The most delinquent loan of them all: Student debt delinquencies at record levels on the eve of rates doubling. Half of college graduates working in jobs where their degree is not required.

- 10 Comment

If the news for college graduates couldn’t get any better. Our woefully motivated millionaire Congress is unable to figure out what is necessary to stop the doubling of interest rates on student debt. While the Fed can turn on a dime to rectify zero percent interest rates for member banks, trying to help the youth of the nation well, that is just too hard to do. Milling around through the data I found that for the first time in history, student debt had the highest delinquency rate of all household debts. This is a big deal given that Americans now carry over $1 trillion in student debt and most of it is in the hands of the young. At the nucleus of this argument is that people are going into too much debt to finance their educational pursuits. Collecting tips at the Olive Garden is not exactly going to payoff that $50,000 in student debt. How is it that the Fed can subsidize big banks with zero percent rates so they can speculate in real estate and other ventures while college graduates are now faced with the doubling of interest rates?

Half of college graduates not utilizing degree

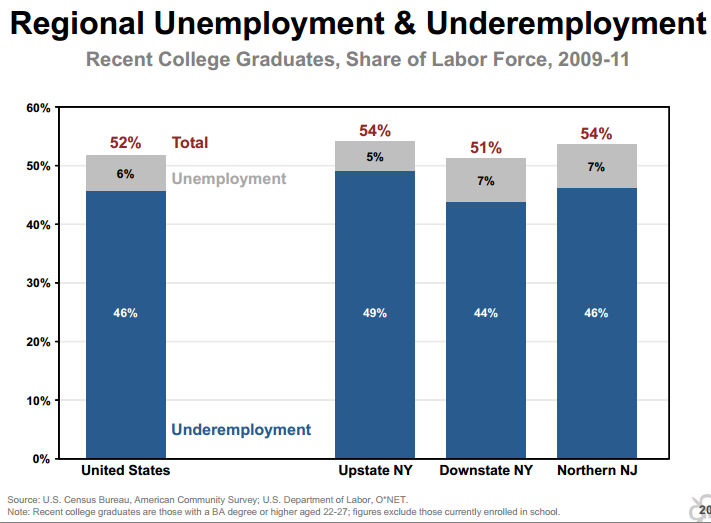

Part of the problem is the voting power (or lack of it) from younger Americans. Many simply do not vote. And the baby boomer cohort is guiding many policies through elected officials although they only serve a tiny pizza slice of the baby boomers at that. So with that said, the voice of the young is largely drowned out by big business and higher education has turned into a very lucrative private-public venture. With that as our backdrop, half of college graduates are not utilizing their increasingly more expensive degrees:

Half of recent college graduates are either unemployed or underemployed. And recently many have given up on pursuing careers where their degrees would be utilized and have taken up other jobs. Other jobs that would have gone to lower skilled workers. And of course, these workers get pushed down into a lower level of the economic ladder. And what a shocker that as we go into the various levels of Dante’s Economic Inferno we find that 47.7 million Americans are on food stamps.

The above chart is rather sobering because many recent graduates are leaving school with high levels of debt. Incomes for many of these graduates are not justifying the sky high rates of tuition at many schools. Education is still a worthy venture and that is why people continue to go into high levels of debt for this. Yet our banking system has been rather obsessed with one sector of our economy since the tech bubble burst in the early 2000s. Real estate has seemed to dominate every big decision in the last decade to the detriment of creating an economy where millions of jobs are added to meet this more educated workforce. That has clearly not happened. Colleges are not going to turn their back on willing students with fresh loans in hand. And I suppose that is the point. Easy access to debt is like an aphrodisiac for the industry. Go to any college campus and you will see palatial stadiums and massive buildings. Do Olympic sized pools make people discover cures for modern diseases quicker?

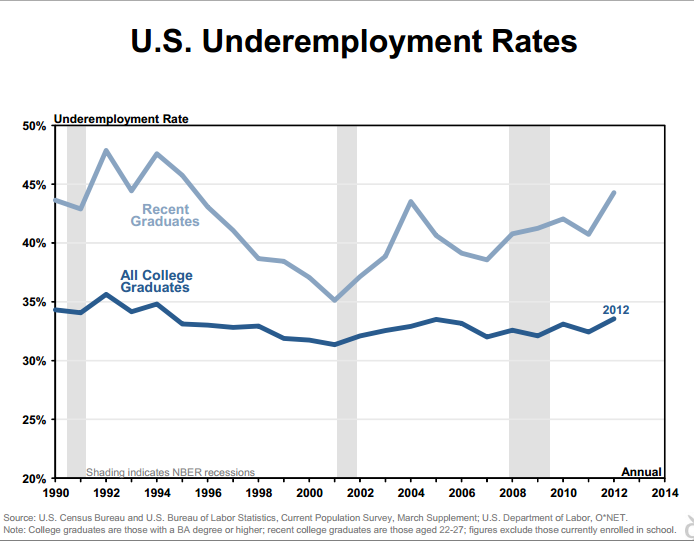

What is even more troubling is that the underemployment rate for recent college graduates has trended up in the last few years while the overall unemployment rate has fallen:

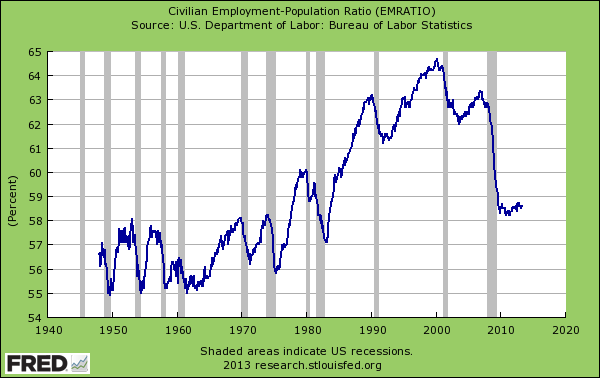

No, we are not looking at a chart of Spain or Greece but a chart of US recent graduates. A large part of the decline in the unemployment rate has come because the civilian employment population ratio continues to lower:

While many older Americans have dropped off the radar, many recent graduates simply do not have this option. Many over the last few years have clearly opted to take on jobs that are underutilizing their degrees. Does that mean they overpaid for their education? $1 trillion in student debt seems to give us an answer that not only did many overpay, they didn’t even have the funds to afford it in the first place. Higher tuition would make more sense if wages were also rising but that doesn’t seem to be the case with the new batch of graduates. And many are falling into student debt quicksand and are unable to pay the loans they now have.

The most delinquent of them all

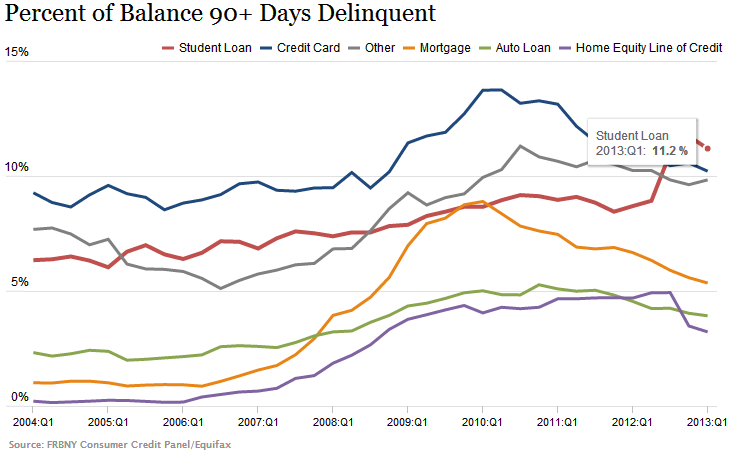

Student debt before the 2000s hit was typically a safe financial bet. Delinquencies on student debt reflected this. Today, we now find ourselves at the precipice of another bubble with student debt having the highest delinquency of any form of household debt:

You can see this rate doubling only in the last few years. Keep in mind this is occurring without the potential doubling of student loan interest rates. Rates are set to go from 3.4 percent to 6.8 percent if Congress does not act. Amazingly, they are able to act quickly when it comes to the interest of large banking but to help the young in our nation? No, let us go on holiday break and see what happens.

The rising delinquency rates are simply the last straw in the student debt bubble. This is a bubble. When you have prices soaring without any underlying economic change, you have a big problem on hand. Keep in mind that what you can afford and the price of something are fully disengaged since the government will lend pretty much whatever is necessary to go to school. If the cap was $100,000 a year, you can rest assured you will have some for-profits cropping up with $100,000 a year degrees. Record delinquencies and half of recent graduates working in jobs where a massively expensive degree is not being used does not bode well for higher ed at the moment. No one has a crystal ball on how this will play out but you can rest assured that something is going to give. You don’t need a college degree to figure that one out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

10 Comments on this post

Trackbacks

-

Doug Welch said:

How are the Chinese, the next #1 economic world power paying for their students to get higher technical education? Are they also giving them usurous loans that banks will profit from, or are they going about it in a more socialist manner? Well, if the US continues to gouge students in order for them to get trained and educated while China subsidizes their students we all may as well start to learn Mandarin to know how to take orders from our new bosses.

Hm, maybe if we abandoned the exploitative “race to the bottom” ethos of Globalization and returned to the American System of planning for economic development we might have a chance to get out of this predicament.June 29th, 2013 at 12:30 pm -

Gary said:

The problem is all of the useless degrees college graduates have “earned”. Black studies, women’s studies, French literature, drama, etc. Does anyone in those degree programs think they will actually get a job in their degree field? The government should stop giving loans to students in those programs!

June 29th, 2013 at 5:15 pm -

Rastro said:

Re complaining about low interest rates for banks: banks serve an essential social and economic function. Sociology majors, gender studies majors etc, not so much.

June 30th, 2013 at 6:42 am -

jmatt said:

The debt levels are a result of low interest rates. Higher rates will mean less student debt, forcing colleges to lower rates.

You cannot simultaneously wish for less debt AND lower rates; they are intrinsically linked.

June 30th, 2013 at 11:28 am -

Getch said:

“How is it that the Fed can subsidize big banks with zero percent rates so they can speculate in real estate and other ventures while college graduates are now faced with the doubling of interest rates?”

Doesn’t the author answer this question by citing the high default rate for student loans? Bad loans require higher interest rates.

What students and recent grads need to do is (a) vote and (b) require a market-based response to the other great Ponzi scheme: Social Security and Medicare. Just as they are being forced to confront the economic reality associated with excessive loans to pay for a worthless degree, so should seniors be forced to confront the reality that financially strapped young people can’t afford to feather their retirement nests.

June 30th, 2013 at 3:54 pm -

Steve said:

Given enough time and a generation growing up hating the Government, expect riots and a populace that loathes the government and disobeys any like authority. Watch out as strife and misery will engulf this country long before WE the people force morals on the Feds. The Feds are making our beds and we have to sleep in it for now. I have trouble sleeping now as I constantly hear our forefathers rolling in their graves.

July 1st, 2013 at 6:47 am -

ame said:

Congress’ children don’t need loans to go to college. So what do they care about the peasants’ children who go into massive debt for a useless piece of paper?

Besides, if the gov is trying to cultivate the next big batch of willing enlistees for an upcoming world war, what better way to motivate the young to sign on the dotted line? Let Uncle Sam take care of you while you “serve your country”. If that doesn’t convince enough young people, perhaps ol’ Unc will offer to reduce the poor sap’s current debt while they labor in the force.

Our young people are being harvested for war.

July 11th, 2013 at 4:20 pm -

GA Mom said:

Half of college grads don’t have a job because half of college grads should never have gone to college in the first place! Fly by night colleges and online colleges are giving degrees away to anyone with a pulse. Many states have lottery funded money to pay for college degrees, therefore A’s & B’s are routinely and falsely given to keep the little “money makers” in a desk seat so the Universities can reap the financial benefits.

America needs a serious wake up call. Only the qualified should be in college. The degree hardly means anything anymore.

July 27th, 2013 at 6:34 pm -

Jakob Stagg said:

They should be thankful the student loan rate isn’t almost 10%, as it was when I was in school. Then add that inconvenient part where most students will not get a job for which they prepared. If they get a job it will probably be a job that does not need a degree.

Welcome to the “shell game” of Americans. You can’t win, you can’t leave the game. You can only do your best until you die.

July 28th, 2013 at 9:37 am -

Anthony Eller said:

Until full student loan consumer protection is given back to student loans both Federal and Private which means the reinstatement of student loan bankruptcy which if you not aware ….Federal student loans was taken away in 1978 and the Private student loans was taken away in 2005 .

the lenders who now own more more the collection agencies that before long defaults will be worth more to the lenders than the actual student loans.This is corruption to the very core! Just so your aware a gambler can declare bankruptcy??? Our children future are going to be destroyed Project Tuition ReimbursemenMay 21st, 2014 at 6:07 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!