The consequences of bubblenomics: Fed balance sheet increases to $3.5 trillion, negative interest rates since 2009, and part-time employment at record high.

- 3 Comment

While the Federal Reserve mumbles about tapering back quantitative easing, the balance sheet the Fed is carrying tells us an entirely different story. The latest report shows that the Fed has grown its balance sheet to a stunning $3.5 trillion. The ability to travel with an economic blindfold has been a strategy the Fed has been employing since the crisis unfolded in 2007. What is certain is that this negative interest rate environment has fueled the wild spirits of banking speculation at the expense of the working and middle class. As we look over the June employment report, we see a big trend towards a low wage America. The large growth in employment came from part time work. As the Fed becomes more aggressive with policy, we find ourselves in a modern bubblenomics system of booms and busts and most Americans are one step behind any opportunity for getting ahead.

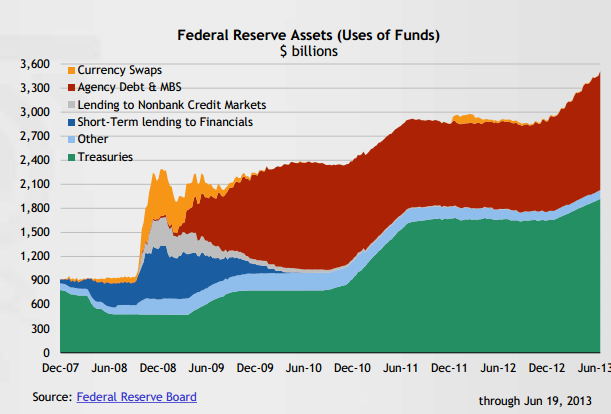

Fed balance sheet

The Fed might be uttering about tapering QE in the future but for the present, the party is still in full motion:

The Fed has increased its balance sheet to a startling $3.5 trillion. We are well on our way to having a $4 trillion balance sheet. The Fed tries to quell the public but none of this has ever been tried before. Keep in mind the Fed was also the same agency that in 2007 mentioned that there was no housing bubble right at the pinnacle of the bubble bursting. The Fed has created an entirely artificial market of low rates by mispricing risk and banks are exposing this since the biggest benefactors of this environment are the financial institutions with deep ties to the Fed.

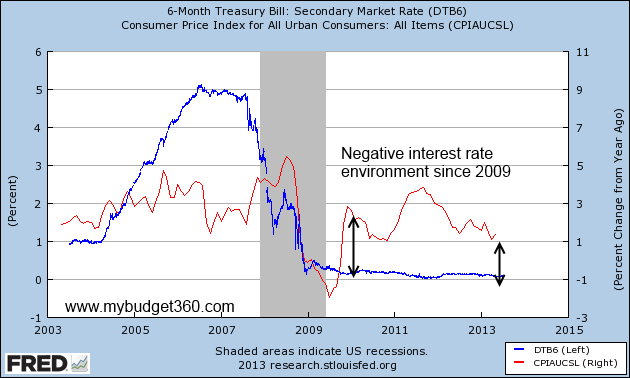

Negative rate environment

This negative interest environment is punishing savers. You want safe Treasury bills to at least keep pace with inflation. We have changed that in 2009:

Since 2009 we have been in a negative interest rate environment. Most Americans are getting close to zero percent on their savings, CDs, and money market accounts. Treasuries? Look at the chart above. However, the stock market has soared but most Americans barely have enough to invest after the necessities are paid for and the stock market has never been a big part of their net worth.

This negative rate environment has spurred the housing market to surge again on the addiction to low rates but a large part of this fever is coming from Wall Street money leveraging the negative rate environment.

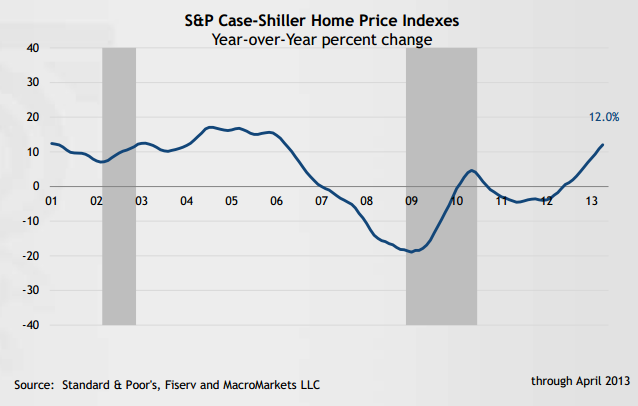

Spurring housing bubble

While household wages are back to levels last seen in the 1990s, this is what is occurring with home values:

The problem of course is that wages are not keeping up. This is some kind of Fed hocus pocus where lower rates are simply creating higher amounts of leverage. As rates rise, something will need to give. The Fed is increasingly backing itself into a position of perpetual bubblenomics. That is, shifting from one bubble to another (i.e., tech, housing, student debt, housing again, etc).

Housing values are going up on the low rate environment and speculators are flooding the market trying to find a better yield for their investment. This isn’t exactly a positive for middle class families that have seen a stagnant market when it comes to wage growth.

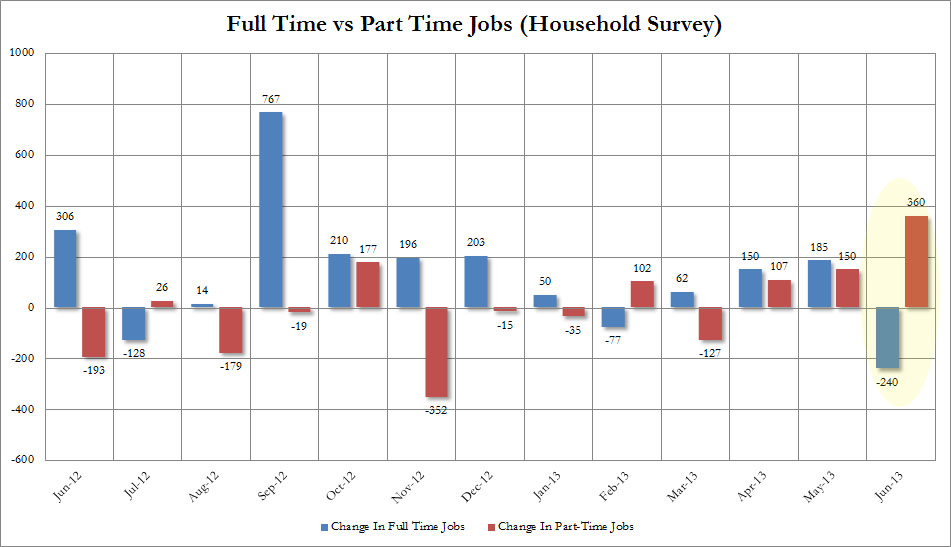

Quality of jobs

The employment report today shows another solid amount of jobs being added. But what kind of jobs are these?

Source:Â BLS, ZeroHedge

The press is running as if the jobs report was completely fantastic but we saw a net add of 360,000 jobs (a total of 28,059,000 Americans are now working part-time, a record) but a drop of 240,000 full-time jobs. This is consistent with the trend of low wage America that has been going on for well over a decade. Interestingly enough, Japan with a head start on us with QE has a massive part-time workforce. Is this really the way for economic prosperity for the middle class? Not exactly but it is certainly the way for bubblenomics.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

theyenguy said:

Thanks for the nice chart. You relate, we are well on our way to having a $4 trillion balance sheet.

I disagree, I expect the value of its “assets” to begin to decrease.

The Fed provides its Balance Sheet each Thursday here

http://www.federalreserve.gov/releases/h41/Could you please consider producing a mini chart, that is one that covers just a few weeks, showing the commencement of the decline?

July 7th, 2013 at 9:41 pm -

Russ Smith, Caliornia said:

Hi!, Patrons Of My Budget 360 Et Al:

Awhile ago a friend called and balled me out: “Russ, U NEVER told me that the FED is non governmental but a private corporation that creates OUR money out of thin air charging interest on the loans for which the interest is NEVER created!!” I told Justin that I was sorry but that his explanation wherever he obtained it is absolutely 100% correct. All Federal Reserve Notes in circulation within the entire world are owed back to this illicit FED pluss the interest the FED NEVER creates which means we can NEVER pay off OUR National Debt but, as long as people have jobs and can bitch we do absolutely NOTHING about this bubbling debt we can NEVER repay!! Had OUR Nation remainded on the safer and sounder grounds dictated by OUR US Constitution in Article 1; Section 10; that we are to have only gold and silver coins as our money in lieu of debts, the FED could have NEVER become a part of OUR economic fabric could it? Now, it represents in my mind at least the TROJAN HORSE whereby it and its’ associate banks can adroitly bleed the working class here in the US dry. As Daniel Webster once quipped: “Of all the contrivances ever designed for cheating the laboring classes of mankind, none has been more successful than that which deludes them with issues of fiat, irreedemable, paper, I Owe U Nothing, money!” I think that ole Daniel Webster knew something that the American poeple are refusing to admit to themselves and each other and which keeps us messmerized into allowing the dictates of the FED in league with OUR so called government; rather than obey the law of the land found enthroned within the intentions of OUR Nations’ founders who provided US with OUR Constitutional standars/safeguards by which we are to rule OUR country for which we not only elect but pay OUR representatives. When, folks, and how do these elected men earn their pay? As Peter Schiff has quipped from Euro Pacific Capital: “It use to be that these officials worked for us but NOW we work for them!”

RUSS SMITH, CA (One Of Our Broke Fiat Money States)

resmith@wcisp.comJuly 8th, 2013 at 6:18 am -

Russ Smith, Caliornia said:

Hi!, Patrons Of My Budget 360 Et Al:

A CUTE STORY TO ILLUSTRATE AN ECONOMIC POINT: My deceased mentor from Holland, Bernard Jongste, when he arrived on American Soil lived on the Fleshman Estate and played tennis with two of the Fleshman boys. The Fleshman boys invited Bernard to accompany them to hear Will Rogers speak in SanFrancisco @ the Public Utilities Commission during the Great Depression and industry in SanFrancisco was primarily shut due to a lack of electricity.

One the balance of the other speakers had finished speaking, it was Will’s turn to speak. “Ladies and Gentlemen, this will be very short and sweet! The other day my youngest son went with me in my New Pickup Truck to drive through my Wyoming Ranch. As we turned a corner my young son spied the bull servicing a heifer. What’s that daddy he asked me? Why son that’s the Bull servicing the Heifer. What’s service daddy? Why son, that’s what the Public Utilities Commission is providing their customers!!” Bernard said that people were literally rolling in the isles but Will Rogers, as The Ambasador Of Good Will, turned the tide between the deadlock of the public’s need to commence jobs through their access to electricity and the stubborn will of the SanFrancisco Public Utilities Commission. This provided he told me the psychological framework to begin geting people on their jobs towards ending the Great Depression. One man did all of that!! Thanks for reading my post.RUSS SMITH, CA (One Of Our Broke Fiat Money States)

resmith@wcisp.comJuly 8th, 2013 at 6:39 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!