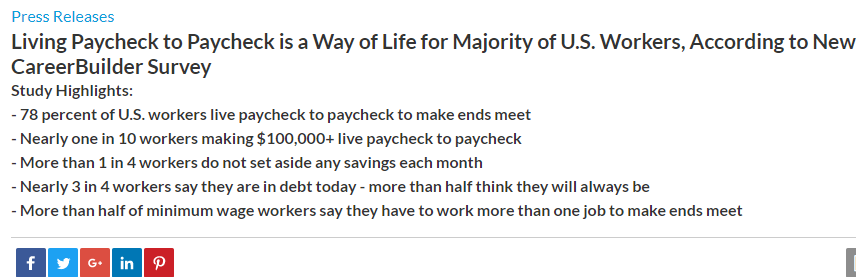

Living paycheck to paycheck is the way of life:Â New Harris poll finds that 78 percent of US workers live paycheck to paycheck.

- 3 Comment

For most Americans, living for payday is the way of life. And many use debt to bridge the gap between money hitting their bank account and the bills that need to be paid. We know since many banks make billions of dollars on people over drafting accounts. A new Harris Poll found that 78 percent of US workers live paycheck to paycheck. Now this news may be shocking to some but in reality, it is no surprise at all. How can this be if the stock market is near a record high, real estate is at record levels, and the headline unemployment rate is near record lows? Well first, most Americans don’t own stocks. Second, the homeownership rate has dropped to near generational lows. You also have nearly 95 million adults that are not part of the labor force so don’t count for employment figures. So this is why the survey results may not be all that surprising. But let us dig into the numbers a bit more.

Living paycheck to paycheck

Beyond the reality that most Americans are just getting by there are many other data points in the survey that are somewhat startling.

Take a look at this:

Source:Â Harris Poll

The first point is that most Americans are just scraping by on what they earn. We keep hearing that inflation is tame but try telling that to the family trying to feed their kids. Does it seem cheaper to get by? What about buying healthy foods? Sure, you can purchase junk food for cheap but the end result is that you are going to get medical issues in the end that will put you deeper into the hole.

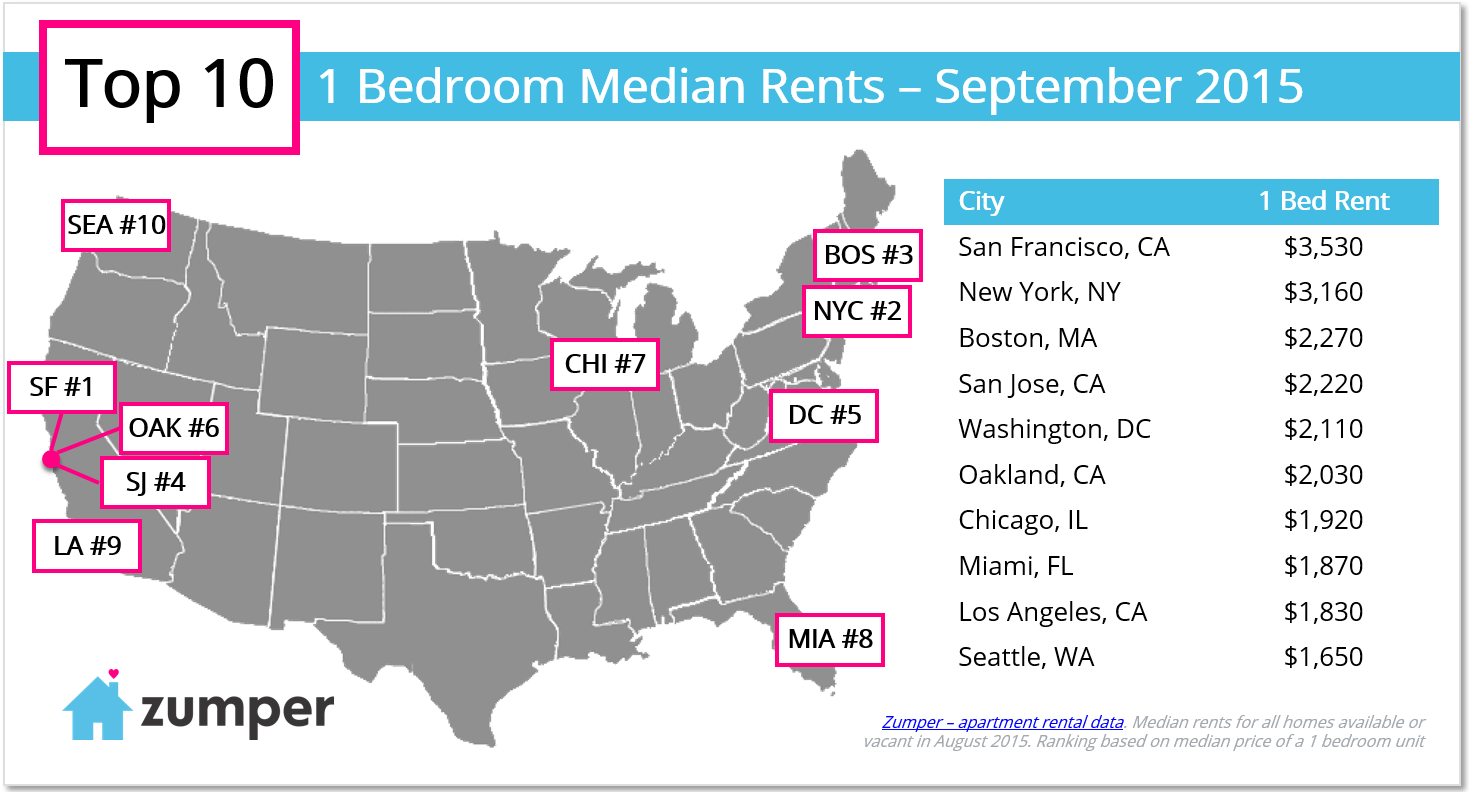

The second point is that even making $100,000 isn’t enough to get by for some. One in ten workers that make $100k or more are living paycheck to paycheck. Is this a shock? Well think of those that live in places like Los Angeles, New York, or San Francisco. Housing can eat up a major portion of your paycheck.

Take a look at rents in larger cities:

This is two years old so you know it is even higher today. So yes, even at $100k some people are just getting by. Yet we keep hearing about no inflation.

Another scary point as it relates to saving for retirement is that one in four workers does not put anything aside each month. This is troubling. As you know, saving for even an emergency is critical to keeping yourself out of financial turmoil. Which leads to the final point.

Workers are using debt to bridge the gap. Three out of four workers are in debt. Half of workers feel they will be in debt forever. It is good to pay off debt like auto loans, credit cards, and student debt. Yet people are feeling as if they will never get out of the circular trap of being in debt. Think of all the young Americans that come out of college with $30,000, $50,000, or even $100,000 in student debt. It must seem like they will never pay it off.

The poll is shocking but not for those that look at the overall trends and figures. Just look at the massive growth in dollar stores catering to lower wage Americans. The destruction of retail outlets coincides with the middle being hollowed out. 78 percent of Americans live paycheck to paycheck and this is in the wealthiest country in the planet.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

3 Comments on this post

Trackbacks

-

Robert in Houston said:

Sad indeed. But entirely man-made and artifical. Houston rents are less than 1/3rd of these. Mostly because corrupt zoning and rent-control don’t exist here to increase land cost and restrict supply.

August 31st, 2017 at 5:03 pm -

gerald peters said:

the ACA has made this situation much worse. when a person is forced to spend hundreds each month on a policy that does not fit their needs, that is money that is not available for home repairs, car repairs, etc.

September 2nd, 2017 at 11:00 am -

Beenthere said:

For the vast majority of them they only have themselves to blame. Being ignorant of finances, debt and for many their social choices put them there. I suspect too “nearly 3 out of 4 workers are in debt” is very low ball, they are not including housing…only counting credit card, car and student loan debt. If there is a loan or mortgage against it YOU DON’T OWN IT! I would like to see what the % of the population is now that has negative net worth, I bet it is very high now. With so many living on other people’s money (aka credit) and with healthcare costs going through the roof in the last 3-4 years eating up even more of their income.

September 3rd, 2017 at 4:17 pm