Debt U – 4,800 colleges and universities in the U.S. and many are putting students into massive amounts of debt. The higher education bubble is getting to a point of bursting.

- 9 Comment

A few months ago a troubling milestone was passed. In the United States college loan debt outstanding has surpassed credit card debt. As of June 2010 $829 billion in student loan debt was outstanding compared to $826 billion in credit card debt.  Higher education by looking at a handful of metrics is clearly in a bubble. The only question that remains is when will it burst? Bubbles tend to go on longer than many people expect (i.e., the housing bubble) but when they burst they carry long-term ramifications for the economy. Bubbles have unique sociological phases that they go through. For example, at the height of the housing bubble people started questioning whether home prices were really worth it. When people woke up from their sleepwalking and questioned ancient mantras like real estate never goes down, then the bubble implodes either by the sheer size of debt or by people shunning the market completely. In education, the mantra has always been “going to college is worth it no matter what the costs†but the costs are now so high that we do have to question whether college is worth it. Let us take a look at a few reasons why higher education is in a bubble and why it will certainly pop.

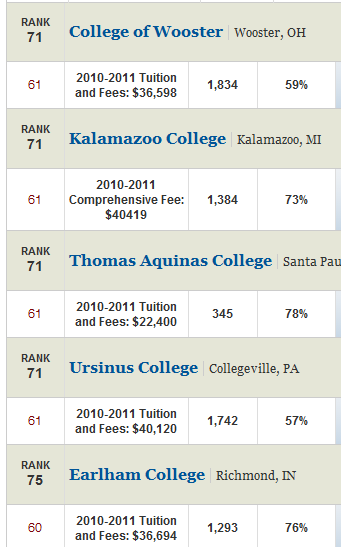

Even lower ranked schools charging extremely high prices

According to the U.S. Department of Education there are over 4,800 colleges and universities in the United States serving over 18,000,000+ students. When even going to an elite school isn’t a guarantee of a promising future, you have to ask how many of the other lower ranked colleges are doing? For example, I pulled up some of the lower ranked schools that are tiered off in the liberal arts category:

Source:Â U.S. News

Even a school that is ranked 71 only in the liberal arts category is still charging $40,000 a year. Many of their graduates won’t even make that much on their first year out. You can go lower on the list and you will find similar trends and patterns. College costs have gotten out of control. This is similar to the housing bubble where any house in any area regardless of quality went up in price just because it was a house. Colleges have now experienced the biggest bubble of all time even outpacing the housing bubble in terms of percentage increases. Higher education is merely the last bubble to burst. The real estate bubble has popped and so has the credit card bubble.

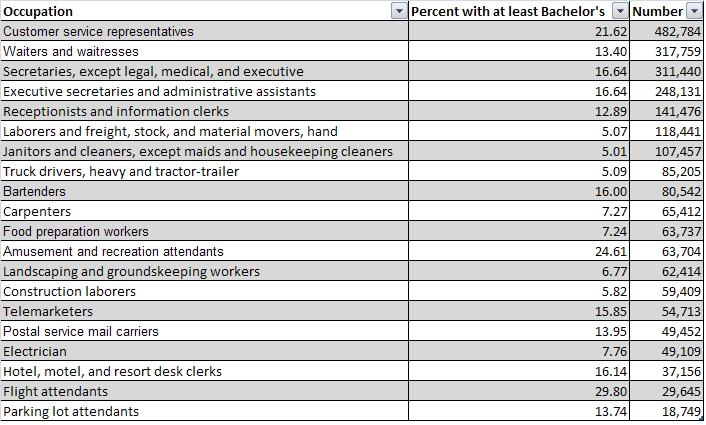

A college degree for many is not translating to a good paying career

There was an interesting article showing details of some of the lower paying fields in our country but also, how many of those people actually had college degrees. The chart is fascinating:

Source:Â Ben Casnocha

I found it interesting that 21 percent of customer service representatives have at least a bachelor’s degree (if not a master’s or a Ph.D.). This is clearly a field that doesn’t require a 4-year degree but 1 out of 5 people in this industry have a 4-year degree. How many of those are in student loan debt? The implicit assumption with college has always been that it would provide you at the very least, with a job that would allow you for a path to a middle class lifestyle. That is clearly not the case. Many in the college industry would argue that college isn’t about getting a job. Okay, I can agree with that. But on the other side of the coin, it shouldn’t cost a student $40,000 to $50,000 a year to attend either.

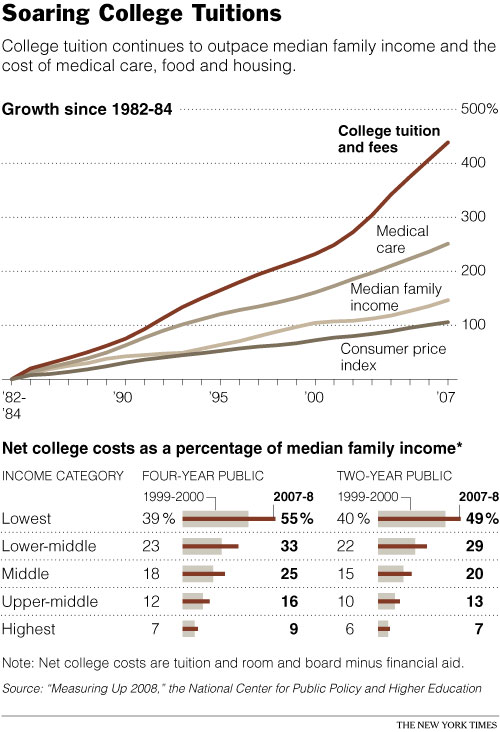

College costs have outpaced inflation

The reason more students are also going into debt is because they simply cannot pay for going to school:

Source:Â New York Times

Long gone are those days when someone could work the night shift and pay for college. You always hear from older baby boomers how students need to suck it up and how they worked at the local retail store and paid their way to college. This was possible when a semester of school cost $300 but even state schools are becoming more expensive:

Take a look for the cost of fees at the University of California system. No student working part-time is going to muster up $10,000+ for tuition while actually doing well in school. The cost has doubled in nearly 5 years while the California economy is reliving the days of the Great Depression. There is a real disconnect here. The same thing happened in housing where incomes went stagnant for a decade yet the desire to buy propelled the housing debt bubble even further. Yet at a certain point, you have to have the ability to service the debt. Student loan debt is no exception.

Unemployment for college graduates

The unemployment rate for college graduates is the highest it has been in record keeping history:

As we have seen in the previous chart, even those that are employed with college degrees might be working in industries that don’t utilize or provide them with their “ideal†salary. In fact, many that are working in their specified field are feeling the squeeze that is being experienced by the working and middle class. The higher education market is in one giant debt bubble. It will burst. It actually is bursting with many students now entering into default. Yet what this will do to the economy is hard to determine.

Even with the housing bubble, you saw predators come in with subprime loans and today, the for-profit education system is basically the subprime industry of college. They use government backed money and provide a shoddy education for students unlikely to garner anything else than a piece of paper. Do you really need to pay $20,000 a year for a degree that is absolutely worthless? Why does the government even need to subsidize for-profit schools? Why not require the for-profit school system to provide employment metrics since their big selling point is that they will get students a job. At the very least this should be a requirement if they are to receive funding.

This is simply another ticking bubble that is reaching closer to an end. 4,800+ college and universities and how many are ranked in the top 100? I wonder what the 4,799th ranked school is charging for tuition?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

PHD in the Soup Line said:

American colleges have for many years been churning out far too many idiots with worthless degrees (social sciences, psychology, humanities, etc.). There is an educational and unemployment crisis in the U.S. Here is an EXCELLENT VIDEO which shows well educated, middle class people who cannot find a job:

http://www.youtube.com/watch?v=CwpdGyIY2fQ&feature=player_embedded#!

Excellent video! Worth watching! Makes you feel fortunate to have a job and food on the table!

Unfortunately too, many colleges and universities have become “diploma mills” or businesses whose sole purpose is to LURE STUDENTS IN, promising them a (near-worthless) degree, all in the name of making a quick, pretty penny with no real interest in giving students a quality education.

Ultimately, A NATION WHICH CANNOT OR DOES NOT PRODUCE GOODS will become as EXTINCT AS THE DINOSAURS.

October 25th, 2010 at 11:30 pm -

Jane said:

Yes, the costs of higher education are disturbing, but consider the larger context…

The fees charged to students (and their families) are increasing so rapidly not because the total spending by colleges and universities in increasing so much, but because the support provided by the public sector has consistently declined for over a generation now, leaving tuition and fees as the way to make up the difference.

Over the same period a new population has come into higher education. Their preparation for university level studies is significantly different from that of previous generations of students in terms of their academic and psycho-social background. Where previous generations required little from support services — remedial classes, psychological counseling, support groups, etc. — many in the current university population require such services to function at minimal levels in an academic setting. State and local governments unwilling to pay for the costs of K-12 programs to meet the needs of an expanded college-bound population have externalized those costs onto colleges and universities.

Between decreased social support and increased social costs, students and their families have been caught in a financial bind. So it goes.

October 26th, 2010 at 6:22 am -

Forty2 said:

Xrist I can remember when it cost like $450 a year at a U of Cal for residents. I was stonked after returning from a hiatus how much fees had gone up to oh $1500 a year when I finally graduated from UC Irvine in 1990. Now? 10K a YEAR at a UofC? That’s insane. UofC is probably the best state university in the US but sheesh. $40-50K for an undergrad from a state U is absurd.

October 26th, 2010 at 6:07 pm -

Larry Livingston said:

thanks for raising this issue.

any idea how much of debt are backed by tax payer? my guess is the debt was exploding due to the federal gov’t backing, and you have sally mae of the world that mints money w/o any risks.

this works just like housing bubble as you pointed out. except i heard it’s rather hard to walk away from a student loan. it’s pathetic that large number unfortunate young men and women end up as “debt slaves” to greedy banks that does not even take any risk. Why is this allowed? Where is the outrage?

October 26th, 2010 at 7:20 pm -

Don Levit said:

I understand that student loans cannot be liquidated via bankruptcy.

There obviously is a bubble here, as there is in housing and health insutance.

With subsidies coming from the taxpayers, won’t that merely increase poremiums even more?

Don LevitOctober 29th, 2010 at 8:21 am -

Jennifer Barry said:

I think the problem is too much government money, rather than too little. Government subsidies in the form of guaranteed loans and grants have pushed up the price of college, just as Medicaid and Medicare had the unintended consequence of boosting health care bills. Students used to work their way through college, but with easy access to credit, universities no longer have to worry about the affordability of tuition. In addition, borrowers no longer have to prove they are a good credit risk, or that their major is practical, so now anyone can take on crushing school debt.

I agree that college is too expensive, and most students won’t get a reasonable return on investment. However, the propaganda tells you that a college degree = a good job, even as you point out this isn’t so.

October 29th, 2010 at 8:33 pm -

Jay W said:

“PHD in the Soup Line said:

American colleges have for many years been churning out far too many idiots with worthless degrees (social sciences, psychology, humanities, etc.). ”Tsk tsk, with such a patronizing attitude, you have got to be an Engineer. Funny, because this Social Sciences graduate owns his own business and is currently managing a team of far less egotistical and arrogant Indian Engineers for a fraction of the cost.

Let us see, would I want to pick a degree that teaches you to see the entire picture (in other words, a Classical Education), or a degree that is so narrowly-defined that your job can easily be outsourced to much cheaper alternatives.

There is a reason why Thomas Jefferson called Classical Education the education for leaders and statesmen.

November 1st, 2010 at 8:26 am -

Milan Moravec said:

Universities and higher education pick the pockets of students and their parents clean: University of California Berkeley.

March 11th, 2012 at 4:00 pm -

Kristie said:

Is there any serious way to warn young Americans about what they are purchasing with college debt? They are promised a future, but of course, with no guarantee… They are solicited constantly, but not advised of the down-side of the contract. Somehow, young Americans need to become aware that college debt is one of the only loans that cannot ever be absolved- NOT EVEN IN BANKRUPTCY! They are being fleeced because of their idealism, optimism, strength and stupidity… but who is really pulling the alarm to warn them? The parents cooperate and contribute (because for their generation, “it worked”), by giving what they have, and signing their children on for what they DON”T HAVE. How can this older generation be so senseless with their progeny? The government is co-opting a labor force who WILL fund them… they will be educated, young, strong and idealistic. They will not be property owners, nor have significant assets (poor), and they will consist of all who were lured by the promise of a future, and signed themselves up for a lifetime of service! Our government is not entirely without an asset for the payment of future interests, and facilitating the will of it’s long arm. Meanwhile… as the children are not available to “help” their parents (since getting “educated” and scrambling to pay the bills takes all free time), the rich in this country are securing the estates of the older generation through medical “needs” (which ensures that the young, endentured generation will continue without assets (poor), and have no choice but to be co-opted servants of the state. Notice, that for “doing the work of the State”, the government offers “forgiveness” of college debt? Cheap labor- hmmm- and in the ever competing market, the State will have an abundance of cheap, co-opted labor in times to come. Who won’t opt for service to the State in lieu of debt forgiveness or reduction? Meanwhile, they are EATING… right? And not having to live at home with mom and dad, as a dependant forever. Is this what college students think they are signing up for? The opportunity to barely be able to feed and house themselves? They can do that now, with no education!

My advice for anyone with a shred of college debt- first, pay it off, but if that’s not immediately possible, turn it into debt of ANY other kind! Transfer that debt to banks, credit cards, mortgage, ANYTHING, because anything that remains as a college debt, you will go to the grave with.

Advice for students. Evaluate the expense- are you getting something useful? Don’t accept a load of debt for “personal development” (NO MATTER HOW MUCH YOUR PARENTS ARE WILLING TO CONTRIBUTE)!!! It’s a scam. And you will pay it back… with the same crappy job you started with… if it’s still available when you get back!

March 15th, 2012 at 5:49 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!