the mortgage interest deduction is flawed. First, it subsidizes and industry that would do well regardless of the deduction. Next, it is costly at a time when the government is hurting for revenue. But here are the three common criticisms of the mortgage interest deduction:

-1. The actual deduction doesn’t really impact the rate of homeownership.

-2. We now allow deduction of interest on home equity loans which allowed consumers to go around laws and regulations that do not allow for the deductibility of personal loans. For example, someone who used their home equity loan to purchase 10 flat screen TVs can actually deduct the interest each year just because it was financed with a home equity loan. A renter that even buys one flat screen is unable to deduct this kind of consumption.

-3. The actual deduction favors the high-income taxpayer at incredibly disproportionate levels.

These issues strike at the core of the problem with subsidizing home buying to extreme measures. Many of the higher income states benefit extraordinarily from this and have also added fuel to the flame in regional housing bubble differences. For example, let us run an example with the standard deduction:

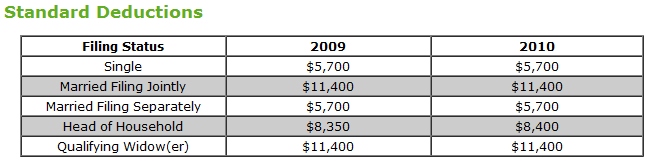

Source:Â H&R Block

A single filer already has a $5,700 deduction right off the bat. A married couple filing jointly will have a standard deduction of $11,400. So in lower priced housing states many people won’t really benefit from the deduction unless they itemize (and even then the standard deduction might be higher). In that case of itemization, it usually favors higher income families. This is revealed when we look at the data carefully:

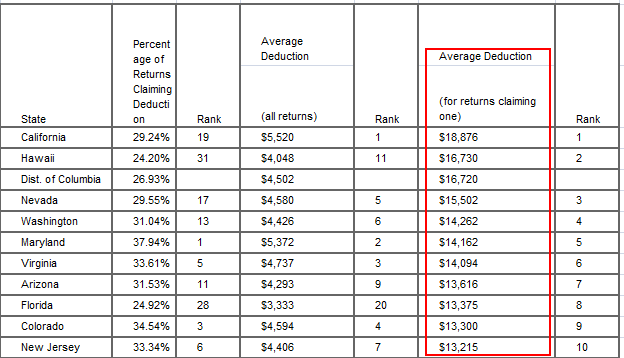

Now this is an interesting break down. If we look at the states that receive the highest average tax deduction based on returns claiming the mortgage interest deduction we will notice many states with inflated housing bubbles show up. California, Nevada, Arizona, and Florida all show up here in the top 10 states. It is incredible that California has an average of $18,876 for those who claim the deduction while the national average is $12,221 (35% lower than California). But even here, this average is skewed by higher income households across the country who write-off interest at the expense of everyone else.

The mortgage interest tax deduction seems to be sacrosanct for many. Yet there should be a cap on how much can be written off. The difference can be seen on a $100,000 mortgage versus a $1 million mortgage. Why not cap the maximum interest deduction to the actual median home price nationwide? Currently that stands at $178,000 so this should cover the bulk of the country without favoring one state over another. Why should there be a bigger benefit in more expensive states?

Why don’t people touch this issue even though the bulk of middle class Americans garner very little benefit from it? Because of this:

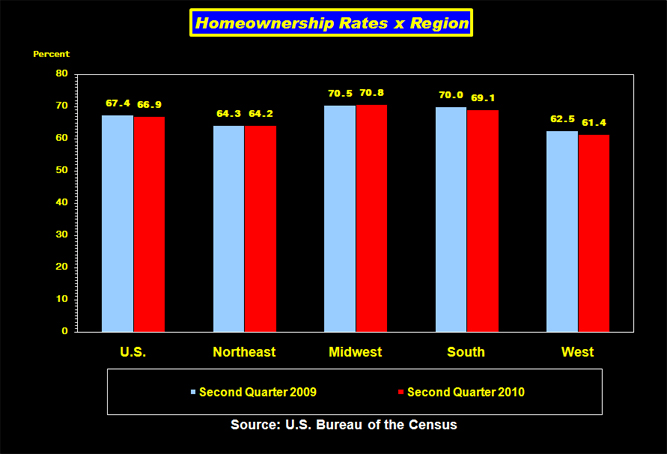

Source:Â Census

Over 66 percent of U.S. households own their home so politicians are reluctant to issue nuanced arguments that demonstrate to the vast majority of Americans that the mortgage interest deduction should be modified to have a cap since it is subsidizing the lifestyle of higher income Americans. It is unfortunate that many Americans already through the standard deductions have benefitted but misunderstand the actual bigger picture with the mortgage interest deduction. A high income family will benefit incredibly by the deduction while a middle class family will not. Let us run a scenario here. Let us look at a family making $50,000 a year with a $80,000 mortgage (on a $100,000 home) versus a family making $250,000 with a $500,000 mortgage (on a $600,000 home):

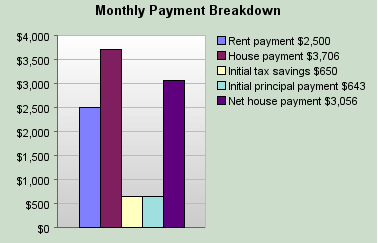

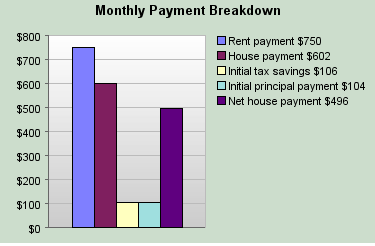

Here is a rundown for the home with an $80,000 mortgage. The tax savings aren’t that significant. We’ve assumed that this family would have a rental substitute at $750 a month. The tax savings are minimal in the bigger scheme of things. But let us look at that $500,000 mortgage:

The tax savings here are significant. Some might say that a $500,000 mortgage is rare. Actually, at the height of the housing bubble California had a median home price that reached close to $600,000. This occurred in the most populated state. So this scenario wasn’t merely hypothetical, it actually happened.

It is important to examine the mortgage interest deduction because it is simply another policy that has lost its way. The middle class are largely financing the debt spending of the wealthy.   Why not cap the deduction to the median home price nationwide? So far we have seen very little movement in terms of helping the working and middle class in the U.S. and this is simply another example.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

toaster said:

Good post. I, too, believe the mortgage interest deduction is a sop to the wealthy. It subsidizes those who could and would buy on their own dime. It promotes housing bubbles by encouraging leverage, and has the perverse effect of driving up the price of housing (rentals included), thereby canceling it’s supposed positive effects. Finally, it sends false pricing signals to the market, attracting far more capital (including human capital) than would otherwise be the case. This is a loss for the economy, as it is by definition starving other, more promising sectors of the economy, and hence makes us all poorer.

Rather than capping the deduction, I would suggest getting rid of it altogether, and cutting rates across the board.

October 24th, 2010 at 4:34 am -

mike said:

As usual on this site, the data, charts and presentation is excellent. I do however believe that in this case, this is truly a “nit” compared to all the other tax inequalities that exist.

Had we not had the housing “bubble” in the 2002 to 2007 time period and housing had continued on an orderly incline with features and size, there would have been the natural progression of “moving up”. This would have continued to expand the feeling of well being, the growth of GDP and the resulting economy based upon all the businesses that grow with housing.

As it was, the bubble created incestuous greed, easy profits, far too much wealth speculation, constant refinancing to pull money out. Orderly growth of the economy is a good thing.

The only reason the 650 tax savings for the bigger mortgage seems out of place (same percentage as the smaller mortgage) is that the house should have been 250 grand on an orderly growth curve. The bubble across all the mortgages, refinances etc in that period, created a huge unreal money pool for banks, Realtors, mortgage companies, tittle insurance companies, tax authorities, etc to grow the economy disproportionately to reality.

The total federal tax code is now a joke after all these years of constant “modifications” for special interests. I believe that the most damaging to the average American is that the tax tables are NOT adjusted for inflation. Everyone moves into higher tax brackets as time progresses with less “real” purchasing power.

Please continue your excellent work.

October 24th, 2010 at 5:31 pm -

RealisticOptimist said:

I’m not a big fan of the interest deduction, but couldn’t you also argue that a family making $250k a year pays a lot more in income taxes too? I think a better angle is showing how renters subsidize homeowners because you can’t write off your rent payment. Like you mention, do we really need to create additional incentives to buy a home?

I did like your example of the HELOC that buys 10 big screen TVs. I never even thought of that. Total BS.

October 24th, 2010 at 9:12 pm -

Fishsticks said:

First, the mortgage interest deduction is completely phased out at $160K AGI. Second, the deduction is not at the expense of the middle class. Most people making average wages pay very little income tax and would therefore have a limited amount to deduct even if interest expense is substantial.

Many of the problems we have around housing revolve around government policies encouraging home ownership and from both sides of the isle. Barney Frank D-MA and Dodd D-CT to Prez Bush all encouraged housing excess. That said I would be delighted to see the interest deduction phased out. A sudden reversal now would be I’ll advised with housing weak and in disarray.

October 25th, 2010 at 5:09 am -

Tim said:

The folks who own more expensive home are not being subsidized by the middle class, because the middle class (those in the bottom 75% of the AGI rung) pays very little in taxes. The top 10% of income earners pay 70% of all taxes, the top 25% pay nearly 87% of all taxes. I have been a renter all my life, and have many complaints about the housing game, but mortgage interest deduction is certainly not one of them.

Don’t forget that in many states (like CA), those who buy expensive homes are paying more in local property tax. A 1$ million fixer up in nicer parts of CA incurs ~$12,000 a year in property taxes. Mortgage interest deduction would net $6000 dollars. (this payment offsets much of the savings as a result of the mortgage interest deduction) — at the end of the day, there is not as much disproportionate fleecing as you are implying.

You want to take a really bad housing market and make it worse, then you proceed with

October 25th, 2010 at 5:09 pm -

Russ Wetherill said:

There are many problems with the US tax code. The mortgage interest deduction is just one of the many. Until the entire code is revised, it makes little sense to change the mortgage interest deduction.

While it may appear that Californians are not paying their fair share of Federal taxes, you might consider the following:

1) $100k does not buy the same standard of living in Los Angeles as it does in Dallas. If the progressive nature of the tax code is indeed based on the ability to pay taxes, shouldn’t the cost of living in different locales be considered? The rich aren’t really richer if they have less money left at the end of the month than the so-called poor due solely to location specific costs (basic housing, state income taxes, local sales taxes, utility costs, property taxes, usage fees, gasoline taxes, food costs, etc.). In fact, someone making 50k in Dallas may have more left at the end of the year than someone making $150k in Los Angeles, while enjoying equal or better living conditions.

2) $20B more in federal taxes are sent to Washington by Californians than the Federal government returns to California in expenditures (this $20B is sent to other states which can thereby reduce their state expenditures, and presumably, their state tax burden levied on their own citizens).

3) The people buying these $600k houses in California aren’t as wealthy as you might think. The typical buyer in that price range, in my experience, is a dual-income professional family. They are not all dual-income by choice, but by necessity. They would like for one of the parents to stay home with the kids, but they can’t afford to do so. I’m sure this is typical throughout the rest of the country, by the way, but it is even more acute here. One income buys a house in a very bad school district, and two incomes buys a small starter home in a good school district. So the parents both work and sacrifice for their children. That is the reality.

October 26th, 2010 at 10:04 am -

Don Levit said:

The mortgage interest deduction obviously favors the more expensive homes, and those who itemize.

The largest revenue loser in our tax code, however, is the employer exclusion for health insurance.

This exclusion has helped drive up premiums.

Now, with the exchanges in 2014, the subsidies will help drive up premiums.

Don LevitOctober 29th, 2010 at 8:13 am -

MarkH said:

Yes and no. The deduction seems to favor the wealthy because the mortgage deduction for entry-level homes amounts to less than the standard deduction, in most cases. The way to help first-time buyers is to itemize the mortgage deduction on Form 1040 and not on Schedule A, so that it comes in addition to the standard deduction.

The mortgage deduction does not favor rich because the rich do not need to borrow to buy their homes. They can pay cash, in full. It favors the banking and real estate industries.November 1st, 2010 at 2:01 pm -

john said:

heres a real solution…end the tax credit and end compound interest on primary residences under a million dollars

ending compound interest on primary residences would have the added benefit of removing the motivation for abject fraud from the bankers….of course they would find a new way to commit fraud, but if we actually enforced the laws we have it wouldnt be such a problem

instead we often reward a big enuf criminal with their own show…on FOX….November 2nd, 2010 at 4:40 am -

don said:

I don’t know where you got your savings of $650 for the high income family on a $3706 mortgage.

The high income family saves 35% on monthly interest expense of $3063. That works out to a savings of $1270 a month, not $650. I have not taken into consideration the phase-out. if someone can share the phase-out calculation, it would be appreciated.

November 18th, 2010 at 4:23 pm -

Joe said:

I just want to correct some blatant errors in the comment sections.

First of all the top 10% pay 47% of all taxes, not 70%. I hear numbers like that thrown around all the time and they are always different…

The overall tax rate when you consider federal,state, and local taxes is actually very flat. The bottom 20% pay about 18%, next 20% pay 22%, the next 20% pay 27%, the next 20% pay 30%, the next 10% pay 31%, the next 5% pay 32.1%, the next 4% pay 32.2%, the top 1% pay 30.9%.

So the tax code is quite flat and even a bit regressive in the upper income brackets.

http://www.ctj.org/pdf/taxday2009.pdf

An actual link.

May 22nd, 2011 at 12:05 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!