Oil has Crushed the Suburban Homeowner Dream – How $75 a Barrel Oil no longer Supports New Home Construction in Distant Areas. Case study of Riverside and San Bernardino Foreclosures and Housing.

- 8 Comment

The peak of $147 for a barrel of oil seems to be a long gone memory. Yet oil per barrel is still up over $75, a long cry from the $20 barrel many became accustomed to. I have been mulling this issue over for a few months because few people are even considering oil prices in relation to the value of housing. With the current economic crisis, there has been nearly an obsessive view that if we only manage to solve housing prices, then all will be well in the economy. Clearly this is not the case given that unemployment is still at peak levels. Home prices have fallen drastically in many areas across the country. But if we look at areas that are less economically diverse and merely serve as suburb hubs, these areas are getting a dual correction.

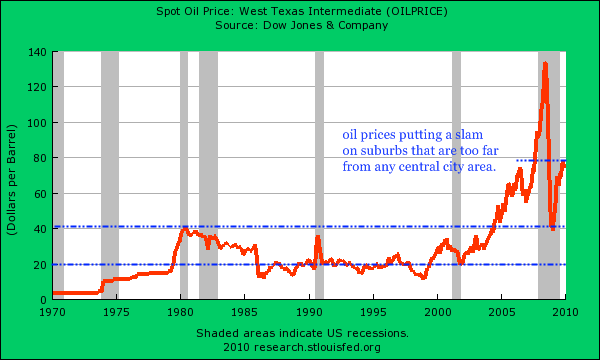

First, these areas have commercial real estate developments that assumed continuous urban growth that relied on cheap oil. Cheap oil seems to be a thing of the past. Second, these areas were built around the notion that many people would be willing to drive into a city hub in order to purchase cheap and plentiful housing. Well this only would work with cheap oil. Let us look at the oil chart first:

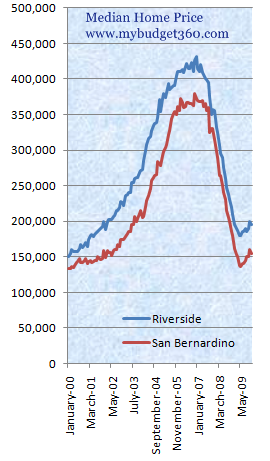

Putting aside the 1970s oil spikes, we had over 20 years of stable and cheap oil prices. So fuel was only an afterthought in building suburbs that were miles away from any city center. The idea was that there would always be enough people willing to drive any distance for a piece of the American dream. That of course is largely not the case anymore. And at closer examination, many of these areas are seeing real estate prices crash at a higher rate than areas closer to employment centers. California is a perfect example of this phenomenon. We already know that the overall California housing market is in deep trouble. Yet if we look at areas like San Bernardino and Riverside Counties, prices have corrected much quicker than counties closer to population and employment hubs. These two counties known as the Inland Empire to people in Southern California had massive bubbles that have largely corrected. Many in the area think that these areas will see prices go up but that is a large assumption.  If energy costs remain high, there is little reason to believe this. Let us examine their values over the last decade:

The correction in these two counties is fierce. Riverside is down 54 percent from its peak value and San Bernardino is down by 59 percent. These are deep cuts in values from peaks that were clearly unsustainable. Did oil push these values down faster than the overall market?  I would say that it did. We need to also remember than many people that bought out in these areas also had lower incomes than those that were able to afford higher prices near prime areas. So by default, they had a smaller buffer to withstand any external shocks from the market. Next, the cheap oil era fueled growth since long commutes didn’t really matter aside from the time spent commuting back and forth. With higher fuel costs, this ate into the budget of many families that were already stretching to get by.

So even though oil is now at $76 a barrel and not $147, it is certainly not at $20. That is a big difference. Plus, many of these areas require central cooling and heating for the summer and winter given their variable temperature climates and this also relies on energy prices. The Inland Empire resembles the dynamics of Arizona and Nevada much more closely than say beach front property in Malibu. Now for these areas, they have seen a lost decade in home values both nominally and in real terms.

Part of the long-term issues in these suburb areas is also based on their troubled employment base. Take a look at the unemployment rate for these areas:

California:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12.3

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14.6

San Bernardino:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 13.8

Source:Â Employment Development Department, CA

And California’s unemployment and underemployment rate is closer to 22 percent so you can imagine the rate for these two areas. In California you are seeing many investors buying up these properties thinking that prices will go up once again. But this bet is being made on the cheap oil notion. In fact, if the U.S. dollar keeps on declining oil will go up just by default.

Even though we may be facing drops in demand, the world certainly isn’t:

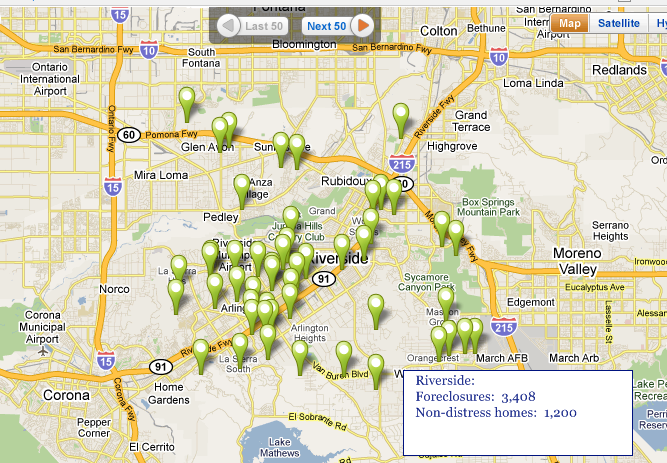

When you add the above, it makes you wonder how well these areas are going to cope with sustained higher energy prices. Many of these areas weren’t planned well either so it isn’t like a self sustaining community. Many were betting on easy back and forth access to big city hubs. Is there the infrastructure to support a local population base? Maybe. Yet the deep hits in prices causes one to wonder whether these areas are functioning on a model that is now outdated. It is also the case that these areas have the largest amount of foreclosure activity:

You have one normal home sale for every three foreclosures on the market. This is data as of this week so problems are still occurring in these areas. The average American trying to make it on a long commute is going to need to get used to high energy costs. Short of the dollar staging a massive rally and world oil demand collapsing, this seems to be the new calculus of the market.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

8 Comments on this post

Trackbacks

-

JG said:

The San Joaquin Valley is in the same boat.

Based on classical physical geography, these areas are the least likely, least rational places to ever put cities or towns – it’s only the leverage provided by cheap oil and cheap imported water combined with suburban car-culture that ever allowed them to exist in the first place. There are no real natural resources (other than maybe agriculture which itself is largely artificially supported), like rivers or bays for trade, minerals for mining or anything else. These were largely unpopulated deserts for a very good reason.

Everything has to be “imported” from outside the region themselves which are completely incapable of being is slightly self-dependent: everything on every store’s shelves and gasoline for the cars which you can’t survive without (because of sprawl). The climate requires a disproportionate amount of energy to make houses and living habitable (which comes from outside the areas also). Even jobs had to be “outsourced” back to areas like LA and SF that were the only “natural” places to establish cities and there are no “natural” employee resources either. Apparently the old-school geography some of us learned in the 1950s and 1960s aren’t taught anymore.

The idea that these areas will recover in lifetime of anyone currently alive is pretty laughable. Number one reasons on the list: Peak Oil and Peak Credit.

Even the spawl of places like LA or SF metro areas will become a problem soon enough. Travel to major cities in Asia or Europe that have ample public transportation and you immediately understand why.

January 21st, 2010 at 10:12 pm -

Peter said:

I’ve plotted the latest BLS Unemployment data for Riverside and San Bernardino to create this heat map:

http://www.localetrends.com/metro/inland-empire-palm-springs-california-home.php?MAP_TYPE=curr_ueJanuary 22nd, 2010 at 6:08 am -

Terrance Stuart said:

This story is on target. Futurists indicate that the suburbs are liable to be the domain of houses “cut up ” for the poor to live in with the urban areas being prime residential space. Some predict oil at $225.00 per barrel by 2012, this assumes that there is an economic recovery in the West and growth continues in India and China.

There are other resources that ar ein short supply, rare earths for the creation of “green energy” products. Very few suppliers for lithium, most of whom do not like the US, notably Bolivia. In terms of food production, world reserves of phosporous which is crucial for modern fertilizers is being depleted.

Technology may find substitutions for certain resources, but they may be expensive and limited, thus placing a capstone on economic development or even sustainability.

The US has huge energy deposits, but due to purposeful restrictions, our deposits are not large in most areas, save coal. To be a reserve it must be produceable at todays prices, and must be accessible. Many deposits are locked up in on and off shore federal lands which are held hostage by governmental policies.

Resource shortages may result in conflict, which could pit major powers against each other. We live in interesting times.

January 22nd, 2010 at 1:29 pm -

P said:

Oil prices climbed due to the Fed not raising interest rates when the economy overheated. If the gov’t doesn’t stop inflation using interest rate policy, then commodity prices go up and cause the economy to slow. Not just oil, but all commodities including food.

The overall commodity price increase is probably what slowed the economy enough to kill the housing pyramid/ponzi scheme…when you run out of stupid buyers with tons of cheap capital, the market prices crash.

January 24th, 2010 at 12:02 am -

Daniel Kroc said:

Price of Oil:

Many think the price of oil was manipulated just as were global housing prices, the price of credit, equities, etc. – all for the gain of insiders. So sky high oil prices are not a certainty even as demand from China and India grow.Transportation & Costs:

If you look at other countries, the transportation problems get worked out over time. What happens is more businesses move out to near the burbs and jobs follow. More small start ups actually start up in the cheaper areas and branch offices also end up there as the cost of workers is less.Korea started creating satellite cities outside of Seoul in the late 90s. At the onset, 99% of the workers commuted to Seoul – a long commute at the time. They did so because the housing was much cheaper and lifestyle better. Soon businesses followed and now only a fraction commute.

Korea is also building new satellite cites as I write. But this time they already have businesses relocating even before the housing part is complete. One of our clients is set to move their HQ in Q3 to a new burb outside Seoul that is still under construction – a place that didn’t exist 2 years ago. And public transportation is not coming online for another 3 years. Yet, people are moving in as soon as the paint dries – even with gas prices at $5.50 a gallon.

But I agree with the author about the Inland Empire and I wouldn’t invest in it unless I was living there. When I was in LA for business a few months ago I drove through the area and looked at some homes – couldn’t help but ‘feel’ the decay and decline. What good is good weather if there are no jobs?

Daniel Kroc

DanielKroc.comJanuary 24th, 2010 at 8:59 am -

JeremiadJones said:

Your 35-year oil price chart is ridiculous. Oil is cheaper now than at the 1980 peak, adjusted for inflation. The chart is meaningless. If there were truth in advertising, the dollar would have to be renamed every 10 years or so. The 2009 dollar bears the same relationship to the 1980 dollar as the 2009 Cowboys bear to the illustrious Dallas teams of 30 years ago — not much. Yet fans conflate them.

The suburbs are not doomed, assuming our well-intentioned leaders don’t impose gas rationing. But housing prices should fall to reflect the cost of commuting. When the adjustment is complete, “bargain” prices will bring back buyers.

Chicken Little believes the world faces a lethal competition for resources. This is propaganda brought to you by the military-industrial complex, aided and abetted by Big Oil. The truth is, we are profligate in our wastefulness. If prices are allowed to make the market — rather than the Pentagon — people will alter their consumption patterns accordingly. In this case, we really have nothing to fear but fear itself.

January 24th, 2010 at 1:56 pm -

RICHARD RALPH ROEHL said:

Obviously… THE DOCTRINE OF PERPETUAL GROWTH of the human population and the global consumer economy in a world of finite space and finite resources is over.

So the question becomes: How can we maintain a civil and prosperous $ociety without perpetual growth and/or waging foreign invasions for the $ake of corp-rat war profiteering?

Answer: Abandon the religion of profligate consumption… and replace it with common $ense for the common good. If we fail to do this, then we shall trundle down the road toward a horrible extinction event. Rome is burning! Old Coyote Knose can smell the $moke.

February 19th, 2010 at 2:54 pm -

Craig said:

I am enjoying this series of posts on housing. It’s interesting to integrate the oil price because that not only affects construction costs but also transportation costs.

With copper back over 3.50 again however and lumber futures recently making 4 year highs….along with commensurate rises in many other building materials, is it possible that a price floor will develop based on the “cost of production”? or will the existing inventory overhang prevent that for some time to come?

I’m not sure how you make all these great charts but it would be excellent to see one of home prices overlaid with the cost of construction.

April 20th, 2010 at 5:34 am